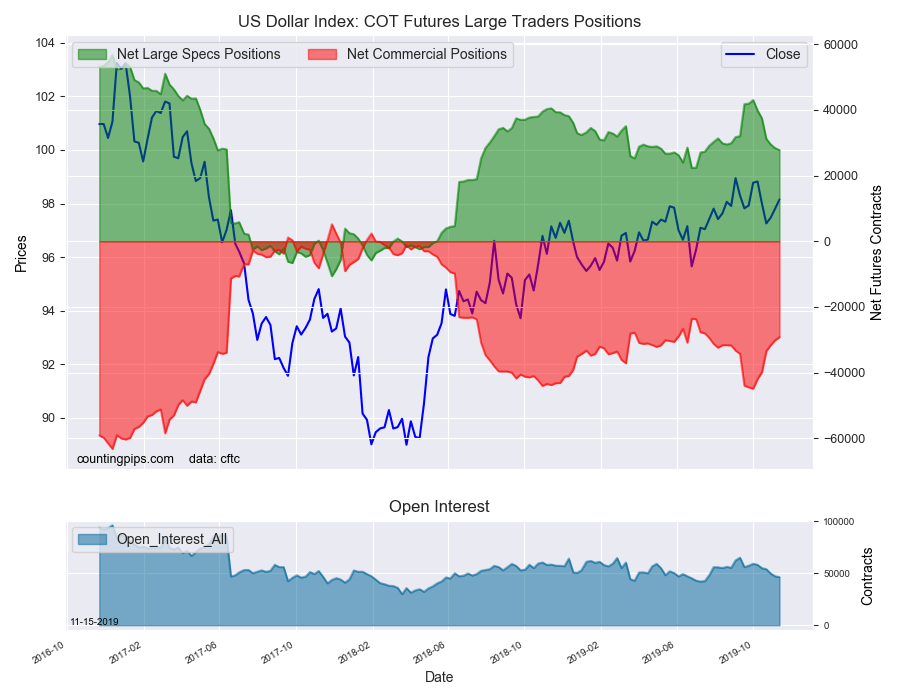

US Dollar Index Speculator Positions

Large currency speculators continued to reduce their bullish positions in the US Dollar Index futures markets, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of US Dollar Index futures, traded by large speculators and hedge funds, totaled a net position of 27,784 contracts in the data reported through Tuesday, November 12th. This was a weekly decline of -595 contracts from the previous week which had a total of 28,379 net contracts.

Individual Currencies Data this week:

The week’s net position was the result of the gross bullish position (longs) sliding by -1,066 contracts (to a weekly total of 33,917 contracts) compared to the gross bearish position (shorts) which saw a smaller reduction by -471 contracts on the week (to a total of 6,133 contracts).

Speculators cut their bullish bets for a sixth straight week and have now reduced their positioning by a total of -15,244 contracts over that time-frame. The current standing for speculative bullish bets is now at the lowest level in seventeen weeks, dating back to July 16th. Despite the recent shortfalls in dollar bets, the spec positions have remained above the +20,000 net contract level now for sixty-nine consecutive weeks, underscoring the continued USD strength.

In the other major currency contracts data, we saw two substantial changes (+ or – 10,000 contracts) in the speculators category this week.

Australian dollar bets dropped sharply (-14,015 contracts) in the latest data and essentially erased last week’s strong gains (+13,493 contracts). The latest decline (or rise in bearish bets) pushed the bearish bet level above -40,000 contracts (after a drop last week to -26,794 contracts). The AUD speculator positions have now been in bearish territory for a total of 85 weeks.

