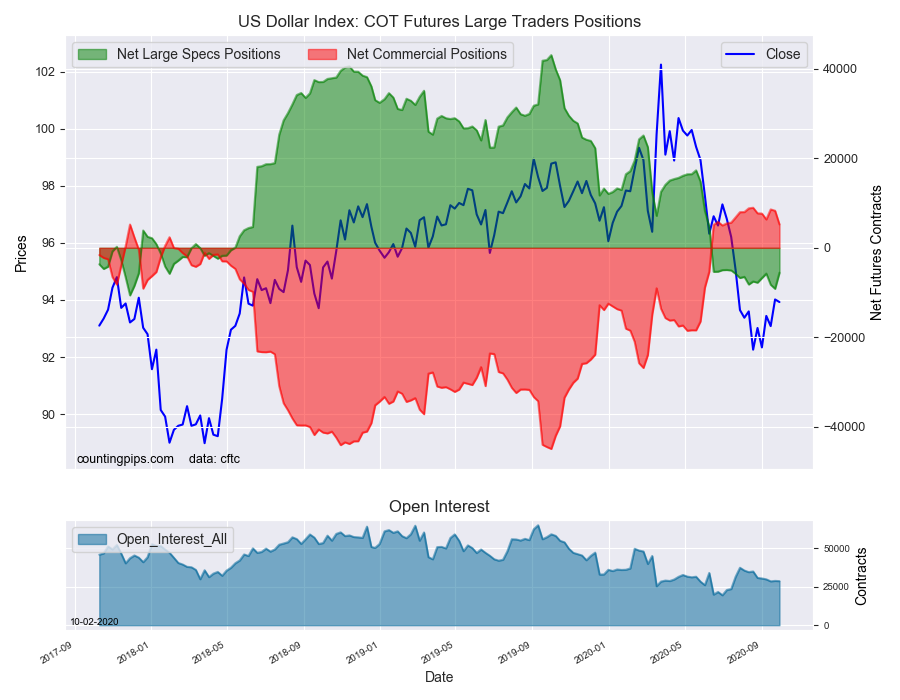

US Dollar Index Speculator Positions

Large currency speculators decreased their bearish net positions in the US Dollar Index futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of US Dollar Index futures, traded by large speculators and hedge funds, totaled a net position of -5,555 contracts in the data reported through Tuesday September 29th. This was a weekly improvement by 3,591 contracts from the previous week which had a total of -9,146 net contracts.

This week’s net position was the result of the gross bullish position (longs) growing by 2,908 contracts (to a weekly total of 14,840 contracts) compared to the gross bearish position (shorts) which saw a reduction by -683 contracts on the week (to a total of 20,395 contracts).

US Dollar Index speculators reduced their bearish bets this week following two straight weeks of rising bearish positions that had brought the overall standing to the lowest level in 147 weeks. The +3,591 net contracts this week marks the best one-week gain in 27 weeks, dating back to March 24th. The overall speculator standing remains in a bearish position for the 16th consecutive week but has now improved to the least bearish level of the past eleven weeks.

Individual Currencies Data this week:

In the other major currency contracts data, we saw two substantial changes (+ or – 10,000 contracts) in the speculators category this week.

