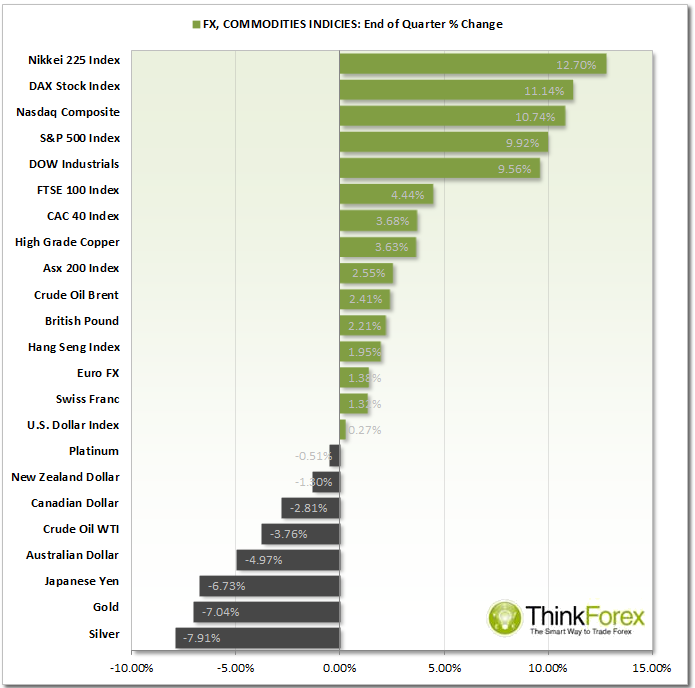

Market Snapshot:

After the Fed said it would scale back it's $85bn per month bond purchasing program US growth was revised up from 3.6% to 4.1% for the last quarter, to further validate the Fed's decision.

Needless to say US Equities closed the year at their record highs with European Equities following suit to finish the year in a high.

With only two trading sessions this week traders would be advised to trade with caution, especially as we still await for liquidity to arrive back within the markets.

So this leaves us with 2 choices:

- Scalp/daytrading

- Wait for longer-term setups to appear on the higher timeframes

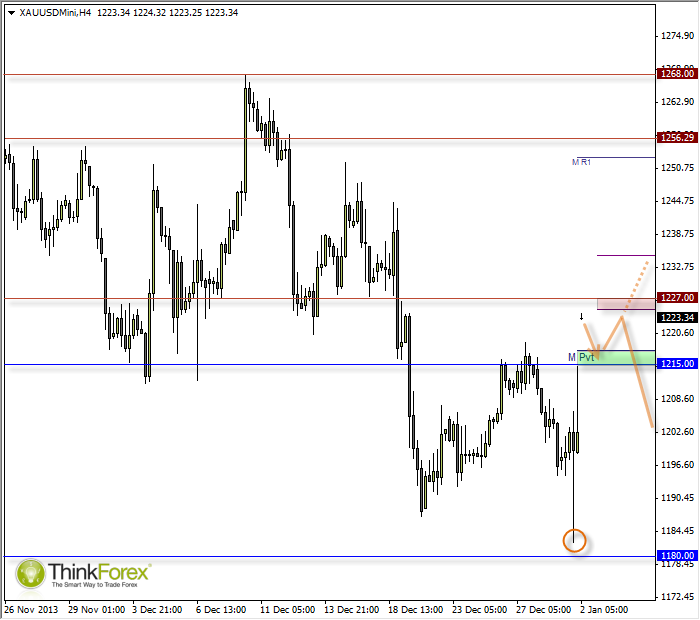

GOLD: Opening Gap may entice bearish gap trader

After opening the new year with a gap up it is hard to imagine bearish gap traders not becoming enticed by this setup. We are trading between 2 clear support and resistance zones after a volatile trading session last week.

Whilst it has been good to see price very nearly reach my 1180 target last year, the reaction is caused around these levels does raise a little concern for the bearish argument and for the potential of a much deeper bullish retracement.

It is the volatility and indecision around 1180 which make me want to keep away from the higher timeframes today and see how price settles before becoming committed towards a direction.

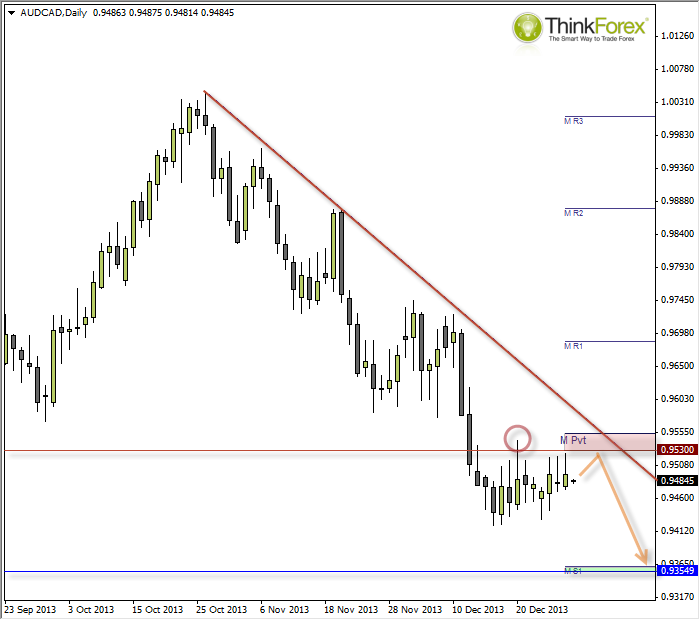

AUD/CAD: Setting up for a move down to 0.9350?

A confluence of resistance has formed around 0.9530 which comprises of the Monthly Pivot, descending trendline and pivotal S/R.

The descending trendline also helps to highlight the 'cyclicity' of the move and suggest current price actions is 'phase 2' of the cycle, which should then be followed by a 'phase 1' leg lower beneath the previous swing low.

We are now consolidating beneath the 0.9530 resistance and I have highlighted the failed attempt to break above this level. I particularly like how price has failed to move back up to the swing high which is why I favour another leg down towards the 0.9350 lows.

The danger with this kind of setup is how to enter. Do you enter live at market and hope for it to tank? Or do you set a pending order, which runs the risk of being triggered into an unfortunate position, as the pattern is not at all neat and tidy.

Personally I prefer to do the following. Set a sell-limit order to enter upon any bullish retracement with a stop loss placed above 0.9550 (how far above is up to you). The reason is I am taking for granted the resistance confluence will hold and in the event it does not hold I no longer want to be in the trade anyway as the analysis has now become invalidated. If I trigger I have also increased my reward to risk ratio, however I run the risk of not entering the trade at all and watching price decline without me.

Personally I prefer to do the following. Set a sell-limit order to enter upon any bullish retracement with a stop loss placed above 0.9550 (how far above is upto you). The reason is I am taking for granted the resistance confluence will hold and in the event it does not hold I no longer want to be in the trade anyway as the analysis has now beomce invalidated. If I trigger I have also increased my reward to risk ratio, however I run the risk of not entering the trade at all and watching price decline without me.  AUD/USD Daily Chart" title="AUD/USD Daily Chart" width="452" height="688">

AUD/USD Daily Chart" title="AUD/USD Daily Chart" width="452" height="688">