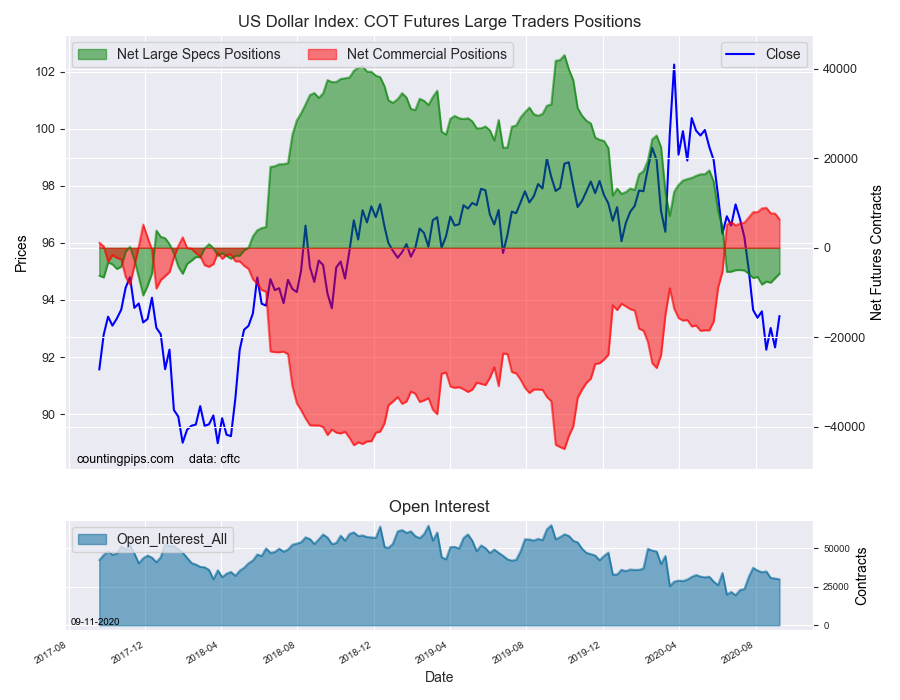

Large currency speculators cut back on their bearish net positions in the US Dollar Index futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of US Dollar Index futures, traded by large speculators and hedge funds, totaled a net position of -5,758 contracts in the data reported through Tuesday, September 8th. This was a weekly gain of 988 contracts from the previous week which had a total of -6,746 net contracts.

This week’s net position was the result of the gross bullish position (longs) decreasing by -895 contracts (to a weekly total of 13,453 contracts) compared to the gross bearish position (shorts) which saw a larger decline by -1,883 contracts on the week (to a total of 19,211 contracts).

US Dollar Index speculators reduced their net bearish bets this week for the second straight week and for the third time in the past four weeks. The speculative positions have been in bearish territory for thirteen straight weeks after sentiment turned negative for the USD on June 16th. The overall standing, with sentiment improving slightly in the past two weeks, is now at the least bearish level of the last eight weeks at -5,758 contracts.

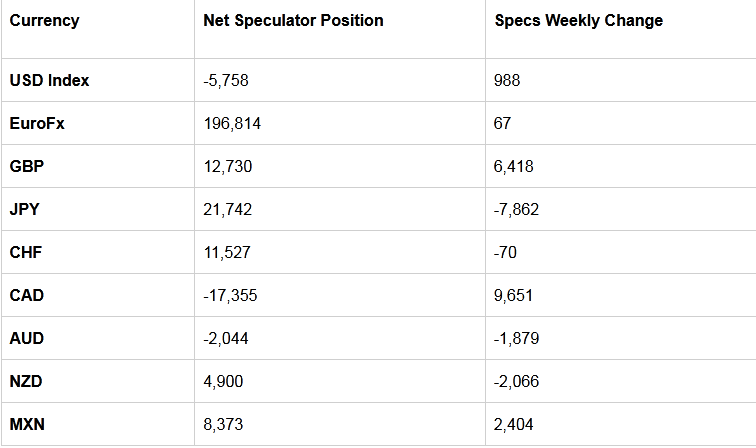

Individual Currencies Data this week:

In the other major currency contracts data, we saw improvements in the COT positioning for the British pound sterling and the Canadian dollar in the speculators category this week.

