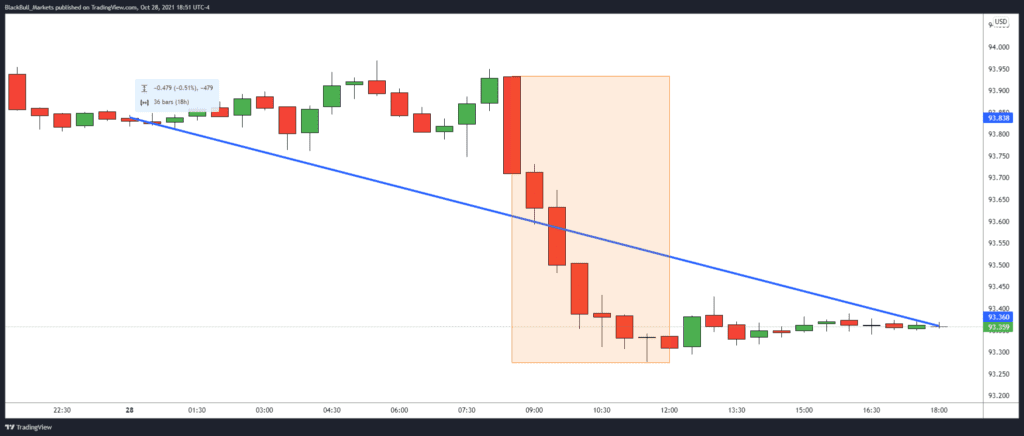

At the time of writing, the US dollar index is trading at 93.35, down by 0.50% on Thursday trading.

The GDP growth in the US is a factor contributing to the 4-week low in the US dollar. It missed expectations for Q3 2021, reporting 2.0% rather than the expected 2.7%. The Q3 GDP growth represents the lowest value reported for this data point since the US began to recover from the worst of the pandemic.

Supply constraints have been pointed out as one of the major causes for the GDP growth miss, as reported by Fannie Mae earlier in the month. Fannie Mae expects the constraints to continue for another 12 months, weakening in intensity as time passes.

The US dollar has lost the most ground against the euro in the past 24 hours. EUR/USD is trading at 1.16831 at the time of writing, up by 0.72% and a one-month high for the pair. The cause of the euro's strength is the public address by Christine Lagarde, head of the European Central Bank (ECB), playing down any fears of inflation.

While inflation in the Eurozone is at a 13-year high, Lagarde and her ECB associates are not ready to drop the notion that inflation is transitory. The ECB wants to see inflation above 2% over the medium term before considering rate hikes or taking a more hawkish tone.

The ECB believes that inflation in the Eurozone has been driven chiefly by supply bottlenecks and energy prices. It could be some time before investors see any change in ECB's dovish stance.

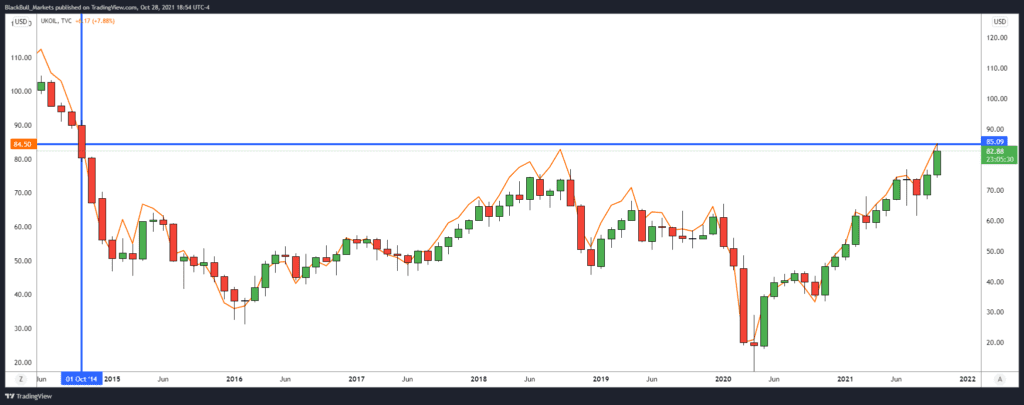

Supply constraints could last for a great deal of time, while energy prices are yet to show any sign of abatement. The Biden administration has asked energy producers to lift production to help drop the cost of energy. But the request is falling on deaf ears.

At the time of writing, WTI is trading at $83.04 per barrel, while Brent is trading at $84.39 per barrel. Both oil instruments are trading at multi-year highs.

The price of natural gas does swing widely day-to-day. A 7% swing either way over a day's trading is not uncommon. Yet, natural gas is still trading at $5.732/MMBtu, more than double the price at the beginning of 2021.