The Economic Activity Composite (EAC), a proprietary multi-variable composite of mostly market-based variables, represents a leading measure of economic activity within the United States.

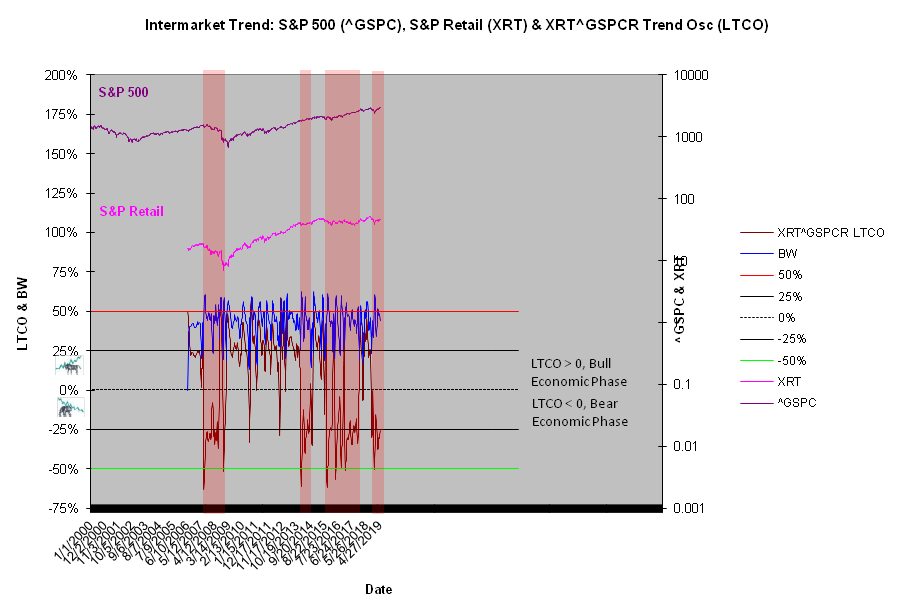

The economy is far weaker than advertised. If you don't believe the Economic Activity Composite, then maybe the chronic underperformance of the retail stocks will convince you (see Retail Stock Oscillator, Matrix Line 79). The retail stock oscillator has been below the zero line for 31 weeks. It's also been below the zero line around 75% of the time since 2015. Why?

The economy is weak. The majority of people are having a hard time recognizing the economic weakness because the US stock market is rallying. US stocks can't rally if the economy slows or contracts, right? Most of the time this is correct, but there are exceptions. If stocks are viewed as a safe haven, especially during a public sector driven crisis, a cycle inversion can take place. Stocks can rally even as the economy slows.