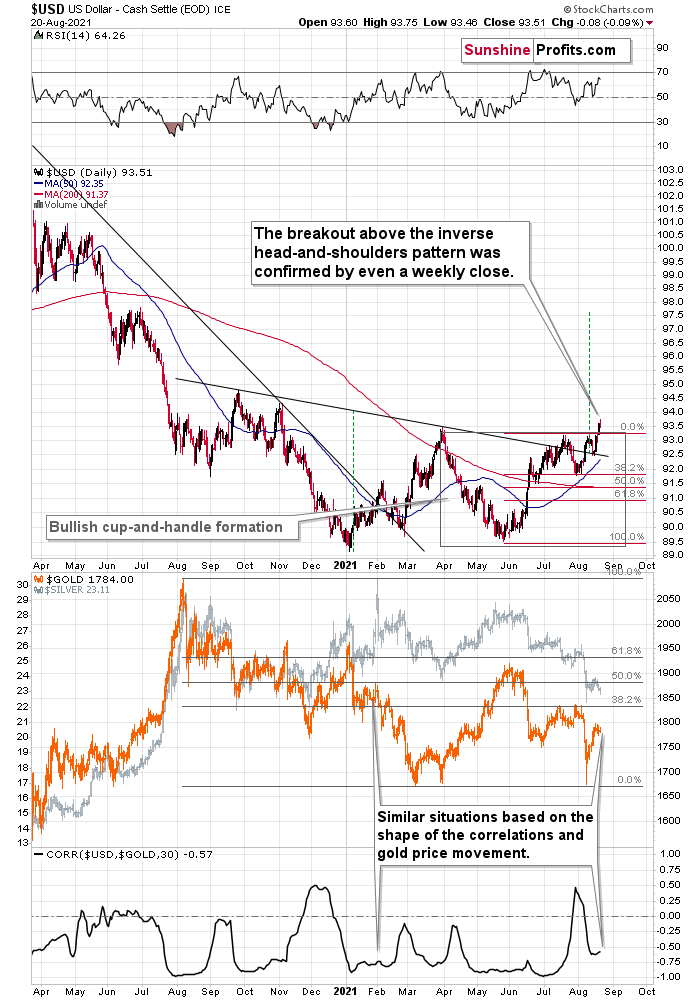

With its negative correlation to the metals, the USDX rally weighed heavily on gold, silver and stocks. Stop and think: what would happen if it continued?

While the overwhelming majority of investors entered 2021 with a bearish outlook for the U.S. dollar, our optimism has proved quite prescient. The USDX bottomed at the beginning of the year. With the USD Index hitting a new 2021 high last week—combined with the EUR/USD, the GDX ETF, the GDXJ ETF, and the price of silver (in terms of the closing prices) hitting new 2021 lows—the ‘pain trade’ has caught many market participants flat-footed. Even silver stocks [the Global X Silver Miners ETF (NYSE:SIL)] closed at new yearly lows.

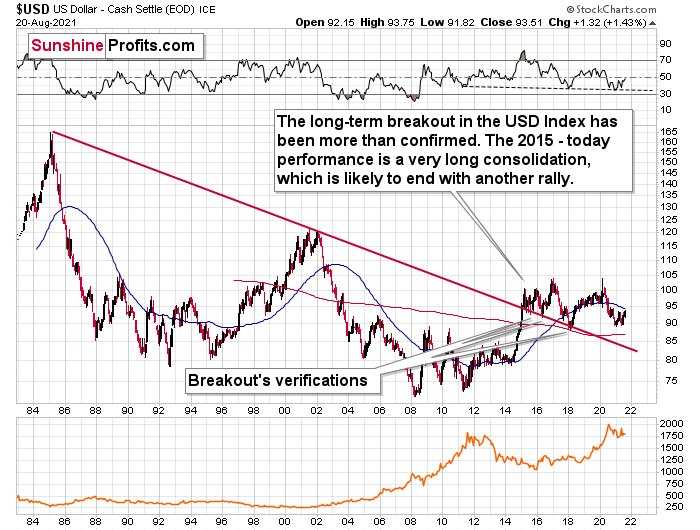

Moreover, after the USD Index surged above the neckline of its inverse (bullish) head & shoulders pattern and confirmed the breakout above its cup and handle pattern, the combination of new daily and weekly highs is quite a bullish cocktail. Given all that, even if a short-term pullback materializes, the USDX remains poised to challenge ~97.5 - 98 over the medium term—perhaps even over the short term (next several weeks).

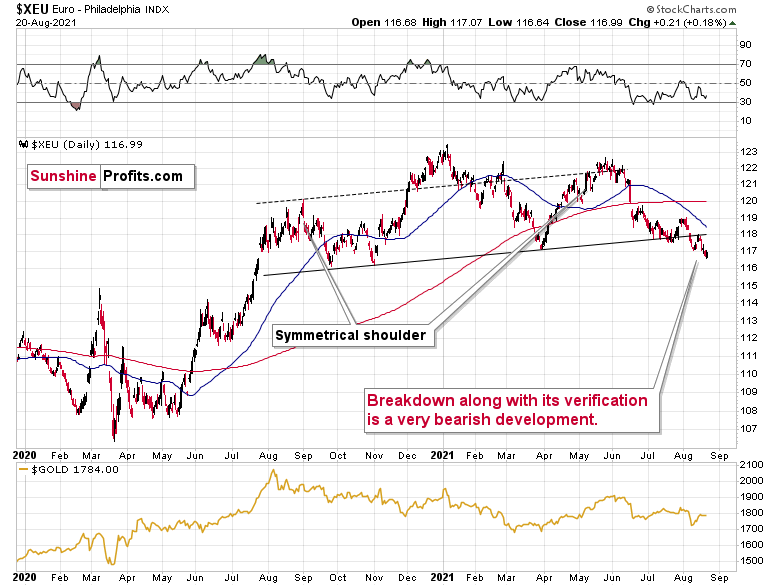

Furthermore, as the USD Index seeks higher ground, the euro has fallen off a cliff. For context, the EUR/USD accounts for nearly 58% of the movement of the USD Index, and that’s why the currency pair’s performance is so important. If you analyze the chart below, you can see that the Euro Index has confirmed the breakdown below its bearish head & shoulders pattern, and the ominous event was further validated after the back-test of the breakdown failed and the Euro Index hit a new 2021 low.

Eye In The Sky Doesn’t Lie

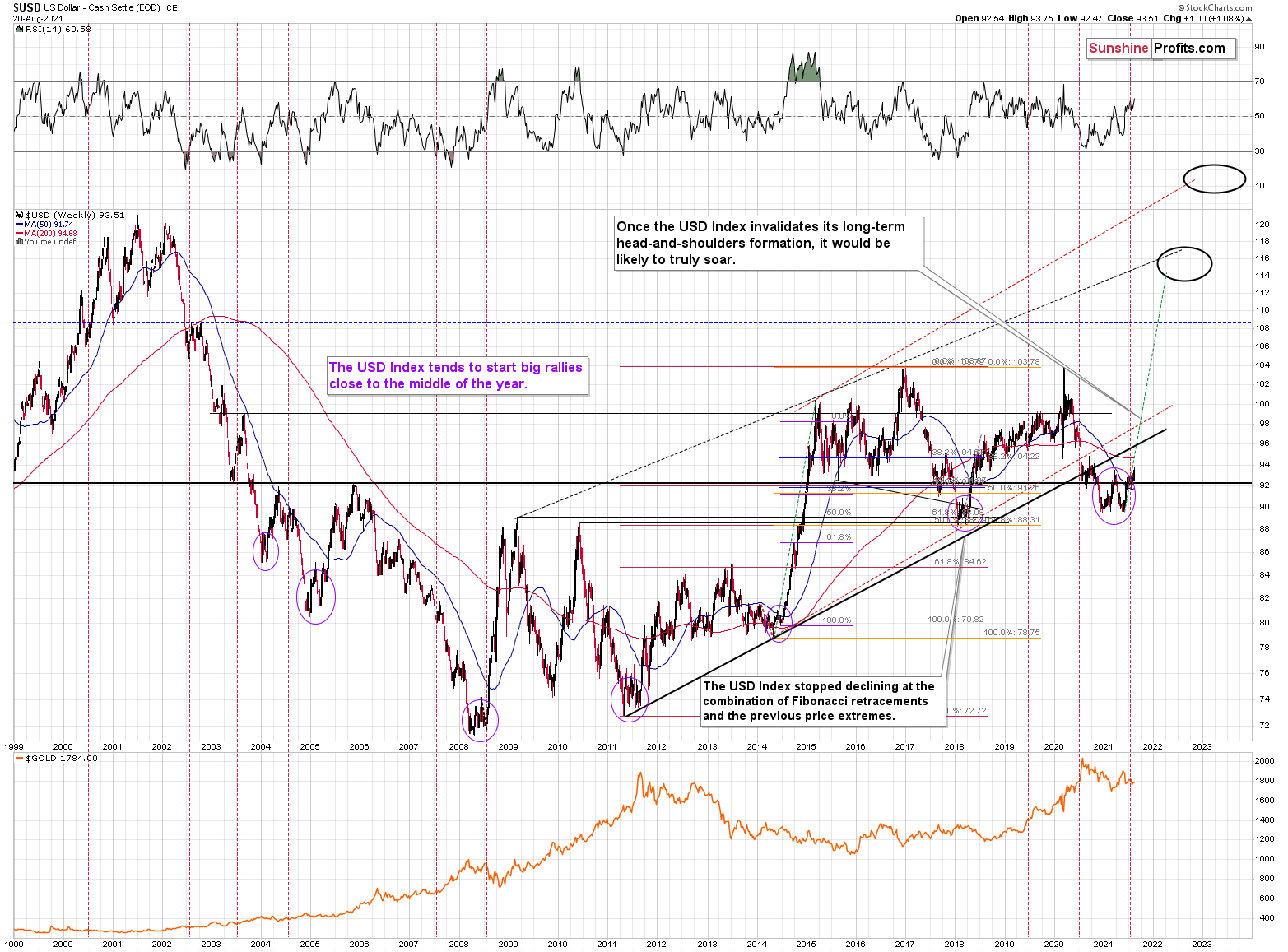

What is signaling trouble for dollar bears as well, the USD Index often sizzles in the summer sun and major USDX rallies often start during the middle of the year. Summertime spikes have been mainstays on the USD Index’s historical record and in 2004, 2005, 2008, 2011, 2014, and 2018, a retest of the lows (or close to them) occurred before the USD Index began its upward flights (which is exactly what’s happened this time around).

What’s more, profound rallies (marked by the red vertical dashed lines below) followed in 2008, 2011, and 2014. With the current situation mirroring the latter, a small consolidation on the long-term chart is exactly what occurred before the USD Index surged in 2014. Likewise, the USD Index recently bottomed near its 50-week moving average; an identical development occurred in 2014. More importantly, though, with bottoms in the precious metals market often occurring when gold trades in unison with the USD Index (after ceasing to respond to the USD’s rallies with declines), we’re still far away from that milestone in terms of both price and duration.

Just as the USD Index took a breather before its massive rally in 2014, it seems that we saw the same recently. This means that predicting higher gold prices here is likely not a good idea.

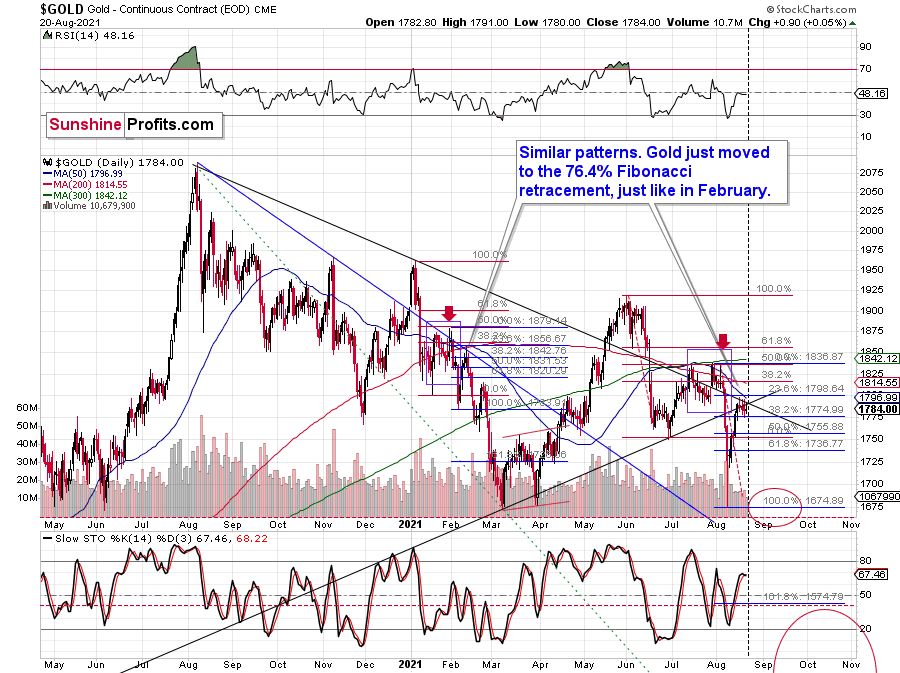

Ok, but didn’t we just see strength in gold—the one that you just wrote about? The USD Index soared last week by a full index point, and yet gold didn’t decline…

