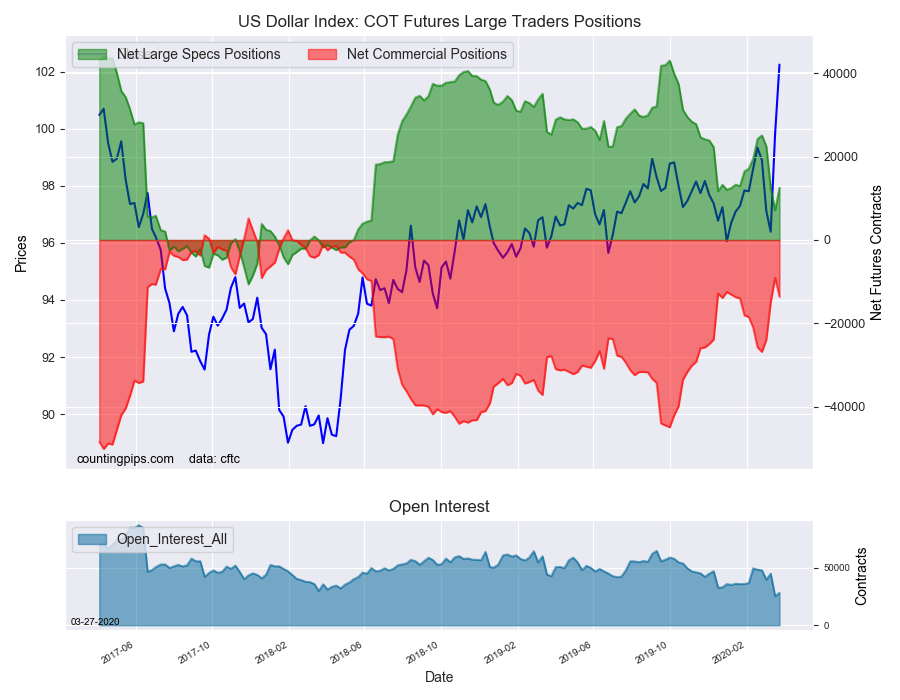

U.S. Dollar Index Speculator Positions

Large currency speculators lifted their bullish net positions in the U.S. Dollar Index futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of U.S. Dollar Index futures, traded by large speculators and hedge funds, totaled a net position of 12,520 contracts in the data reported through Tuesday, March 24th. This was a weekly rise of 5,368 contracts from the previous week which had a total of 7,152 net contracts.

This week’s net position was the result of the gross bullish position (longs) going up by 2,914 contracts (to a weekly total of 22,456 contracts) compared to the gross bearish position (shorts) which saw a decline by -2,454 contracts on the week (to a total of 9,936 contracts).

U.S. Dollar Index speculators had cut their bullish bets in the previous three straight weeks and pushed the overall net position to the lowest level in ninety-two weeks at just +7,152 contracts before this week’s turnaround. Despite this week’s gain, the USD Index positions remain under the 2020 weekly average of +16,300 speculator contracts. The dollar index prices cooled as this week went on and ended Friday around the 98.30 level after surging as high as almost 103.00 (late last week and early this week) as traders sought safe haven in the dollar.

Individual Currencies Data this week:

In the other major currency contracts data, we saw three substantial changes (+ or – 10,000 contracts) in the speculators category this week.

