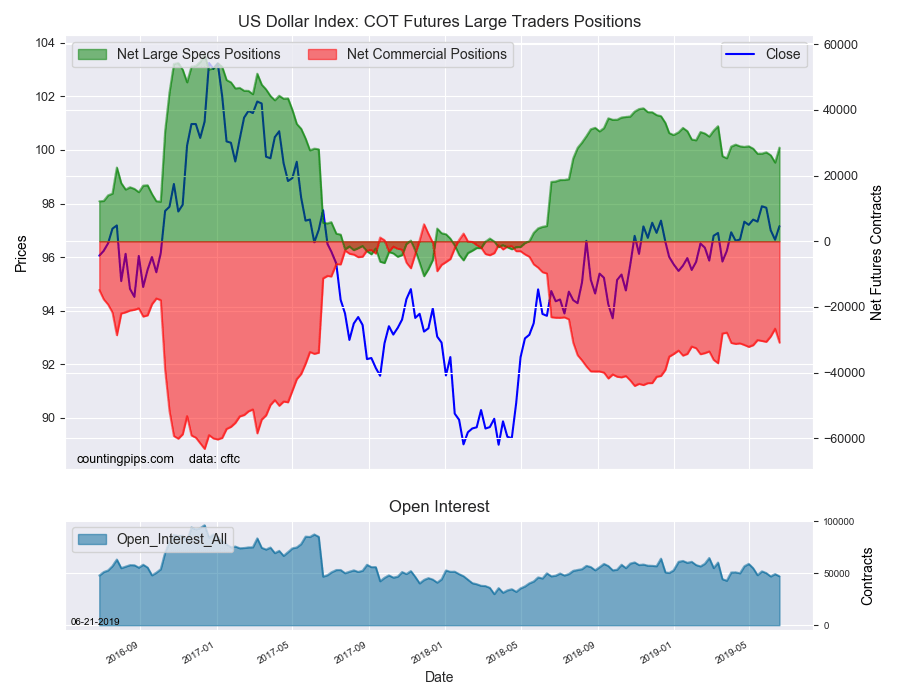

US Dollar Index Speculator Positions

Large currency speculators raised their bullish net positions in the US Dollar Index futures markets this week while also sharply cutting back on bearish bets in the Japanese yen and the euro, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of US Dollar Index futures, traded by large speculators and hedge funds, totaled a net position of 28,549 contracts in the data reported through Tuesday June 18th. This was a weekly advance of 4,560 contracts from the previous week which had a total of 23,989 net contracts.

This week’s net position was the result of the gross bullish position growing by 3,434 contracts (to a weekly total of 40,319 contracts) while the gross bearish position fell by -1,126 contracts for the week (to a weekly total of 11,770 contracts).

The large speculators added to their bullish bets for the dollar after decreasing their positions in the previous two weeks. The gain brought the overall long position to the highest level in seven weeks and above +28,000 contracts.

The latest COT data is through the close on Tuesday and was a day before the US Federal Reserve meeting which suggested traders are more certain that interest rate reductions could be coming.

