U.S. investors pushed equity funds to their fourth consecutive quarter of plus-side performance in Q1 2021. Investors embraced the $1.9 trillion stimulus package signed into law by President Joseph Biden in late March, the Federal Reserve Board’s commitment to keeping interest rates low through at least 2023, and the rollout and improving distribution of COVID-19 vaccines.

All of these factors contributed to relatively strong returns for equity funds and ETFs during the quarter, with the average equity fund posting a 6.31% return, with Lipper’s Sector Equity Funds macro-classification (+8.94%) leading other macro-classifications.

However, fixed income investors evaluated what a third round of stimulus, a new infrastructure spending plan, and the continuation of loose monetary policy might have on the economy and inflation, leading to a steepening Treasury yield curve for the quarter—with the 10-year Treasury yield jumping 81 basis points to 1.74%, contributing to a slight market decline for the average taxable fixed income fund (-1.26%).

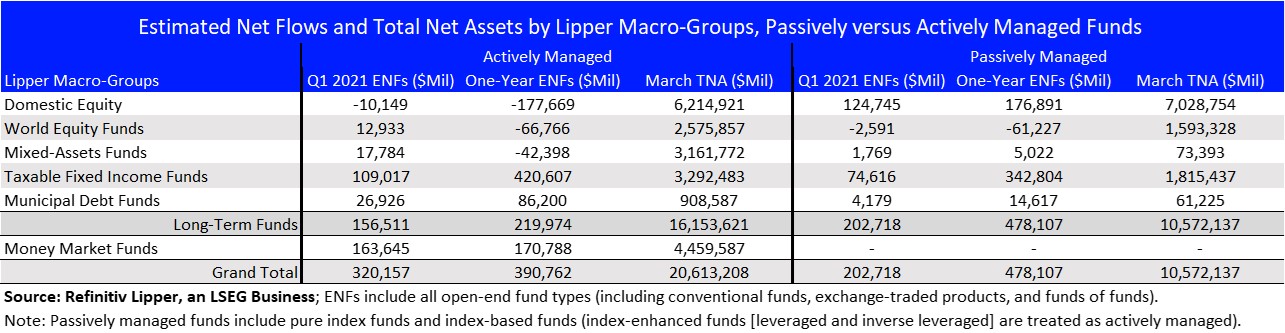

Mutual funds and ETFs attracted $522.9 billion in net new money during the quarter, with actively managed funds—excluding money market funds (+$163.6 billion)—taking in $156.5 billion, while their passively managed counterparts attracted $202.7 billion.

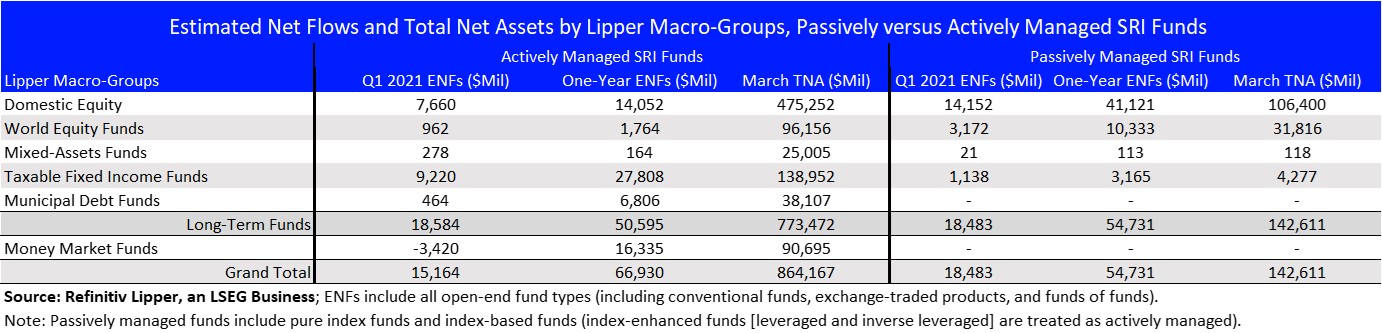

Taking another slice of the data shown above and focusing on socially responsible investing (SRI) funds and the more recent focus on environmental, social, and governance (ESG) focused investment/screening practices, we saw similar passive versus active fund-flows trends for the quarter. Actively managed funds still slightly outdrew their passively managed cohorts for the one-period ended Mar. 31, 2021.

Investors injected some $33.6 billion into SRI and ESG focused mutual funds and ETFs (collectively, responsible investing [RI] funds) during Q1 2021, bringing the one-year net inflows total to $121.7 billion. Assets under management for U.S. RI funds rose 7.05% from $940.5 billion on Dec. 31, 2020, to $1.007 trillion on Mar. 31, 2021.

Estimated net flows into long-term RI funds for Q1—excluding money markets again—slightly favored actively managed RI funds (+$18.584 billion) over their passively managed RI brethren (+$18.483 billion).

But in contrast to their non-RI funds counterparts in both the active versus passive breakouts, all the Lipper RI fund macro-groups witnessed net inflows, including actively managed domestic equity RI funds and passively managed world equity RI funds.

In another opposing trend, we saw net redemptions in RI money market funds (-$3.4 billion) as the non-RI funds witnessed net inflows to the tune of $163.6 billion. We have written in the past about the stickiness of assets in this RI subset. Investors appear to be willing to put their money where their convictions are generally for the long haul when it comes to socially responsible investing practices.

Total asset under management continued to favor actively managed RI funds (+$864.2 billion) over their passively managed counterparts ($142.6 billion). And as we have mentioned before, this is more than likely a result of investors’ long-term commitment to SRI practices seen as early as the 1920s in the U.S., when one of the first publicly available SRI funds (Pioneer Fund) used negative screening practices to exclude tobacco, alcohol, and gambling investments from its portfolio.

Since then, socially aware practices have continued to evolve and recently take on a more mainstream focus by investors as ESG pillars become standard metrics of investment evaluations.

In-line with estimated net flows for traditional funds and ETFs, investors continued to favor passively managed RI domestic equity funds (+$14.2 billion) over their actively managed counterparts (+$7.7 billion) for the Q1, but in contrast both remain positive.

Whereas like with the non-RI universe, investors continued to prefer RI taxable bond funds, injecting $9.2 billion for the quarter, over their passively managed cousins (+$1.1 billion).