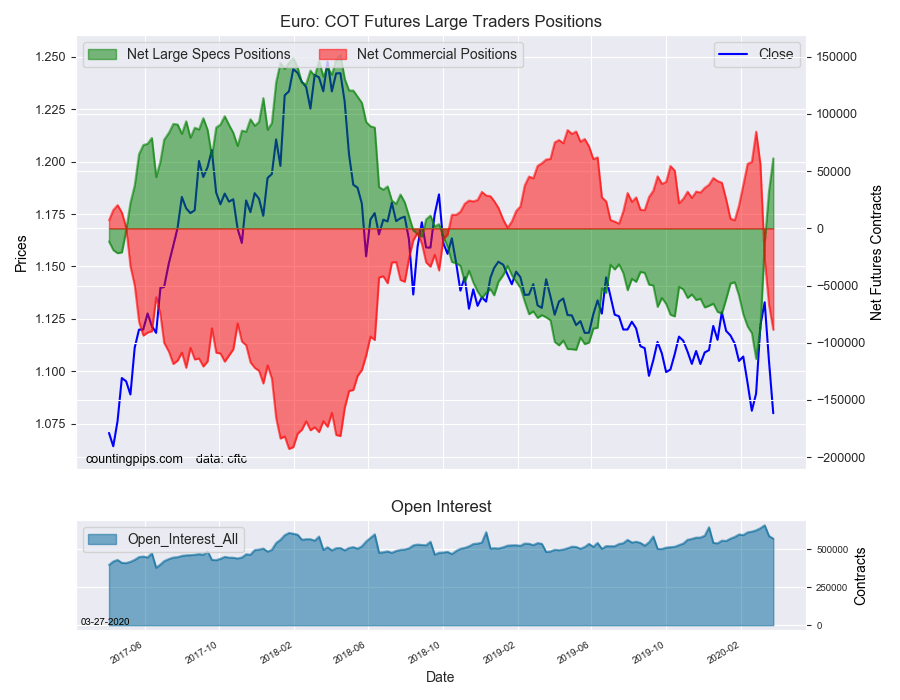

Euro speculator bets surged once again this week for a fourth straight week. The euro position has gained by a huge total of +175,311 contracts in just these past four weeks and is now at the most bullish level since June 12th of 2018 (a span of 93 weeks).

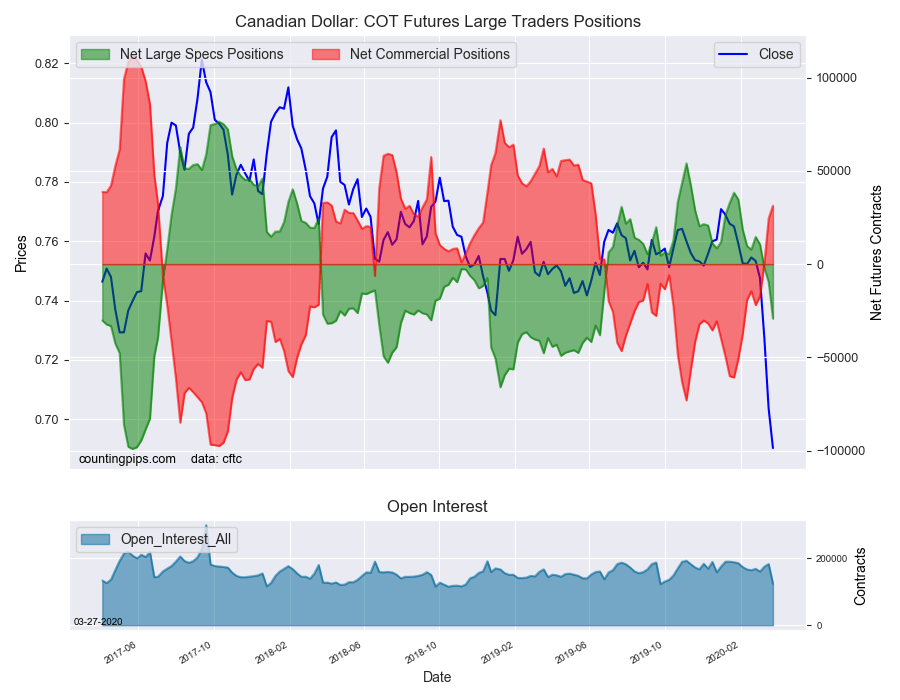

Canadian dollar bets dropped sharply this week by almost -20,000 contracts and overall, the CAD spec position has declined for four straight weeks. The CAD bets have now been in bearish territory for three straight weeks following thirty-six consecutive weeks in bullish territory.