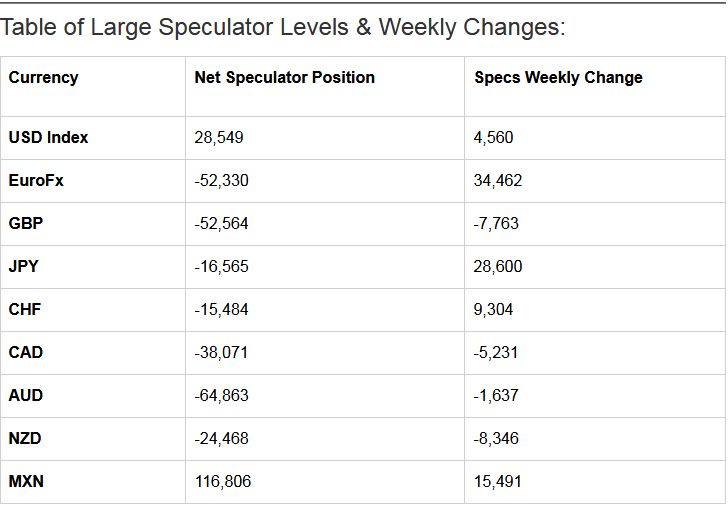

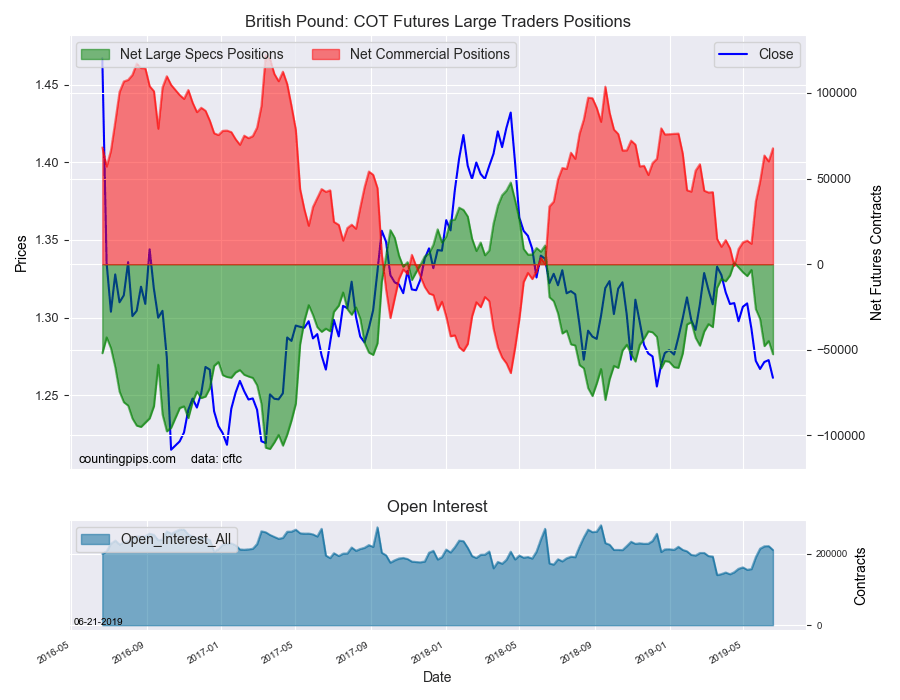

Individual Currencies Data this week:

In all of the major currency contracts data, we saw three substantial changes (+ or – 10,000 contracts) in the speculators' category this week.

Euro currency speculators sharply reduced their bearish positions this week by over 34,000 contracts. This is the largest one-week gain for the euro since October 2nd of 2017 when bets rose by over 35,000 contracts. The change this week brought the euro bearish position sharply lower and to the lowest level since February. Overall, the euro has seen improving positions for four straight weeks.

