The US dollar took losses against virtually all of its main currency rivals yesterday, following a disappointing consumer sentiment indicator that generated concerns regarding the pace of the US economic recovery. Today, US news is once again forecasted to generate volatility in the marketplace. Traders will want to pay attention to the ADP Non-Farm Employment Change, Advance GDP figure and FOMC Statement. If any of the news signals a further slowing down in the US economy, the dollar could take additional losses.

Economic News

USD - Disappointing US News Leads to Dollar Losses

The US dollar took losses against most of its main currency rivals throughout the European session yesterday, amid a decrease in confidence in the US economic recovery, highlighted by a disappointing CB Consumer Confidence figure. The USD/CHF fell close to 70 pips over the course of the mid-day session, eventually reaching as low as 0.9192 before a slight upward correction brought the pair to the 0.9210 level. Against the Japanese yen, the greenback fell close to 40 pips during the first part of the day to trade as low as 90.32. By the start of afternoon trading, the pair was stable at 90.60.

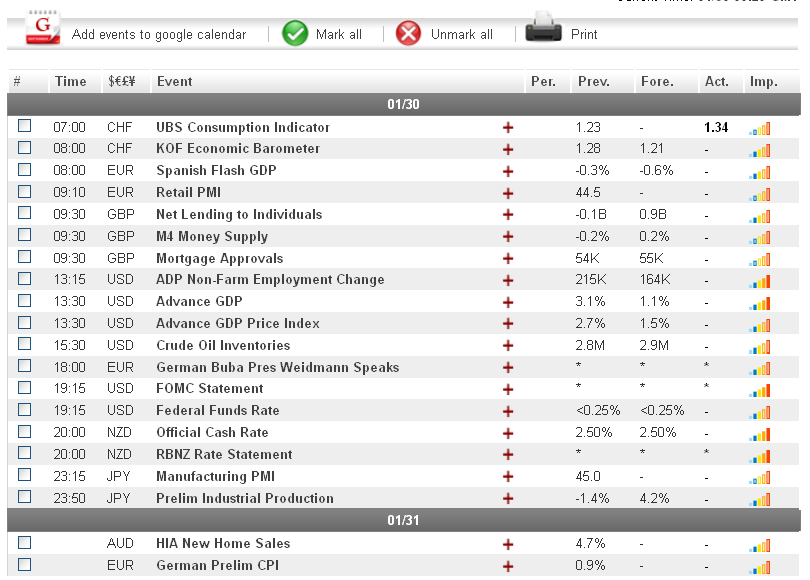

Today, US news is forecasted to generate volatility throughout the marketplace. The ADP Non-Farm Employment Change, which is widely considered an accurate predictor of Friday's all important Non-Farm payrolls, could lead to additional losses for the greenback if the indicator comes in below expectations. Similarly, the USD could extend its bearish run if either the Advance GDP figure or FOMC Statement shows that the US economic recovery is slowing down.

EUR - Optimism in EU Economic Recovery Keeps Euro Bullish

The euro was able to extend its recent upward trend throughout the day yesterday, amid confidence in the euro-zone economic recovery, combined with weak economic data out of the US. The EUR/USD advanced 68 pips during mid-day trading, eventually reaching as high as 1.3494 before dropping back to the 1.3485 level. Against the Japanese yen, the euro started off the day on a bearish note, dropping close to 100 pips to trade as low as 121.19, before an upward correction brought prices back to the 122.35 level during afternoon trading.

Euro traders can anticipate another volatile day today, as significant data out of both the euro-zone and US is set to be released. Traders will want to pay close attention to the Italian 10-year bond auction. If there is high demand for Italian debt, confidence in the euro-zone economic recovery is likely to increase, which would result in gains for the euro. Furthermore, if US economic data once again comes in below expectations, the EUR/USD could see additional gains.

Gold - Gold Sees Modest Gains as Dollar Weakens

The price of gold advanced close to $8 an ounce during Asian trading yesterday as a decrease in value of the US dollar made the precious metal cheaper for international buyers. Gold traded as high as $1664.65 before a slight downward correction later in the day brought prices back to the $1660 level.

Today, gold has the potential to extend yesterday's gains following the release of several potentially significant US economic indicators. If any of the news results in losses for the greenback, investors may shift their funds to safe-haven assets, which would boost gold prices.

Crude Oil - Risk Taking Drives Oil Prices Higher

The price of crude oil shot up above the $97 level during mid-day trading yesterday, as increased confidence in the euro-zone economic recovery led to risk taking in the marketplace. Overall, prices gained close to $0.50 a barrel during European trading to peak at $97.28. By the beginning of the afternoon session, the commodity was trading at $96.98.

Today, oil traders will want to pay attention to the US Crude Oil Inventories figure, set to be released at 15:30 GMT. Analysts expect the figure to come in at 2.9M, which if true, would signal a decrease in American demand for oil, and would likely result in a downward correction during afternoon trading.

Technical News

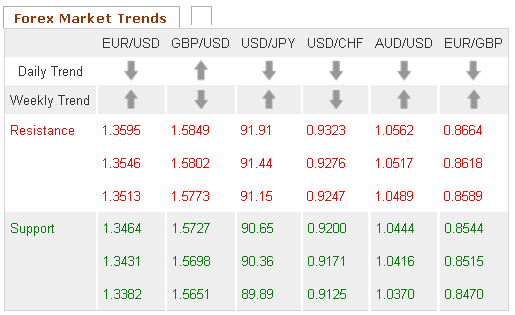

EUR/USD

A bearish cross is close to forming on the weekly chart's Slow Stochastic, indicating that a downward correction could occur in the near future. This theory is supported by the Williams Percent Range on the same chart, which is currently in overbought territory. Opening short positions may be the best option for this pair.