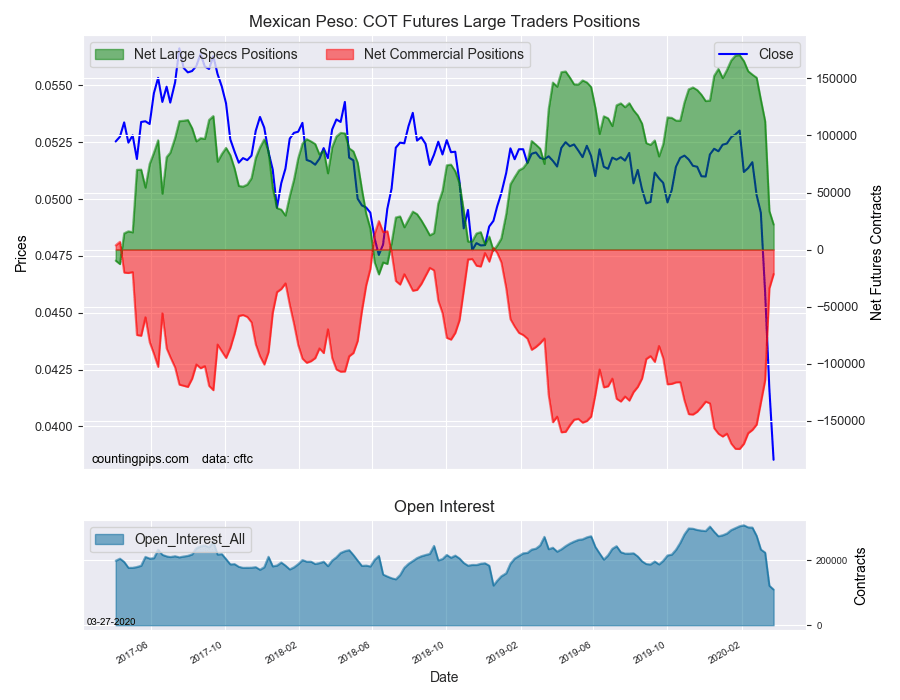

Mexican peso positions fell for an eighth straight week and by a total of -148,387 contracts over that period. The peso position is now down to the least bullish level in sixty-four weeks, dating back to December of 2018. Peso positions had recently hit an all-time high position of +170,366 contracts on January 28th.

Overall, the major currencies that saw improving speculator positions this week were the U.S. dollar index (5,368 weekly change in contracts), euro (28,795 contracts), Australian dollar (3,526 contracts) and the New Zealand dollar (4,259 contracts).

The currencies whose speculative bets declined this week were the British pound sterling (-7,756 weekly change in contracts), Japanese yen (-9,072 contracts), Swiss franc (-2,483 contracts), Canadian dollar (-19,622 contracts) and the Mexican peso (-11,866 contracts).

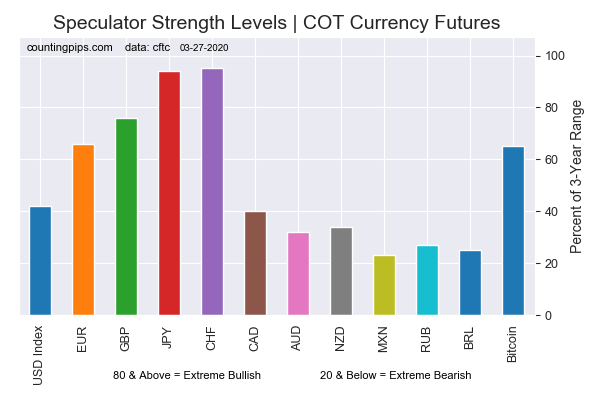

Chart: Current Strength of Each Currency compared to their 3-Year Range

The above chart depicts each currency’s current speculator strength level compared to data of the past 3 years. A score of 0 percent would mean speculator bets are currently at the lowest level of the past three years. A 100 percent score would be at the highest level while a 50 percent score would mean speculator bets are right in the middle of the data (a neutral score). We use above 80 percent (extreme bullish) and below 20 percent (extreme bearish) as extreme score measurements.

Please see the data table and individual currency charts below.

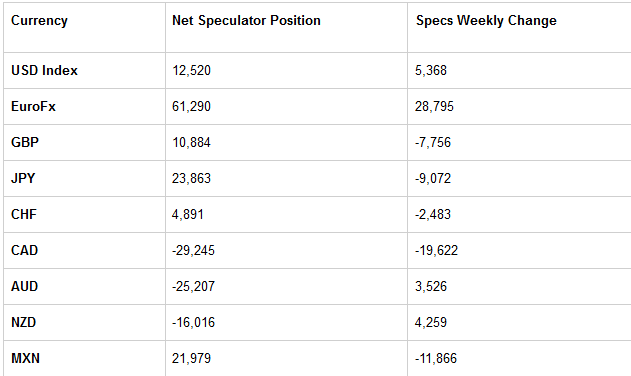

Table of Large Speculator Levels & Weekly Changes:

This latest COT data is through Tuesday and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets. All currency positions are in direct relation to the US dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar while a bet against the euro will be a bet that the dollar will gain versus the euro.

