De-dollarization, the BRIC countries are destroying the US dollar, and many other theories… All or some of them might be true, but it absolutely doesn’t mean that they have to result in any specific market moves NOW or shortly.

Conversely, the proponents of those theories usually become most vocal (or maybe it is that people start to agree with them at those times) when the US Dollar Index is bottoming. It is not the case that those fundamental analyses are wrong – it’s that they might not result in USD’s declines in the near term or even in the medium term. It might take many years.

What is happening, in reality is, that due to different (emotional = technical) reasons, the sentiment gets so bad that people will start to feel that the outlook for the US Dollar Index is bearish (not really based on outlook, but by looking back and extrapolating the most recent price move), and then they use whatever they can to justify this outlook.

And since there are plenty of theories to choose from, they take one or more, and they claim that the US Dollar Index is going to decline because of those reasons, while in reality (which is happening on the subconscious level), they are expecting the US Dollar Index to move lower just because it’s been moving lower in the past.

This appears to have been the case recently.

And you know what happens when the sentiment for a given market is extremely bad? It bottoms, and it bottoms precisely because the sentiment is extremely bad. Everyone, who was on the sidelines is not just out of the long positions, but maybe even in short positions. Conversely, when everyone and their brother think that a given market can only move up because of some new paradigm (stock market and AI stocks, anyone? Crypto, maybe?), the top is formed. Ok, sometimes it takes longer for the top to form, like the one in bitcoin – it took years.

Before presenting you with the US Dollar Index charts, let me state the (hopefully) obvious:

A decline is not bearish.

A rally is not bullish.

No, declines are not bullish, and rallies are not bearish, either.

The point is to emphasize what is so obvious and what so many people constantly get wrong. Just because a given market moved in a given direction, it doesn’t mean that it will continue to move in this direction. A rally or a decline refer to the past – it’s a description of what already happened. And being bullish or bearish is a description of one’s expectations regarding future. While forming expectations regarding the future, it’s important to take many more factors into account than just the most recent price performance.

Having said that, let’s take a look at the bad-sentiment-preceded, and record-breaking rally in the US Dollar Index.

This weekly rally truly is spectacular. Like a coiled spring, or a ball kept underwater, the US Dollar Index soars with vengeance, after multiple failed (!) attempts to break below the previous lows. Each of them was invalidated and I kept repeating that the implications of those events were bullish.

The US Dollar Index didn’t just move back below all previous important lows this week – it even rallied back above the rising support line based in the 2023 lows!

Given how oversold the RSI was, given where the USDX has been trading, and given the strength of the current rally, this situation is similar to only one case from the recent past and that is the mid-2023 post-bottom rally.

Back then, the US Dollar Index kept soaring - despite small corrections – until it moved to about 107. This time, the USDX started its rally higher and it’s still below 103. The upside remains huge – even based on the above chart alone, and in reality, it’s much bigger, but you’ll see why on a bigger chart shortly.

For now, I’d like to point your attention to the fact that after dollar’s mid-2023 bottom, the decline in the precious metals sector took a specific form. Namely, gold was relatively late to join mining stocks in the slide. And… We see the same thing right now! The GDXJ is declining in a visible way while gold itself is still hesitating.

The above long-term US Dollar Index chart shows what exactly happened recently. Thanks to this year’s decline, the US Dollar Index verified the breakout above the declining, medium-term support line based on the previous highs. And since this breakout was verified… Sky’s the limit for the U.S. currency.

Ok, there is some limit to USD’s rally (in my view, it will probably be substituted with some CBDC down the road), but for now, it looks like it can rally for months.

Like I wrote earlier, gold and silver are still hesitating now, and it’s nothing to write home about. They are likely to decline soon, regardless of this pause – just like what we saw in 2023.

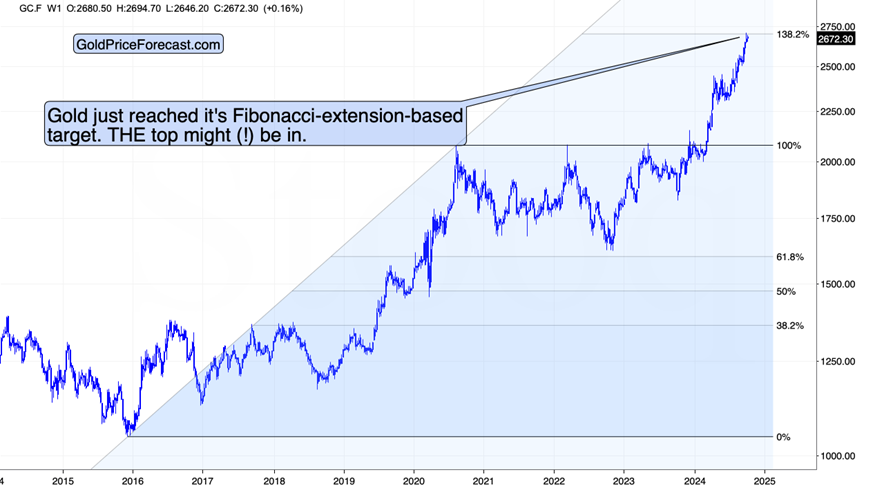

This time, however, the outlook is very different, as gold already reached its Fibonacci-extension-based upside target – as I wrote previously.

Based on the size of the previous (2015 – 2020) rally, the top is most likely in.

The above chart alone is a reason to expect gold to decline in the following weeks, and the situation in the US Dollar Index given another – huge – reason for it to happen. Sure, it’s still a good idea to buy gold as insurance or to diversify, but it you think about trading a given market, it seems to me that being long gold now is particularly risky.

GDXJ Leading the Downturn

Meanwhile, the junior mining stocks are after an invalidation of the breakout above their July highs, most likely leading the rest of the precious metals market lower. Just like it was the case in mid-2023 – the decline in the GDXJ is more visible than the one in gold.

When the precious metals market finally starts reacting to US Dollar Index’s strength – which is likely to happen soon – mining stocks are likely to continue to underperform – being the leaders in the move down – just like it happened many times before, for example in 2020 and 2008.

Really big money is made by being fearful while others are greedy (which is now in case of many markets) and by being greedy while others are fearful (which will be the case at the upcoming lows in the precious metals sector). It’s difficult because one often has to be patient and do what doesn’t “feel” right.

One needs to pay attention to their position size remembering that investing and trading is not a one-time bet, but rather a marathon, and it’s imperative to be able to stay in the game despite a single or even a series of unfortunate trades.

Temperance is not one of the key Stoic virtues for nothing (the other ones are Wisdom, Courage, and Justice – but let me stress that in the Stoic sense of the word, it’s not about “equality”).

The ultimate rewards for contrarian approach, patience, and temperance are really well worth it.