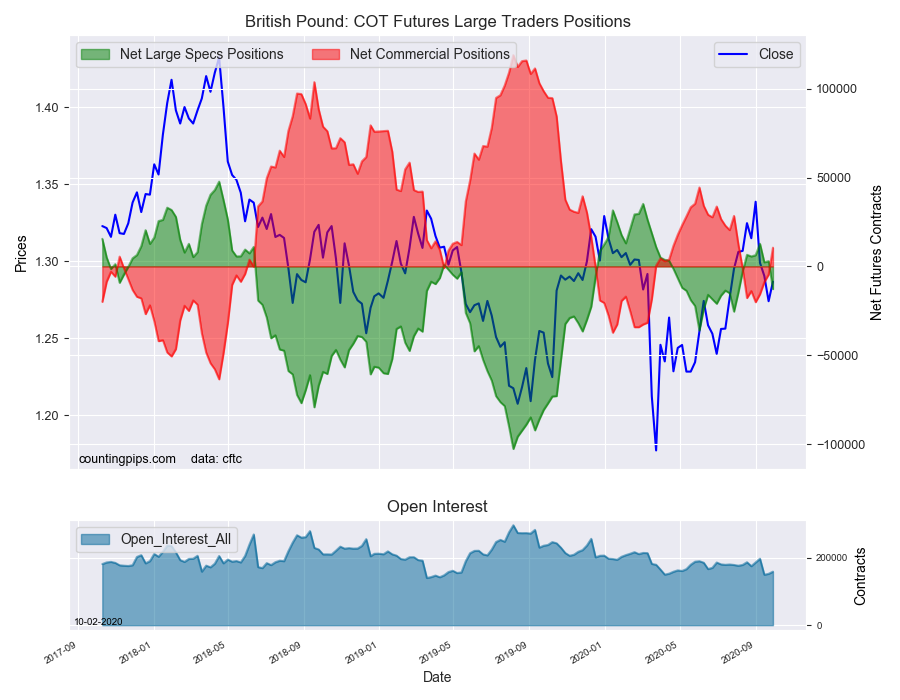

The British pound sterling dropped sharply by over -15,000 contracts this week. This sharp decline pushed the overall net position back into bearish territory for the first time in the past seven weeks. The messy Brexit divorce from the EU is weighing on the pound and has pushed the GBPUSD currency pair back under the 1.30 exchange rate.

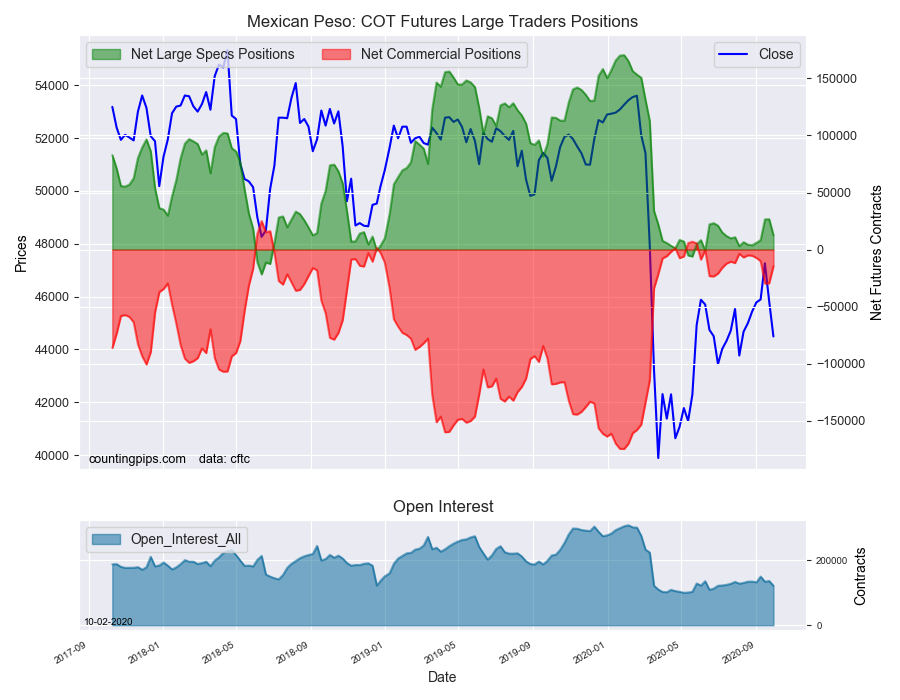

Mexican peso positions fell by over -14,000 contracts this week following four straight weeks of gains. The peso speculator position remains in bullish territory for the sixteenth straight week after a short spell in a bearish position in May and June. Overall, peso bets are in a small bullish level (+12,636 contracts) and down from stronger bullish levels in early 2020 that included an all-time record high of +170,366 contracts on January 28th.

Overall, the major currencies that saw improving speculator positions this week was just the US dollar index (3,591 weekly change in contracts).