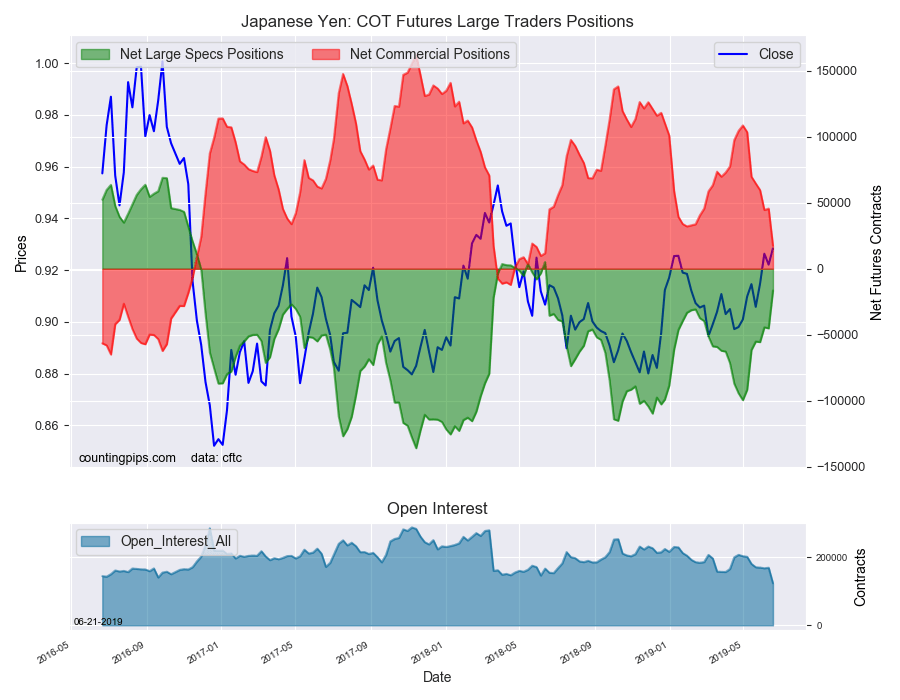

Japanese yen speculators also sharply cut back on their bearish bets this week by over 28,000 net contracts. The yen position has improved mighty fast as the bearish position was at -99,599 contracts on April 30th and is now down to just -16,565 contracts on June 18th. The yen standing is at the best level since just about a year ago when positions were in a small bullish level on June 12th, 2018.

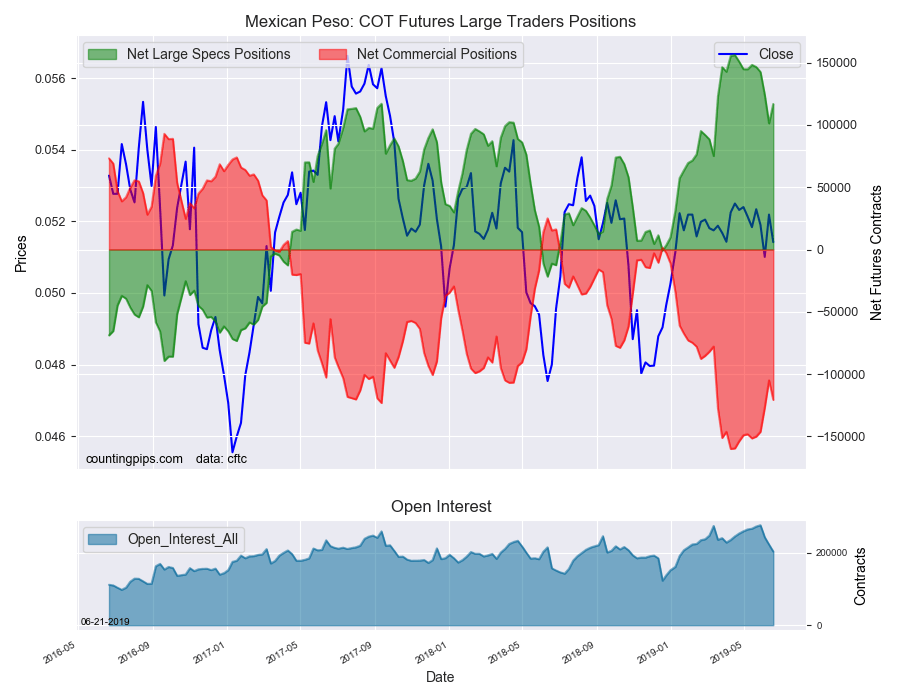

Mexican peso positions rebounded this week by over +15,000 contracts after four straight declining weeks as well as decreases in seven out of the previous eight weeks. Peso bullish bets had ascended to a record high bullish position of +156,030 contracts on April 16th before speculators started cutting their long positions. This week’s gain keeps the MXN net position above the +100,000 net contract level for a fourteenth straight week which is the longest streak on record for MXN speculator bets (a previous run in 2012 lasted 13 straight weeks).

Overall, the major currencies that saw improving speculator positions this week were the US dollar index (4,560 weekly change in contracts), euro (34,462 contracts), Japanese yen (28,600 contracts), Swiss franc (9,304 contracts) and the Mexican peso (15,491 contracts).

