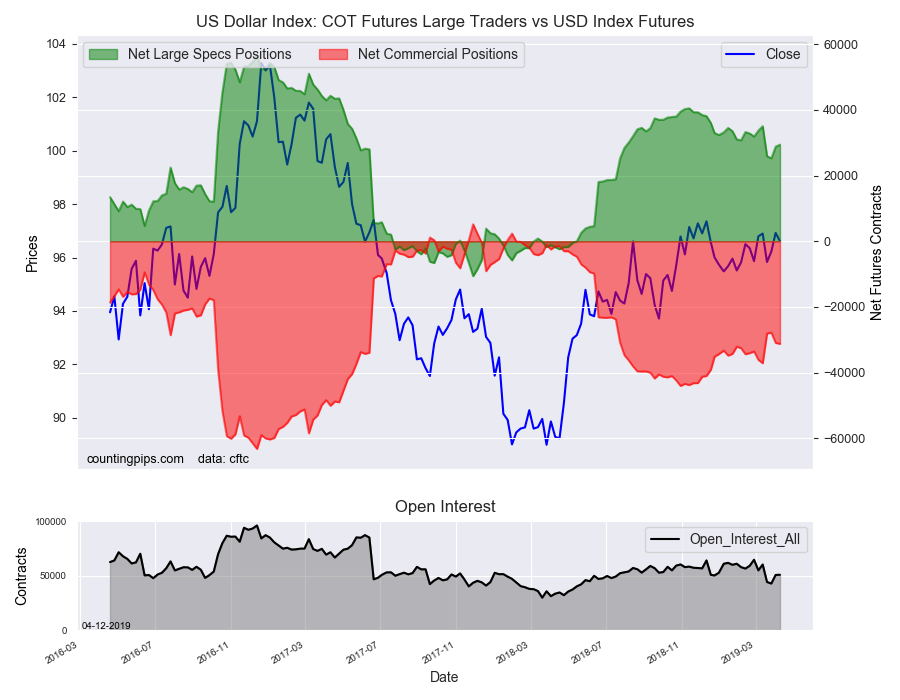

US Dollar Index Speculator Positions

Large currency speculators lifted their bullish net positions in the US Dollar Index futures markets this week while pushing euro bets to over a two-year low, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of US Dollar Index futures, traded by large speculators and hedge funds, totaled a net position of 29,446 contracts in the data reported through Tuesday, April 9th. This was a weekly gain of 598 contracts from the previous week which had a total of 28,848 net contracts.

This week’s net position was the result of the gross bullish position (longs) dropping by -205 contracts to a weekly total of 44,569 contracts but being overcome by the decline in the gross bearish position (shorts) by -803 contracts for the week to a total of 15,123 contracts.

The net speculative position advanced for a second straight week this week after falling in the previous two weeks. The current spec standing is at the highest bullish position of the past four weeks but remains under the +30,000 net contract level for a fourth straight week as well. Previously, bullish bets had remained above the +30,000 net contract level for thirty-two straight weeks through March 12th.

Individual Currencies Data this week: Peso bets at Record High Spec Level, Euro bets falter

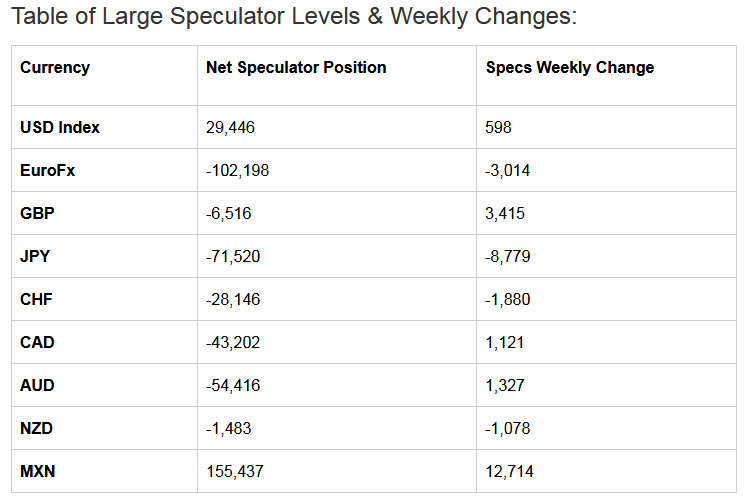

In the other major currency contracts data, we saw only one substantial change (+ or – 10,000 contracts) in the speculators' category this week.