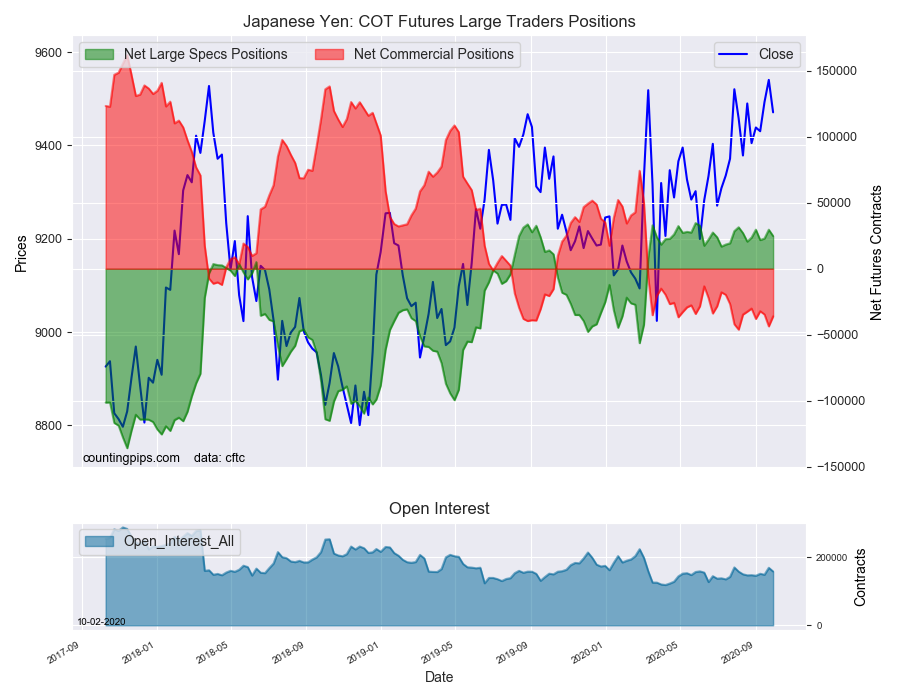

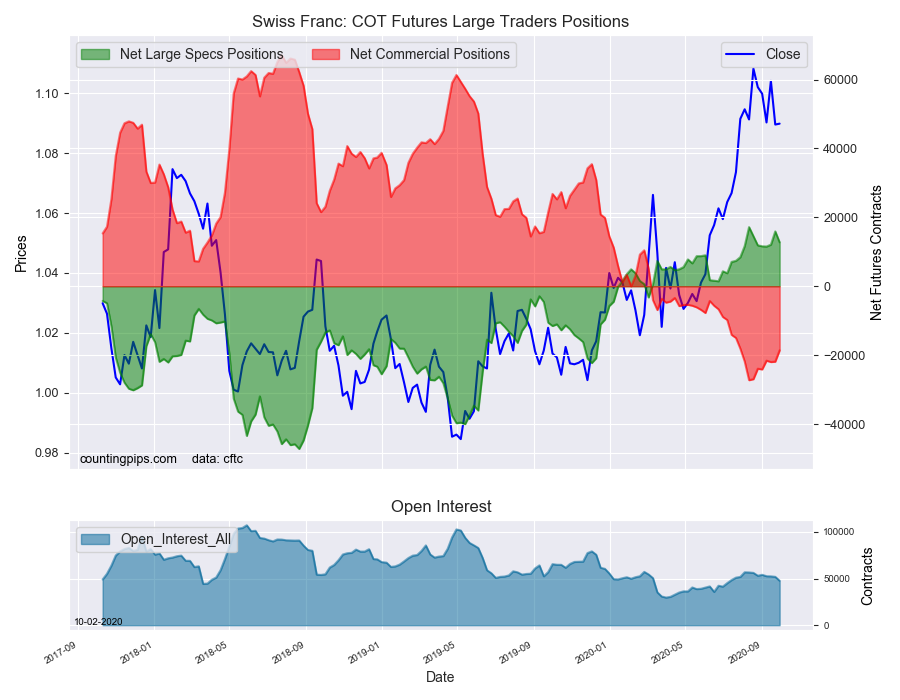

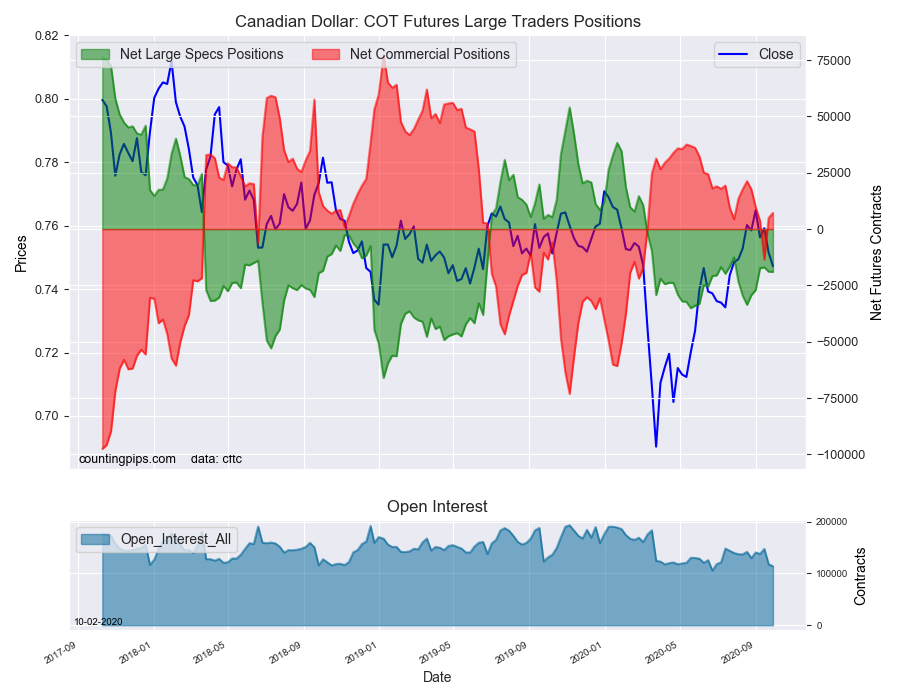

The currencies whose speculative bets declined this week were the euro (-2,706 weekly change in contracts), British pound sterling (-15,709 contracts), Japanese yen (-4,792 contracts), Swiss franc (-3,175 contracts), Canadian dollar (-66 contracts), Australian dollar (-7,402 contracts), New Zealand (-1,531 contracts) and the Mexican peso (-14,014 contracts).

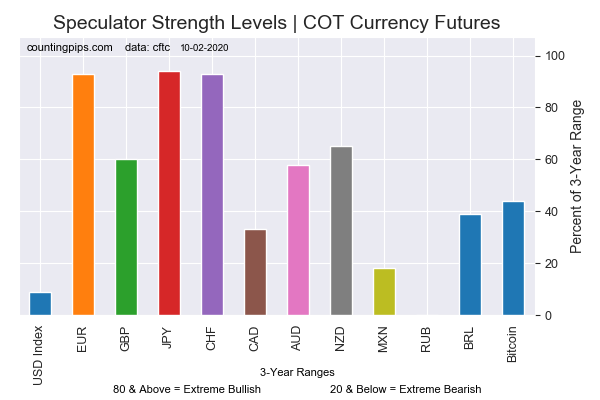

Chart: Current Strength of Each Currency compared to their 3-Year Range

The above chart depicts each currency’s current speculator strength level compared to data of the past 3 years. A score of 0 percent would mean speculator bets are currently