The US dollar has fallen quite a bit this week against the Mexican peso, perhaps in a bid to find yield in a low interest rate environment. After all, out of the most common global currencies, the Mexican peso stands head and shoulders as far as swap is concerned. Beyond that, keep in mind that the Mexican peso is also a proxy for Latin America, as well as crude oil.

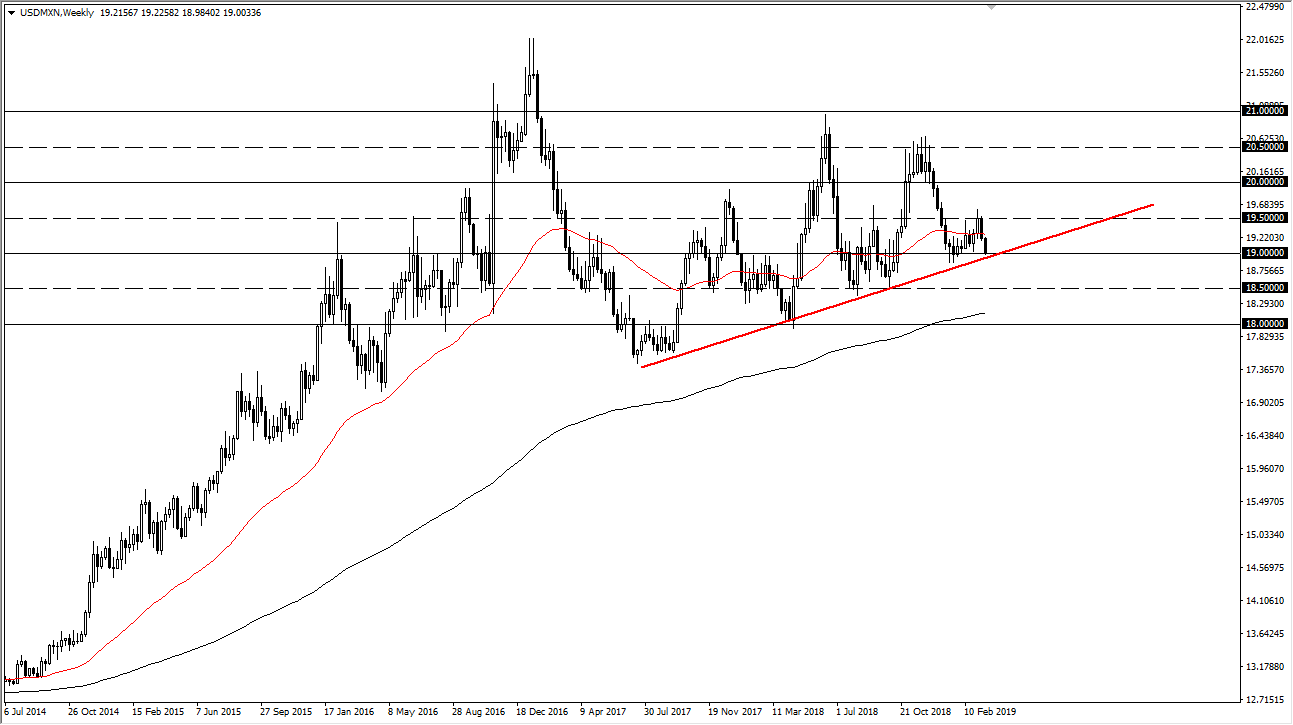

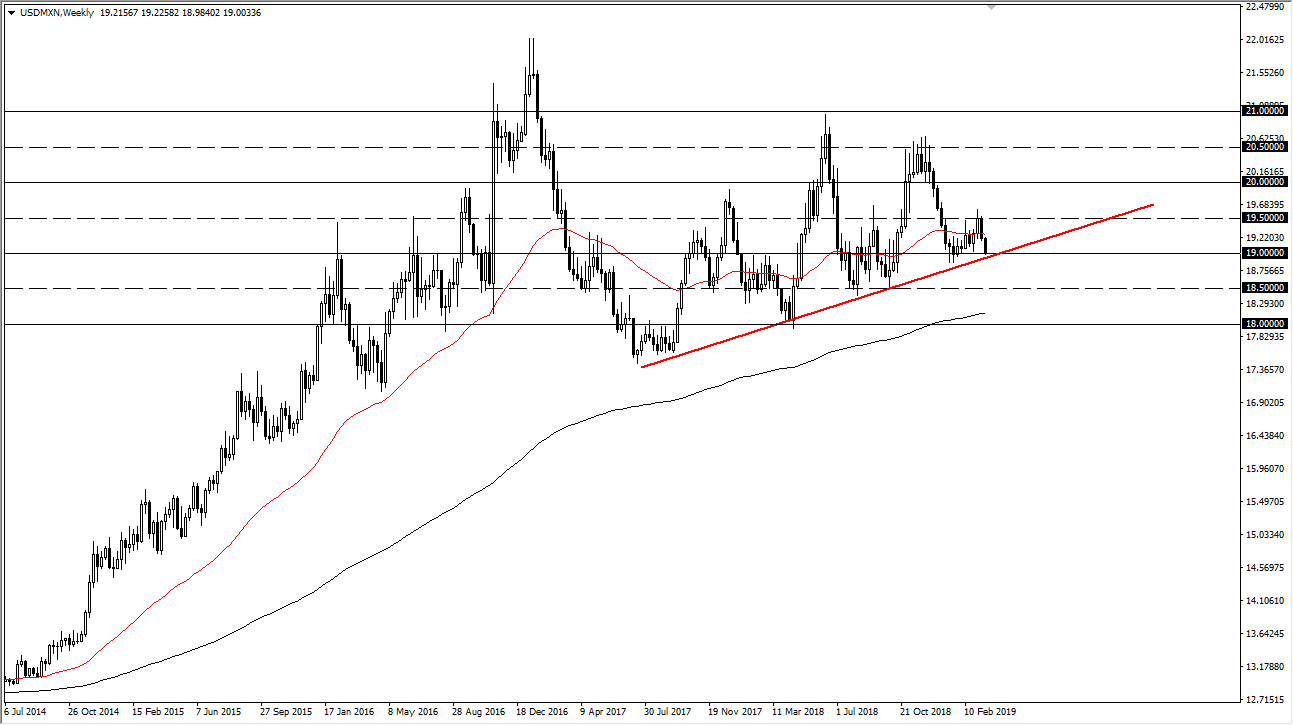

The pair is currently testing a major trendline that extends all the way back to April 2017, and it coincides nicely with the 19 pesos level. This of course is a very negative sign, and you can even make an argument for a bearish flag leading into the downtrend line. If this does kick off, we could find this market reaching down towards the 17.50 pesos level or even beyond. This would obviously be a major trend change, but at this point we are still trying to solve the equation.

Looking at the market, it’s very likely that there will be a certain amount of interest around the 19 pesos level not only because of the uptrend line, but also because it has been psychologically and structurally important in the past. A bounce from here opens the door to the 19.50 pesos level but could take several sessions to get there.

Pay attention to the crude oil market, because if it does break to the upside rather stringently, specifically the West Texas Intermediate market breaking the $60 gap, that could have people looking for crude oil based currencies such as the Mexican peso. In order to trade the next move be it up or down, you should wait for a daily close, because this pair does tend to be a bit thin at certain times of day. Nonetheless, we have a very interesting level in front of us.