Key Points:

- US Election fallout seeing capital flood back to the Swiss franc.

- Recent fundamentals could provide some buoyancy for the pair moving forward.

- Technical bias remains bullish in the near-term.

After a rather precipitous fall following a bout of heightened market fear, the USDCHF has moved back to the mid-point of its ranging phase. As a result, the question is now whether the pair will remain in decline or if a corrective rally will occur. From a technical perspective at least, it appears that some near-term bullishness is the more likely of the two outcomes, especially given the recent US fundamental results. However, one shouldn’t discount the ongoing influence of the US election on this pair.

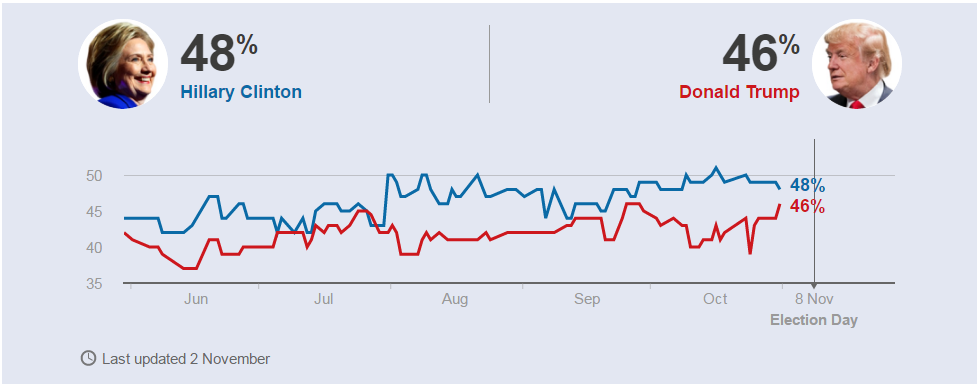

Starting with the election, the Swissy has responded rather strongly to the latest developments in the ongoing circus that is the US presidential race. Specifically, news of the reopening of the FBI case against Hilary Clinton combined with Trump narrowing the gap in the polls has hit this pair harder than most.

The reason for this is largely a result of the Swiss franc’s status as a safe haven currency, making it the perfect place for traders to retreat to when anti-USD sentiment and wider market uncertainty are on the rise.

As a result of the USDCHF’s relative sensitivity to these kinds of fundamental factors, it could be quite reasonable to assume that the pair will remain under pressure as November 8th draws nearer. However, there could also be some relief for the Swissy as a number of stronger US results released during the prior session might begin to mitigate some of the damage.

Notably, the ISM Manufacturing PMI figure, among other PMI results, came in appreciably above expectations. Additionally, the Swiss Retail Sales data contracted by 2.3% which should see the franc soften against its US counterpart. Combined with the fact that the Fed is widely believed to either be holding rates steady or increasing them in the coming announcement, the fundamental bias for the Swissy should be relatively bullish.

This bias is largely mirrored in the pair’s technicals as a number of indicators are signalling that a reversal should occur in the very near term. As is shown below, the USDCHF remains within the constraints of its short-term bullish channel and it is currently challenging the downside boundary of said channel. What’s more, the old long-term trend line also intersects the lower constraint of the channel at the point which limits the chances of a downside breakout.

Furthermore, stochastics are heavily oversold in the wake of the prior session’s major slip. Consequently, technical selling pressures should now be in the process of abating as we move forward. However, it is worth noting, the Swissy has sunk below the 100 day moving average and will likely need to move back above this EMA before bullish momentum truly begins to pick up. Once this occurs, we can expect to see the 23.6% Fibonacci level challenged but probably not breached.

Ultimately, due to the current technical bias and relatively positive economic news, the near-term is likely to see a degree of recovery for the USDCHF. However, in the medium to long-term, the overall ranging phase is likely to remain intact and any further US election surprises could see the Swissy move to the lower boundary of its sideways movement. As a result, keep an eye on the ongoing drama for any hints that traders are getting ready to swing back to their old safe haven in either the lead up to, or aftermath, of November 8th.