at the lowest level of the past three years. A 100 percent score would be at the highest level while a 50 percent score would mean speculator bets are right in the middle of the data (a neutral score). We use above 80 percent (extreme bullish) and below 20 percent (extreme bearish) as extreme score measurements.

Please see the data table and individual currency charts below.

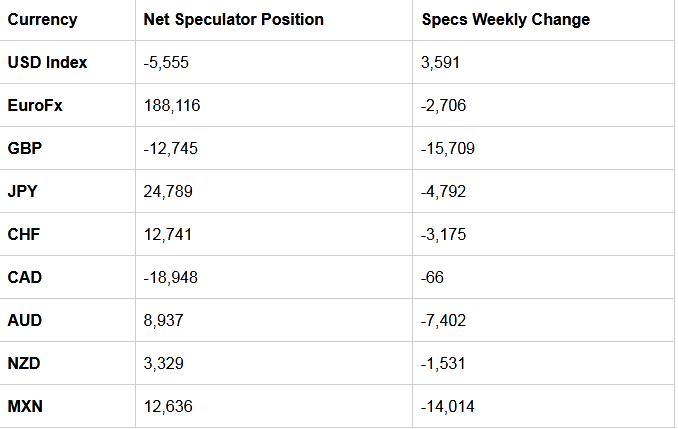

Table of Large Speculator Levels & Weekly Changes:

This latest COT data is through Tuesday and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets. All currency positions are in direct relation to the US dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar while a bet against the euro will be a bet that the dollar will gain versus the euro.

