Talking Points

- US Dollar Technical Strategy: Long via Mirror Trader USD Basket

- Prices Correct Lower from 5-Month High, Retest Broken Trend Line.

- Long-Term Uptrend May Be Resuming, But Event Risk Threatens Setup.

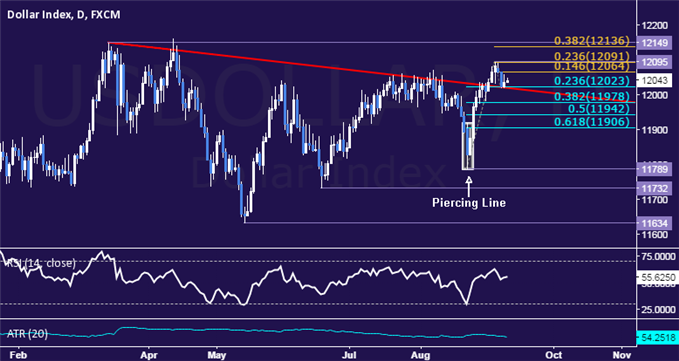

The Dow Jones FXCM Dollar Index corrected lower after hitting the highest level in five months, but the overall trend bias continues to favor the upside. Prices raced higher from swing lows set in late August, breaking trend line resistance capping the upside since mid-March and hinting the longer-term ascent started in June 2014 may be resuming.

From here, a daily close above the 14.6% Fibonacci expansion at 12064 opens the door for a test of the 12091-95 area, marked by the 23.6% level and the September 4th high. Alternatively, a turn below the 12023 – the intersection of falling trend line resistance-turned-support – and the 23.6% Fib retracement, clears the way for a challenge of the 38.2% threshold at 11978.

Technical positioning suggests the near-term bias may be realigning with the multi-year upward trajectory once again. Choppy volatility over recent weeks calls for caution in betting on immediate follow-through, however, particularly as September’s much-anticipated FOMC meeting draws closer.