- The dollar keeps marching north, PMIs on tap

- Yen extends rally as traders unwind carry trades

- Aussi and Kiwi slide on China concerns, loonie awaits BoC

- Stocks trade in the red, tech earnings in the spotlight

Traders Continue to Buy the US Dollar

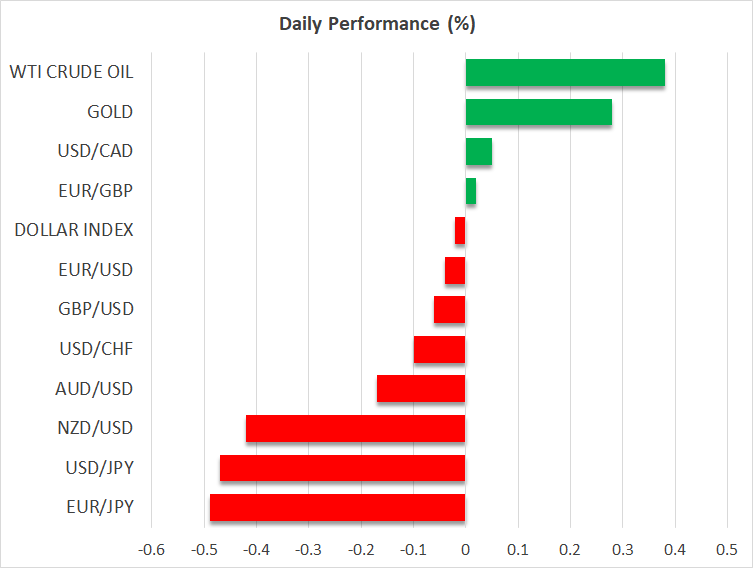

The dollar traded higher against all but one of its major peers on Tuesday and continued to do so today. The exception was the Japanese yen.

With Fed fund futures suggesting little change in market expectations about the Fed’s future course of action, and Treasury yields sliding, it seems that the dollar’s strength may be the result of momentum buying following Friday’s global IT outage, despite the issue being quickly fixed.

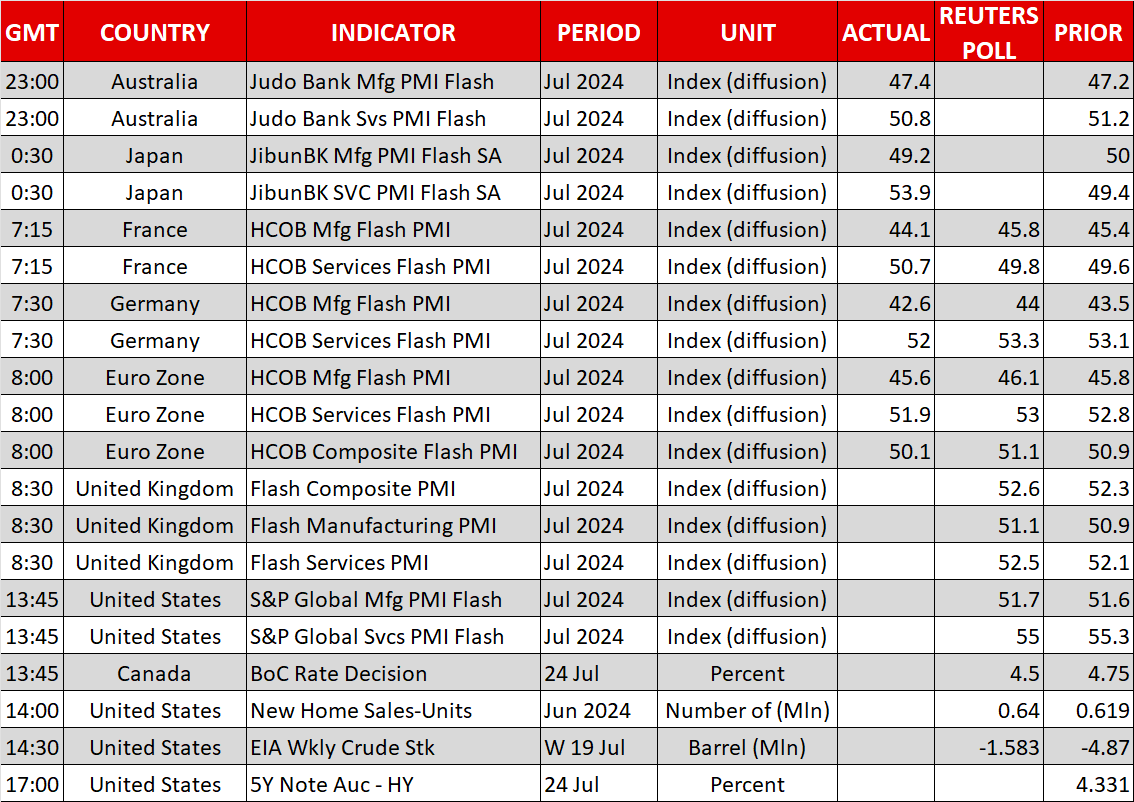

Whether the rally will continue may depend on today’s flash PMIs for July, but also on tomorrow’s first estimate of US GDP for Q2. Friday’s core PCE price index may be also closely monitored.

The Eurozone PMIs have already been released, coming in below expectations and hurting somewhat the euro as the results corroborate the case of a September rate cut by the ECB.

Yen Surges to a 7-Week High

The yen extended its rally, hitting its highest level in seven weeks against its US counterpart. After hitting a 38-year low of 161.96 at the start of the month, the Japanese currency entered a strong recovery mode, initially aided by suspected intervention, but also due to the intervention leading traders to unwind their carry trades.

Recent remarks by a senior Japanese politician that the Bank of Japan should be clearer in indicating its intention to normalize policy, may have also helped. The BoJ meets next week, on July 31, and the market is seeing a 57% chance for another 10bps rate hike.

Chinese Concerns Hit Aussie, Kiwi; BoC Awaited

The Aussie and the Kiwi extended their tumble, triggered after Chinese growth figures missed their forecasts last week and intensified by surprise rate cuts by the PBoC on Monday.

Along with rising expectations of a ceasefire in Gaza, growing concerns about demand in China weighed on oil prices, as well as on bellwether commodities such as iron ore and copper.

The Canadian dollar traded on the back foot as well ahead of today’s BoC decision, with the market being almost 90% confident that officials will proceed with a back-to-back 25bps rate cut. Therefore, a rate cut on its own is unlikely to shake the loonie.

Traders may quickly turn their attention to any hints on whether the easing cycle will continue in September as well. If they get enough dovish signals, the loonie is likely to suffer.

Wall Street Rally in Question Amid Earnings Results

All three of Wall Street’s main indices closed slightly in the red on Tuesday, with the futures market pointing to more losses ahead of today’s open, despite both Tesla (NASDAQ:TSLA) and Alphabet (NASDAQ:GOOGL) recording positive revenue numbers for Q2.

Perhaps this was due to Tesla reporting its smallest profit margin in more than five years, and due to the bar being set so high for Alphabet that the modest beat was not enough to propel the stock higher.

Moving forward, more earnings from tech giants may be very important in determining whether the rally on Wall Street will continue or whether stocks are indeed overvalued.