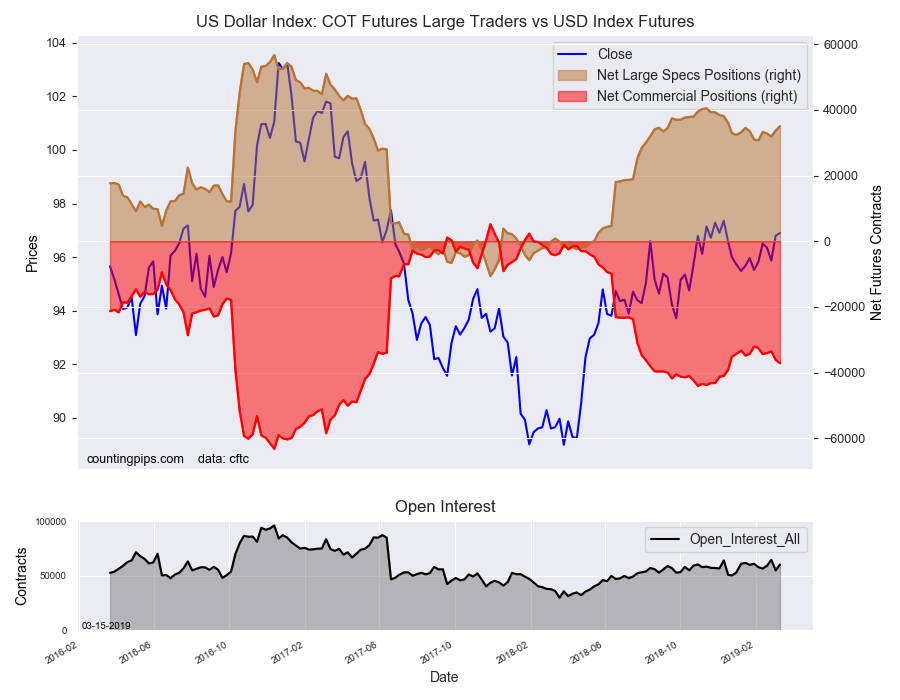

US Dollar Index Speculator Positions

Large currency speculators raised their bullish net positions in the US Dollar Index futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of US Dollar Index futures, traded by large speculators and hedge funds, totaled a net position of 35,074 contracts in the data reported through Tuesday March 12th. This was a weekly advance of 1,360 contracts from the previous week which had a total of 33,714 net contracts.

This week’s net position was the result of the gross bullish position gaining by 3,358 contracts to a weekly total of 45,030 contracts which overcame the gross bearish position total of 9,956 contracts that rose by 1,998 contracts for the week.

The net speculator position gained for a second straight week after having dipped in five out of the previous six weeks. The current standing is now at the most bullish level since December 18th, a span of twelve weeks.

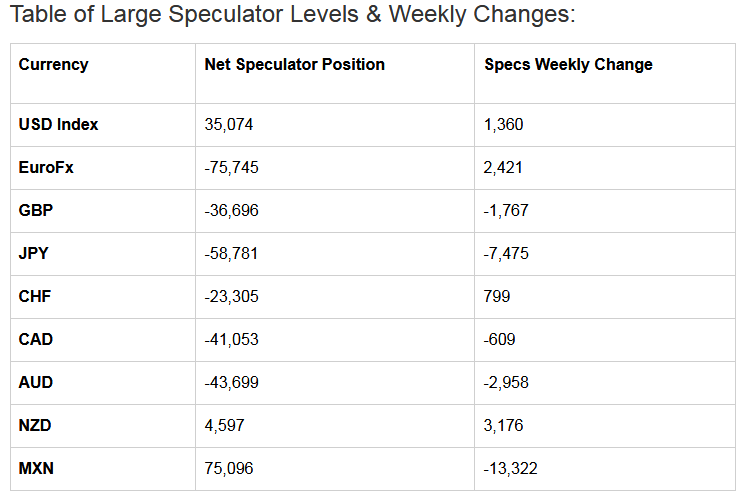

Individual Currencies Data this week:

In the other major currency contracts data, we saw just one substantial change (+ or – 10,000 contracts) in the speculators category this week.