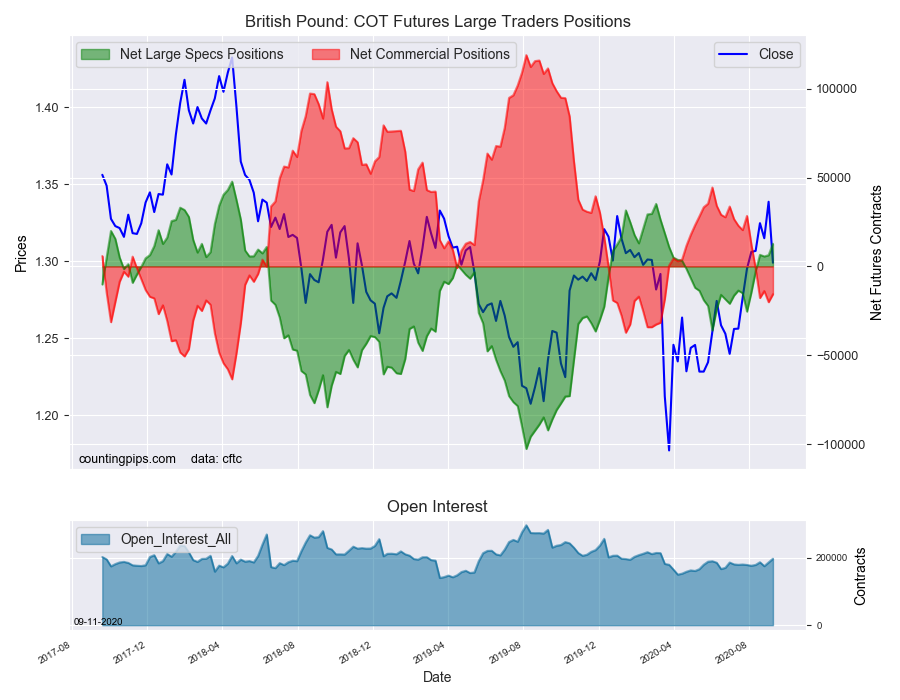

British pound sterling positions rose this week for a second straight week and for the fifth time in the past six weeks. The sterling bets have now improved by a total of +38,139 contracts over the past six weeks. These gains have brought the GBP bets into a small bullish level which is the best position since March 17th, a span of twenty-five weeks. The GBPUSD currency pair cooled off considerably this week as the Brexit situation once again has come into effect. The GBPUSD had been on a bullish run that had pushed the currency pair to a 2020 high level just below the 1.35 exchange rate (up from around 1.16 in March).