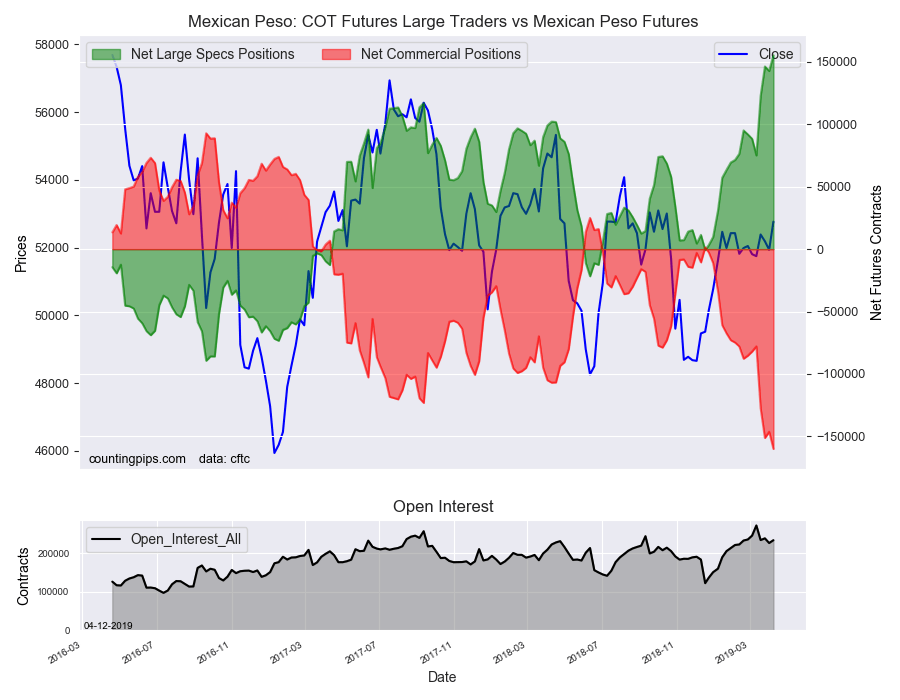

Mexican peso bets continued their upward surge this week and rose by over +12,000 contracts. Peso bets have gained for three out of the past four weeks and for thirteen out of the past eighteen weeks. The current speculative standing is at the highest bullish level on record, according to cftc data going back to 1995. The previous high point was on January 15th of 2013 with a total of 151,665 contracts.

Another notable this week is that the euro currency bets dropped for a fourth straight week and for the tenth time out of the past twelve weeks. The euro speculator position is above the -100,000 contract level and has now fallen to the most bearish standing since December 2016 (a span of over 2+ years).

Overall, the major currencies that saw improving speculator positions this week were the US dollar index (598 weekly change in contracts), British pound sterling (3,415 contracts), Canadian dollar (1,121 contracts), New Zealand dollar (1,327 contracts) and the Mexican peso (12,714 contracts).

The currencies whose speculative bets declined this week were the euro (-3,014 weekly change in contracts), Japanese yen (-8,779 contracts), Swiss franc (-1,880 contracts) and the New Zealand dollar (-1,078 contracts).

See data table and individual currency charts below.

