U.S. Dollar Index Speculator Positions

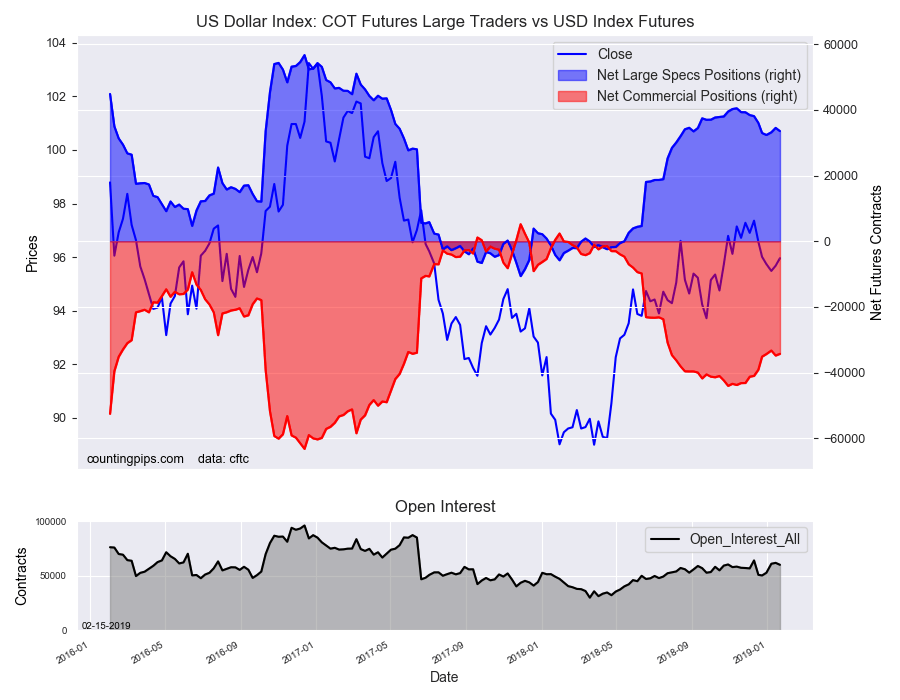

Large currency speculators decreased their net positions in the U.S. Dollar Index Futures markets in January, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

This latest COT data is from later in January due to the government shutdown which suspended the releases. The CFTC is releasing data on Tuesdays and Fridays going forward until the data is back up to date.

The non-commercial futures contracts of U.S. Dollar Index futures, traded by large speculators and hedge funds, totaled a net position of 33,556 contracts in the data reported through Tuesday, January 22nd. This was a weekly decline of -985 contracts from the previous week which had a total of 34,541 net contracts.

The week’s net position was the result of the gross bullish position (longs) decreasing by -1,659 contracts to a weekly total of 48,913 contracts compared to the gross bearish position (shorts) which saw a fall by -674 contracts for the week to a total of 15,357 contracts.

The net speculative position remains bullish for a thirty-seventh straight week and has continued to stay above the +30,000 net contract level for twenty-five weeks in a row through January 22nd.

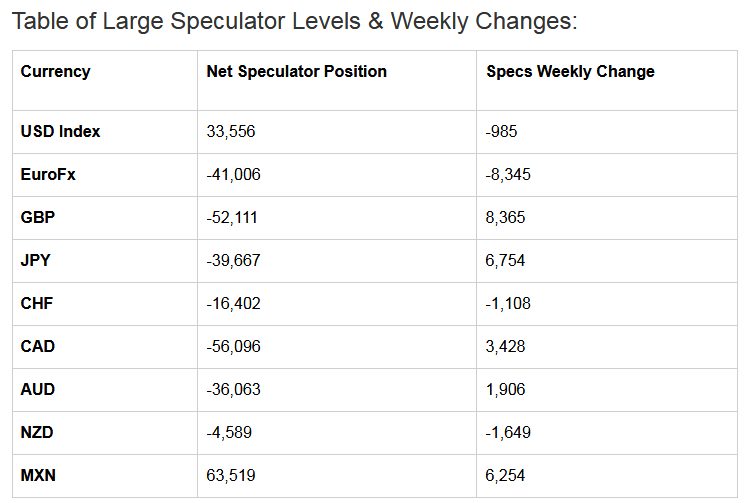

Individual Currencies Data this week:

In the other major currency contracts data, we saw improving speculator positions through January 22nd for the British pound sterling (8,365 weekly change in contracts), Japanese yen (6,754 contracts), Canadian dollar (3,428 contracts), Australian dollar (1,906 contracts) and the Mexican peso (6,254 contracts).

The currencies whose speculative bets declined that week were the U.S. dollar index (-985 weekly change in contracts), euro (-8,345 weekly change in contracts), Swiss franc (-1,108 contracts) and the New Zealand dollar (-1,649 contracts).

Notables:

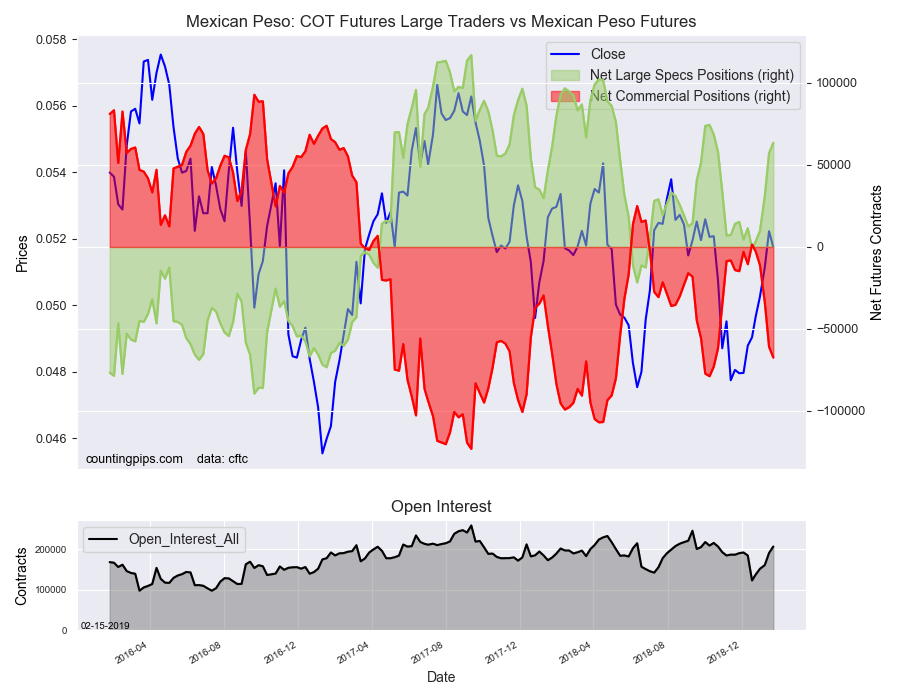

Mexican peso bets rose again through January 22nd for a fifth consecutive week. The peso positions moved to their highest level since the middle of October and remain the only currency with positive speculative positions beside the U.S. Dollar Index.

See the table and individual currency charts below.