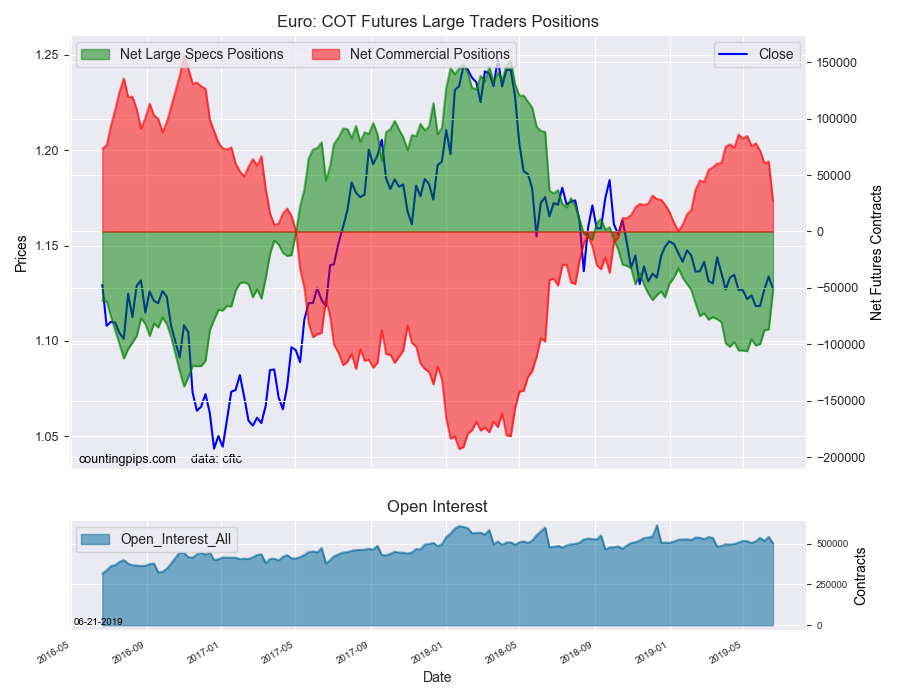

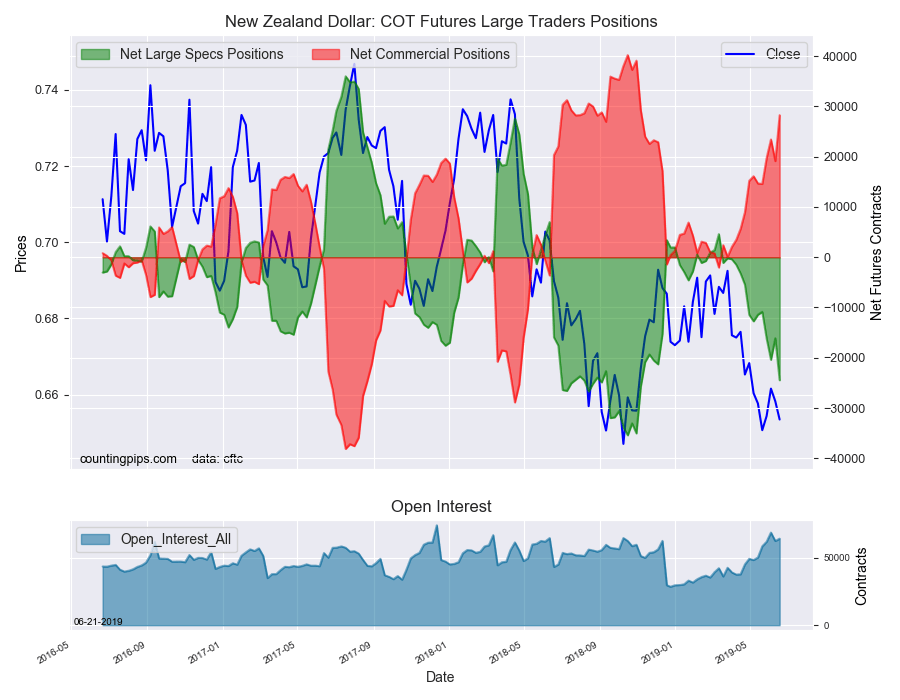

The currencies whose speculative bets declined this week were the British pound sterling (-7,763 weekly change in contracts), Canadian dollar (-5,231 contracts), Australian dollar (-1,637 contracts) and the New Zealand dollar (-8,346 contracts).

