The slowdown in US economic growth has yet to reach a tipping point that marks the start of recession, but the expansion may run out of road as early as November, according to new forecasts for a set of proprietary indicators published in The US Business Cycle Risk Report.

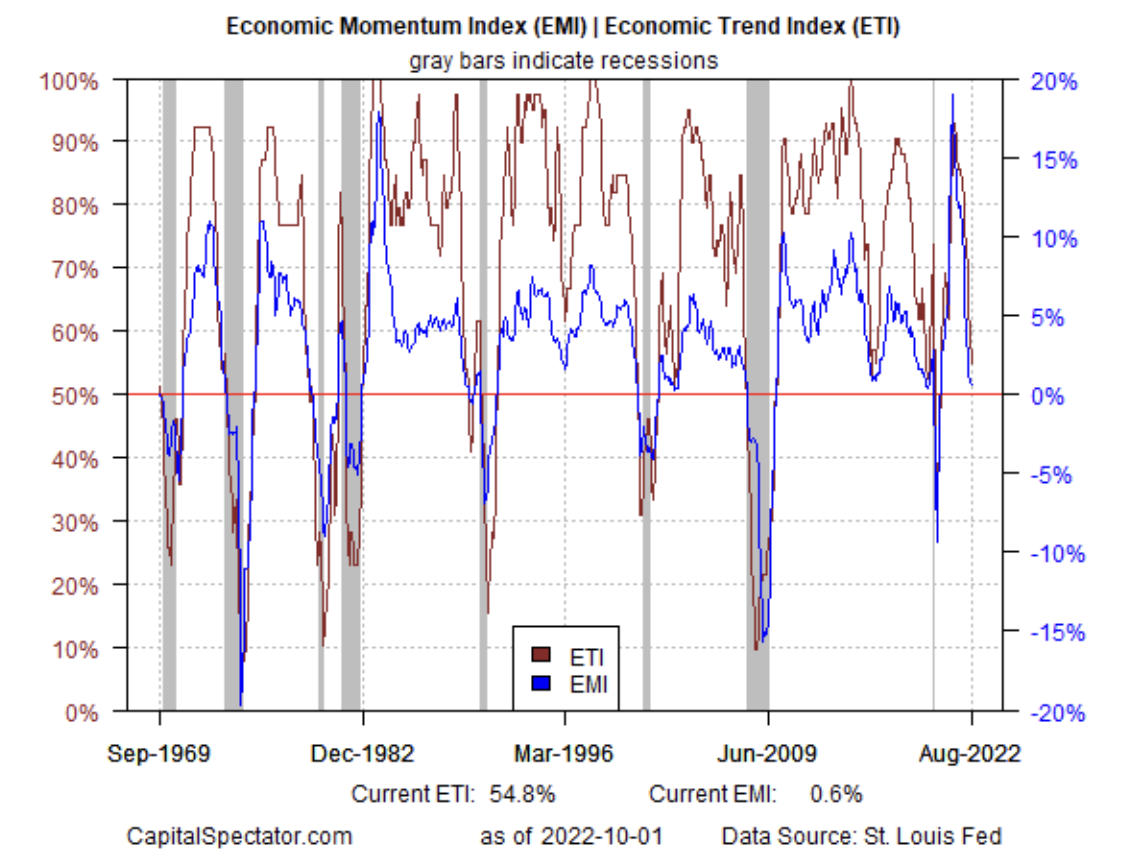

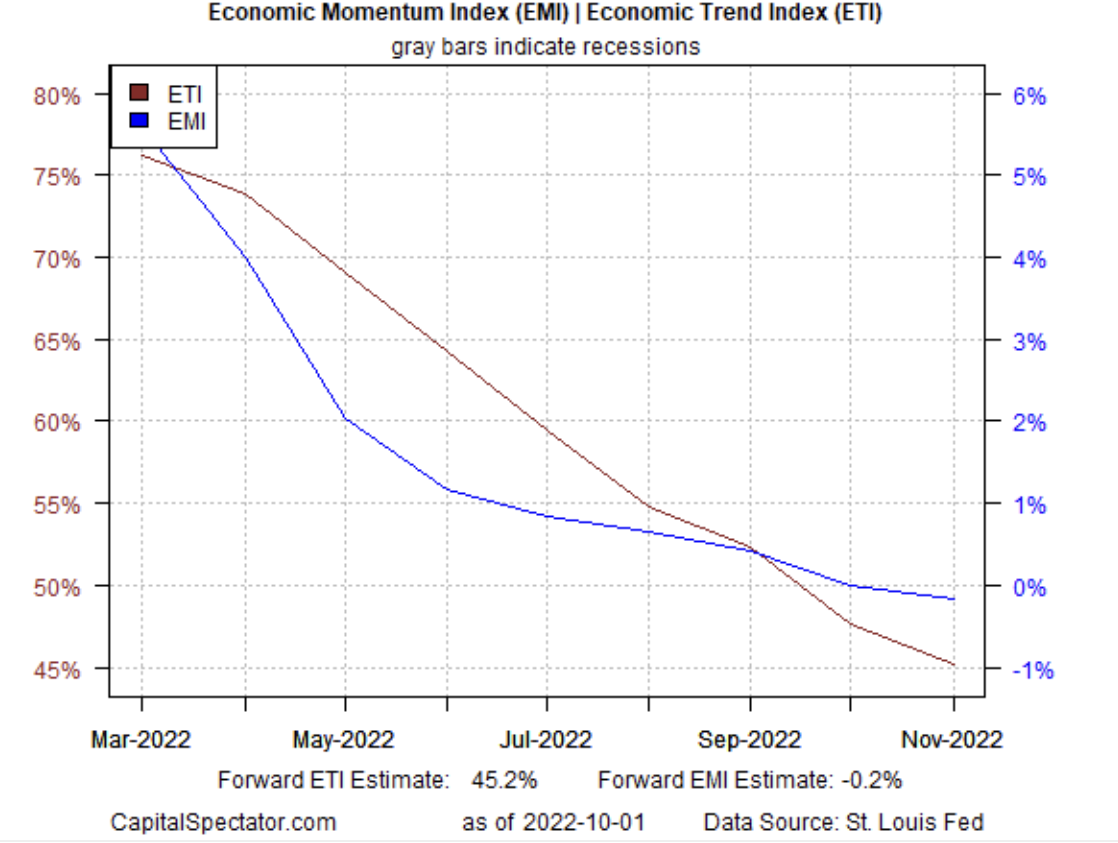

In the edition sent to subscribers on Oct. 2 I advised that the Economic Trend Index (ETI) and Economic Momentum Index (EMI), a pair of multi-factor benchmarks tracking US economic activity, slipped below their respective tipping points that indicate contraction for estimates through November. If correct, the decline will mark the start of a new NBER-defined recession.

The question is whether incoming data in the weeks ahead change the trend? Maybe, but for now the headwinds are strengthening, a trend that appears set to reach a critical point next month.

