- US dollar extends rebound as US yield curve steepens on Trump bets

- Dow Jones hits fresh record, but global stocks slip on trade war fears

- Dovish Powell lifts sentiment, retail sales eyed next

Dollar Catches a Bid on Trump Trade

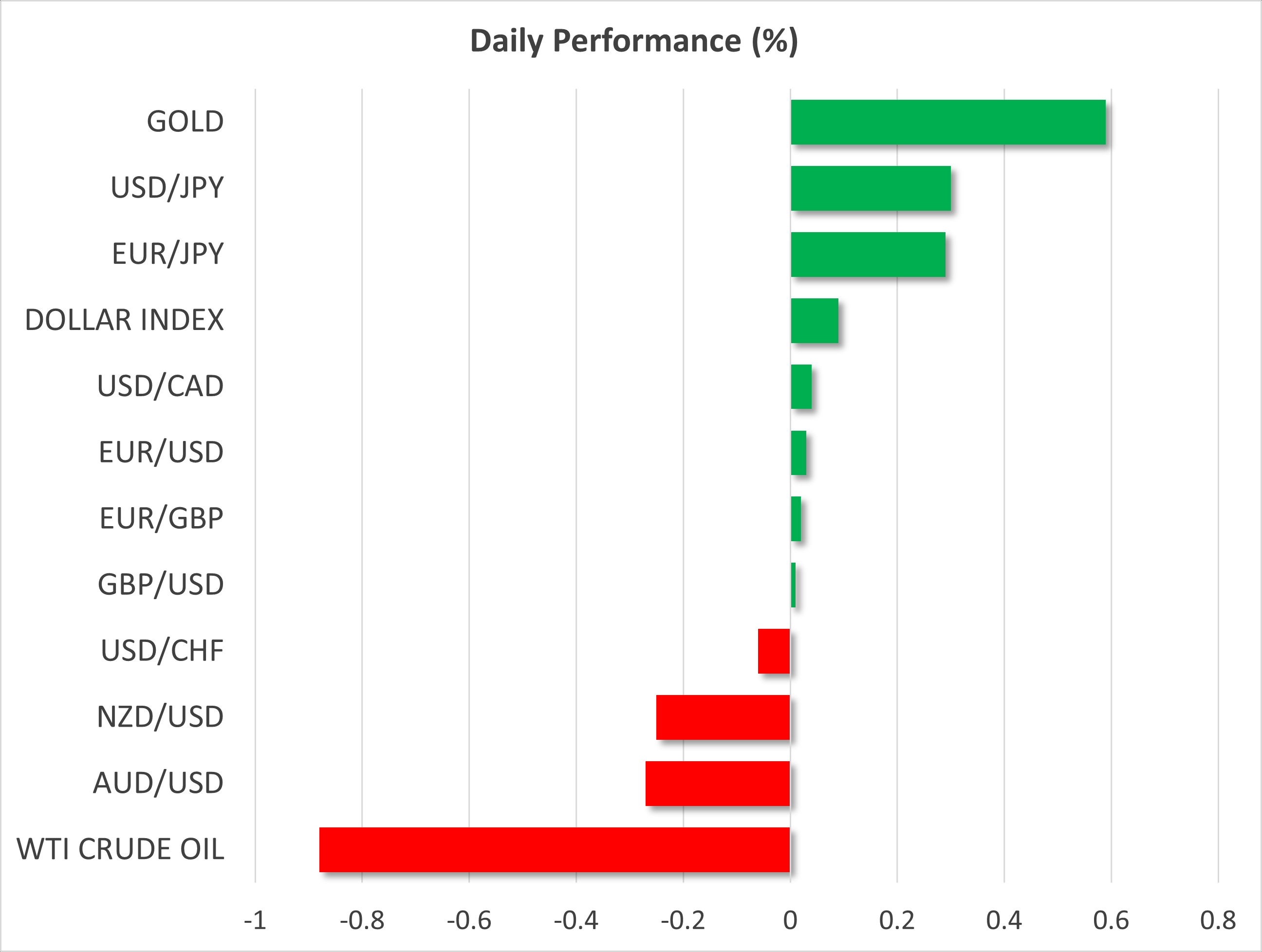

A steepening US yield curve helped the US dollar to bounce back from last week’s post-CPI lows as growing bets that Donald Trump would get re-elected as President pushed long-dated yields higher while short-term yields fell on firming expectations that the Fed will cut rates in September.

The US Dollar Index is heading higher for a second day on Tuesday as investors position themselves for a second Trump presidency following the boost to his popularity after Saturday’s failed assassination attempt.

Trump is seen as increasing deregulation, cutting taxes and slapping fresh tariffs on Chinese imports, which, regarding the latter two, would be inflationary.

But this is a more long-term view on inflation and why the 30-year Treasury yield jumped the most since the shooting. In the near term, however, rates look set to fall, as Fed Chair Powell gave further hints on Monday that a rate cut could be close.

Speaking at the Economic Club of Washington DC, Powell said that the recent inflation data does “add somewhat to confidence” that inflation is on course to reach the 2% inflation target sustainably.

US Equities Rally on Upbeat Earnings and Trump Bets

Rising expectations that the Fed will not only slash rates at least twice this year, but also that rate cuts in 2025 will be a lot more aggressive, fed the positive sentiment on Wall Street. The Dow Jones Industrial Average closed at a new all-time high yesterday, as energy and banking stocks rallied.

