The holiday season was quite eventful, with the U.S. avoiding its fiscal cliff with an eleventh-hour agreement. Following months of conflict, Republicans and Democrats finally agreed to delay budget cuts and raise tax rates for the wealthy. Even if the announcement was well received in the markets, we can still expect major confrontations in Washington over the next few months regarding the debt ceiling and management of public spending.

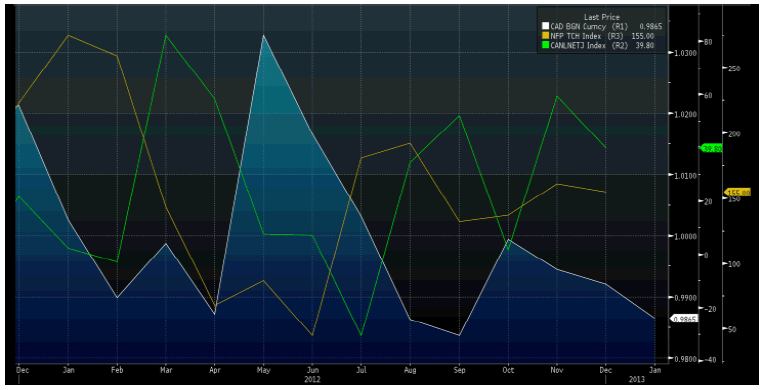

The U.S. employment figures released on Friday were very close to expectations: the unemployment rate for December 2012 was 7.8% and 155,000 jobs were created. In Canada the news for December was also good, with the unemployment rate falling from 7.3% to 7.1% and 39,800 jobs created. Following the release of these figures, the Canadian dollar rose over 0.5% in 10 minutes

The Loonie

“Experience enables you to recognize a mistake when you make it again.” - Franklin P. Jones

The New Year got off to an unusual start. Throughout December, the U.S. President and the members of Congress had investors holding their breath over the outcome of talks on the fiscal cliff. Then, at the last minute, Democrats and Republicans were able to reach an agreement to prevent the country from slipping into another recession. Essentially, with the exception of individuals earning more than $400,000 per year, U.S. income taxes will not rise from 2001 levels.

Unfortunately—and here’s the rub—Congress did not vote on any major cuts in spending. This therefore leaves the federal government with a slightly less enormous deficit in the short term, but with long-term budget problems that are as troubling as ever. Here, the U.S. representatives and senators will need to reach an agreement on the debt ceiling, because the government does not currently have the right to borrow beyond the $16 trillion ceiling negotiated in a last-minute deal in the summer of 2011. In short, the U.S. political model will continue to be tested.

On a slightly different note, 2013 began with good economic news. On Friday we learned of encouraging employment growth in the U.S. and Canada in December, despite the fiscal cliffhanger. As the above graph shows, the two economies created slightly fewer jobs than they did in November but nevertheless managed to exceed investors’ expectations. More specifically, the Canadian economy (the green line) continues to post an impressive performance.

For the third consecutive month, the economy significantly outperformed economists’ expectations. If we compare these figures with U.S. figures for an economy that is almost 10 times larger, we see that Canada created over 2.5 times more jobs, in relative terms. While it may be too soon for such predictions, a wave of good economic news may force our central banker to apply a less expansionary monetary policy, i.e. raise Canada’s key interest rate.

The resulting impacts on the Canadian dollar and Canada’s yield curve are very clear: the CAD would immediately jump several points against the greenback, and the yield curve would continue the upward trend begun at the end of December.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

US Employment Figures Close To Expectations

Published 01/14/2013, 02:32 AM

Updated 05/14/2017, 06:45 AM

US Employment Figures Close To Expectations

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.