We welcome you to a new trading week which seems to be a light one in terms of market moving data. There are no major economic data releases scheduled for this week, so trading might be quieter than usual but this remains to be seen.

For sterling traders, the only interesting piece of data could be the monthly jobs report, due on Tuesday. On the same day we have the U.S. the Retail Sales Report due for release which could garner some attention.

The dollar rally has lost momentum which is not surprising after the greenback’s linear climb of late. Traders now wonder whether the recent pullback could be the beginning of a reversal. Let’s take a brief look at the technical picture.

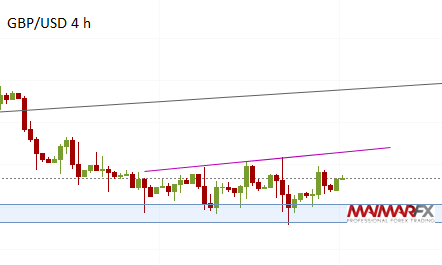

GBP/USD

If the pound climbs above 1.3630 and further 1.3665 we may see an upward move towards 1.3760/80. However, as long as prices remain below 1.38 traders could call any upward movements a long overdue correction in the pound’s recent downtrend. For bearish momentum to accelerate, we would need to see a break below 1.3440.

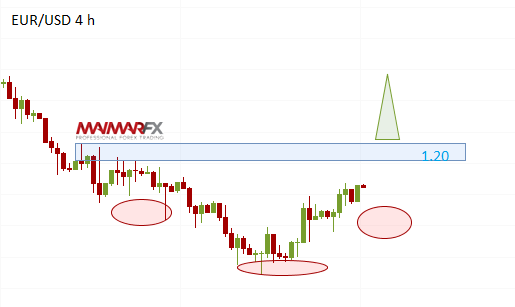

EUR/USD

The euro seems to be bottoming from an oversold condition, formatting an inverted head-shoulders pattern (SHS) in the 4-hour chart. The neckline of that potential SHS-pattern is seen at 1.20 with a possible upward extension until 1.2030. Euro bulls should pay attention to a climb above 1.2060 that could lead to a bullish continuation towards 1.2150. A renewed break below 1.1880 would brighten the outlook for the bears.

Here are our daily signal alerts:

EUR/USD

Long at 1.1970 SL 25 TP 30-40

Short at 1.1920 SL 25 TP 20, 40

GBP/USD

Long at 1.3610 SL 25 TP 20, 40

Short at 1.3535 SL 25 TP 20, 40

We wish you good trades and many pips!

Disclaimer: Any and all liability of the author is excluded.