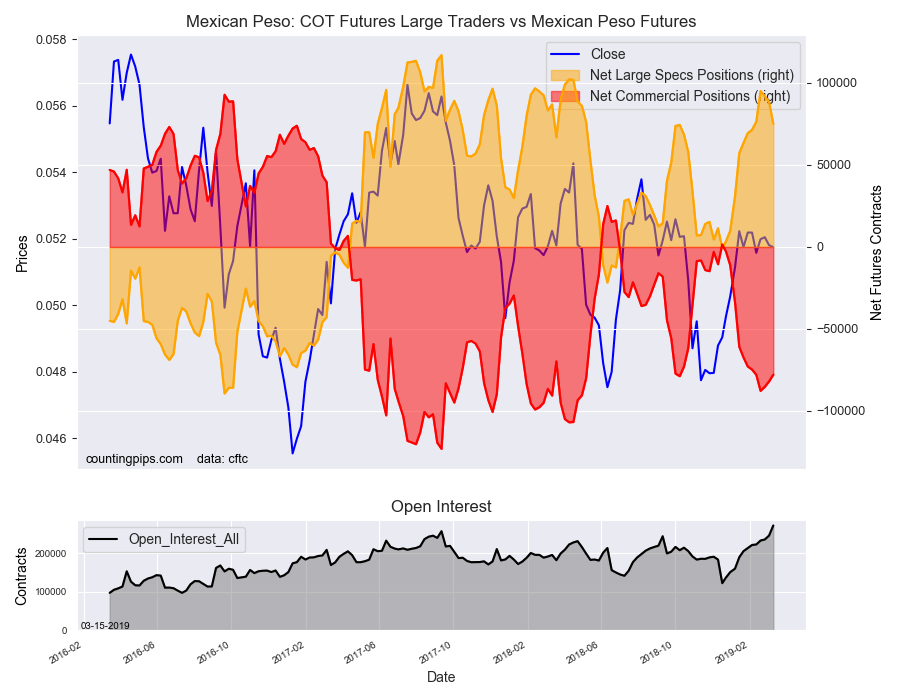

The Mexican peso contracts fell by over -13,000 contracts this week and declined for a third consecutive week after gaining for the previous nine weeks in a row. The peso remains strongly in bullish territory and is one of only three currencies (USD Index & New Zealand dollar) that continues to have bullish speculative levels.

Overall, the major currencies that saw improving speculator positions this week were the US dollar index (1,360 weekly change in contracts), euro (2,421 contracts), Swiss franc (799 contracts) and the New Zealand dollar (3,176 contracts).

The currencies whose speculative bets declined this week were the British pound sterling (-1,767 weekly change in contracts), Japanese yen (-7,475 contracts), Canadian dollar (-609 contracts), Australian dollar (-2,958 contracts), and the Mexican peso (-13,322 contracts).

See the table and individual currency charts below.