Strong earnings results by Goldman Sachs lifted the banking sector, while energy stocks climbed on hopes that a Trump win would be positive for the fossil fuel industry. Apple was another winner after it received a new analyst buy rating, with the stock closing at a new all-time high.

Bitcoin also surged at the prospect of a Trump victory in the November election amid Trump’s apparent change of heart about the crypto industry.

Global Markets Anxious About Trump Presidency

Elsewhere, the mood was more muted, with European indices in the red for a second day, while shares in Asia were mixed. The fear is that another term of Trump as president would lead to an escalation of trade tensions between the US and China, and potentially between Brussels and Washington as well.

The former president was formally nominated as the Republican party nominee on Monday, but of more interest to the markets was his choice of his running mate, who could become the next vice president.

Trump picked Ohio Senator JD Vance as his VP, adding to concerns that a Trump administration would take an even more hardline stance the second time around on key issues such as Ukraine, China and NATO.

Yen on the Slide Again, US and Canadian Data Eyed

In the FX market, the yen found itself on the backfoot again, weakening to around the 158.50 per dollar level, despite fresh warnings by Japan’s Chief Cabinet Secretary Yoshimasa Hayashi about “excessive volatility”.

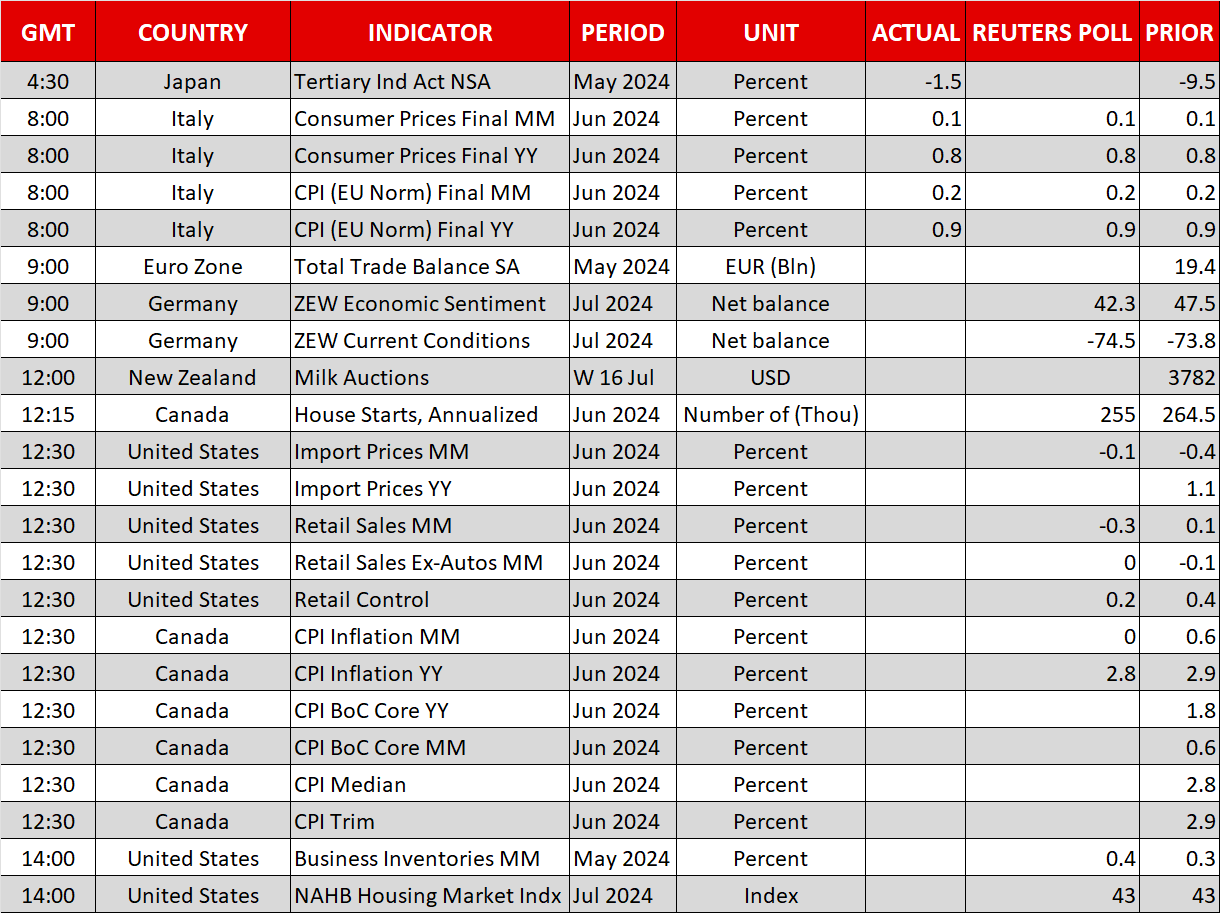

The focus later in the day will be on Canada’s CPI report, which will likely be crucial for the Bank of Canada’s policy decision next week.

Traders will also be watching retail sales numbers out of the United States due at 12:30 GMT, as well as comments by Fed Governor Kugler at 18:45 GMT.