Weekly Charts: Large Trader Weekly Positions vs Price

EuroFX:

The Euro large speculator standing this week recorded a net position of 61,290 contracts in the data reported through Tuesday. This was a weekly lift of 28,795 contracts from the previous week which had a total of 32,495 net contracts.

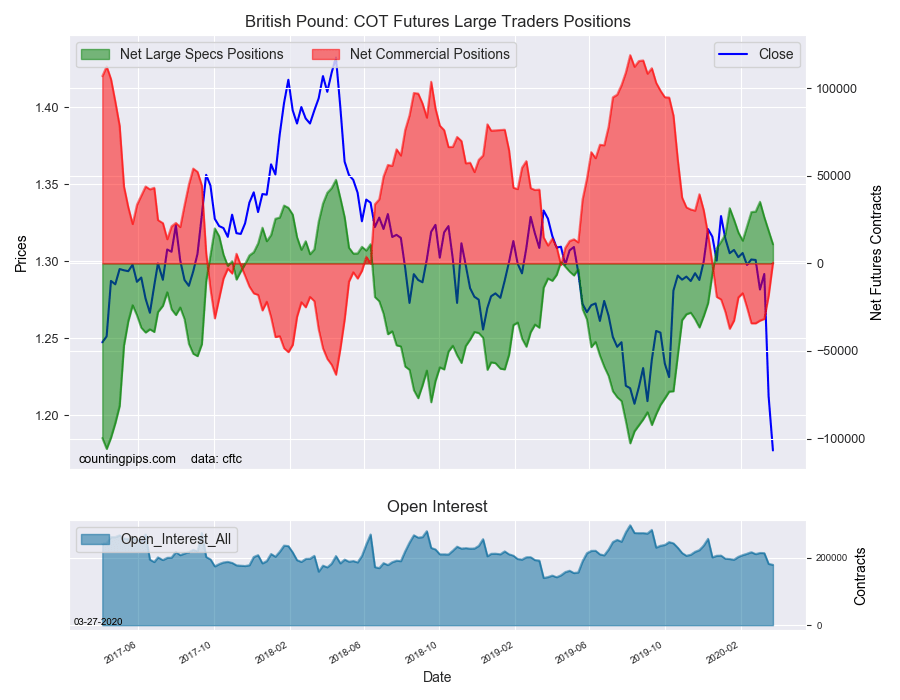

British Pound Sterling:

The large British pound sterling speculator level reached a net position of 10,884 contracts in the data reported this week. This was a weekly lowering of -7,756 contracts from the previous week which had a total of 18,640 net contracts.