Weekly Charts: Large Trader Weekly Positions vs Price

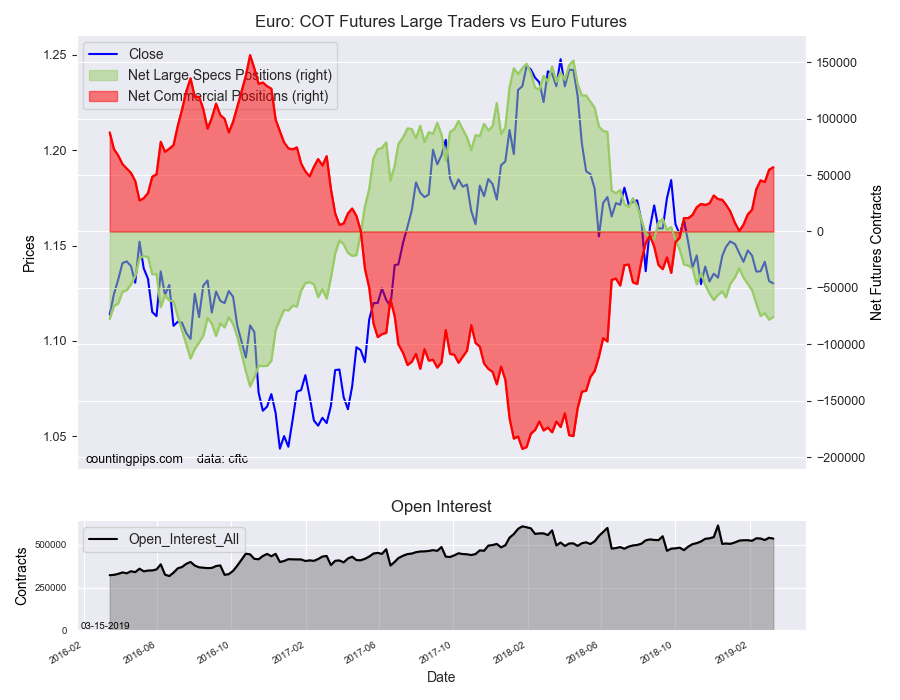

EuroFX:

The euro large speculator standing this week totaled a net position of -75,745 contracts in the data reported through Tuesday. This was a weekly rise of 2,421 contracts from the previous week which had a total of -78,166 net contracts.

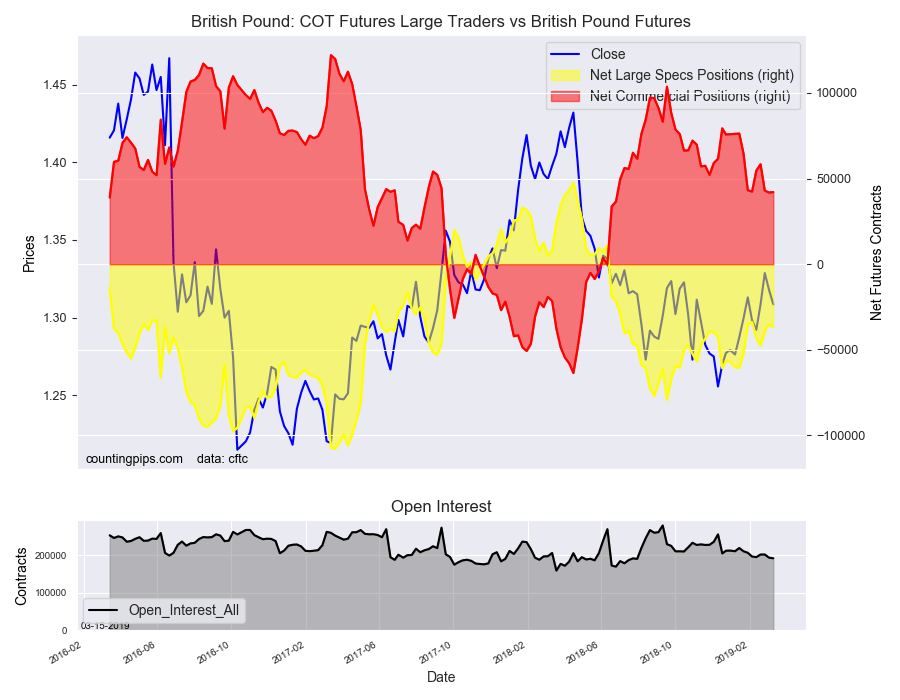

British Pound Sterling:

The large British pound sterling speculator level recorded a net position of -36,696 contracts in the data reported this week. This was a weekly reduction of -1,767 contracts from the previous week which had a total of -34,929 net contracts.

