Talking Points:

- New Zealand Dollar Down on Soft 4Q Westpac Consumer Confidence Data

- Risk Appetite Firms in Overnight Trade, Driving the Aussie Dollar Upward

- US Dollar May Rise as Home Sales Data Amplifies Fed Rate Hike Outlook

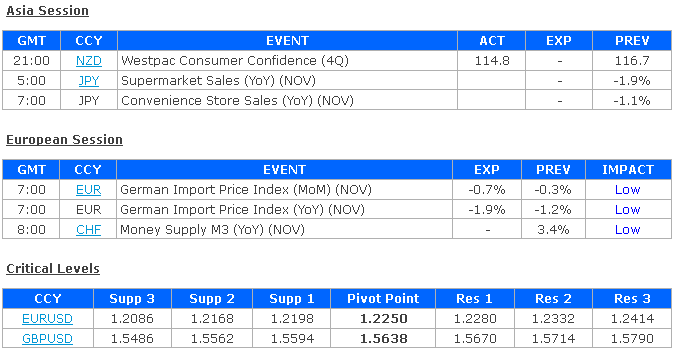

The New Zealand dollar underperformed in overnight trade, falling as much 0.5 percent on average against its leading counterparts. The move played out against a backdrop of disappointing economic data after the Westpac Consumer Confidence gauge sank to 114.8 in the fourth quarter, the lowest level since the three months through March 2013.

The Australian Dollar rose as much as 0.4 percent against the majors. The move appeared to reflect the supportive influence of risk appetite on the sentiment linked currency. Indeed, the Aussie’s move higher tracked a parallel advance in Australia’s benchmark S&P/ASX 200 stock index.

Looking ahead, a quiet economic calendar in European trading hours is likely to see investors looking ahead to US news-flow, where November’s Existing Home Sales report headlines the docket. A mild moderation is expected with a print at 5.20 million compared with a 16-month high at 5.26 million in the prior month.

Realized US data outcomes have increasingly outperformed relative to consensus forecasts over the past month however. This opens the door for an upside surprise, which may boost Federal Reserve interest rate hike expectations and offer a lift to the US Dollar.