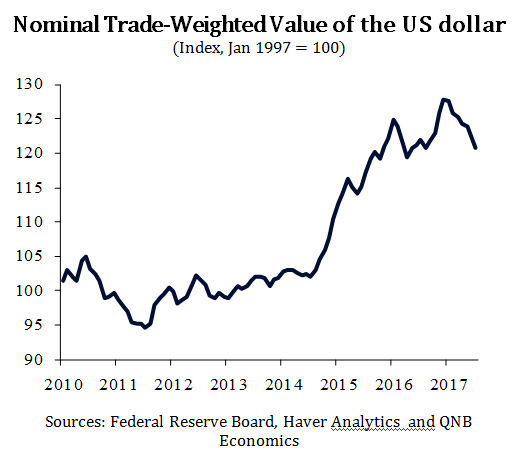

One of the more surprising developments of 2017 has been the weakening of the US dollar. Since the start of the year, the greenback has declined by 5% against a basket of the world’s most traded currencies. This has happened despite the Federal Reserve hiking interest rates twice in 2017 while also signalling its intention to deliver another rate hike and start unwinding the balance sheet by the end of the year.So then, why has the dollar fallen? The lack of progress on promised fiscal stimulus implementation, low inflation and foreign currency appreciation are the main factors causing dollar weakness.

The first factor behind the dollar weakness is fading investor optimism about President Trump’s fiscal stimulus. In the aftermath of the election, inflation expectations rose on the promise of a massive tax cut and spending package, pushing US yields and the dollar to new heights by the end of 2016.However, since assuming office in January, the new US administration has failed to implement its promised fiscal measures, being bogged down on other legislative issues such as health care.This has virtually eliminated the possibility of stimulus being implemented this year and reduced expectations of the magnitude of any possible stimulus in the future.

The second factor is that inflation has disappointed. Core personal consumption expenditure (PCE), the Fed’s preferred measure of inflation, has declined throughout the first five months of 2017 even though the US labour market has continued to improve. As a result, some market participants have responded to tepid inflation with caution, fearing that inflation weakness may be persistent and not temporary as the Fed believes (see our recent commentary, Fed eager to tighten despite low inflation worries). This has pushed down inflation expectations and created doubt about whether or not the Fed would continue on its current path to raise rates, putting downward pressure on the dollar.

Sources: Federal Reserve Board, Haver Analytics and QNB Economics

The third factor is that growth momentum has been stronger outside of the US, especially among some of its largest trade partners such as the Euro Area, Canada and China, boosting the value of foreign currencies. Growth in the Euro Area and Canada have both accelerated by more than expected since the start of the year and their respective central banks are tightening their monetary policy stances in response to firming growth prospects.

The Bank of Canada raised its policy rate this past July for the first time since the financial crisis and the European Central Bank has already begun discussing gradually ending its quantitative easing programme. These developments have pushed up the value of the Canadian dollar and the euro against the dollar by 5% and 12%,respectively so far this year. Chinese growth too has surprised on the upside in 2017 and policy makers have given indications that they are moving closer to tightening policy, although this is primarily to curtail financial stability risks.The yuan has responded in kind, ending its two-year slide in 2017 and gained 3%on the US dollar since the start of the year.

A weaker dollar has important, largely positive, implications for the US economy. Namely, it should stimulate exports, deter imports and boost the foreign earnings of US multinational companies abroad. Part of this impact has already been seen through the first half of 2017, with net exports adding an average of 0.2 percentage points to growth.

Considering exports generally respond to currency depreciation with a lag, this impact is likely to increase in the second half of the year. We expect higher trade to compensate for a less expansive fiscal policy, keeping US growth around 2.0% for the year.