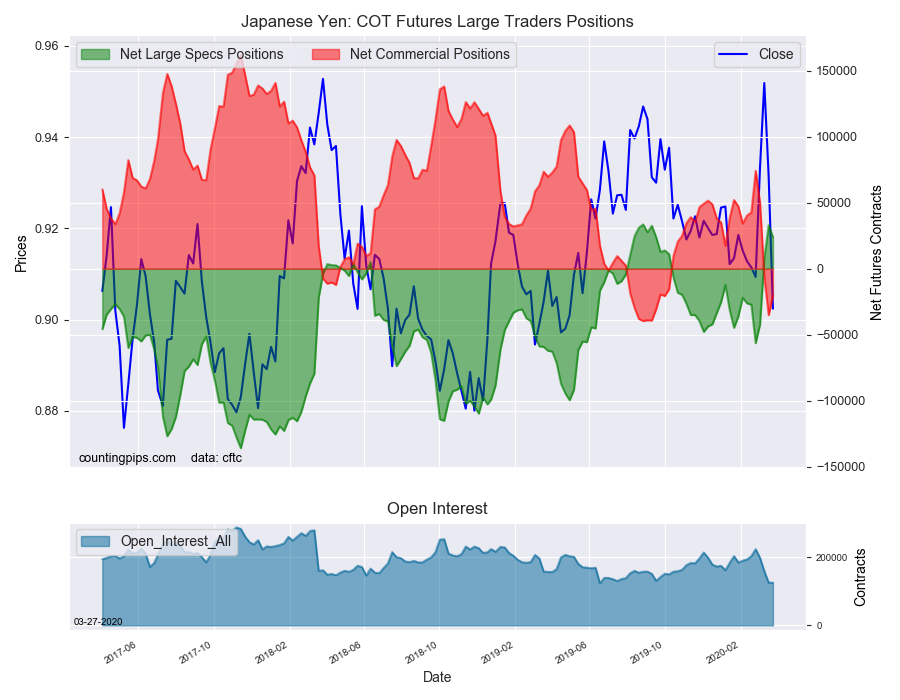

Japanese Yen:

Large Japanese yen speculators totaled a net position of 23,863 contracts in this week’s data. This was a weekly fall of -9,072 contracts from the previous week which had a total of 32,935 net contracts.

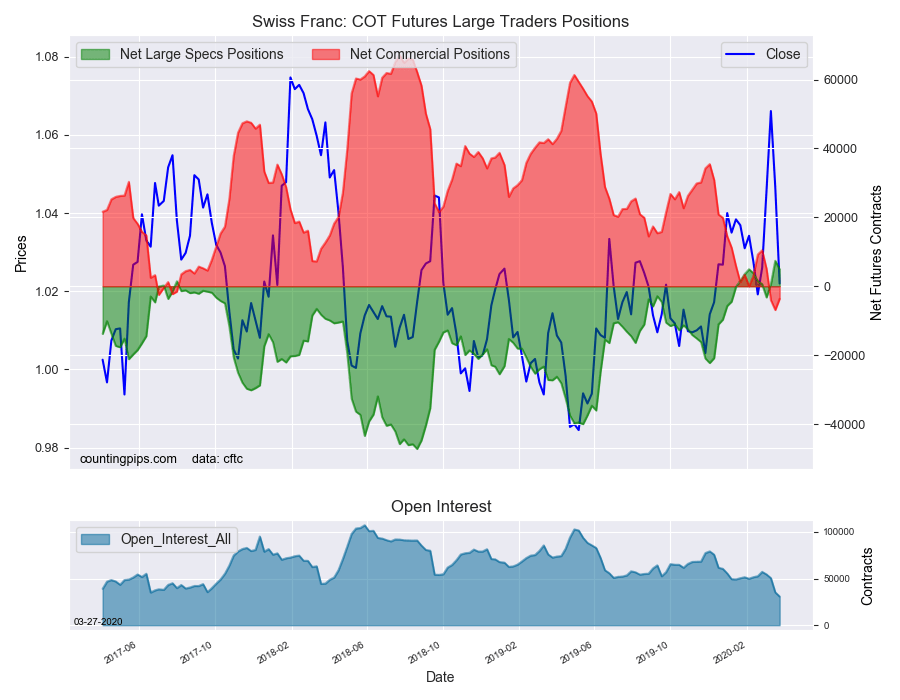

Swiss Franc:

The Swiss franc speculator standing this week resulted in a net position of 4,891 contracts in the data through Tuesday. This was a weekly fall of -2,483 contracts from the previous week which had a total of 7,374 net contracts.

Canadian Dollar:

Canadian dollar speculators came in at a net position of -29,245 contracts this week. This was a fall of -19,622 contracts from the previous week which had a total of -9,623 net contracts.