Other Notables for the week:

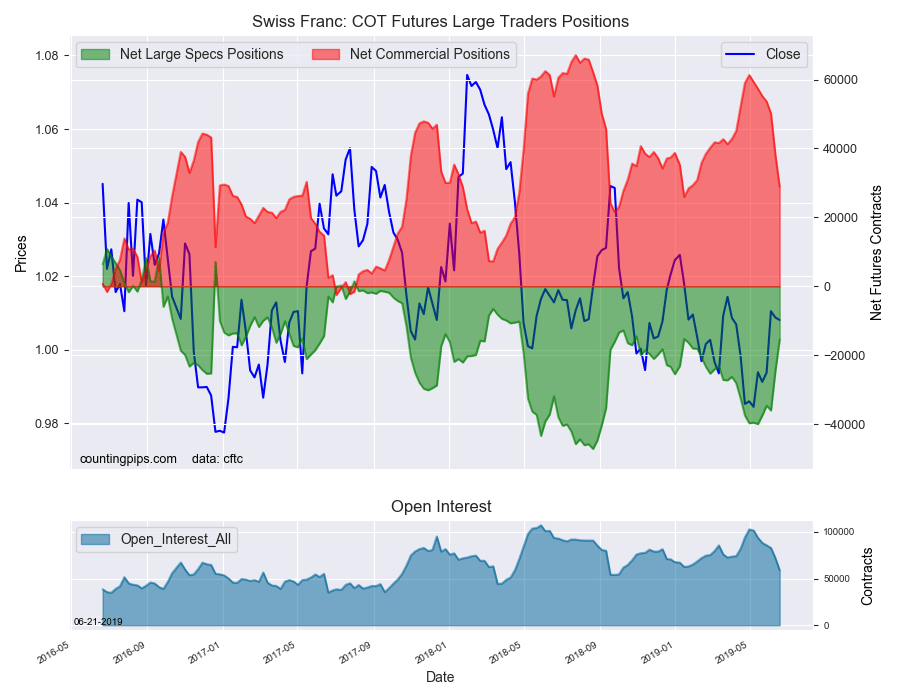

Swiss franc positions have started to improve in recent weeks after reaching a cycle low of -40,010 contracts on May 14th. Since then, speculator positions have improved four out of five weeks and by a total of +24,526 net contracts. The CHF has averaged a gain above +10,000 contracts in the past two weeks and now sit at the least bearish position since January 15th.

See the table and individual currency charts below.

This latest COT data is through Tuesday and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets. All currency positions are in direct relation to the US dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar while a bet against the euro will be a bet that the dollar will gain versus the euro.

Weekly Charts: Large Trader Weekly Positions vs Price

EuroFX:

The euro large speculator standing this week equaled a net position of -52,330 contracts in the data reported through Tuesday. This was a weekly lift of 34,462 contracts from the previous week which had a total of -86,792 net contracts.

British Pound Sterling:

The large British pound sterling speculator level equaled a net position of -52,564 contracts in the data reported this week. This was a weekly fall of -7,763 contracts from the previous week which had a total of -44,801 net contracts.

Japanese Yen:

Large Japanese yen speculators reached a net position of -16,565 contracts in this week’s data. This was a weekly lift of 28,600 contracts from the previous week which had a total of -45,165 net contracts.

Swiss Franc:

The Swiss franc speculator standing this week totaled a net position of -15,484 contracts in the data through Tuesday. This was a weekly lift of 9,304 contracts from the previous week which had a total of -24,788 net contracts.

