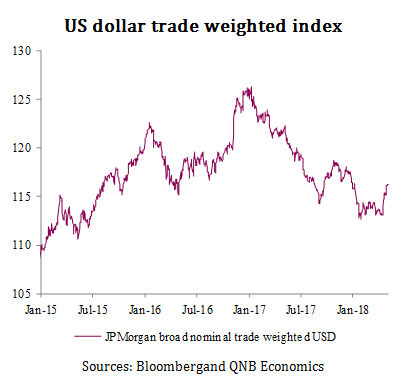

The US dollar has strengthened sharply against a basket of currencies since March 26th this year. Against the DXY index, which is a basket of major trading partner currencies, the US dollar has strengthened by 4.1%. The broader JP Morgan trade weighted US dollar index has appreciated by a less dramatic 2.7% over the same period – this is a broader basket that includes emerging market currencies.

Even after the recent rally the US dollar remains 8% below its most recent peak in December 2016 shortly after the US Presidential election. So, what explains the recent turnaround in the fortunes of the US dollar? The most important driver has been the recent softening in global growth expectations as a result of downgrades to growth forecasts outside the US. In recent weeks, economists at global banks have been revising lower their forecasts of economic growth across a broad range of economies, both developed and emerging markets relative to the US growth forecast. Moreover, forward looking indicators of global growth based on Purchasing Manager Indices (PMIs) have also moved lower with the new orders component having declined for three consecutive months.

When growth forecasts and incoming macroeconomic data are being revised lower relative to the US it tends to favour the US dollar for a number of reasons. First, declining global growth momentum tends to be negative for risk appetite among investors and this can tilt the balance of capital flows in favour of US dollar assets such as US treasuries which are seen as “safe”. Second, global growth is strongly correlated with global trade, and emerging markets in particular tend to be more “open” economies (measured as exports plus imports as a share of GDP) and so their growth prospects are more sensitive to changes in global trade momentum. Hence, negative news on global growth tends to be negative for EM currencies. Third, declining global growth momentum tends to be negative for commodity prices resulting in the underperformance of commodity currencies. So far, however, commodity prices have held up well because, although growth forecasts are being revised down, the overall level of global growth still remains healthy and the consensus is that the recent economic data will prove to be a temporary soft patch in the global economic cycle.

US dollar trade weighted index

Sources: Bloombergand QNB Economics

Another potential reason for the recent surge in the US dollar is the expectation that US corporations are beginning to repatriate earnings that were previously held offshore. The recent tax reform package passed under the Trump administration provides tax incentives to US firms to repatriate earnings from their overseas operations which were previously being held offshore. However, it is very difficult to predict or even monitor in real time the timing and size of these potential capital flows.

Looking ahead, the prospects for the US dollar will depend on the outlook for global growth and, in particular, in other parts of the world relative to the US. The recent flow of economic data likely points to a temporary soft patch in global growth with macroeconomic indicators stabilizing over the coming months. Nevertheless, with global growth likely to slow in 2018 relative to last year, albeit nothing dramatic, driven by a growth slowdown in economies outside the US such as China, does suggest that the period of significant US dollar underperformance since December 2016 is behind us. Instead, we are likely to witness a stabilization of the US dollar within a wide range for the remainder of 2018.