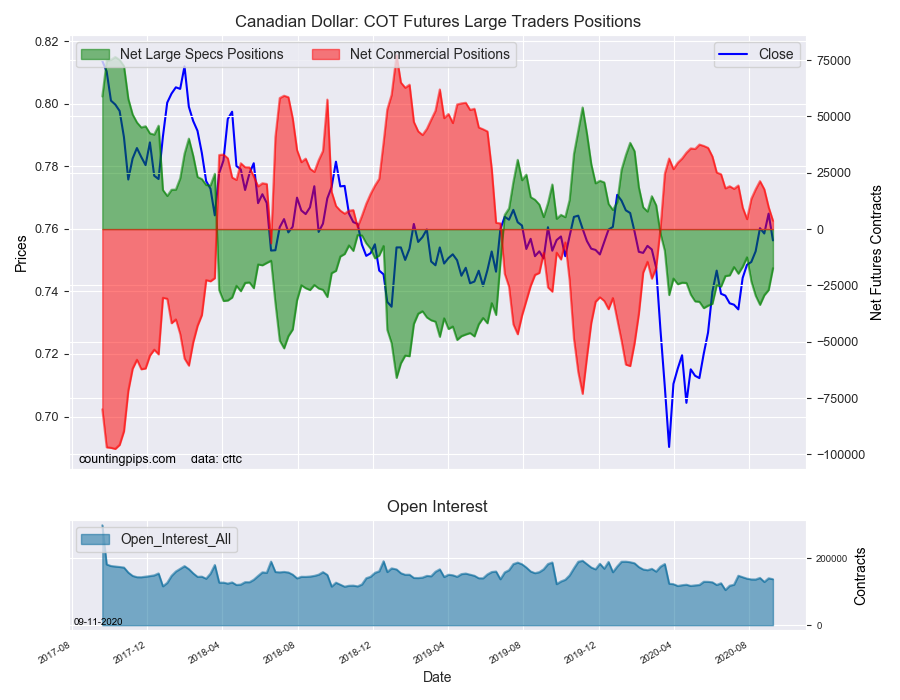

Canadian dollar bearish bets fell this week for a third consecutive week following a streak of declines in the previous three weeks. CAD bets have improved by a total of +16,232 contracts over these past three weeks and have brought the overall net position to the least bearish level of the past six weeks at -17,355 contracts. Despite the recent improvements, the Canadian dollar bets have remained in bearish territory since March 10th, a span of twenty-seven straight weeks. The USDCAD currency pair has been on the decline (USD weakness, CAD strength) in recent weeks with the pair going from an approximate exchange rate of 1.45 in late March to a 1.3177 close this week.

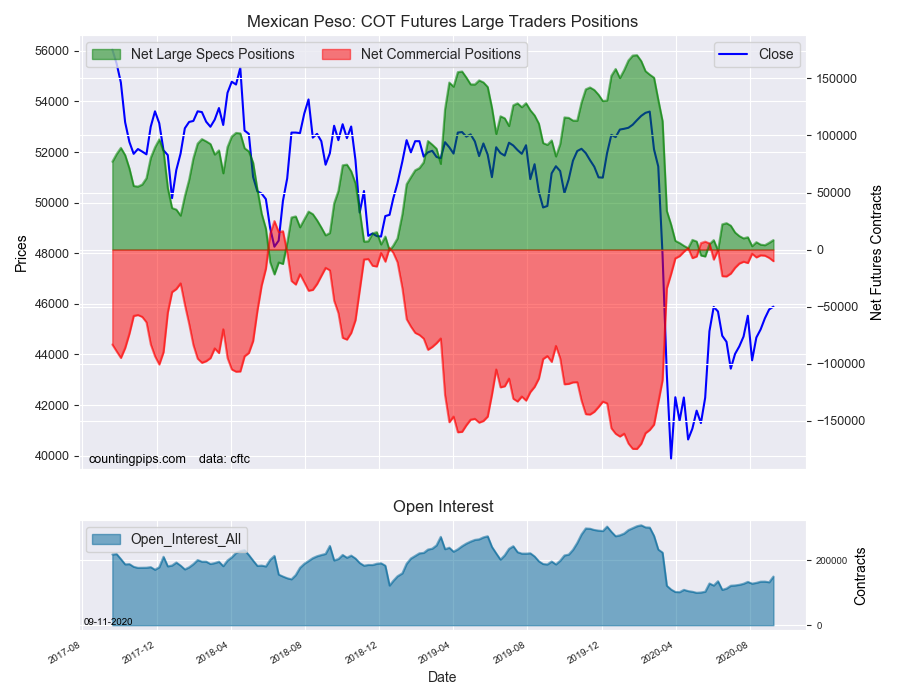

Overall, the major currencies that saw improving speculator positions this week were the US dollar index (988 weekly change in contracts), euro (67 contracts), British pound sterling (6,418 contracts), Canadian dollar (9,651 contracts) and the Mexican peso (2,404 contracts).