Weekly Charts: Large Trader Weekly Positions vs Price

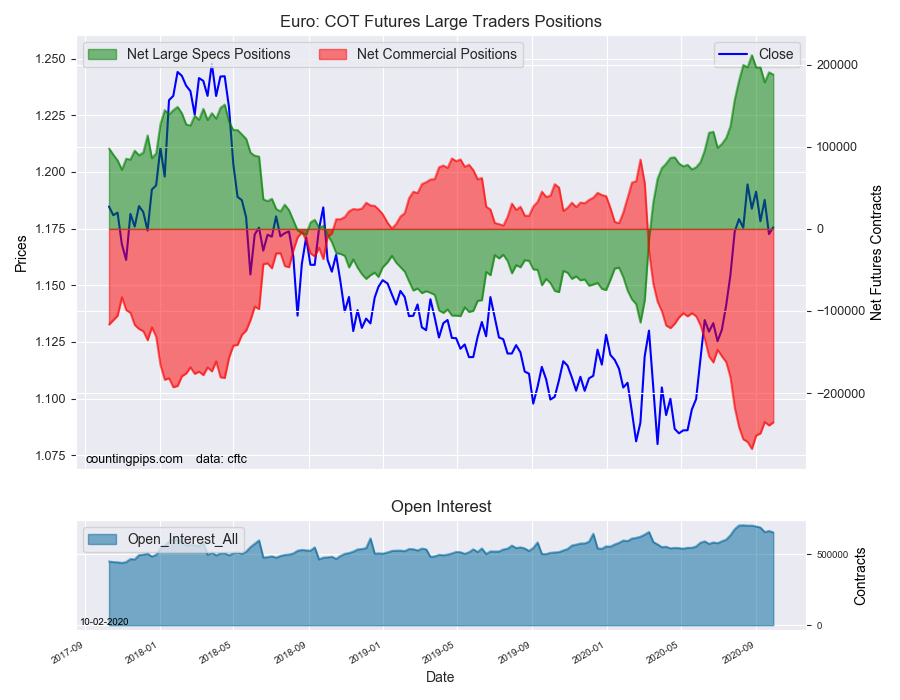

EuroFX:

The Euro large speculator standing this week recorded a net position of 188,116 contracts in the data reported through Tuesday. This was a weekly fall of -2,706 contracts from the previous week which had a total of 190,822 net contracts.

British Pound Sterling:

The large British pound sterling speculator level was a net position of -12,745 contracts in the data reported this week. This was a weekly decrease of -15,709 contracts from the previous week which had a total of 2,964 net contracts.

Japanese Yen:

Large Japanese yen speculators equaled a net position of 24,789 contracts in this week’s data. This was a weekly reduction of -4,792 contracts from the previous week which had a total of 29,581 net contracts.

Swiss Franc:

The Swiss franc speculator standing this week reached a net position of 12,741 contracts in the data through Tuesday. This was a weekly fall of -3,175 contracts from the previous week which had a total of 15,916 net contracts.

Canadian Dollar:

Canadian dollar speculators totaled a net position of -18,948 contracts this week. This was a decrease of -66 contracts from the previous week which had a total of -18,882 net contracts.

