- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

U.S. Dollar Looks Bearish Ahead Of A Busy Week

The US dollar index was seen attempting to pare losses from Friday's news reports on the FBI - Clinton email scandal which sent the dollar broadly lower. However, despite the current uptick, the gains in the US dollar could be limited with the weekly session closing in a dark cloud cover candlestick pattern indicating a near term decline to the downside. Technical support is seen near 96.18 - 95.85 which could infer that the dollar could be seen weakening over a busy week which includes the FOMC statement, ISM manufacturing and Friday's payrolls report.

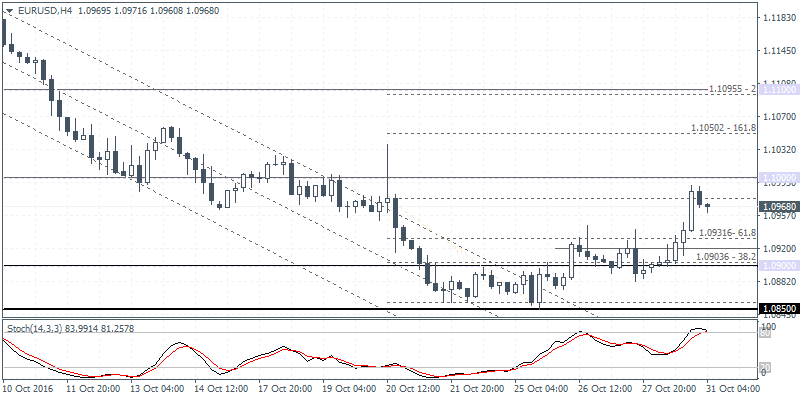

EUR/USD Daily Analysis

EUR/USD (1.0968):With the EUR/USD closing above 1.0900 last week, price action is now a few pips away from challenging 1.1000 resistance. A premature pullback before testing this resistance could see the euro's declines limited towards 1.0920 - 1.0950. The price action on the 4-hout chart time frame also shows a potential cup and handle pattern that could be formed with the resistance seen at 1.0975 with the Fibonacci retracement zone of 1.0931 - 1.0903 marking the 38.2 - 61.8 retracement level. A reversal off this retracement zone followed by a breakout above 1.0975 - 1.1000 could signal further upside in the euro towards 1.1050 followed by 1.1095. A break down below 1.0900 could, however, invalidate this bullish bias, keeping EUR/USD under pressure to the downside.

EUR/AUD Daily Analysis

EUR/AUD (1.4406):EUR/AUD has been bullish for the past two days following the pin bar reversal near the support at 1.4200. The current pullback could be seen limited to 1.4309 - 1.4344 support level. As noted last week, EUR/AUD is looking to target 1.4560 to challenge the broken support level for resistance. A higher low near the support level of 1.4309 - 1.4344 could signal further upside in EUR/AUD. The weekly time frame in EUR/AUD closed with an outside bar indicating that a breakout above the high of 1.4484 could signal further upside in prices.

USD/JPY Daily Analysis

USD/JPY (104.74): USD/JPY has been bullish over the past weeks, but the consolidation into the triangle pattern is indicative of a near-term pullback in prices. Resistance is seen at 105.00 - 105.16 price level, and if USD/JPY fails to breakout above this resistance, a near-term decline could see prices fall towards 104.00 which is the initial support followed by 103.00 - 103.25. Alternately, a bullish continuation to the upside above 105.16 could signal further gains in USD/JPY which could then challenge the next main resistance at 106.00 which was tested briefly in July this year.

Related Articles

The US dollar has come under some pressure on the back of the rerating of the US growth outlook and expectations that the Russia-Ukraine conflict is nearing an end. However, we...

The Japanese yen is slightly lower on Wednesday. In the North American session, USD/JPY is trading at 148.92, down 0.07% on the day. What is the best performing G-10 currency...

USD/JPY is consolidating near 149.33 on Wednesday, with the yen pausing its rally while holding near four-month highs against the USD. This stabilisation follows renewed support...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.