It is extremely hard to shift focus from anything other the US elections, given the abundance of cacophony and headline risk associated with the event; however, Brexit risk hit the limelight overnight after the High Court ruled against the UK government, which means that the government requires Parliament’s approval to trigger Article 50.

US Election Risk

The current climate with extraordinary political risk is not for the faint at heart and while finding prudent investment opportunities in currency markets may prove challenging as everyone is interpreting some element of the ticker tape differently. Ultimately the US election risk event will provide great buying opportunities for both long and short term investors alike, but the name of the game is patience. We are mired in a classic market reaction that is driven by fear and uncertainty and which is the polar opposite to a market that is driven with a solid foundation. Predictably, we have seen traders severely taper outright speculative USD risk, which tends to exacerbate issues given less liquidity in the markets.

The broad-based liquidation that started with the Comey shock on Friday, which was then followed yesterday by a chaotic move with revelations about the Clinton Foundation which has since slowed, but the air remains rife with political risk, so it’s best that traders be nimble in these conditions.

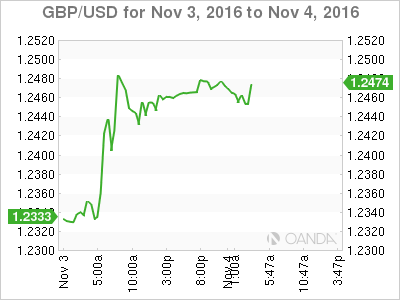

British Pound

Super Thursday lived up to its billing as volumes surged on the Pound yesterday, after the High Court ruling . Cable bounced from the low 1.23t near 1.25, but enthusiasm dampened after the British Government said it would appeal the decision with the Supreme Court, scheduling the call set for between Dec 5 and 8. Price action continued after Governor Carney addressed and surprised the market with a relatively hawkish tone, by removing the explicit easing bias for a more neutral aspect.

While the Brexit economic fallout and risks have abated, the latest move may be borrowing a page from the recent BOE, BOJ and Fed fashion pages, which have all but scotched further rate cuts and in the case of the Fed, is bringing inflation target overshoots to the fore. The next Bigly-level for the pound is the significant 1.2500, where a break would suggest the move has further legs. However, my base case is the current rally is that it is unsustainable and I would expect investors to re-engage their downside exposure, as longer term negative growth projections in the UK are tangible.

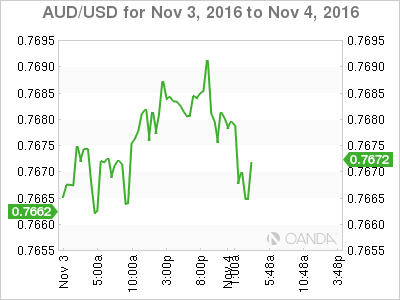

Australian Dollar

While the Australian dollar has recovered nicely from the low .7600 zone , the popular play appears to be little more than a range trade with the imposing pillar of resistance .7020-50 level looking about as daunting an uphill test as Annapurna. However, it is important to keep in mind the Aussie dollars adverse reaction to news reports suggesting the wide-ranging nature of the ongoing FBI investigation into the Clinton Foundation. This sudden capitulation suggests that the Aussie dollar will remain vulnerable to election headline risk and market Knee Jerks. So best not to get too comfortable with the outright long Aussie play. While the move was quickly thwarted as fundamental demand set in, risk abounds.

While Iron Ore continues to froth, one has to be cognizant of the possibility that much of the run is little more than a hedge against further yaun weakness and not fundamentally driven. With Beijing Capital Controls in high gear, Mainland investors may be turning to US linked commodity hedges to protect against further USD depreciation. Let us hope this house of cards remains upright.

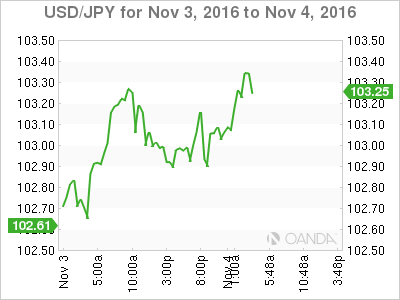

Japanese Yen

In a nutshell, the USD/JPY wants to continue lower after moving through major support levels with surprising ease. Yesterday liquidation to the 102.5 zone was significant. Despite the fact that yesterday’s Japanese holiday likely exacerbated the moves. However, with traders nerves fraying on each and every poll headline, we should expect further USD selling as the market will likely remain on edge into the election zone, more so so if the Clinton headline risk remains in vogue.

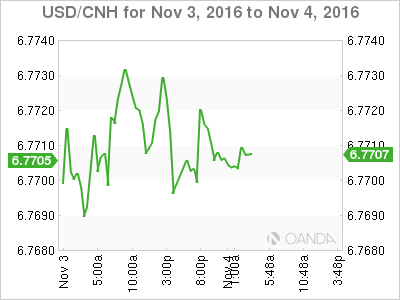

Chinese Yaun

Asian bond and currency markets are for the most part sidelined with the US election political risk premium raging. However, as we try to navigate the turbulent flow from the US election, we should not ignore the weakening Yuan that could begin to haunt regional markets if the currency continues to depreciate. So far it has been more or less a USD move, and with US election risk distorting the real picture, the regional post-election trade is where the debate should lie.

Day ahead

Looking at the day ahead the focus will clearly be on the US employment report – one of two on the calendar befors the December FOMC meeting. A print near the 150-16 level should keep Fed expectation on the course.