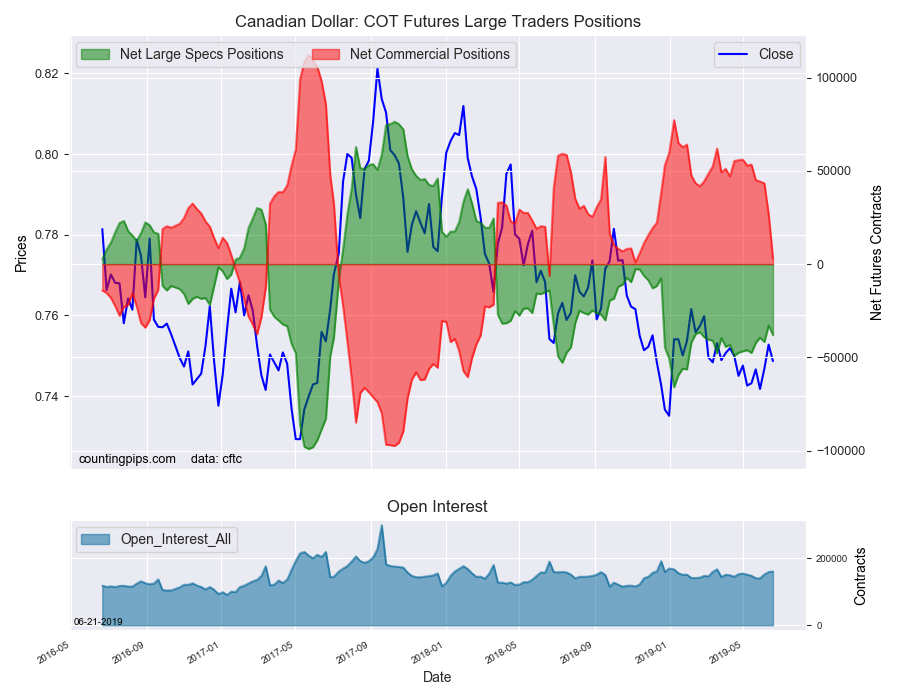

Canadian Dollar:

Canadian dollar speculators reached a net position of -38,071 contracts this week. This was a fall of -5,231 contracts from the previous week which had a total of -32,840 net contracts.

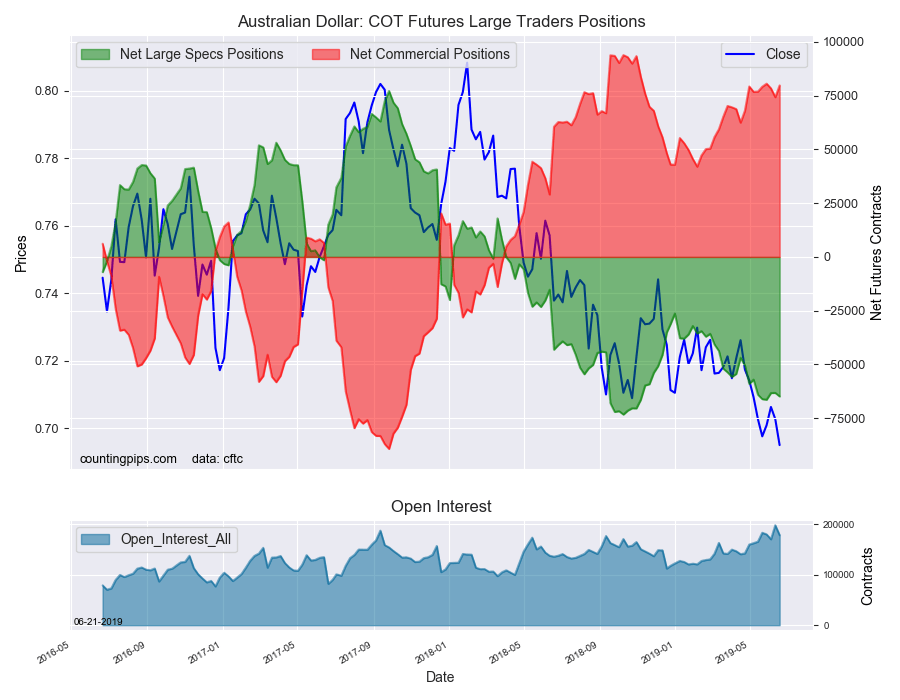

Australian Dollar:

The large speculator positions in Australian dollar futures resulted in a net position of -64,863 contracts this week in the data ending Tuesday. This was a weekly lowering of -1,637 contracts from the previous week which had a total of -63,226 net contracts.

New Zealand Dollar:

The New Zealand dollar speculative standing recorded a net position of -24,468 contracts this week in the latest COT data. This was a weekly decrease of -8,346 contracts from the previous week which had a total of -16,122 net contracts.

Mexican Peso:

Mexican peso speculators equaled a net position of 116,806 contracts this week. This was a weekly advance of 15,491 contracts from the previous week which had a total of 101,315 net contracts.