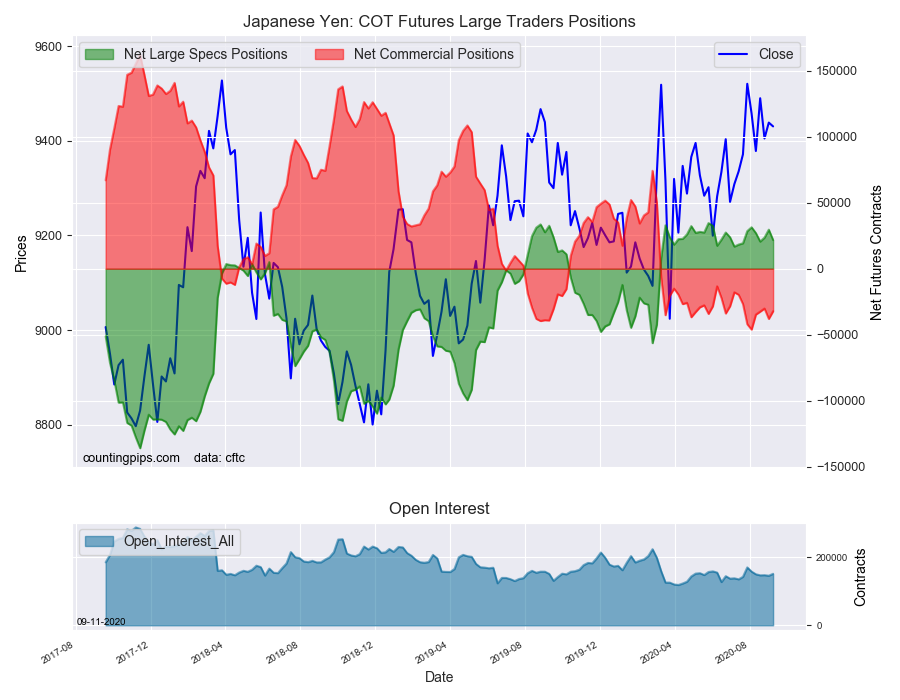

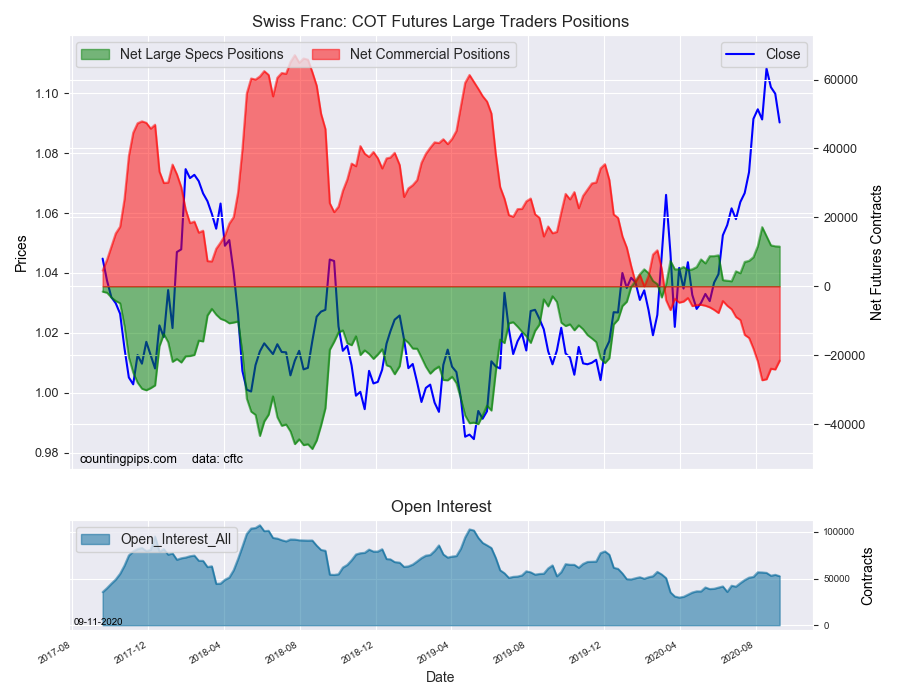

The currencies whose speculative bets declined this week were the Japanese yen (-7,862 weekly change in contracts), Swiss franc (-70 contracts), Australian dollar (-1,879 contracts) and the New Zealand dollar (-2,066 contracts).

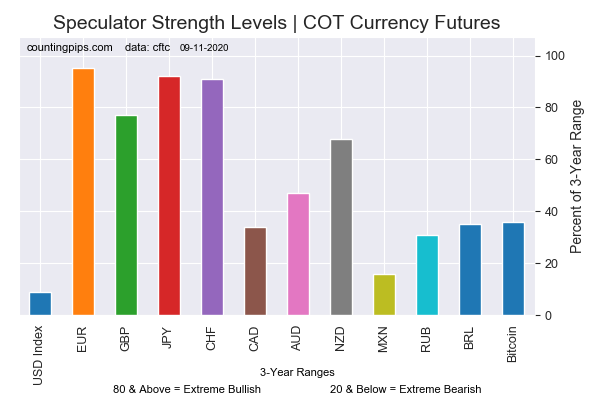

Chart: Current Strength of Each Currency compared to their 3-Year Range

The above chart depicts each currency’s current speculator strength level compared to data of the past 3 years. A score of 0 percent would mean speculator bets are currently at the lowest level of the past three years. A 100 percent score would be at the highest level while a 50 percent score would mean speculator bets are right in the middle of the data (a neutral score). We use above 80 percent (extreme bullish) and below 20 percent (extreme bearish) as extreme score measurements.