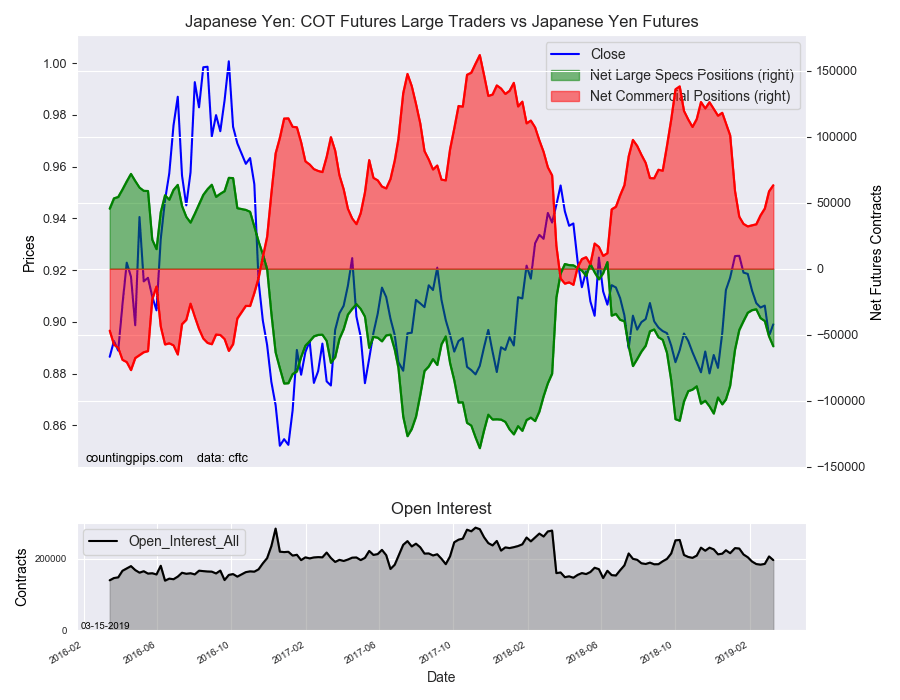

Japanese Yen:

Large Japanese yen speculators resulted in a net position of -58,781 contracts in this week’s data. This was a weekly fall of -7,475 contracts from the previous week which had a total of -51,306 net contracts.

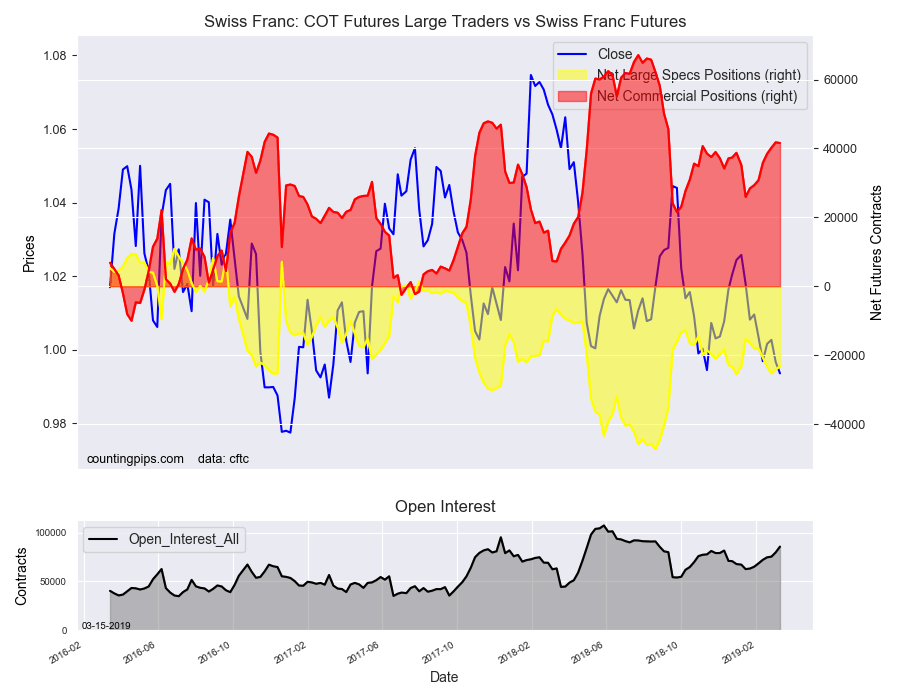

Swiss Franc:

The Swiss franc speculator standing this week equaled a net position of -23,305 contracts in the data through Tuesday. This was a weekly rise of 799 contracts from the previous week which had a total of -24,104 net contracts.

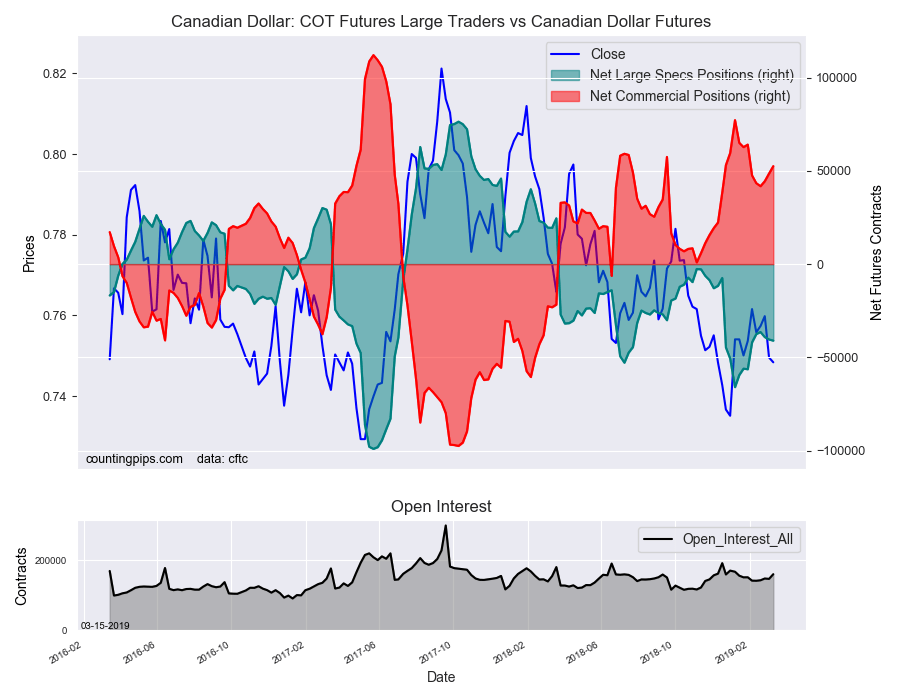

Canadian Dollar:

Canadian dollar speculators recorded a net position of -41,053 contracts this week. This was a decline of -609 contracts from the previous week which had a total of -40,444 net contracts.