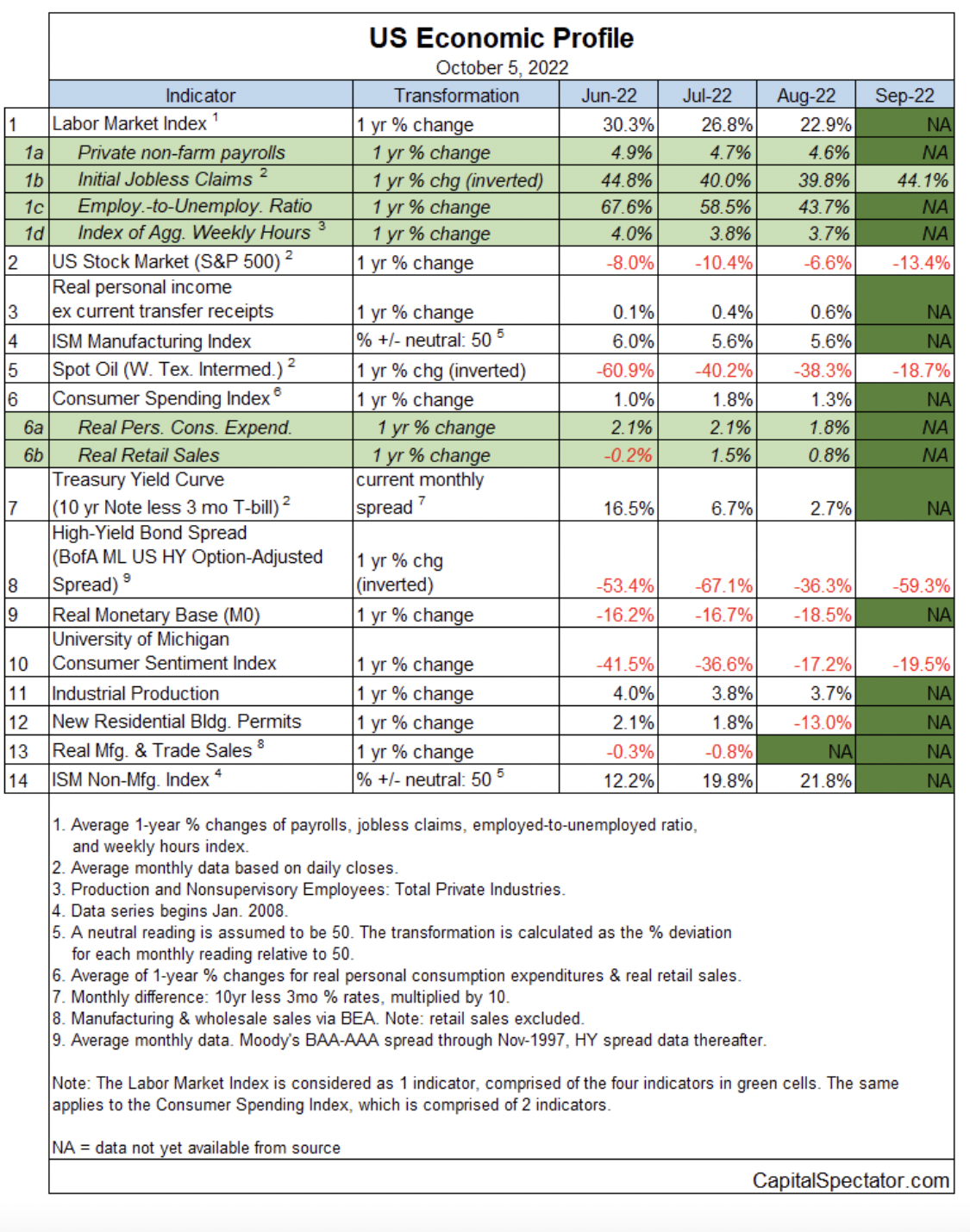

For some context on how and why I’m making this forecast, let’s start by noting that ETI and EMI are calculated using a broad range of indicators that capture the primary ebb and flow of US economic output, as shown in the table below. In other words, this analysis draws on changes in the broad macro trend rather than one or two indicators.

Aggregating the indicators listed above into business-cycle indexes allows us to track the broad evolution of the macro trend through time. The availability of published data to date provides only a partial profile for August and September.

An econometric technique (ARIMA) fills in the missing pieces through November and on that basis the ETI and EMI are set to dip below their respective levels that indicate recession: 50% and 0%, respectively.

Forecasts are always suspect, of course, and so the usual caveats apply, but this methodology has a history of offering reliable estimates. Why? Several reasons, starting with the relatively low-risk focus on projecting data for the immediate future, which is less prone to error compared with guesstimating trends far into the future. Second, the estimates for the various indicators are aggregated into broad macro indexes, which tends to minimize error compared with trying to estimate any one data set. The net effect: the signal-to-noise ratio for ETI and EMI and near-term estimates is comparatively high.

The key question is whether a strong labor market will persist and offset rising recession risk? Even if a recession begins, the downturn looks set to be mild, at least for now.

This much is clear: the economic updates over the coming weeks will be critical for deciding if recession risk has reached a critical turning point. Based on the current ETI and EMI estimates, the odds no longer look favorable.