Please see the data table and individual currency charts below.

Table of Large Speculator Levels & Weekly Changes:

This latest COT data is through Tuesday and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets. All currency positions are in direct relation to the US dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar while a bet against the euro will be a bet that the dollar will gain versus the euro.

Weekly Charts: Large Trader Weekly Positions vs Price

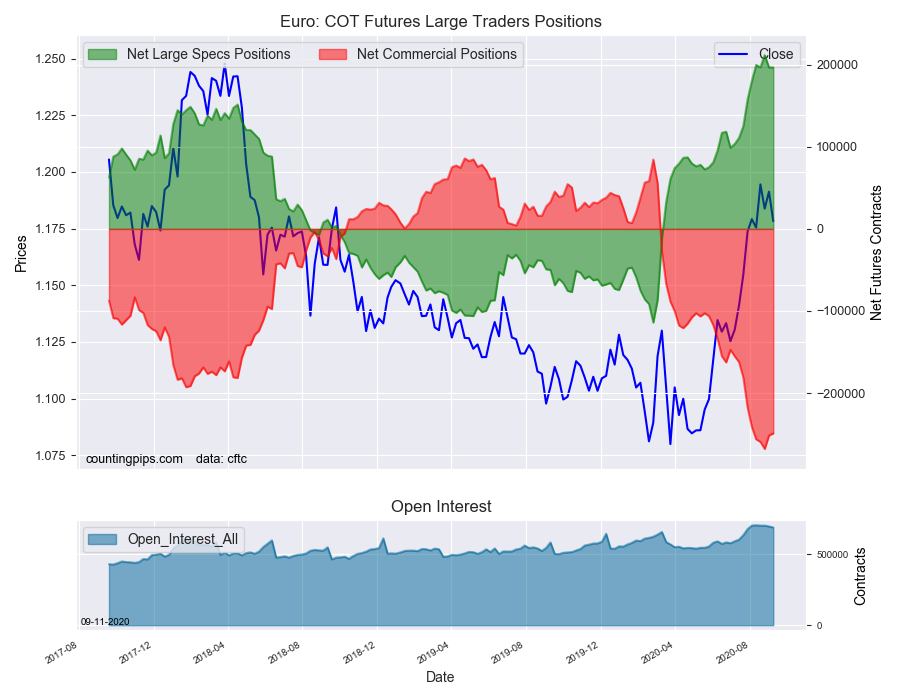

EuroFX:

The Euro large speculator standing this week equaled a net position of 196,814 contracts in the data reported through Tuesday. This was a weekly rise of 67 contracts from the previous week which had a total of 196,747 net contracts.

British Pound Sterling:

The large British pound sterling speculator level reached a net position of 12,730 contracts in the data reported this week. This was a weekly gain of 6,418 contracts from the previous week which had a total of 6,312 net contracts.

Japanese Yen:

Large Japanese yen speculators came in at a net position of 21,742 contracts in this week’s data. This was a weekly decrease of -7,862 contracts from the previous week which had a total of 29,604 net contracts.

Swiss Franc:

The Swiss franc speculator standing this week recorded a net position of 11,527 contracts in the data through Tuesday. This was a weekly decrease of -70 contracts from the previous week which had a total of 11,597 net contracts.

Canadian Dollar:

Canadian dollar speculators resulted in a net position of -17,355 contracts this week. This was a increase of 9,651 contracts from the previous week which had a total of -27,006 net contracts.