Weekly Charts: Large Trader Weekly Positions vs Price

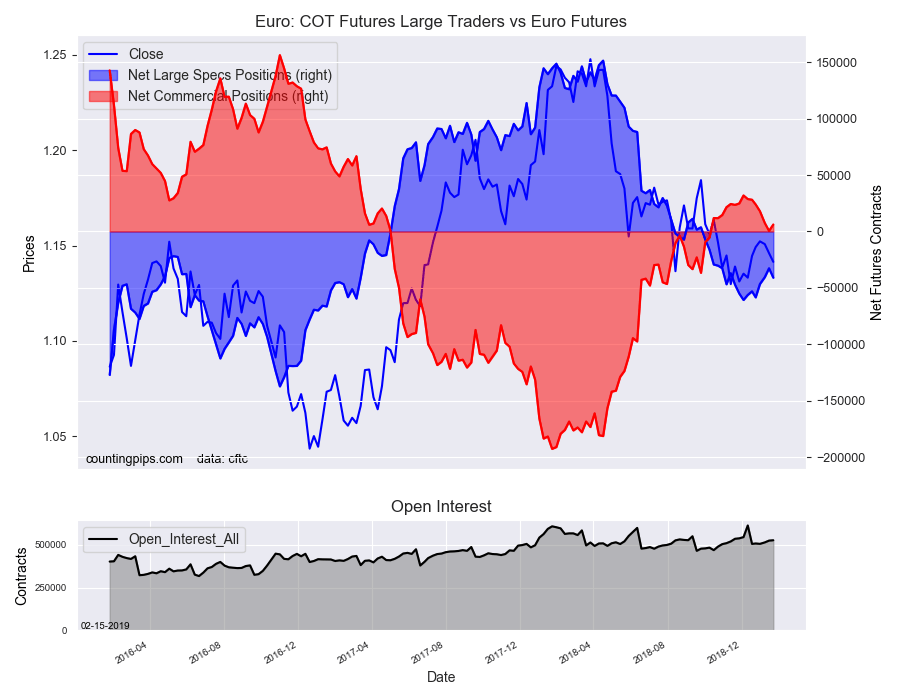

EuroFX:

The Euro large speculator standing on January 22nd reached a net position of -41,006 contracts in the data reported. This was a weekly decline of -8,345 contracts from the previous week which had a total of -32,661 net contracts.

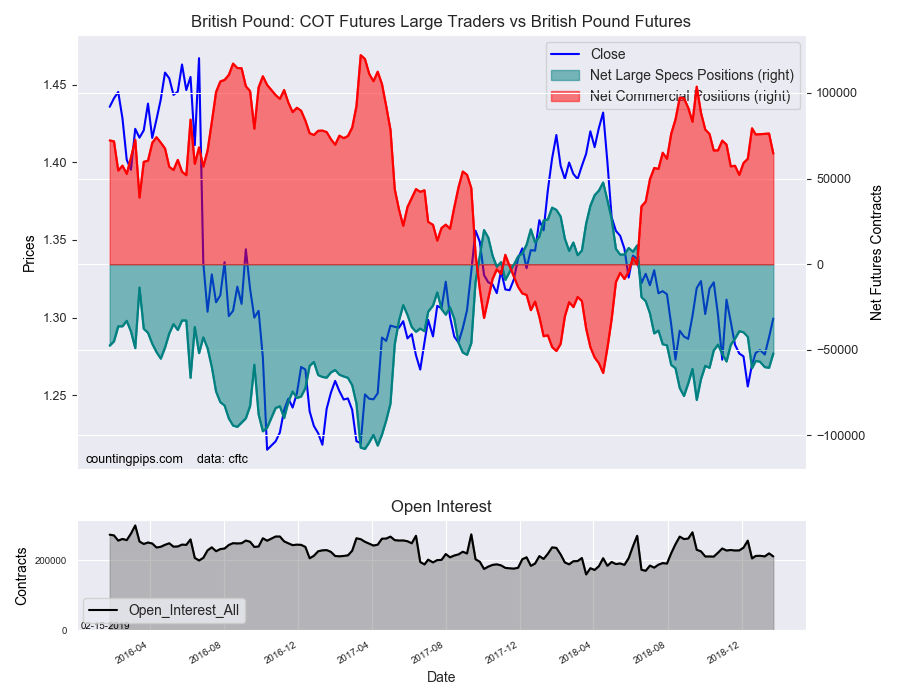

British Pound Sterling:

The large British pound sterling speculator level resulted in a net position of -52,111 contracts in the data. This was a weekly rise of 8,365 contracts from the previous week which had a total of -60,476 net contracts.