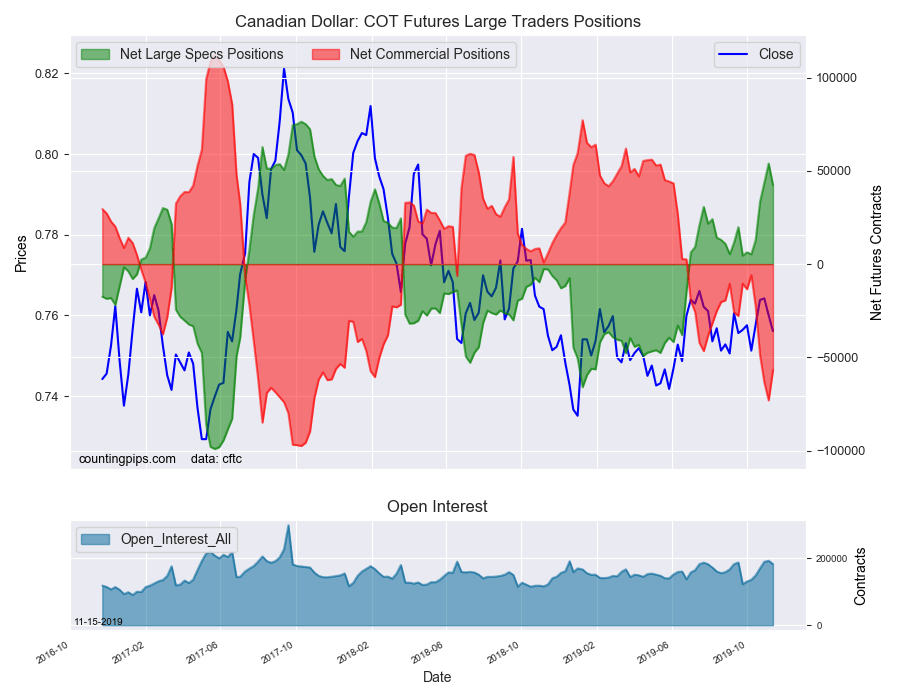

Canadian dollar bullish bets fell sharply (-11,629 contracts) in the latest data after gaining very strongly (by a total of +41,041 contracts) in the previous three weeks. Despite the shortfall, CAD bets have now been above the +40,000 net contract level for three straight weeks. Overall, CAD bets have been in bullish territory for twenty consecutive weeks, dating back to late June.

Overall, the major currencies that saw improving speculator positions this week were the euro (3,077 weekly change in contracts), British pound sterling (902 contracts), New Zealand dollar (2,730 contracts) and the Mexican peso (1,635 contracts).

The currencies whose speculative bets declined this week were the US dollar index (-595 weekly change in contracts), Japanese yen (-8,392 contracts), Swiss franc (-967 contracts), Canadian dollar (-11,629 contracts) and the Australian dollar (-14,015 contracts).

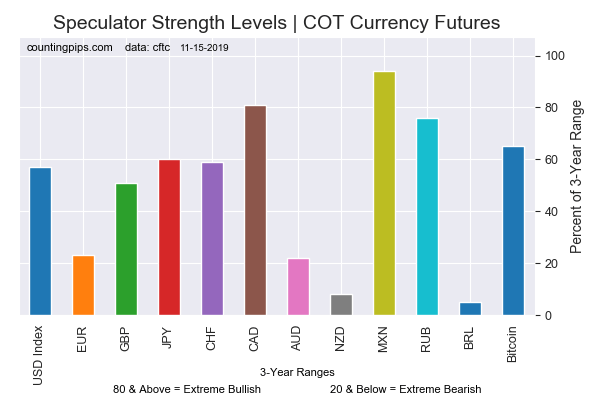

Chart: Current Strength of Each Currency compared to their 3-Year Range

See the table and individual currency charts below.

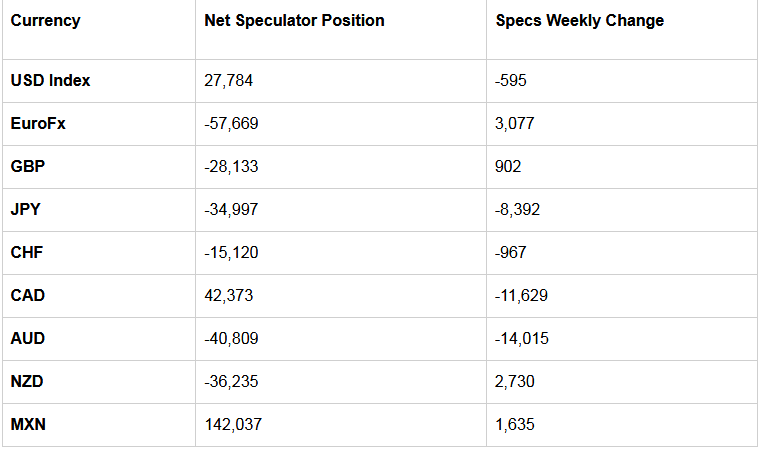

Table of Large Speculator Levels & Weekly Changes:

This latest COT data is through Tuesday and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets. All currency positions are in direct relation to the US dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar while a bet against the euro will be a bet that the dollar will gain versus the euro.

Weekly Charts: Large Trader Weekly Positions vs Price

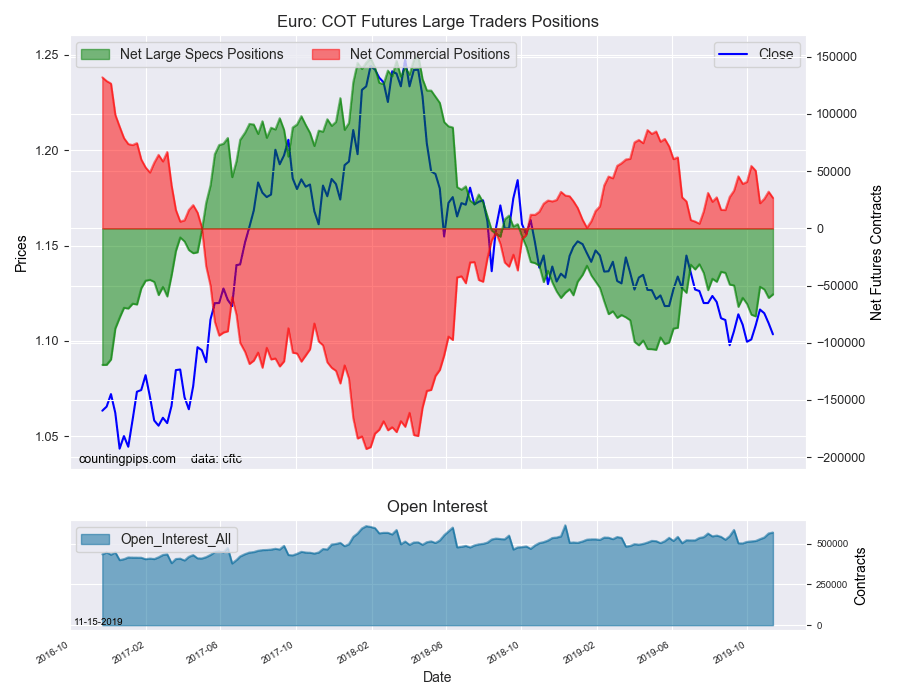

EuroFX:

The euro large speculator standing this week came in at a net position of -57,669 contracts in the data reported through Tuesday. This was a weekly gain of 3,077 contracts from the previous week which had a total of -60,746 net contracts.

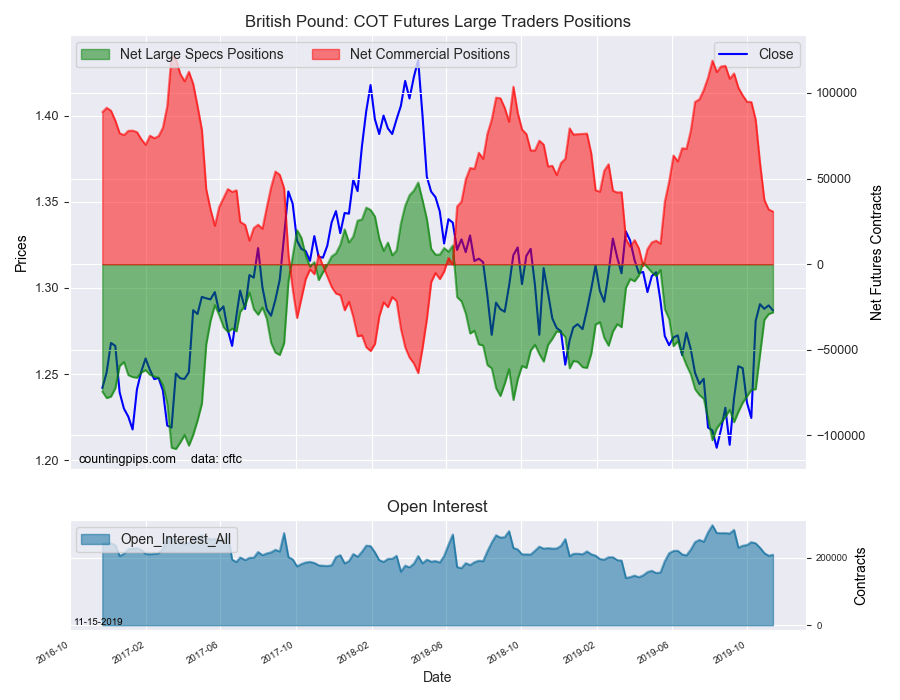

British Pound Sterling:

The large British pound sterling speculator level came in at a net position of -28,133 contracts in the data reported this week. This was a weekly lift of 902 contracts from the previous week which had a total of -29,035 net contracts.

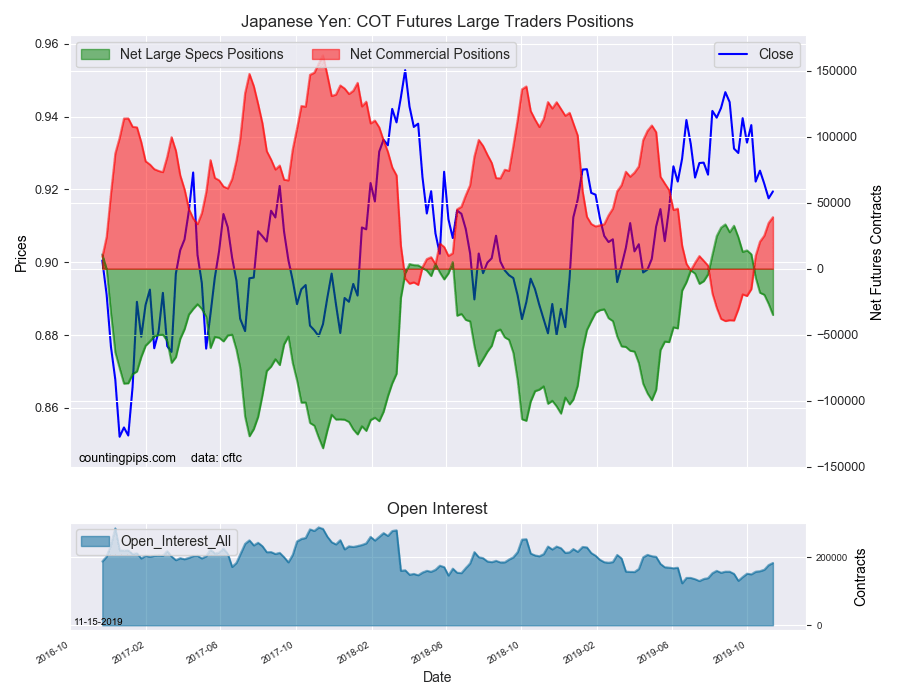

Japanese Yen:

Large Japanese yen speculators totaled a net position of -34,997 contracts in this week’s data. This was a weekly decline of -8,392 contracts from the previous week which had a total of -26,605 net contracts.

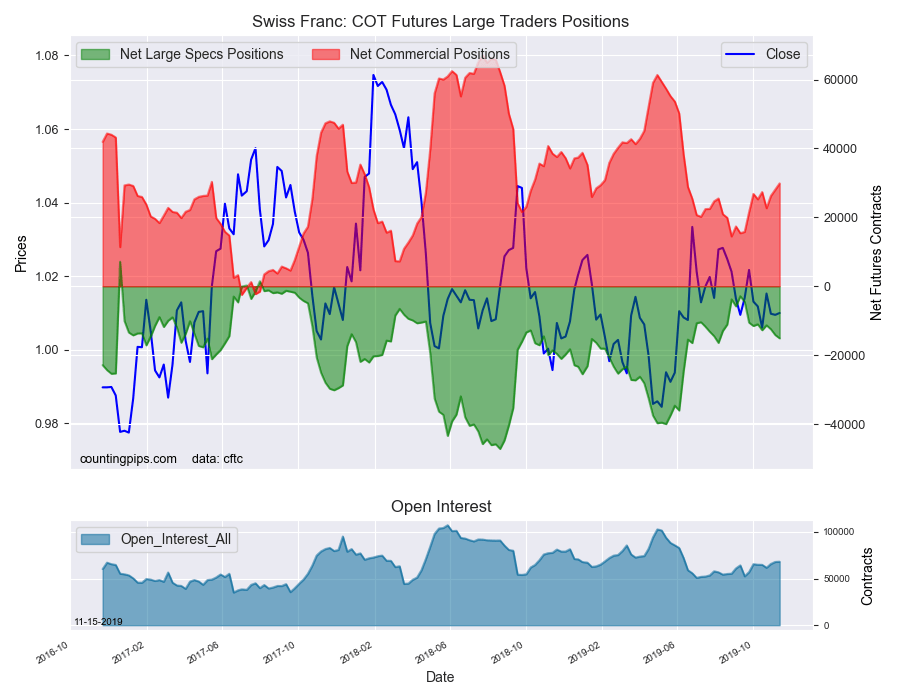

Swiss Franc:

The Swiss franc speculator standing this week recorded a net position of -15,120 contracts in the data through Tuesday. This was a weekly fall of -967 contracts from the previous week which had a total of -14,153 net contracts.

Canadian Dollar:

Canadian dollar speculators recorded a net position of 42,373 contracts this week. This was a decrease of -11,629 contracts from the previous week which had a total of 54,002 net contracts.

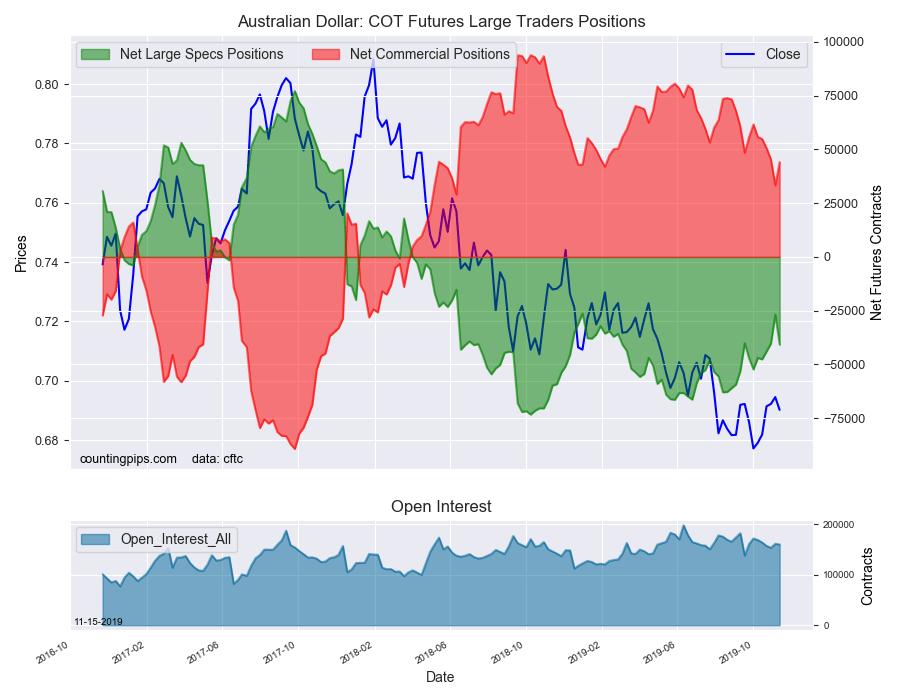

Australian Dollar:

The large speculator positions in Australian dollar futures recorded a net position of -40,809 contracts this week in the data ending Tuesday. This was a weekly decrease of -14,015 contracts from the previous week which had a total of -26,794 net contracts.

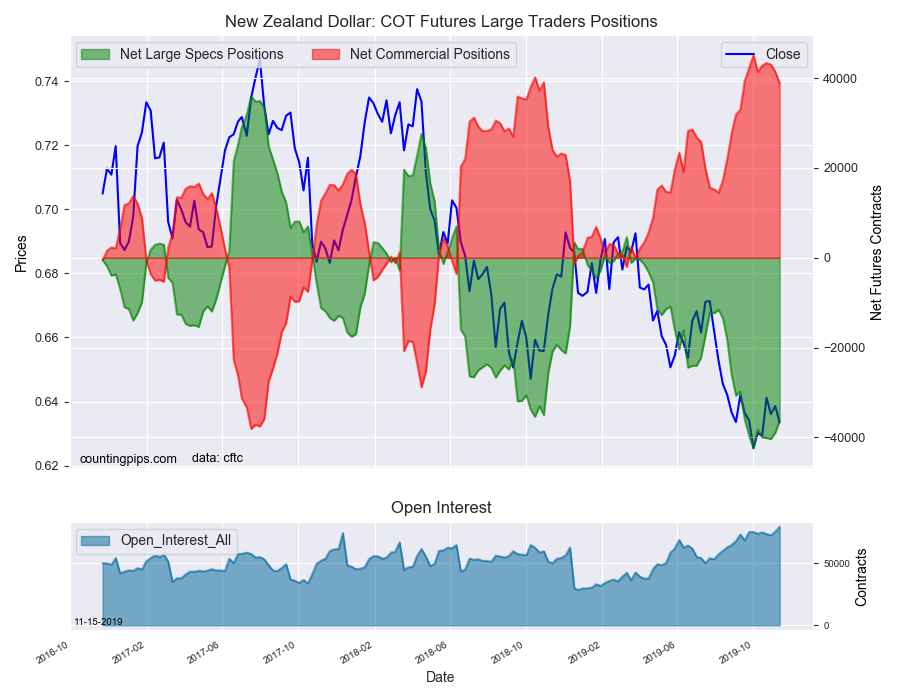

New Zealand Dollar:

The New Zealand dollar speculative standing recorded a net position of -36,235 contracts this week in the latest COT data. This was a weekly gain of 2,730 contracts from the previous week which had a total of -38,965 net contracts.

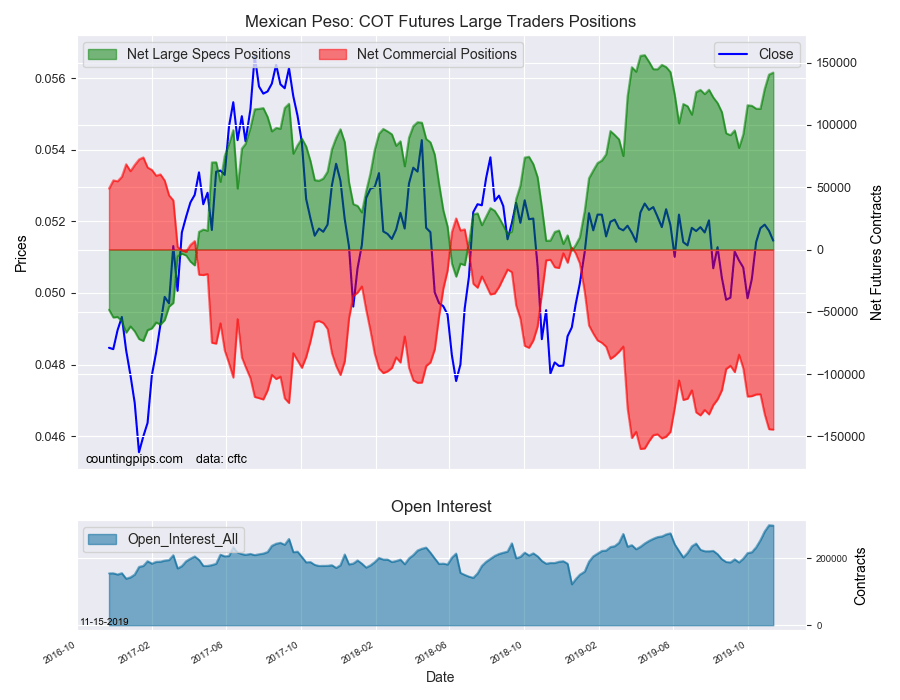

Mexican Peso:

Mexican peso speculators came in at a net position of 142,037 contracts this week. This was a weekly advance of 1,635 contracts from the previous week which had a total of 140,402 net contracts.