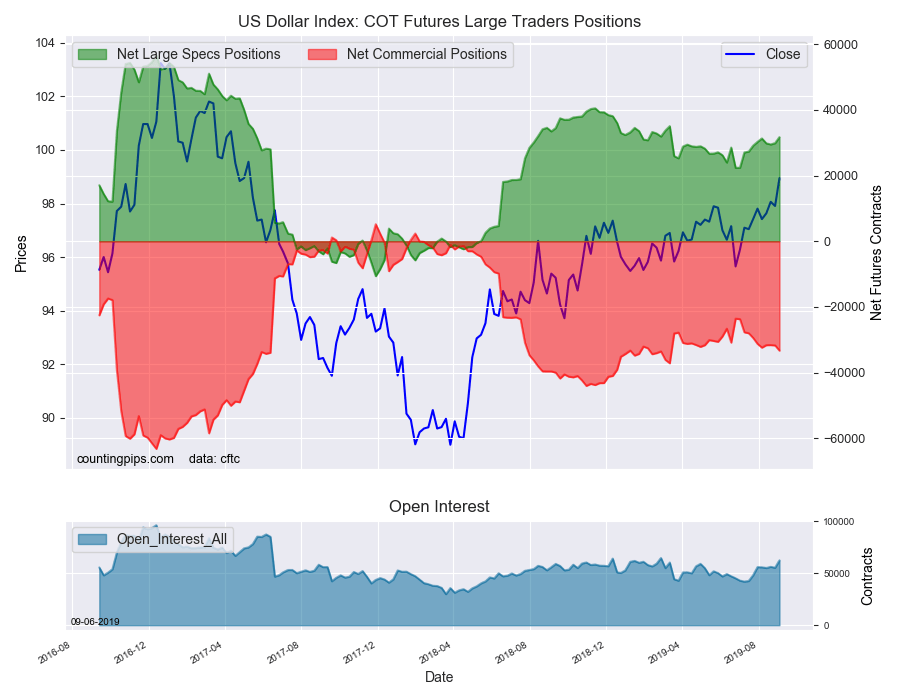

US Dollar Index Speculator Positions

Large currency speculators increased their bullish net positions in the US Dollar Index futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of US Dollar Index futures, traded by large speculators and hedge funds, totaled a net position of 31,736 contracts in the data reported through Tuesday September 3rd. This was a weekly advance of 1,839 contracts from the previous week which had a total of 29,897 net contracts.

This week’s net position was the result of the gross bullish position (longs) going up by 6,308 contracts (to a weekly total of 54,410 contracts) compared to the gross bearish position (shorts) which saw a lesser gain of 4,469 contracts on the week (to a total of 22,674 contracts).

US Dollar Index speculative positions rose for a second straight week and for the eighth time out of the past ten weeks as dollar sentiment remains strong. This week’s bullishness bounced the dollar’s net bullish position back above the +30,000 net contract level for the first time since August 6th. Dollar bullish positions have now stayed above the +22,000 net position level for fifty-nine consecutive weeks.

Individual Currencies Data this week:

In the other major currency contracts data, we saw just one substantial change (+ or – 10,000 contracts) in the speculators category this week.

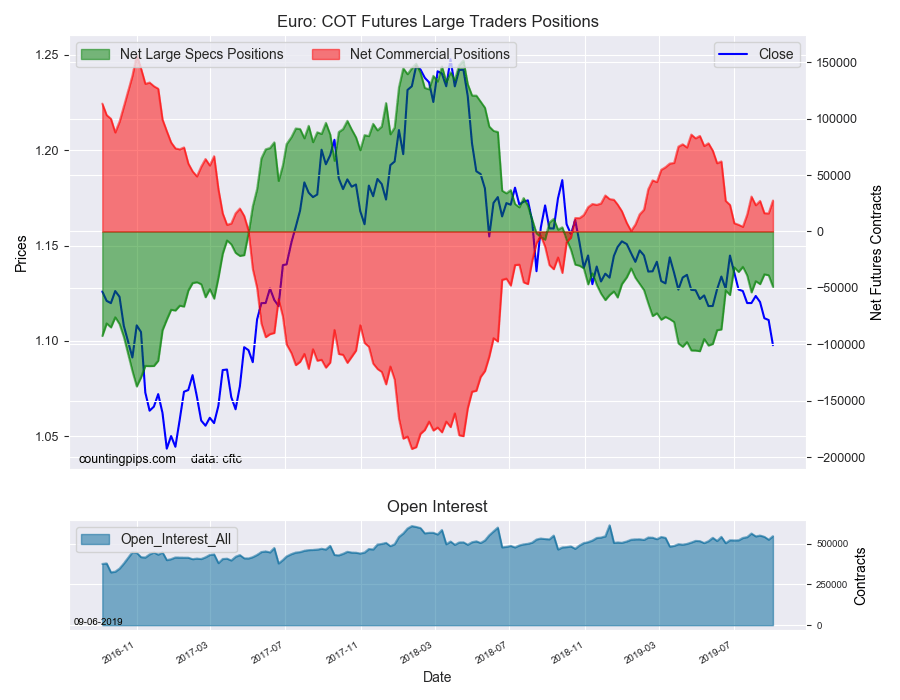

Euro speculators sharply raised their bearish bets this week by over -10,000 net contracts. This is a second straight weekly rise and the fifth time out of the past seven weeks that bearish bets have now gained. Currently, the bearish net position (-49,136 contracts) is modest compared to where the position was on May 21st (-101,102 contracts). Overall, the euro speculative standing has now remained in bearish territory for forty-nine straight weeks dating back to September 25th of 2018.

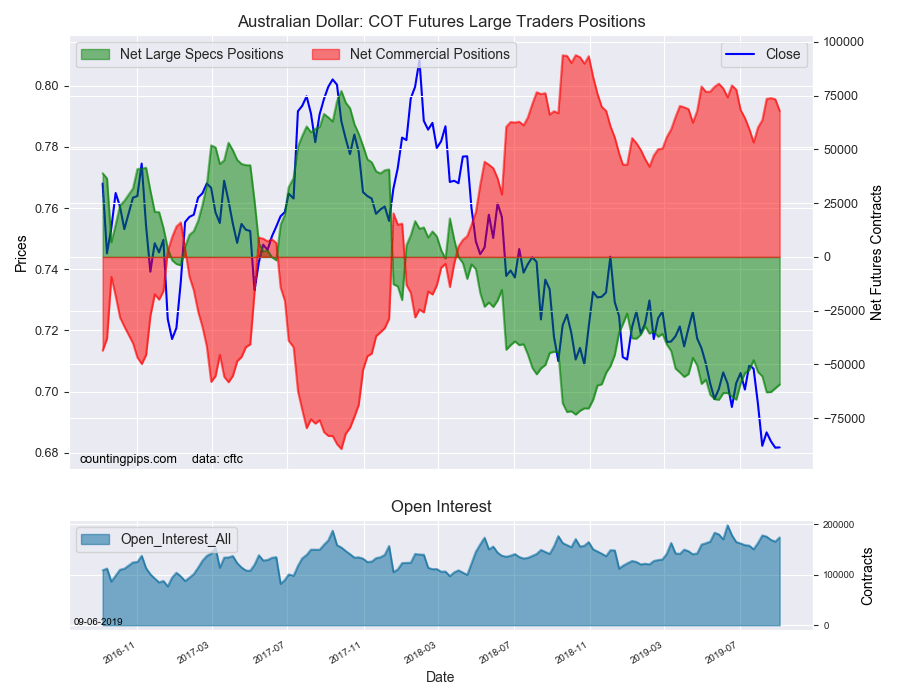

Overall, the major currencies that saw improving speculator positions this week were the US dollar index (1,839 weekly change in contracts), British pound sterling (4,069 contracts) and the Australian dollar (1,714 contracts).

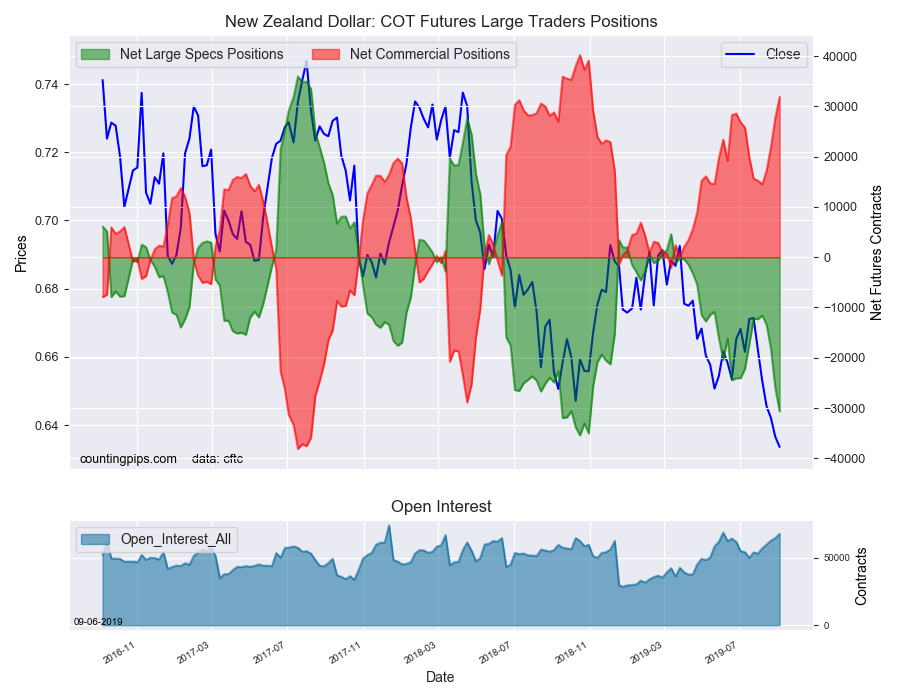

The currencies whose speculative bets declined this week were the euro (-10,332 weekly change in contracts), Japanese yen (-5,925 contracts), Swiss franc (-2,039 contracts), Canadian dollar (-5,556 contracts), New Zealand dollar (-4,629 contracts) and the Mexican peso (-1,523 contracts).

Other Notables for the week:

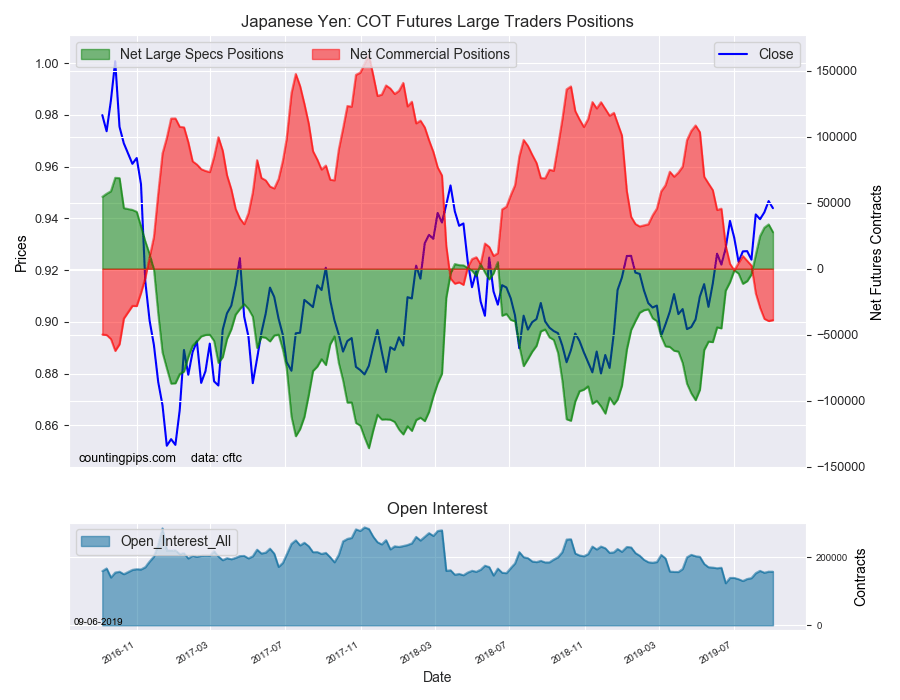

Japanese yen bullish positions dipped this week after rising for six consecutive weeks. The yen turned from net bearish to net bullish on August 6th and has now been in an overall bullish standing for five straight weeks for the first time since the October-November of 2016 time-period.

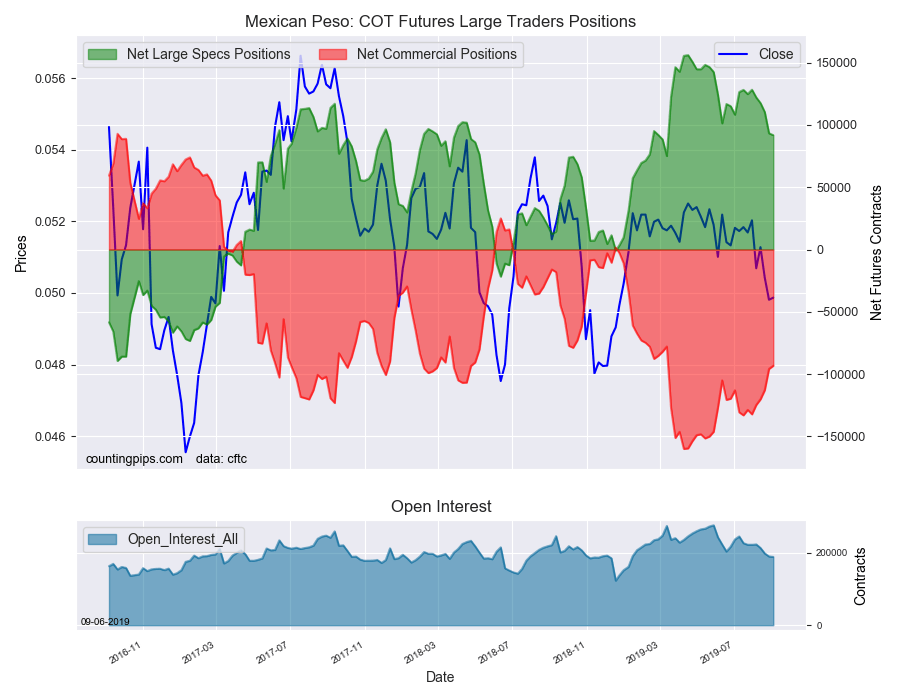

Mexican peso bullish positions fell for the fifth straight week this week and for the sixth time out of the past seven weeks. Peso positions remain in a strong bullish position at +91,791 contracts but have been sliding lower since reaching a record bullish high in mid-April at +156,030 net contracts.

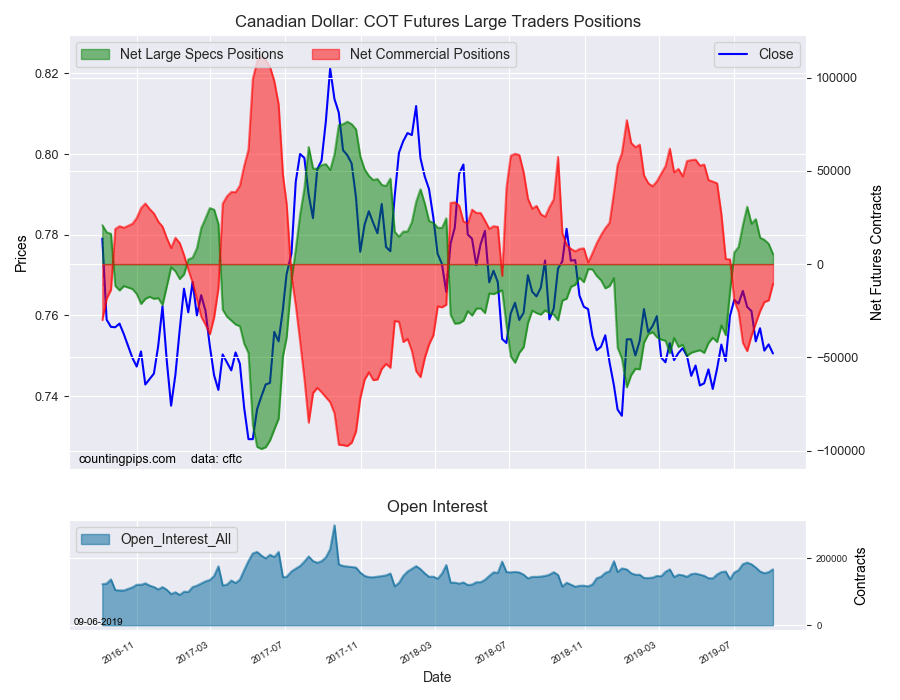

Canadian dollar bullish positions declined for a fourth straight week this week and fell to the lowest bullish position since June. Overall, CAD speculative bets have been in bullish territory for ten weeks now after turning bullish in early July but have been on the decline since reaching a high of +30,750 contracts on July 23rd.

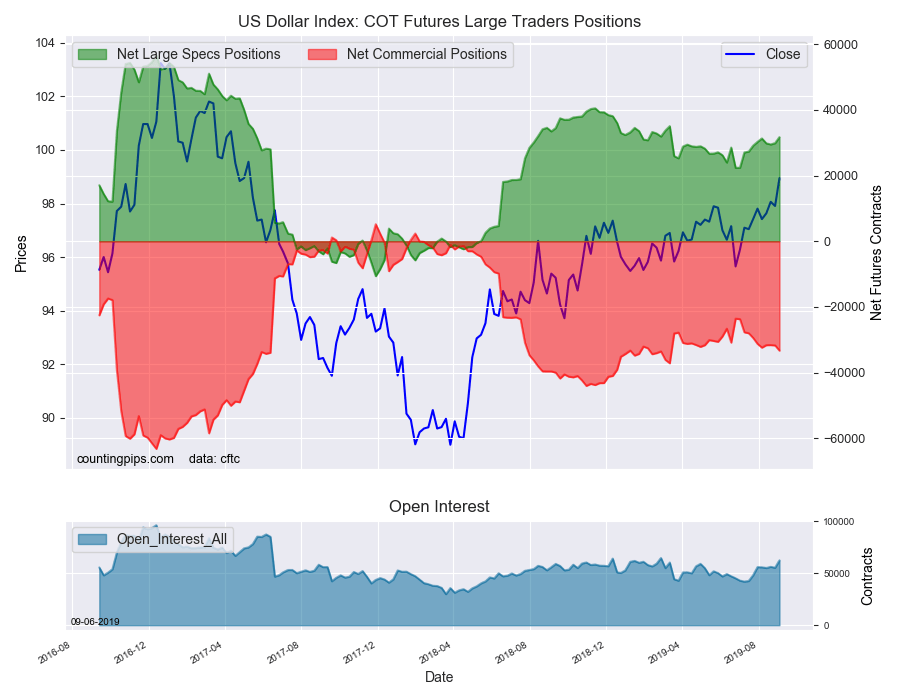

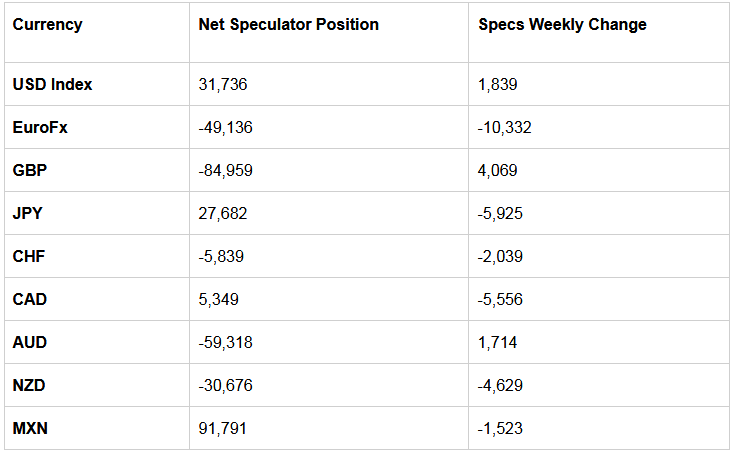

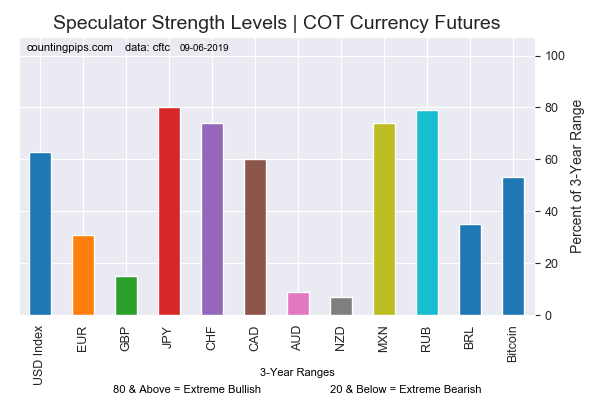

Chart: Current Strength of Each Currency compared to their 3-Year Range

See the table and individual currency charts below.

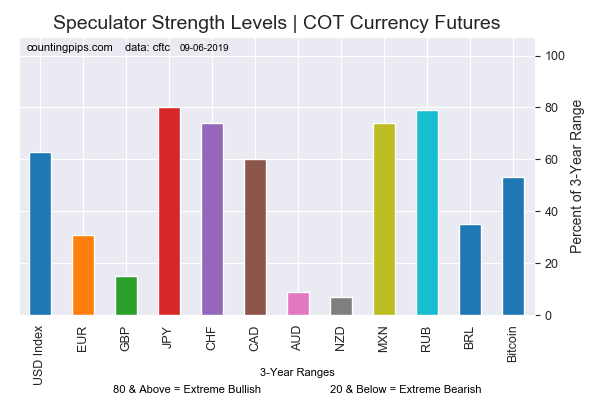

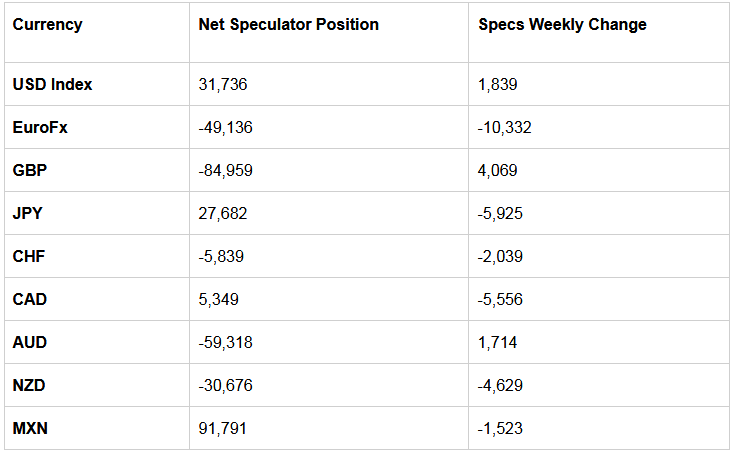

Table of Large Speculator Levels And Weekly Changes:

Weekly Charts: Large Trader Weekly Positions vs Price

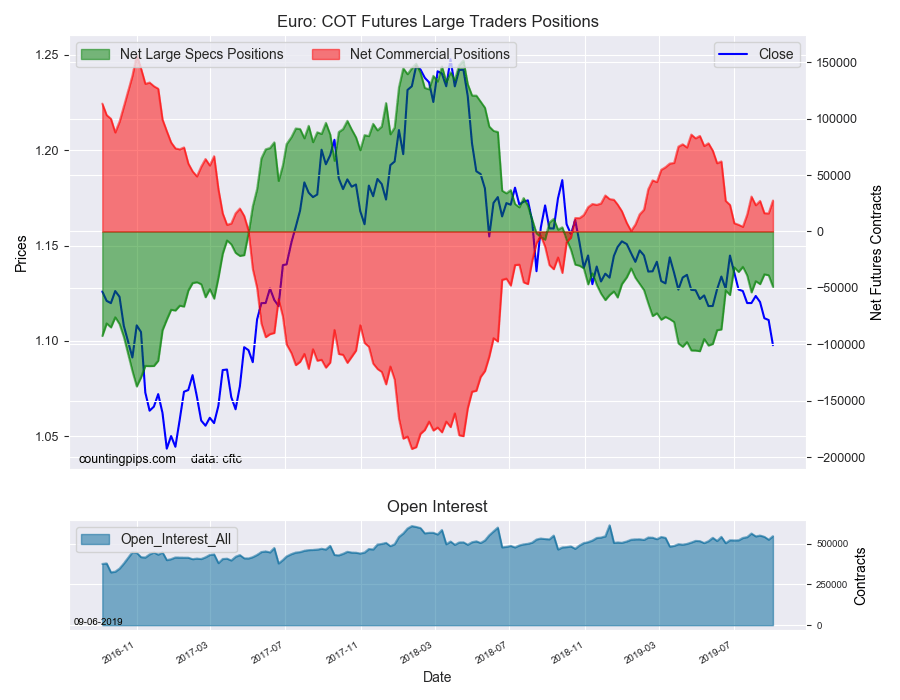

EuroFX:

The euro large speculator standing this week came in at a net position of -49,136 contracts in the data reported through Tuesday. This was a weekly lowering of -10,332 contracts from the previous week which had a total of -38,804 net contracts.

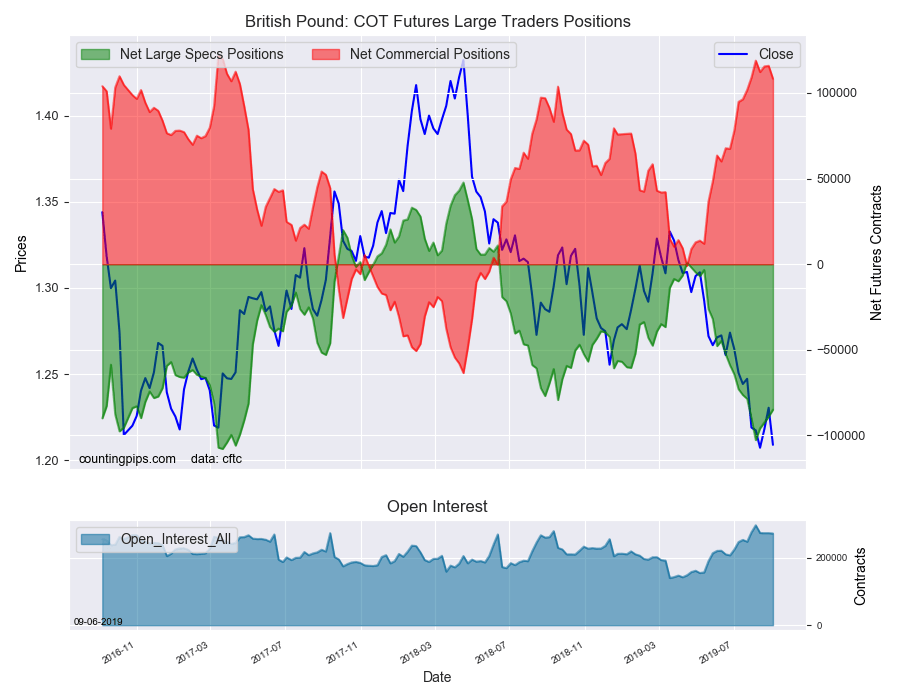

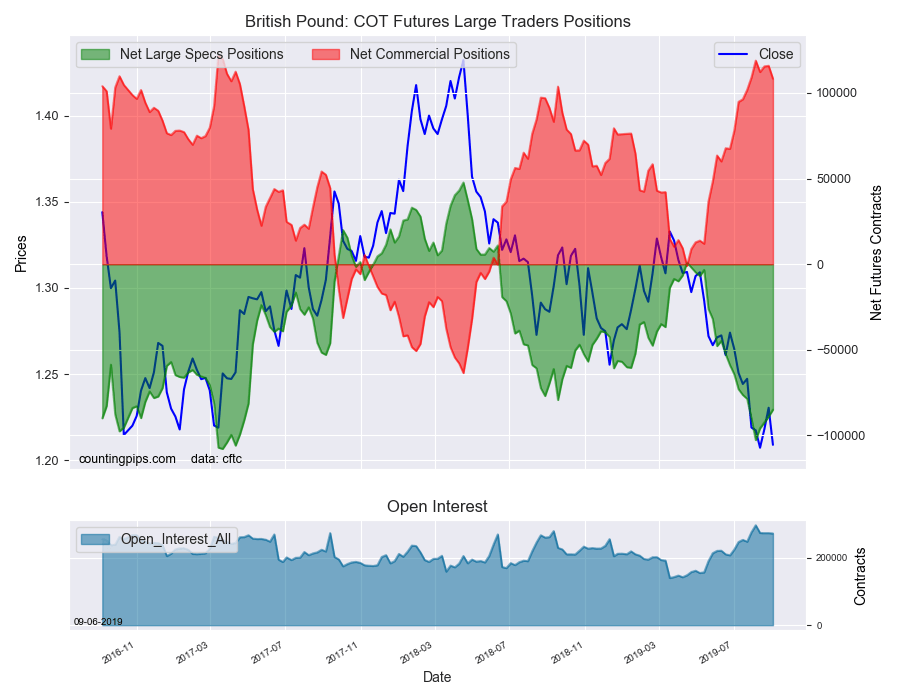

British Pound Sterling:

The large British pound sterling speculator level came in at a net position of -84,959 contracts in the data reported this week. This was a weekly increase of 4,069 contracts from the previous week which had a total of -89,028 net contracts.

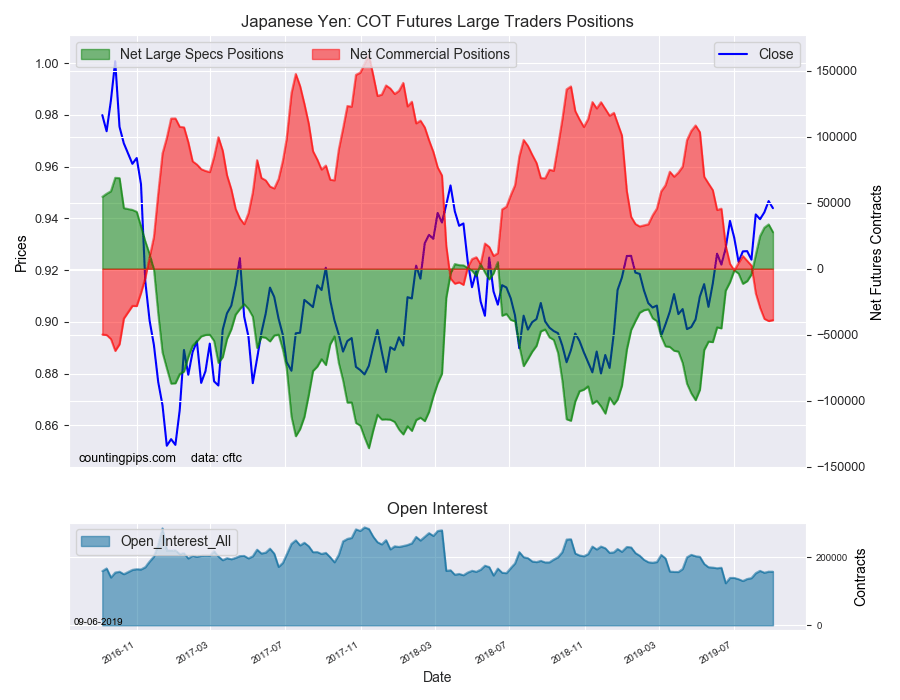

Japanese Yen:

Large Japanese yen speculators totaled a net position of 27,682 contracts in this week’s data. This was a weekly lowering of -5,925 contracts from the previous week which had a total of 33,607 net contracts.

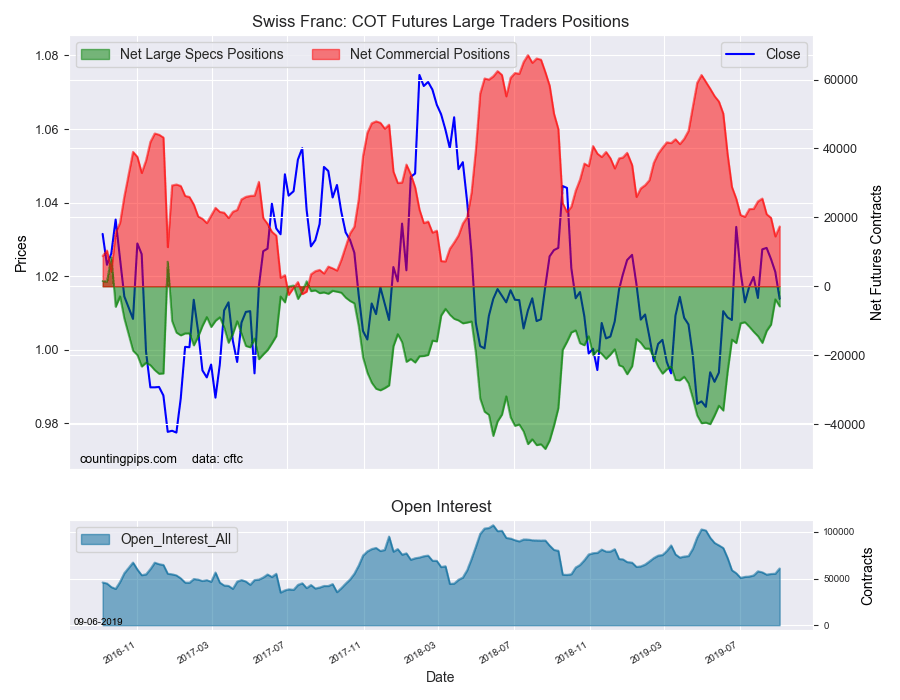

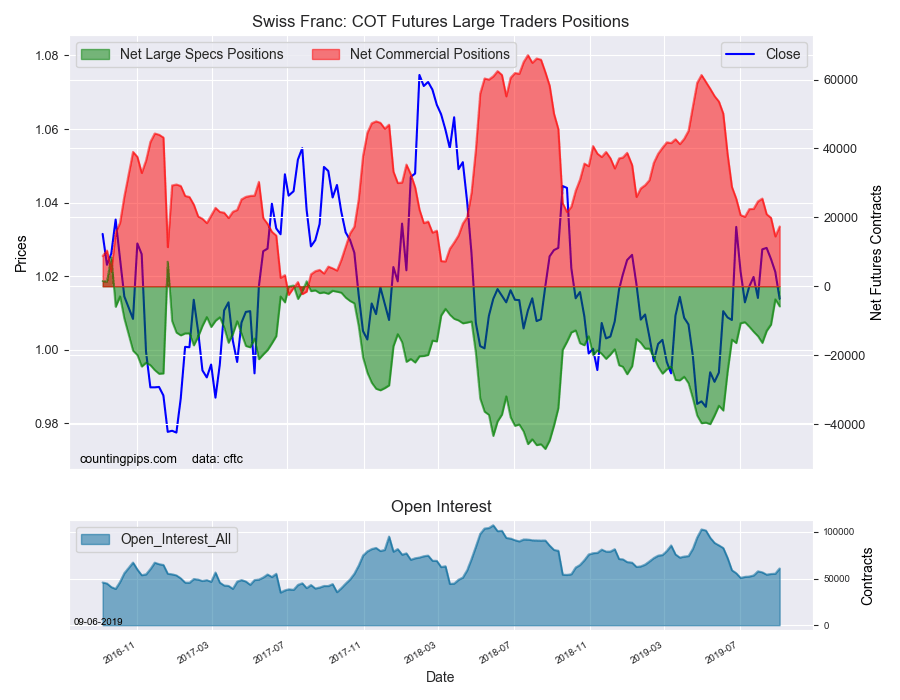

Swiss Franc:

The Swiss franc speculator standing this week resulted in a net position of -5,839 contracts in the data through Tuesday. This was a weekly decline of -2,039 contracts from the previous week which had a total of -3,800 net contracts.

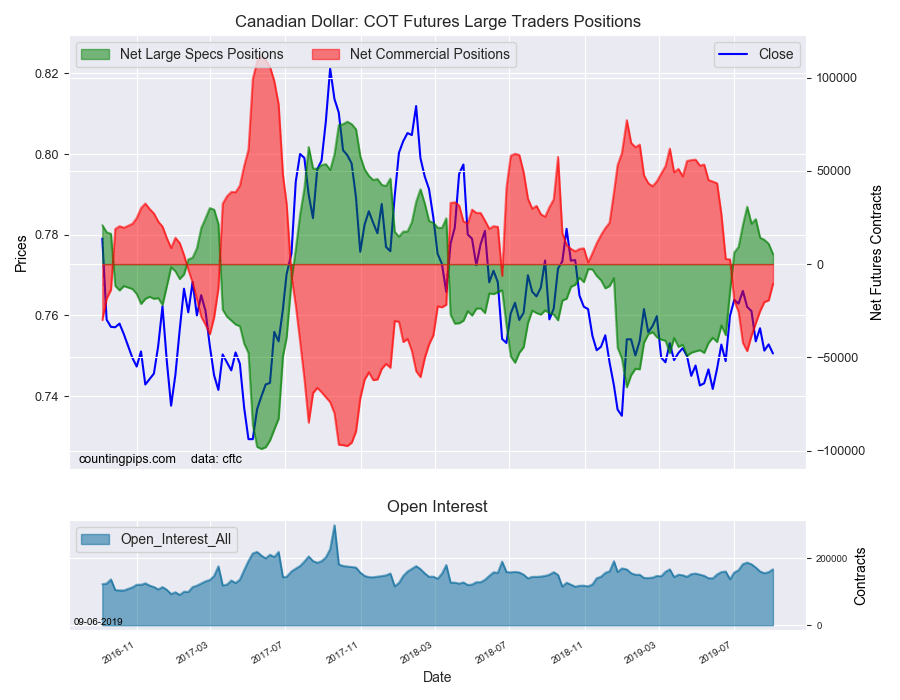

Canadian Dollar:

Canadian dollar speculators reached a net position of 5,349 contracts this week. This was a fall of -5,556 contracts from the previous week which had a total of 10,905 net contracts.

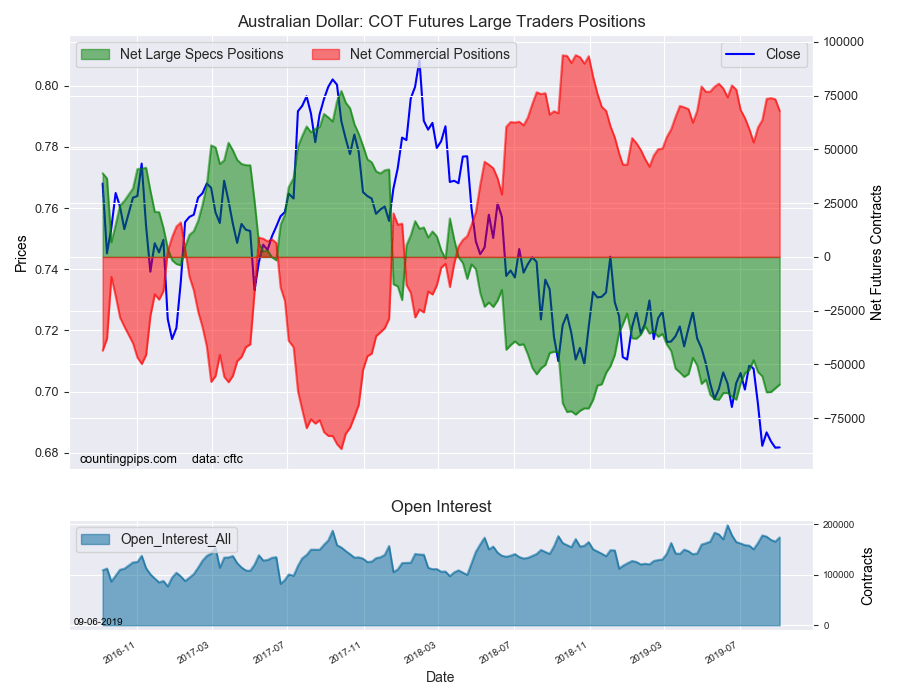

Australian Dollar:

The large speculator positions in Australian dollar futures equaled a net position of -59,318 contracts this week in the data ending Tuesday. This was a weekly gain of 1,714 contracts from the previous week which had a total of -61,032 net contracts.

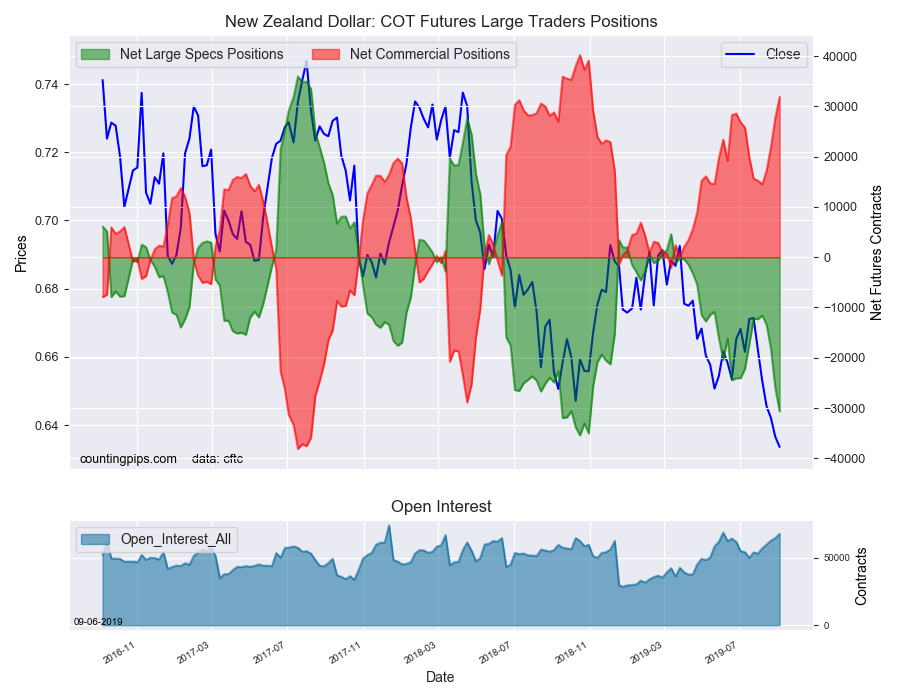

New Zealand Dollar:

The New Zealand dollar speculative standing recorded a net position of -30,676 contracts this week in the latest COT data. This was a weekly lowering of -4,629 contracts from the previous week which had a total of -26,047 net contracts.

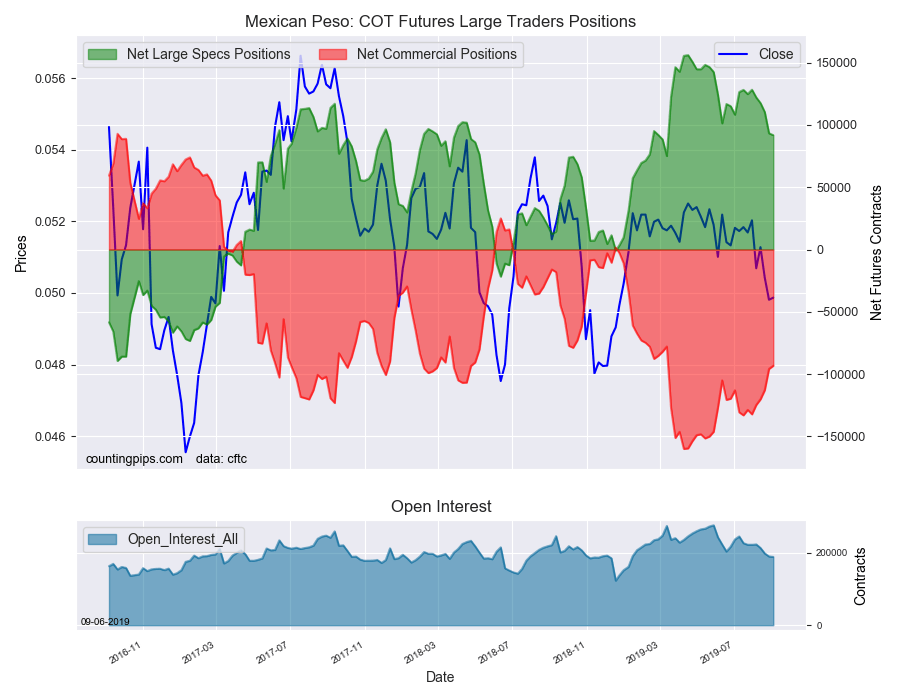

Mexican Peso:

Mexican peso speculators came in at a net position of 91,791 contracts this week. This was a weekly fall of -1,523 contracts from the previous week which had a total of 93,314 net contracts.

US Dollar Index Speculator Positions

Large currency speculators increased their bullish net positions in the US Dollar Index futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of US Dollar Index futures, traded by large speculators and hedge funds, totaled a net position of 31,736 contracts in the data reported through Tuesday September 3rd. This was a weekly advance of 1,839 contracts from the previous week which had a total of 29,897 net contracts.

This week’s net position was the result of the gross bullish position (longs) going up by 6,308 contracts (to a weekly total of 54,410 contracts) compared to the gross bearish position (shorts) which saw a lesser gain of 4,469 contracts on the week (to a total of 22,674 contracts).

US Dollar Index speculative positions rose for a second straight week and for the eighth time out of the past ten weeks as dollar sentiment remains strong. This week’s bullishness bounced the dollar’s net bullish position back above the +30,000 net contract level for the first time since August 6th. Dollar bullish positions have now stayed above the +22,000 net position level for fifty-nine consecutive weeks.

Individual Currencies Data this week:

In the other major currency contracts data, we saw just one substantial change (+ or – 10,000 contracts) in the speculators category this week.

Euro speculators sharply raised their bearish bets this week by over -10,000 net contracts. This is a second straight weekly rise and the fifth time out of the past seven weeks that bearish bets have now gained. Currently, the bearish net position (-49,136 contracts) is modest compared to where the position was on May 21st (-101,102 contracts). Overall, the euro speculative standing has now remained in bearish territory for forty-nine straight weeks dating back to September 25th of 2018.

Overall, the major currencies that saw improving speculator positions this week were the US dollar index (1,839 weekly change in contracts), British pound sterling (4,069 contracts) and the Australian dollar (1,714 contracts).

The currencies whose speculative bets declined this week were the euro (-10,332 weekly change in contracts), Japanese yen (-5,925 contracts), Swiss franc (-2,039 contracts), Canadian dollar (-5,556 contracts), New Zealand dollar (-4,629 contracts) and the Mexican peso (-1,523 contracts).

Other Notables for the week:

Japanese yen bullish positions dipped this week after rising for six consecutive weeks. The yen turned from net bearish to net bullish on August 6th and has now been in an overall bullish standing for five straight weeks for the first time since the October-November of 2016 time-period.

Mexican peso bullish positions fell for the fifth straight week this week and for the sixth time out of the past seven weeks. Peso positions remain in a strong bullish position at +91,791 contracts but have been sliding lower since reaching a record bullish high in mid-April at +156,030 net contracts.

Canadian dollar bullish positions declined for a fourth straight week this week and fell to the lowest bullish position since June. Overall, CAD speculative bets have been in bullish territory for ten weeks now after turning bullish in early July but have been on the decline since reaching a high of +30,750 contracts on July 23rd.

Chart: Current Strength of Each Currency compared to their 3-Year Range

See the table and individual currency charts below.

Table of Large Speculator Levels And Weekly Changes:

Weekly Charts: Large Trader Weekly Positions vs Price

EuroFX:

The euro large speculator standing this week came in at a net position of -49,136 contracts in the data reported through Tuesday. This was a weekly lowering of -10,332 contracts from the previous week which had a total of -38,804 net contracts.

British Pound Sterling:

The large British pound sterling speculator level came in at a net position of -84,959 contracts in the data reported this week. This was a weekly increase of 4,069 contracts from the previous week which had a total of -89,028 net contracts.

Japanese Yen:

Large Japanese yen speculators totaled a net position of 27,682 contracts in this week’s data. This was a weekly lowering of -5,925 contracts from the previous week which had a total of 33,607 net contracts.

Swiss Franc:

The Swiss franc speculator standing this week resulted in a net position of -5,839 contracts in the data through Tuesday. This was a weekly decline of -2,039 contracts from the previous week which had a total of -3,800 net contracts.

Canadian Dollar:

Canadian dollar speculators reached a net position of 5,349 contracts this week. This was a fall of -5,556 contracts from the previous week which had a total of 10,905 net contracts.

Australian Dollar:

The large speculator positions in Australian dollar futures equaled a net position of -59,318 contracts this week in the data ending Tuesday. This was a weekly gain of 1,714 contracts from the previous week which had a total of -61,032 net contracts.

New Zealand Dollar:

The New Zealand dollar speculative standing recorded a net position of -30,676 contracts this week in the latest COT data. This was a weekly lowering of -4,629 contracts from the previous week which had a total of -26,047 net contracts.

Mexican Peso:

Mexican peso speculators came in at a net position of 91,791 contracts this week. This was a weekly fall of -1,523 contracts from the previous week which had a total of 93,314 net contracts.