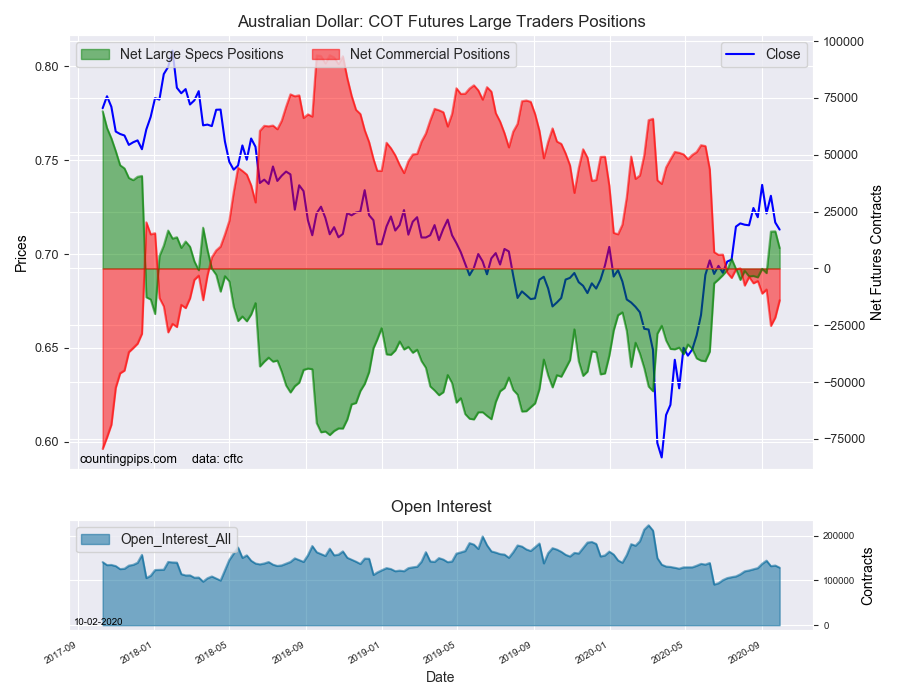

Australian Dollar:

The large speculator positions in Australian dollar futures totaled a net position of 8,937 contracts this week in the data ending Tuesday. This was a weekly lowering of -7,402 contracts from the previous week which had a total of 16,339 net contracts.

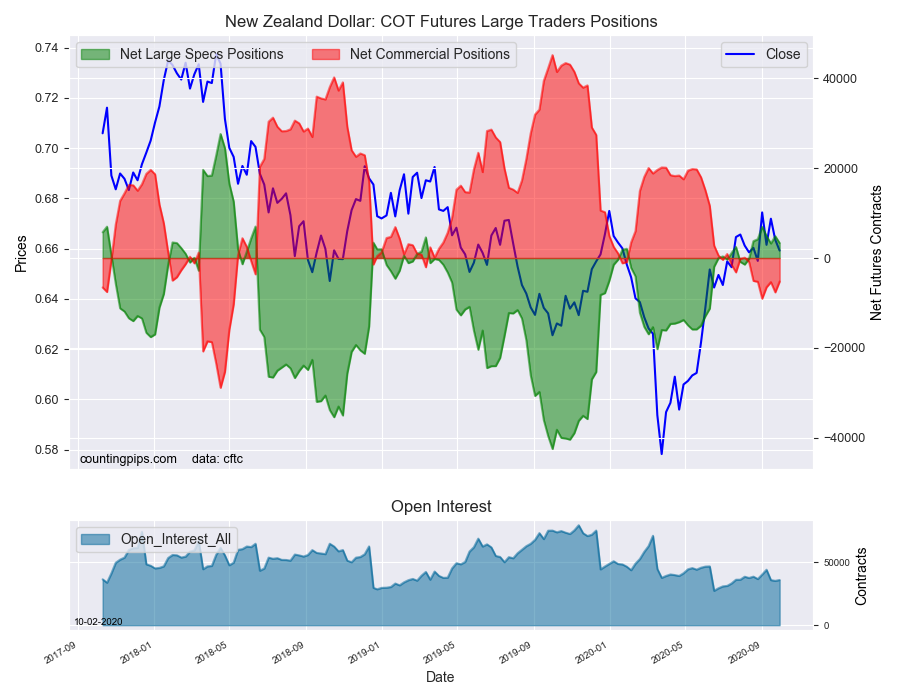

New Zealand Dollar:

The New Zealand dollar speculative standing totaled a net position of 3,329 contracts this week in the latest COT data. This was a weekly decline of -1,531 contracts from the previous week which had a total of 4,860 net contracts.

Mexican Peso:

Mexican peso speculators recorded a net position of 12,636 contracts this week. This was a weekly reduction of -14,014 contracts from the previous week which had a total of 26,650 net contracts.