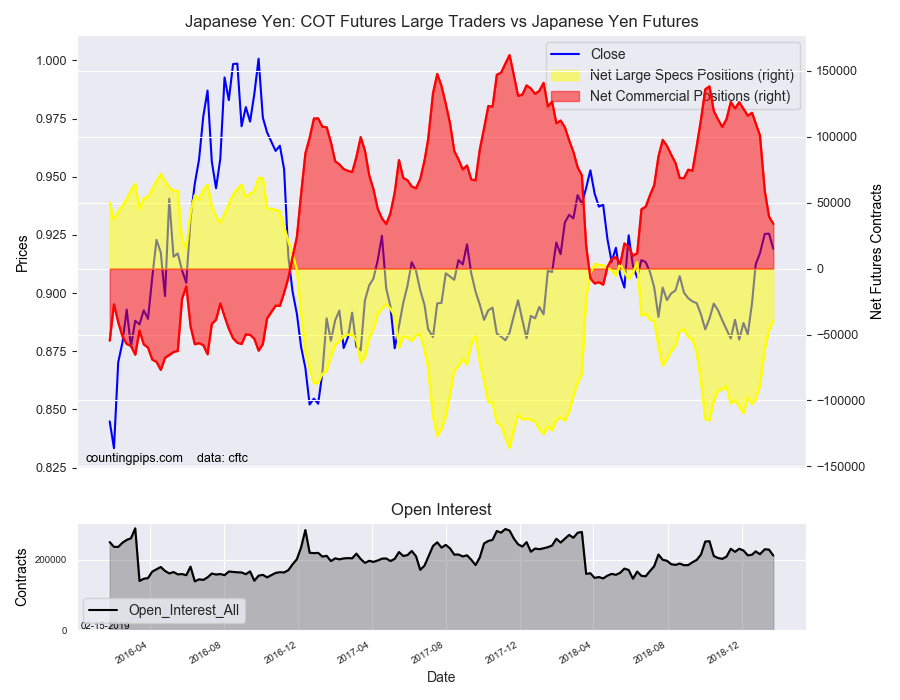

Japanese Yen:

Large Japanese yen speculators reached a net position of -39,667 contracts. This was a weekly boost of 6,754 contracts from the previous week which had a total of -46,421 net contracts.

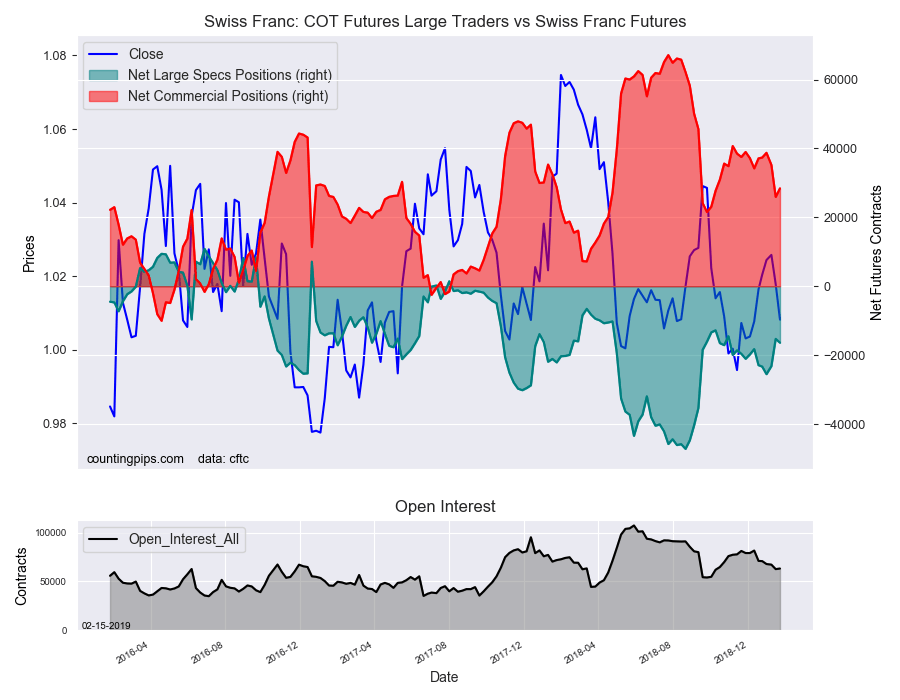

Swiss Franc:

The Swiss franc speculator standing this week totaled a net position of -16,402 contracts in the data through Tuesday January 22nd. This was a weekly fall of -1,108 contracts from the previous week which had a total of -15,294 net contracts.

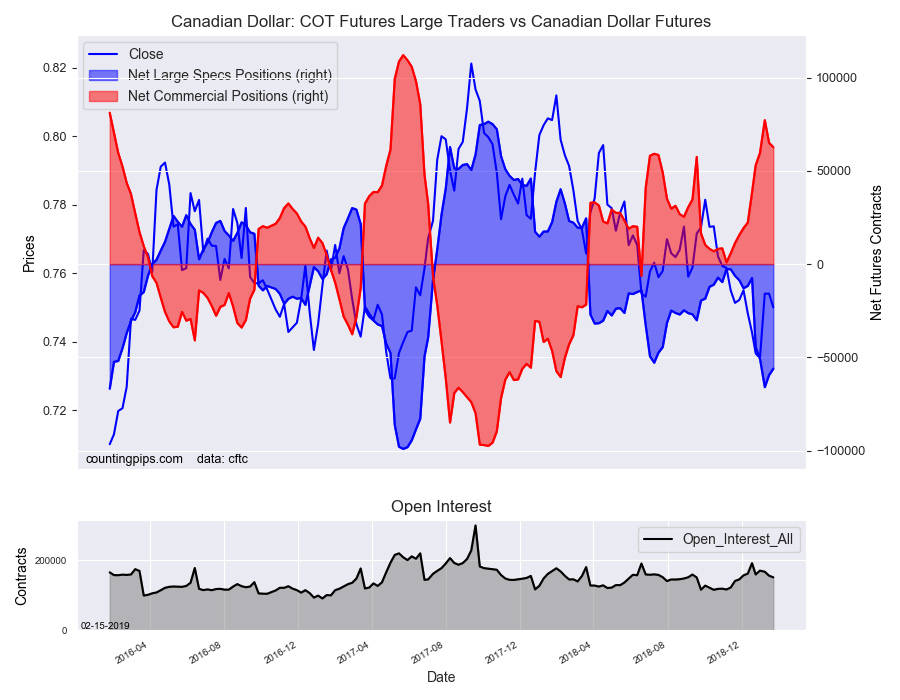

Canadian Dollar:

Canadian dollar speculators recorded a net position of -56,096 contracts. This was a gain of 3,428 contracts from the previous week which had a total of -59,524 net contracts.