Weekly Charts: Large Trader Weekly Positions vs Price

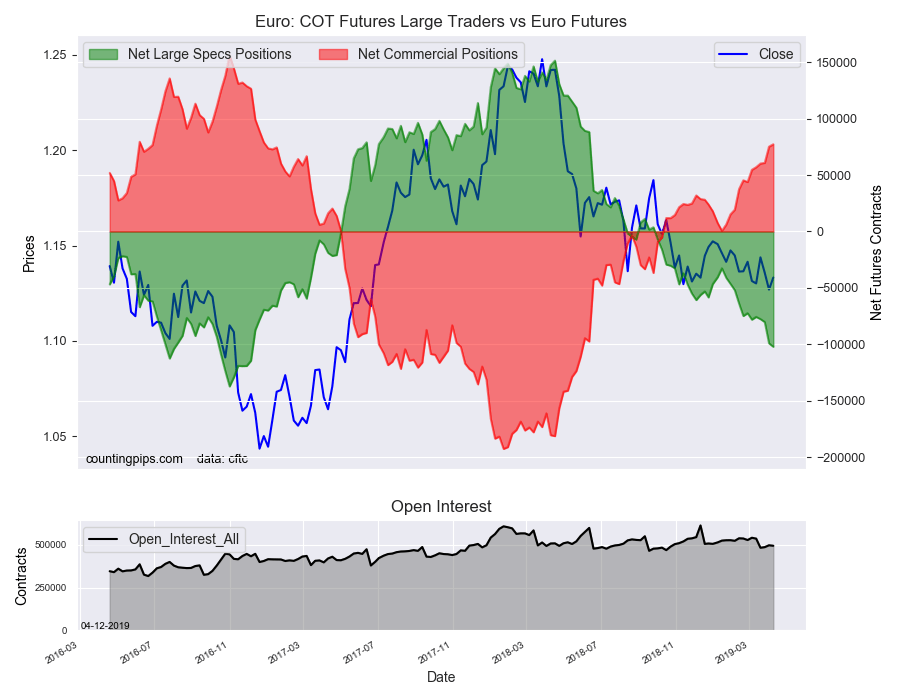

EuroFX:

The Euro large speculator standing this week totaled a net position of -102,198 contracts in the data reported through Tuesday. This was a weekly reduction of -3,014 contracts from the previous week which had a total of -99,184 net contracts.

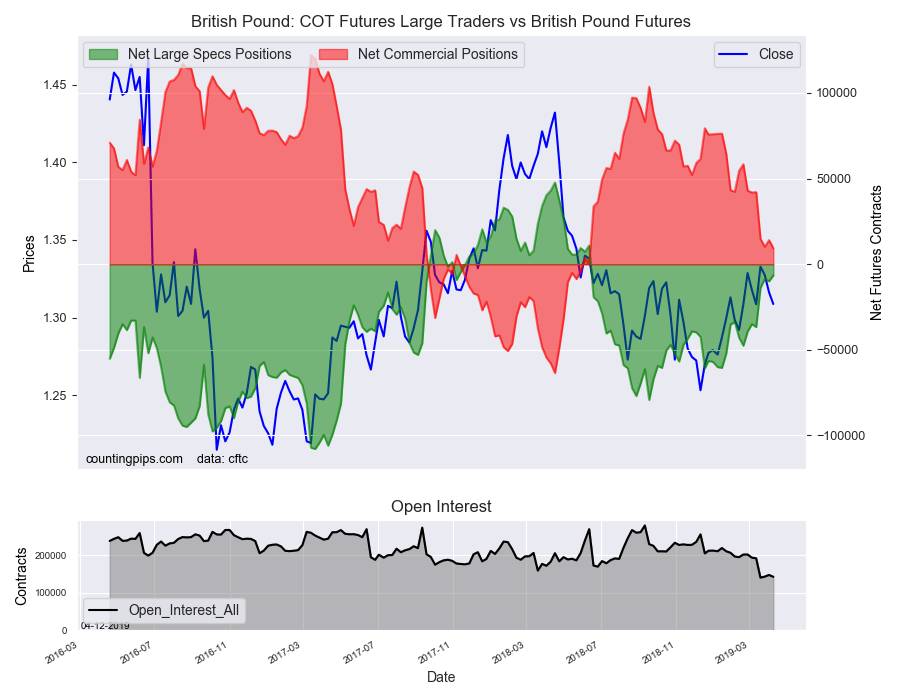

British Pound Sterling:

The large British pound sterling speculator level equaled a net position of -6,516 contracts in the data reported this week. This was a weekly increase of 3,415 contracts from the previous week which had a total of -9,931 net contracts.