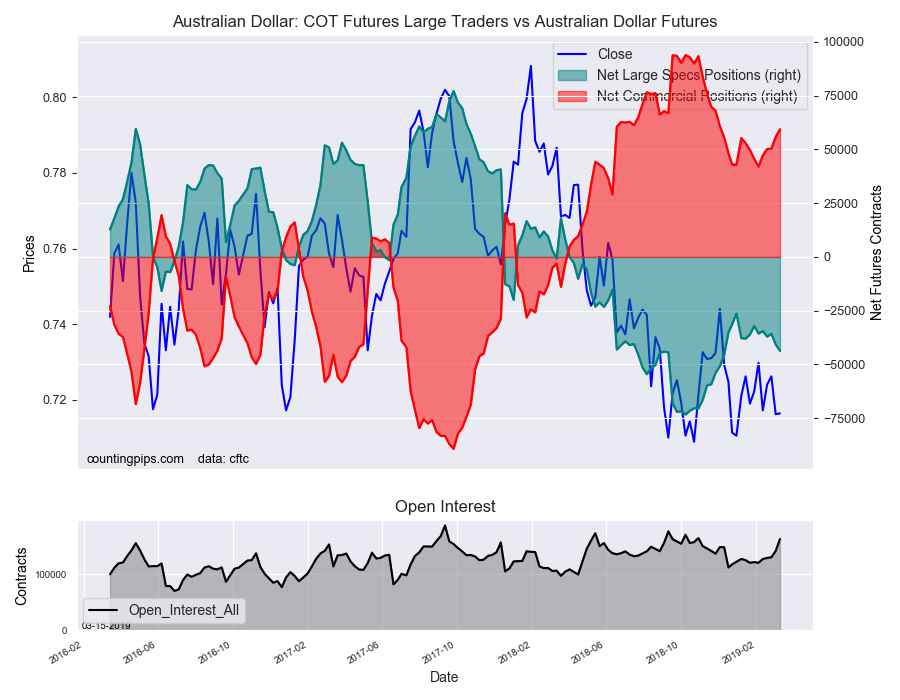

Australian Dollar:

The large speculator positions in Australian dollar futures was a net position of -43,699 contracts this week in the data ending Tuesday. This was a weekly decrease of -2,958 contracts from the previous week which had a total of -40,741 net contracts.

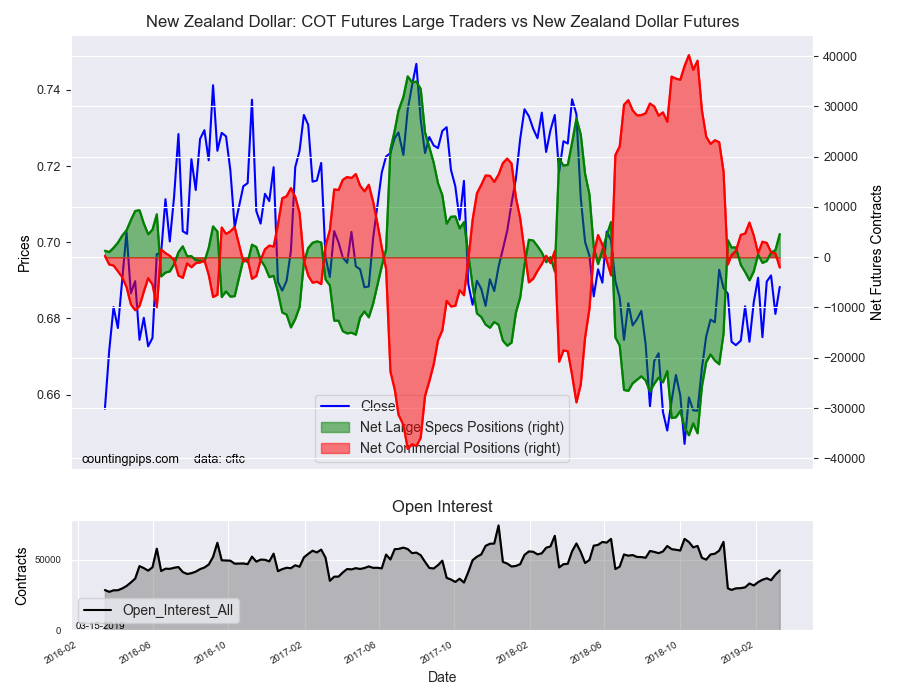

New Zealand Dollar:

The New Zealand dollar speculative standing resulted in a net position of 4,597 contracts this week in the latest COT data. This was a weekly lift of 3,176 contracts from the previous week which had a total of 1,421 net contracts.

Mexican Peso:

Mexican peso speculators totaled a net position of 75,096 contracts this week. This was a weekly lowering of -13,322 contracts from the previous week which had a total of 88,418 net contracts.

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).