GBP/USD

The Williams Percent Range on the weekly chart has fallen in into oversold territory, signaling that an upward correction could occur in the near future. This theory is supported by the Relative Strength Index on the daily chart, which is currently just below 30. Opening long positions may be the best choice for traders.

USD/JPY

The Relative Strength Index on the weekly chart is currently overbought territory, indicating that a downward correction could occur in the near future. Furthermore, the Slow Stochastic on the same chart has formed a bearish cross. Opening short positions may be the best choice for traders.

USD/CHF

Most long-term technical indicators show this pair trading in neutral territory, meaning a definitive trend is difficult to predict at this time. Traders may want to take a wait and see approach for this pair, as a clearer picture is likely to present itself in the near future.

The Wild Card

CAD/CHF

The Relative Strength Index on the daily chart has fallen into oversold territory, indicating that an upward correction could occur in the near future. This theory is supported by the Slow Stochastic on the same chart which has formed a bullish cross. Opening long positions may be the best choice for forex traders today.

Economic News

USD - Disappointing US News Leads to Dollar Losses

The US dollar took losses against most of its main currency rivals throughout the European session yesterday, amid a decrease in confidence in the US economic recovery, highlighted by a disappointing CB Consumer Confidence figure. The USD/CHF fell close to 70 pips over the course of the mid-day session, eventually reaching as low as 0.9192 before a slight upward correction brought the pair to the 0.9210 level. Against the Japanese yen, the greenback fell close to 40 pips during the first part of the day to trade as low as 90.32. By the start of afternoon trading, the pair was stable at 90.60.

Today, US news is forecasted to generate volatility throughout the marketplace. The ADP Non-Farm Employment Change, which is widely considered an accurate predictor of Friday's all important Non-Farm payrolls, could lead to additional losses for the greenback if the indicator comes in below expectations. Similarly, the USD could extend its bearish run if either the Advance GDP figure or FOMC Statement shows that the US economic recovery is slowing down.

EUR - Optimism in EU Economic Recovery Keeps Euro Bullish

The euro was able to extend its recent upward trend throughout the day yesterday, amid confidence in the euro-zone economic recovery, combined with weak economic data out of the US. The EUR/USD advanced 68 pips during mid-day trading, eventually reaching as high as 1.3494 before dropping back to the 1.3485 level. Against the Japanese yen, the euro started off the day on a bearish note, dropping close to 100 pips to trade as low as 121.19, before an upward correction brought prices back to the 122.35 level during afternoon trading.

Euro traders can anticipate another volatile day today, as significant data out of both the euro-zone and US is set to be released. Traders will want to pay close attention to the Italian 10-year bond auction. If there is high demand for Italian debt, confidence in the euro-zone economic recovery is likely to increase, which would result in gains for the euro. Furthermore, if US economic data once again comes in below expectations, the EUR/USD could see additional gains.

Gold - Gold Sees Modest Gains as Dollar Weakens

The price of gold advanced close to $8 an ounce during Asian trading yesterday as a decrease in value of the US dollar made the precious metal cheaper for international buyers. Gold traded as high as $1664.65 before a slight downward correction later in the day brought prices back to the $1660 level.

Today, gold has the potential to extend yesterday's gains following the release of several potentially significant US economic indicators. If any of the news results in losses for the greenback, investors may shift their funds to safe-haven assets, which would boost gold prices.

Crude Oil - Risk Taking Drives Oil Prices Higher

The price of crude oil shot up above the $97 level during mid-day trading yesterday, as increased confidence in the euro-zone economic recovery led to risk taking in the marketplace. Overall, prices gained close to $0.50 a barrel during European trading to peak at $97.28. By the beginning of the afternoon session, the commodity was trading at $96.98.

Today, oil traders will want to pay attention to the US Crude Oil Inventories figure, set to be released at 15:30 GMT. Analysts expect the figure to come in at 2.9M, which if true, would signal a decrease in American demand for oil, and would likely result in a downward correction during afternoon trading.

Technical News

EUR/USD

A bearish cross is close to forming on the weekly chart's Slow Stochastic, indicating that a downward correction could occur in the near future. This theory is supported by the Williams Percent Range on the same chart, which is currently in overbought territory. Opening short positions may be the best option for this pair.

GBP/USD

The Williams Percent Range on the weekly chart has fallen in into oversold territory, signaling that an upward correction could occur in the near future. This theory is supported by the Relative Strength Index on the daily chart, which is currently just below 30. Opening long positions may be the best choice for traders.

USD/JPY

The Relative Strength Index on the weekly chart is currently overbought territory, indicating that a downward correction could occur in the near future. Furthermore, the Slow Stochastic on the same chart has formed a bearish cross. Opening short positions may be the best choice for traders.

USD/CHF

Most long-term technical indicators show this pair trading in neutral territory, meaning a definitive trend is difficult to predict at this time. Traders may want to take a wait and see approach for this pair, as a clearer picture is likely to present itself in the near future.

The Wild Card

CAD/CHF

The Relative Strength Index on the daily chart has fallen into oversold territory, indicating that an upward correction could occur in the near future. This theory is supported by the Slow Stochastic on the same chart which has formed a bullish cross. Opening long positions may be the best choice for forex traders today.