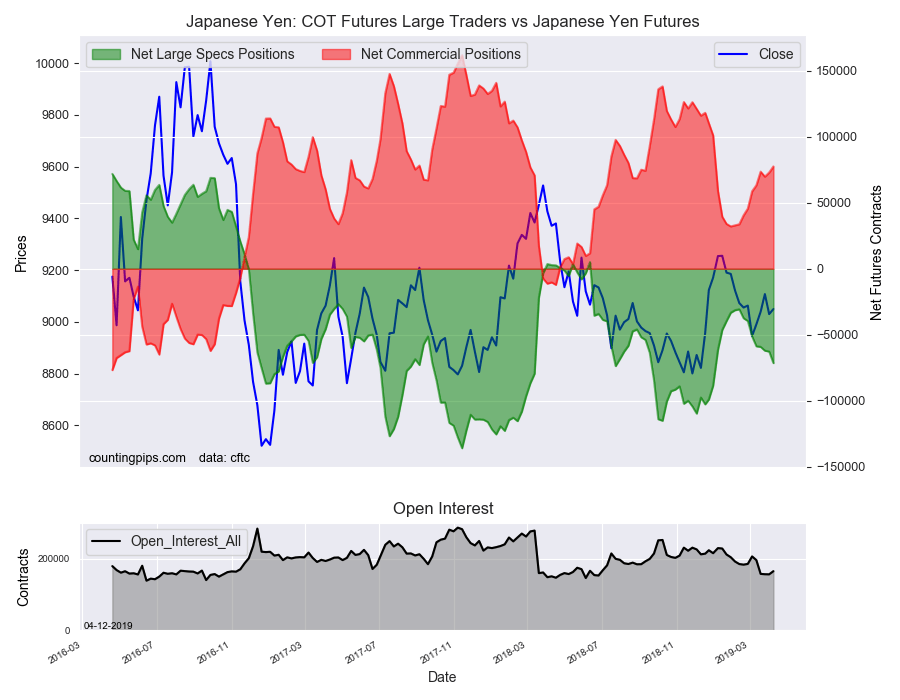

Japanese Yen:

Large Japanese yen speculators resulted in a net position of -71,520 contracts in this week’s data. This was a weekly decline of -8,779 contracts from the previous week which had a total of -62,741 net contracts.

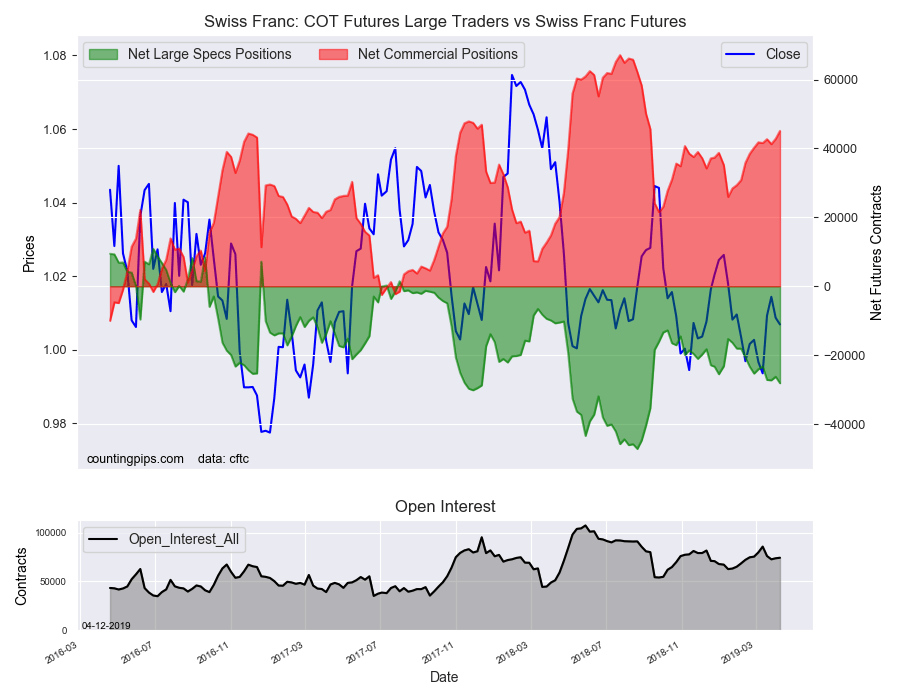

Swiss Franc:

The Swiss franc speculator standing this week was a net position of -28,146 contracts in the data through Tuesday. This was a weekly decrease of -1,880 contracts from the previous week which had a total of -26,266 net contracts.

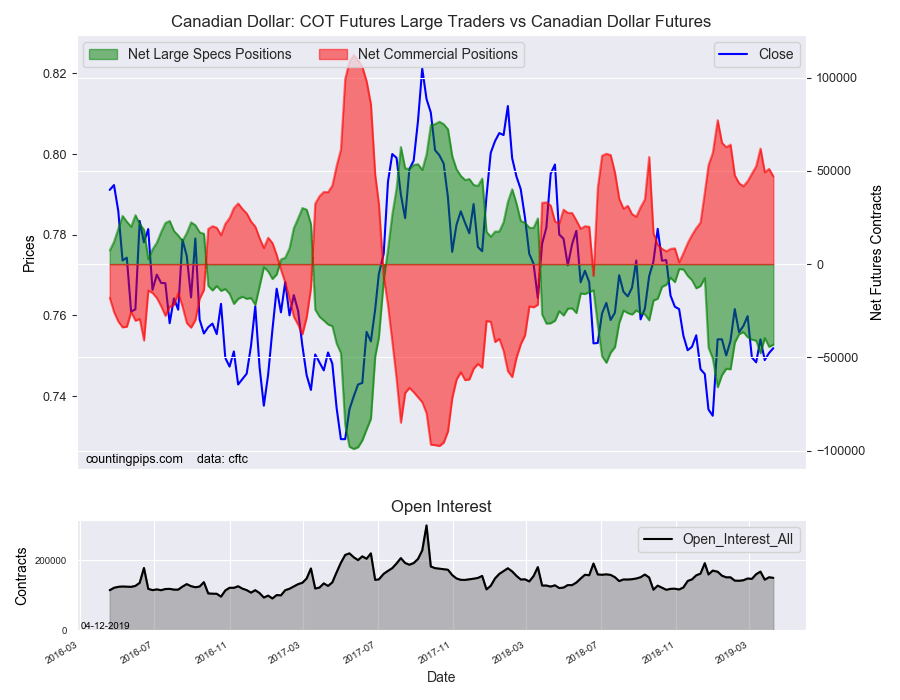

Canadian Dollar:

Canadian dollar speculators recorded a net position of -43,202 contracts this week. This was a advance of 1,121 contracts from the previous week which had a total of -44,323 net contracts.

