The U.S. economy and the labour market faced a set back after the release of the latest employment figures on Friday which has seen the chances of further stimulus from the Federal Reserve increase dramatically. As a result, Treasurys, equity markets and precious metals all rose.

Bernanke has consistently hinted at further easing if the labour market does not improve and the latest figures may just be the trigger that he requires to move ahead with QE3. Only 96,000 jobs were added in August compared to analyst expectations of a 130,000 gain and much lower than the revised 141,000 in July.

Will the Federal Reserve now move to introduce QE3 at the next FOMC meeting this week? We still think not but concede that the chances of them doing so has now increased significantly. The euro opens the week above 1.2800.

The spotlight is increasingly shining on the state of the affairs in the United States as the presidential election looms and the European Central Bank finally gave the market some details of its proposed bond buying programme last week. The Managing Director of the International Monetary Fund, Christine Lagarde, has warned leaders at the Asia Pacific Economic Coop-eration (APEC) Summit in Vladivostok, that the U.S. "fiscal cliff" and the possible automatic spending cuts of more than $480 billion is one of three key risks that the global economy faces today.

She identified the other two key risks as the European debt crisis and medium-term public financing. On a positive note, Lagarde signalled the IMF's support for the ECB's bond buying programme. Although rising with the rest of the majors, the Australian dollar has underperformed to open the week at 1.0360.

U.S. share markets gained last week as stimulus speculation rose on the back of weaker than expected employment data from the U.S. and the ECB moved to outline its proposed bond buying programme. The S&P 500 closed at its highest levels since 2008 after adding 2.2% for the week to 1,438. The index is now within 10% of its all time high in October 2007.

Shares in companies such as Bank of America and JPMorgan Chase gained almost 6% in the week. European stocks were also higher on the last session of the week with the DAX gaining 0.66% while the FTSE rose 0.3%. This week sees the German Consti-tutional Court ruling on the legality of the ESM.

Commodities gained a significant boost in response to the increased chances of further stimulus from the Federal Reserve after the release of weaker than expected U.S. nonfarm payroll figures. The CRB index gained 2.78 points to 311.67. WTI crude has gained almost 1% to $96.42 and is now almost 25% higher than the year's low of $77.69 reached on June 28.

Precious metals were the biggest beneficiary of the weak jobs data saw gold surge more than 2% to above $1,740 while silver sky rocketed more than 3% to $33.70. Soft commodities were mixed while copper recorded significant gains of over 3.6%.

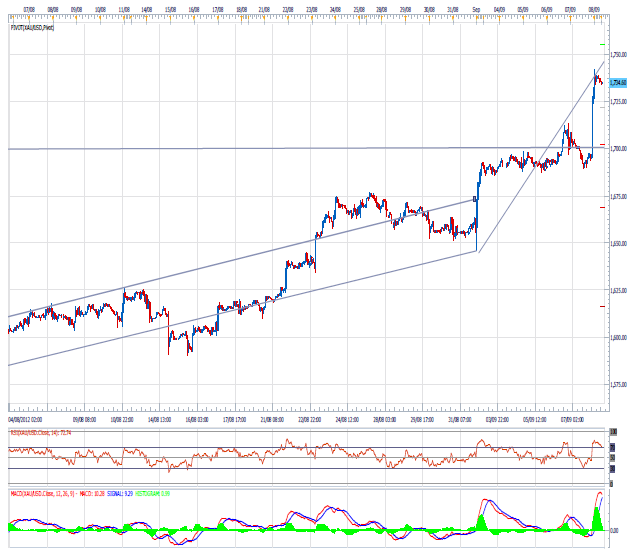

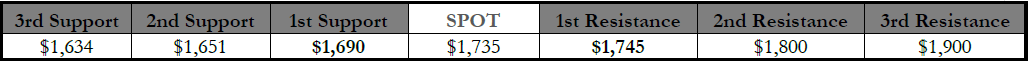

GOLD

We unfortunately incurred a loss trading gold on Friday. After having sold gold at $1,705, it fell below $1,690 almost immediately where we could have taken profits on an intraday basis. However, we had entered into this position in support of our view that QE3 will not happen this quarter and is unlikely to happen this year. However, the release of worse than expected employment data out of the U.S. torpedoed this view as investors rushed to price in imminent stimulus from the Fed.