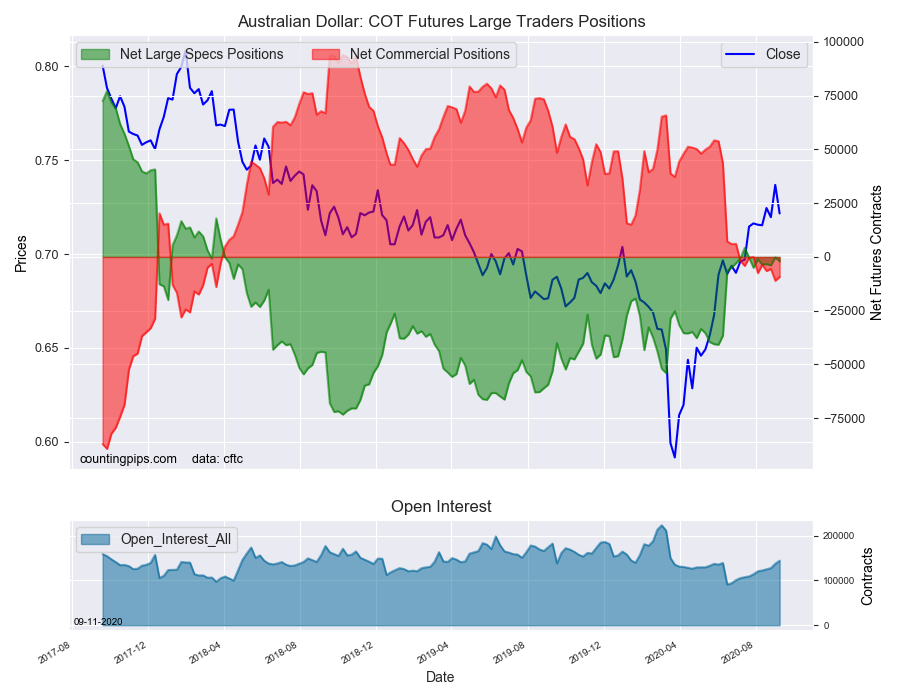

Australian Dollar:

The large speculator positions in Australian dollar futures resulted in a net position of -2,044 contracts this week in the data ending Tuesday. This was a weekly decrease of -1,879 contracts from the previous week which had a total of -165 net contracts.

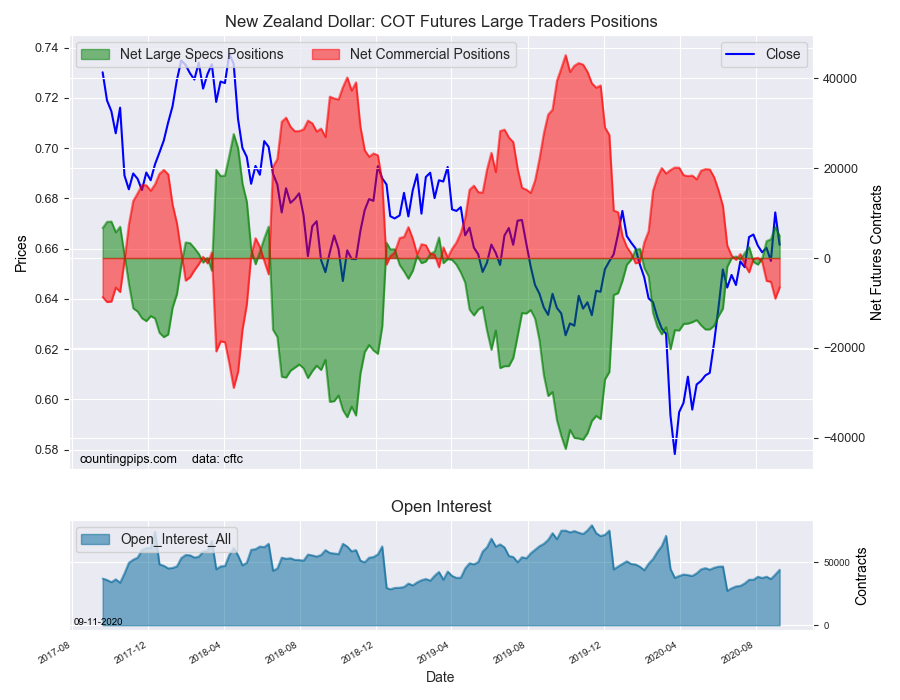

New Zealand Dollar:

The New Zealand dollar speculative standing came in at a net position of 4,900 contracts this week in the latest COT data. This was a weekly decline of -2,066 contracts from the previous week which had a total of 6,966 net contracts.

Mexican Peso:

Mexican peso speculators equaled a net position of 8,373 contracts this week. This was a weekly increase of 2,404 contracts from the previous week which had a total of 5,969 net contracts.