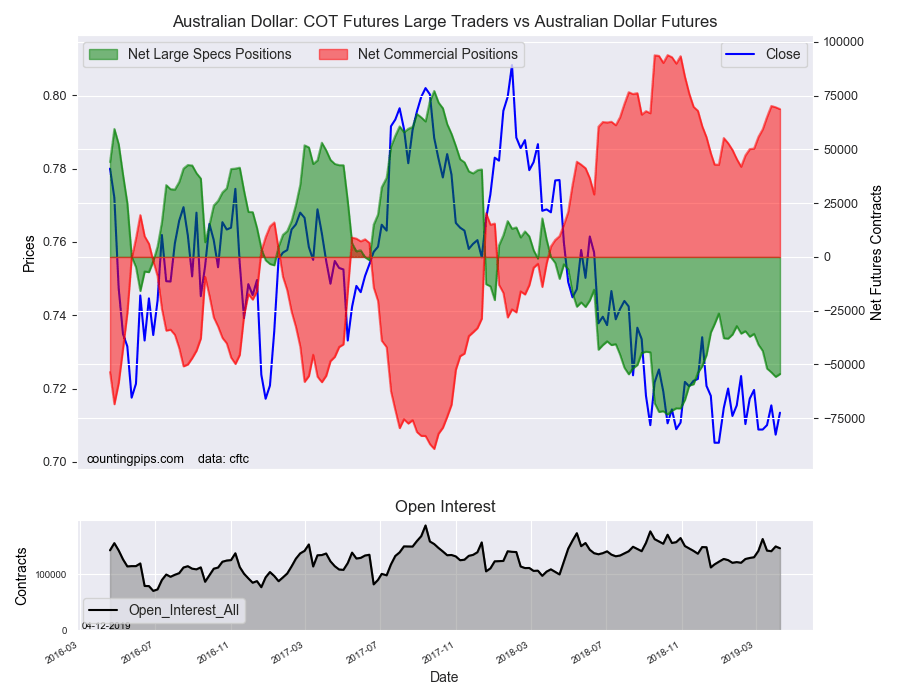

Australian Dollar:

The large speculator positions in Australian dollar futures equaled a net position of -54,416 contracts this week in the data ending Tuesday. This was a weekly gain of 1,327 contracts from the previous week which had a total of -55,743 net contracts.

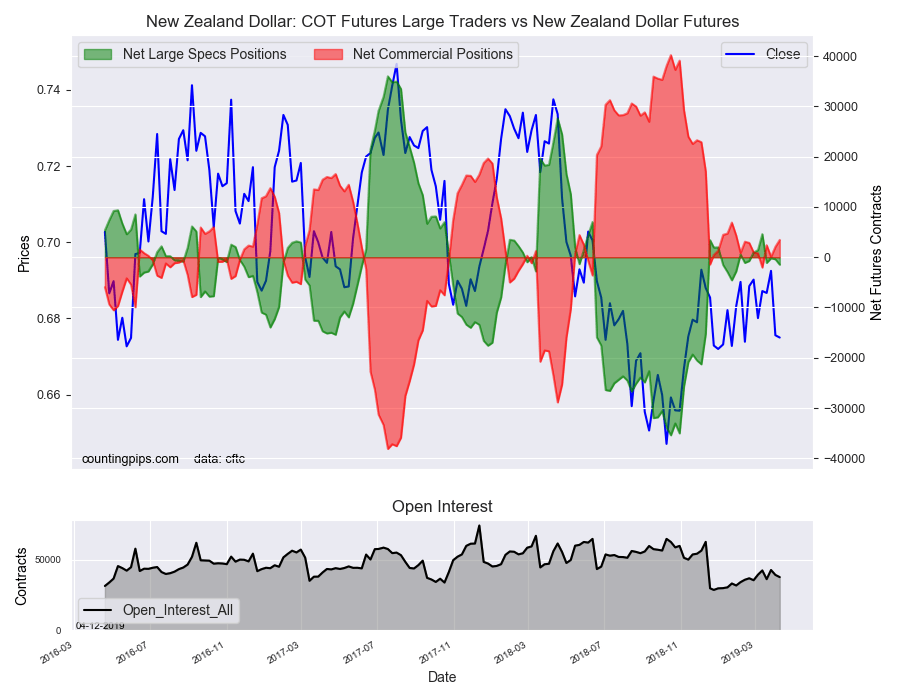

New Zealand Dollar:

The New Zealand dollar speculative standing equaled a net position of -1,483 contracts this week in the latest COT data. This was a weekly decline of -1,078 contracts from the previous week which had a total of -405 net contracts.

Mexican Peso:

Mexican peso speculators totaled a net position of 155,437 contracts this week. This was a weekly lift of 12,714 contracts from the previous week which had a total of 142,723 net contracts.

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).