- Fed expectations drive the market; three Fed speakers on the wires today

- Dollar recovers but all eyes are on the US stocks and Treasury yields

- The pound prepares for the BoE meeting as elections gain more airtime

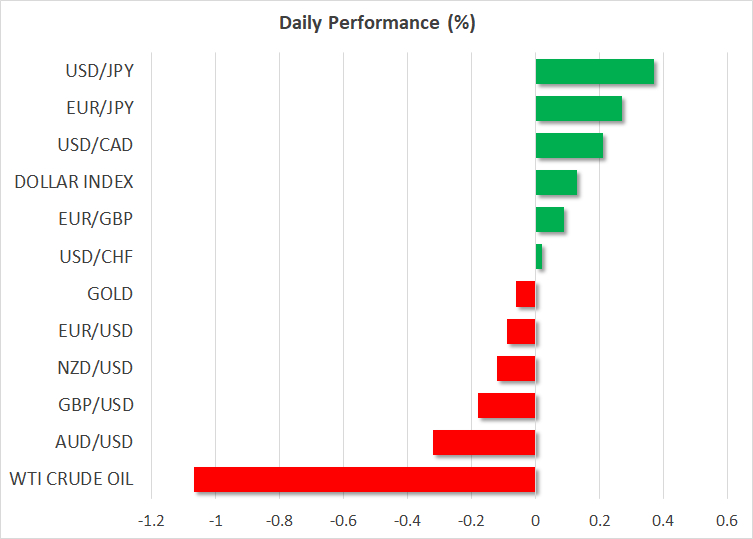

- Yen on the back foot again; gold steady amid the Israeli ground operation

Dollar recovers, equity rally stalls

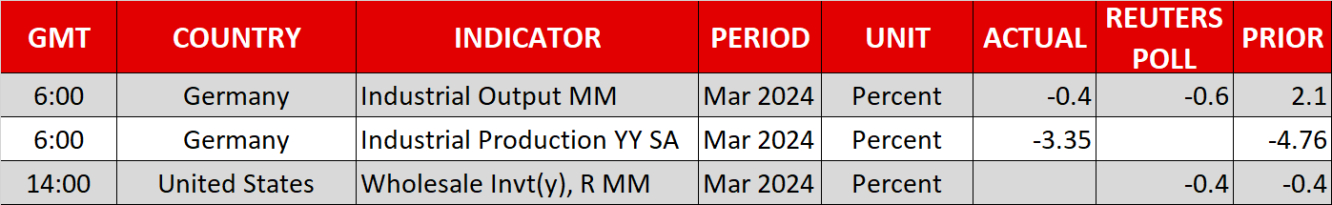

The US dollar has almost erased its NFP losses against the euro as the US stock indices’ rally has stalled. Dovish expectations have taken centre stage but one has to acknowledge that the Fed needs a plethora of weak data prints to firmly open the door to a rate cut as soon as June. The next key data release is the April inflation report, which will be published on Wednesday, May 15.

Fed members will continue to flood the newswires with comments as voters Jefferson, Collins and Cook are scheduled to speak later today. Considering yesterday’s relatively moderate appearance by Fed’s Kashkari, the message from the officials today is not expected to diverge much from Chairman Powell’s commentary at last week’s Fed meeting.

BoE meeting tomorrow; elections in the spotlight

The Bank of England holds its third meeting on Thursday with expectations for a dovish show increasing following the weak US NFP report. Market participants remain split regarding the June rate cut but tomorrow’s quarterly projections could play a crucial role in the BoE’s next move. The pound remains under pressure against both the dollar and the euro.

Putting aside the economic developments, the market is digesting the recent local elections won by the Labour party. Considering that the current Labour party is quite far in terms of its policy direction from the party that ran the UK during the 1997-2010 period, the market might find it difficult to accept Labour’s left-leaning programme. In the meantime, PM Sunak continues to face fierce criticism from the Conservatives ranks as the threat of a complete decimation at the national elections looks like a very credible scenario.

From a market perspective, the exact timing of the elections is important. The UK might not wish these to be held soon before or after the US ones. This means that September is the likeliest month for the UK elections, potentially upsetting BoE’s plan for an easier monetary policy stance down the line.

Geopolitics generate mores headlines, gold supported

Gold is hovering comfortably above the $2,300 level as developments in the Middle East have come again to the fore. Israel started its ground offensive in Rafah despite strong resistance from the US and other allies. Negotiations for an extended ceasefire, which includes the return of the abductees, have restarted in Egypt but chances of an agreement remain quite low at this juncture.

Yen is on the back foot again

Dollar/yen is again on the rise as the yen-positive impact from the repeated BoJ interventions and the weak US NFP report appears to have diminished. Japanese officials including finance minister Suzuki and BoJ Governor Ueda continue to verbally intervene, but the market is not responding favorably. Overall, yen interventions need support from monetary policy to be successful. Considering that the Fed is seen cutting over the summer, the ball in the BoJ’s court now to up its hawkish rhetoric.