Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

I read an article recently that the fundamentals for gold are turning from not great to bad with interest rate hikes on the horizon. My initial thoughts were I wonder which bullion bank they work for and how many short positions they cannot exit.

Gold’s fundamentals are anything but bad. High inflation, stock markets wobbling at all time highs, massive negative real yields, geopolitical problems, US debt over $30 Trillion, petrodollar competition, and countries dumping the dollar to name but a few.

Those who believe that interest rate hikes are bad for gold in high inflationary environments need to look back at history because they aren’t. Interest rate hikes have caused money to rotate into other sectors and it is the turn of commodities with a huge supply and demand deficit.

From a technical point of view, the chart below highlights that gold is on the move, and on the move up. There are two key resistance levels left between where gold is priced today are just over the significant $2000/oz level and then the all time high daily closing price of $2064/oz. The chart pattern is impressive with two notable double bottoms and a continuation of higher lows. Note the recent area of support forming a nice basing pattern around the 1920 level. This has helped launch the price higher.

So back to the title. Dollar up, Yields up, Gold up! That isn’t logical is it? The CPI release yesterday, and in previous months has been a buy the rumour sell the fact style of play. And who in their right mind wants a 10-year yield at 2.8% with inflation at 8.5%? As for the dollar, well it has proven many analysts wrong that claim it has a direct inverse correlation to gold. Algorithm trading may well still do this in its basic form of buy dollar sell gold and vice versa. However while real yields and the dollar can play a big part in gold’s price, despite what some may have you believe, they are not directly correlated.

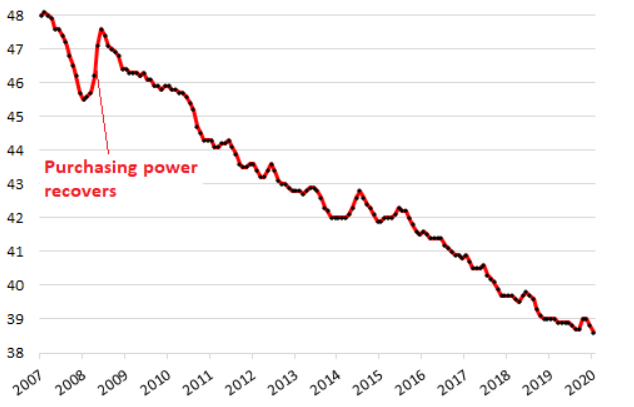

Another belief to dispel is that gold’s price is directly related to the dollar’s loss of purchasing power. Again not true. If it was, the chart below would be yielding a an inversely correlated gold price, yet gold peaked in 2011 and then entered a 5 year bear market dropping considerably in price.

Gold is said to stand for many thing, and I still believe is misunderstood by some as a true store of value, sound money and protection of wealth. Its price can be argued as many things, but what it is, is an insurance policy. How much you have insured in your portfolio