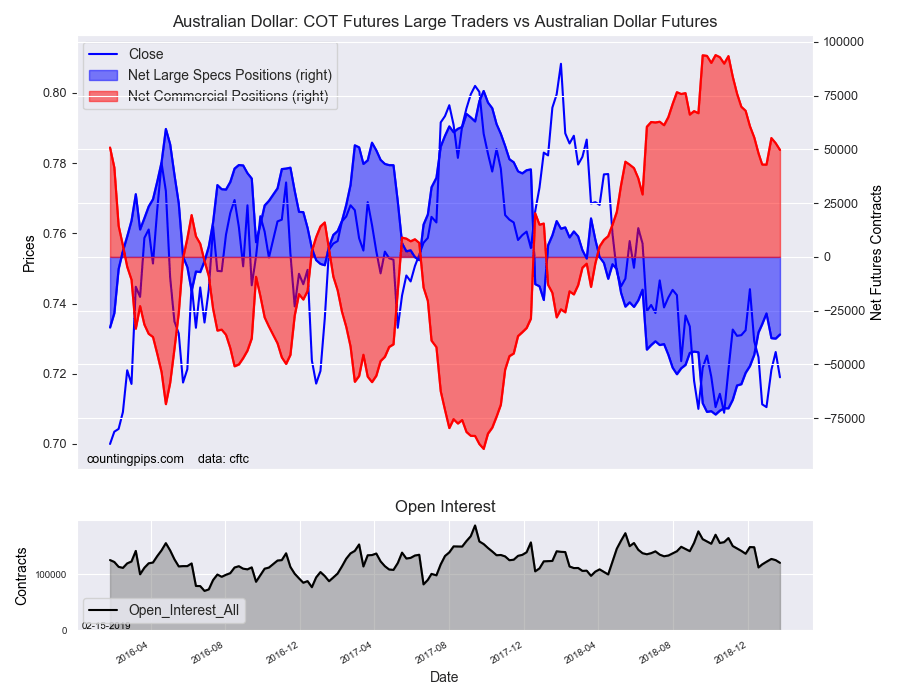

Australian Dollar:

The large speculator positions in Australian dollar futures reached a net position of -36,063 contracts in the data ending Tuesday January 22nd. This was a weekly advance of 1,906 contracts from the previous week which had a total of -37,969 net contracts.

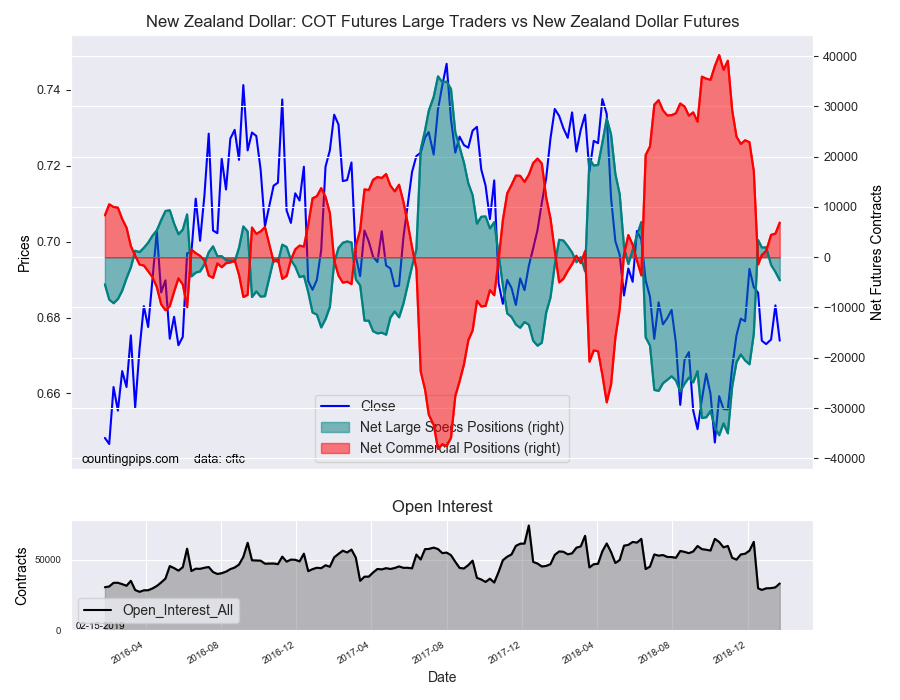

New Zealand Dollar:

The New Zealand dollar speculative standing was a net position of -4,589 contracts in the latest COT data. This was a weekly lowering of -1,649 contracts from the previous week which had a total of -2,940 net contracts.

Mexican Peso:

Mexican peso speculators reached a net position of 63,519 contracts. This was a weekly advance of 6,254 contracts from the previous week which had a total of 57,265 net contracts.

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI