Equities in the US dropped sharply overnight as the bipartisan budget agreement reached earlier this week triggered some anxiety that Fed would taper the asset purchase program sooner as there is stability on the fiscal front. The house of representatives could vote as soon as today while Fed will have the last FOMC meeting in 2013 next week. There are increasing speculations that Fed would start scaling back the treasury buying during this meeting, even though that might only be a small step. The Dow failed to hold on to 16000 level and dropped -129.60 pts to close at 15843.53. S&P 500 also closed down -20.40 pts at 1782.22. The 10-year yield, on the other hand, rose 0.047% to close at 2.844% while 30 year yield close up 0.051% at 3.880%. However, there wasn't much support for the dollar as it stayed soft against Euro and Swiss Franc, as well as Canadian dollar and yen.

The New Zealand dollar is steady against the greenback after RBNZ left the OCR unchanged at 2.50% as widely expected. While this move was widely expected, the MPS came in slightly more hawkish, paving the way for a rate hike at subsequent meetings. It's getting apparent that, thanks to the improving economy and rising inflation, the central bank's next monetary decision would be to tighten, rather than to ease further. That said, the possibility of a rate hike in as soon as January is remote while a more likely timing would be March. Similar to previous meetings, policymakers warned of the strength of the New Zealand dollar, stating that the appreciation is not sustainable and would hurt exports. More in RBNZ Left OCR At 2.5%, Reiterating Tightening In 2014.

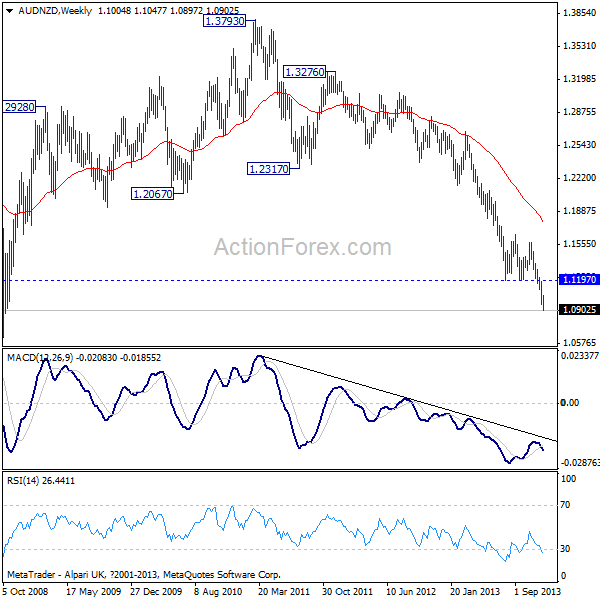

On the other hand, the Australian dollar got no support from better than expected job report. Cross selling against the Kiwi is giving some pressure to the Aussie in general. Australian employment rose 21k in November, double of expectation of 10.3k. Unemployment rate rose to 5.8% as expected. The medium term down trend in AUD/NZD continued this week and reached as low as 1.0897 so far. With weekly MACD crossing below signal line, the cross is gathering downside momentum again. Near term outlook will stay bearish as long as 1.1197 support turned resistance holds. And, we'd very likely see a breach of 1.0628 key support level. AUD/NZD Weekly Chart" title="AUD/NZD Weekly Chart" width="600" height="600" />

AUD/NZD Weekly Chart" title="AUD/NZD Weekly Chart" width="600" height="600" />

Looking ahead, the SNB rate decision is a major focus in European session and the central bank is widely expected to keep rates unchanged and maintain the EUR/CHF floor. Eurozone industrial production, Canada new housing price index, US retail sales, jobless claims, import price and business inventories will be released too.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

US Equities Dropped Sharply On Fears That The Fed Would Begin Tapering

Published 12/12/2013, 03:55 AM

US Equities Dropped Sharply On Fears That The Fed Would Begin Tapering

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.