Gold, being a hedge to inflation, was one of the major beneficiaries of the weaker than expected U.S. data and we were stopped out of our position at $1,722. Gold traded a massive $1,690 to $1,7430 range. Although the chances of QE3 have clearly risen we still do not believe that the Federal Reserve has enough justification to move yet. It will continue to monitor the situation in Europe as there is some chance that the latest ECB programme may finally halt the European debt crisis.

Compass Direction

Short-Term Medium-Term

BEARISH BEARISH

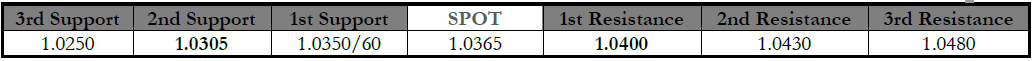

AUD/USD continued its recovery into the US payroll numbers as expectations grew for a QE result if the numbers were to be disappointing. Australian Trade Balance numbers we slightly down on the expected but this didn’t seem to cause any long lasting concerns. The focus was clearly on the employment figure.

The Asian session broke above 1.0300 tripped a round of stop hunting that took the pair into the mid-1.03’s before the weak US payrolls result added to the QE hype and equities rallying and the old link to the AUD kicked in, taking the price 1.0400 offers. These offers were enough to cap the move and this is where the pair closed out the week. Weaker Manufacturing numbers out of China on Sunday has seen the price open the new week slightly lower at 1.0365.

Australian Home Loans data is the highlight for locals with China Trade Balance likely to cause some movement. 18.9B is expected with last months 25.1B looking very unlikely. Should this expectations be correct, the AUD will fall along with commodities.

Compass Direction

Short-Term Medium-Term

NEUTRAL BEARISH

DISCLOSURE AND DISCLAIMER

Compass Global Markets Pty Ltd (“Compass Global Markets”) ACN 144 657 885, Authorised Representative No. 377377, is a Corpo-rate Authorised Representative of Calibre Investments Pty Ltd (Australian Financial Services License No. 337927). Please refer to the Financial Services Guide which is available through our website www.compassmarkets.com for more information regarding the financial services that we offer.

All references to prices, amounts and currency are in Australian dollars unless otherwise noted.

This report is provided for Australian residents only and is not intended for use by residents of any other country.

GENERAL ADVICE WARNING

The advice provided in this report has been prepared without taking into account your particular objectives, financial situation or needs. You should, before acting on the advice, consider the appropriateness of the advice having regard to these matters and, if appropriate, seek independent financial, legal and taxation advice before making any financial investment decision.

This report has been prepared for the general use of Compass Global Markets clients and must not be copied, either in whole or in part, or distributed to any other person. This report and its contents are not intended to be construed as a solicitation to buy or sell any security, product or asset, or to engage in or refrain from engaging in any transaction.

Compass Global Markets does not guarantee the performance of any investment discussed or recommended in this report. This report and the information used within may include estimates and projections which constitute a forward looking statement that express an expectation or belief as to future events, results or returns. No guarantee of future events, results or returns is given or implied by Compass Global Markets. Such statements are made in good faith and based on reasonable assumptions at the time of publication. However, such statements are also subject to risks, uncertainties and other factors which could cause actual results to differ substantially from the estimates and projections contained in this report or otherwise provided by Compass Global Markets.

Any information referencing past performance is not indicative of future performance. All information in this report has been obtained from sources believed to be accurate. Compass Global Markets does not give any representation or warranty as to reliability, accuracy or completeness of information contained in this report and therefore all responsibility is expressly disclaimed, whether due to negligence or otherwise. The information presented and opinions expressed in this report are given as of the date hereof and are subject to change without notice. We hereby disclaim any obligation to inform you of any changes after the date hereof in any matter set forth in this report.

Global Compass Markets, its affiliate and their employees may hold positions in the financial products, or securities or derivatives of, in the companies referred to in this report from time to time.

Analyst Certification: The views or opinions expressed in this report accurately reflect the personal views of the analyst(s) and no part of the remuneration of the analyst(s) was, is, or will be directly or indirectly related to the inclusion of specific recommendations or views in this report. Any views or opinions expressed are the author's own and may not reflect the views or opinions of Compass Global Mar-kets unless specified otherwise.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

US Economy Faces A Setback After Friday's NFP Release

Published 09/10/2012, 03:09 AM

Updated 07/09/2023, 06:31 AM

US Economy Faces A Setback After Friday's NFP Release

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.