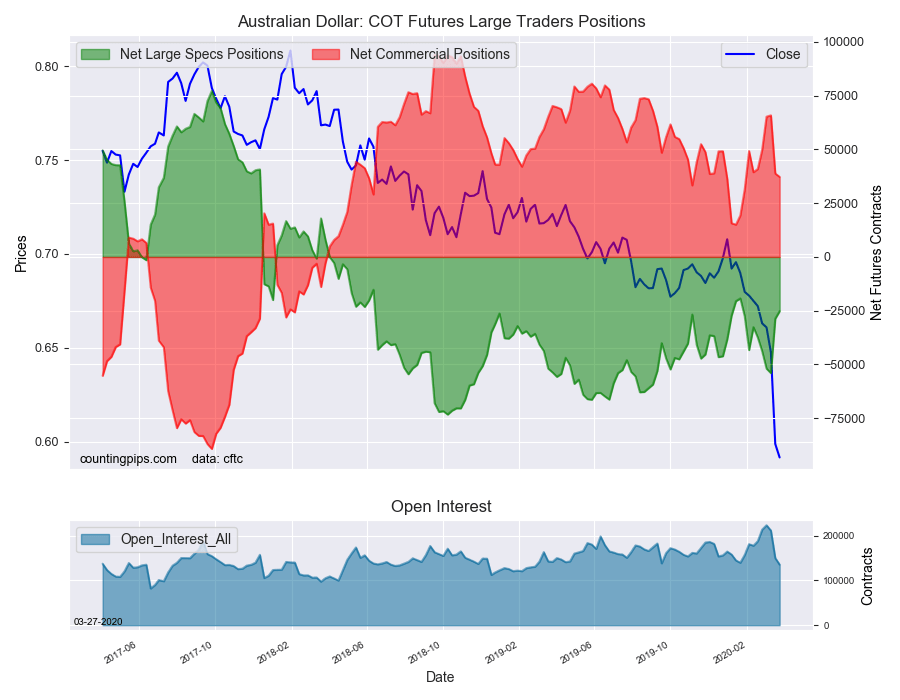

Australian Dollar:

The large speculator positions in Australian dollar futures equaled a net position of -25,207 contracts this week in the data ending Tuesday. This was a weekly lift of 3,526 contracts from the previous week which had a total of -28,733 net contracts.

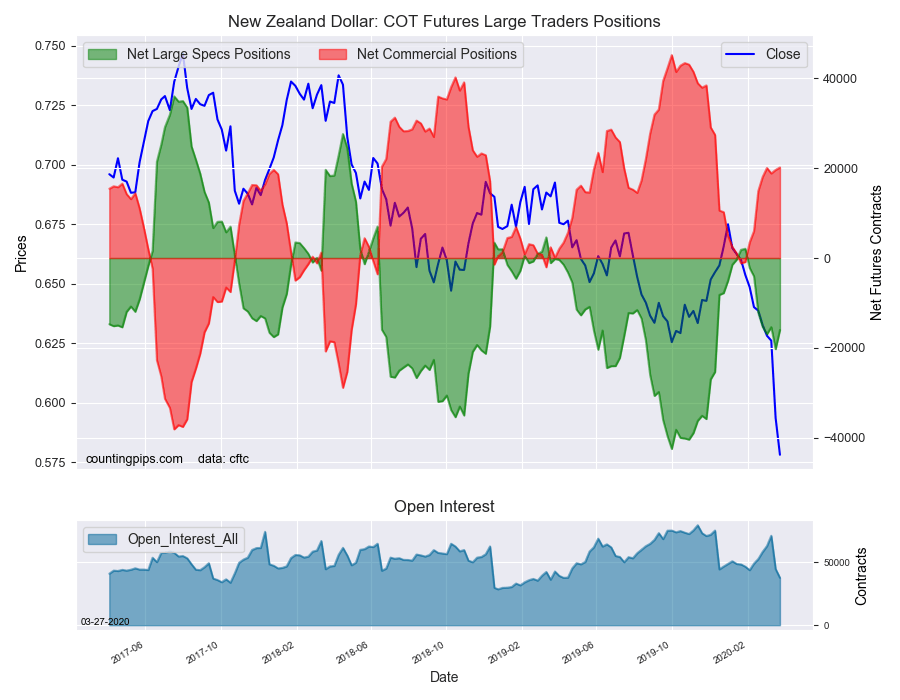

New Zealand Dollar:

The New Zealand dollar speculative standing recorded a net position of -16,016 contracts this week in the latest COT data. This was a weekly gain of 4,259 contracts from the previous week which had a total of -20,275 net contracts.

Mexican Peso:

Mexican peso speculators recorded a net position of 21,979 contracts this week. This was a weekly decrease of -11,866 contracts from the previous week which had a total of 33,845 net contracts.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.