That’s a good question, but the context is very important when analyzing specific price moves and their relative strengths. As I wrote earlier, we saw new yearly lows in practically every other important asset used for determining next moves in the precious metals sector: the EUR/USD, silver, and mining stocks (including practically all noteworthy ETFs and indices). So, did gold really show strength by not declining despite the USD’s strength, or was gold’s performance just a small, local deviation from the ongoing trend? Since practically everything else points to lower PM prices in the next weeks, the latter is more probable.

Besides, there are both technical and fundamental reasons for gold to behave in this way right now. The technical reason comes from the looming triangle-vertex-based turning point in gold, which is due today.

The rising black support line starts at the 2020 low, which is not visible on the chart.

Since these points work on a near-to basis, we might see a turnaround today or within the next few days.

Seen Anything On The News Recently?

Fundamentally, did anything important from the geopolitical point of view happen recently? Like, for example, the U.S. withdrawing from Afghanistan? Exactly…

Geopolitical events tend to impact gold much more than they impact other parts of the precious metals sector, which serves as a perfect explanation of why gold didn’t decline along with the rest of the PMs. As a reminder, geopolitical events usually have a visible but temporary impact on the gold price. They change its short-term price moves, but they don’t change the forecast for gold in general.

Consequently, it was not really the strength in gold vs. the USD Index that took place last week. It was a mix of the above and gold’s weakness relative to what happened in a geopolitical arena sprinkled with technicals. All in all, it’s not bullish for the PMs.

On top of that, the eye in the sky doesn’t lie. And with the USDX’s long-term breakout clearly visible, the smart money is already backing the greenback.

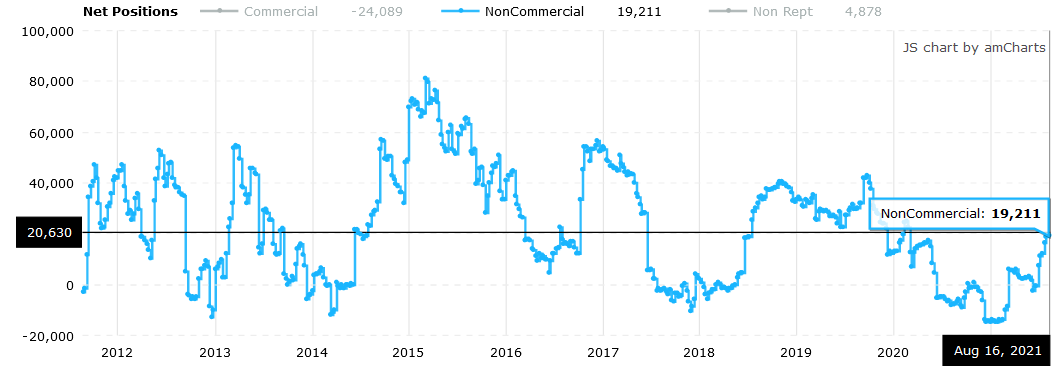

Finally, while short covering helped propel the USD Index higher last week, speculators’ positioning still has room to run. For example, while the latest Commitments of Traders (COT) report shows that net-positioning (long 19,211 contracts) by non-commercial (speculative) futures traders is near its 2021 highs, enthusiasm for the U.S. dollar is still well below the highs witnessed in previous years.

Source: COT

The bottom line?

Once the momentum unfolds, ~94.5 is likely the USD Index’s first stop, ~98 is likely the next stop, and the USDX will likely exceed 100 at some point over the medium or long-term. Keep in mind though: we’re not bullish on the greenback because of the U.S.’ absolute outperformance. It’s because the region is fundamentally outperforming the Eurozone, the EUR/USD accounts for nearly 58% of the movement of the USD Index, and the relative performance is what really matters.

In conclusion, the U.S. dollar’s resurgence has weighed heavily on gold, silver and mining stocks. And with the technicals, fundamentals, and shifting sentiment supporting a higher USD Index over the medium term, the metals’ strong negative correlation with the U.S. dollar should give investors a cause for pause. To that point, while we’re bullish on gold, silver and mining stocks’ long-term prospects, sharp declines will likely materialize over the medium term before they continue their secular uptrends