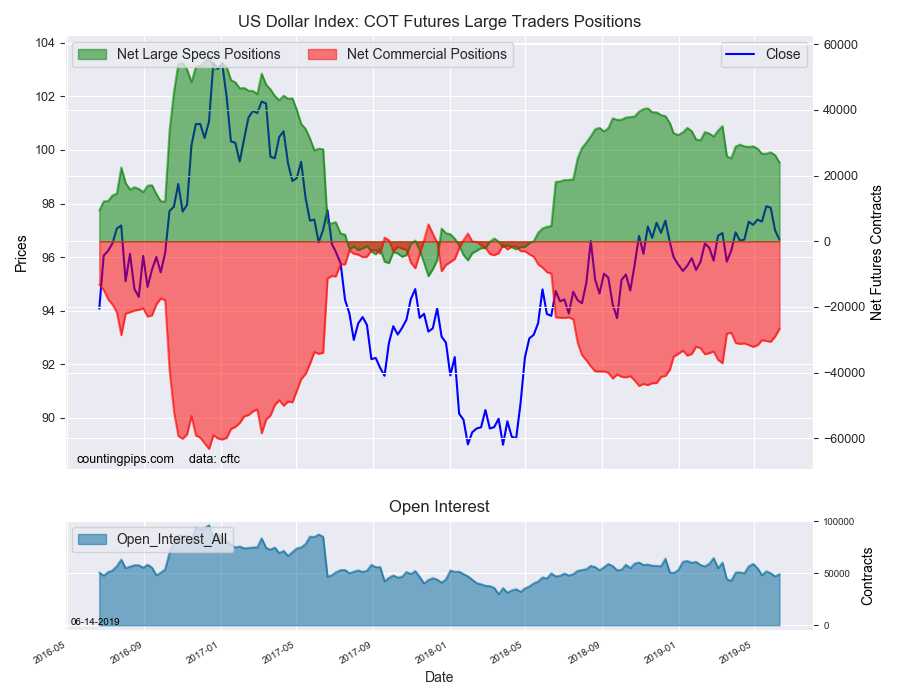

U.S. Dollar Index Speculator Positions

Large currency speculators decreased their bullish net positions in the U.S. Dollar Index futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of U.S. Dollar Index futures, traded by large speculators and hedge funds, totaled a net position of 23,989 contracts in the data reported through Tuesday, June 11th. This was a weekly reduction of -2,245 contracts from the previous week which had a total of 26,234 net contracts.

This week’s net position was the result of the gross bullish position lowering by -2,463 contracts (to a weekly total of 36,885 contracts) while the gross bearish position dipped by -218 contracts for the week (to a total of 12,896 contracts).

U.S. Dollar Index speculative positions fell for a second straight week and brought the bullish standing to the lowest level since July 17th of 2018, a span of 48 weeks. The trend for speculator positions has continued to point downward after reaching a high of 40,513 contracts on January 13th. This week marks the thirteenth straight week of net positions under the +30,000 contract threshold.

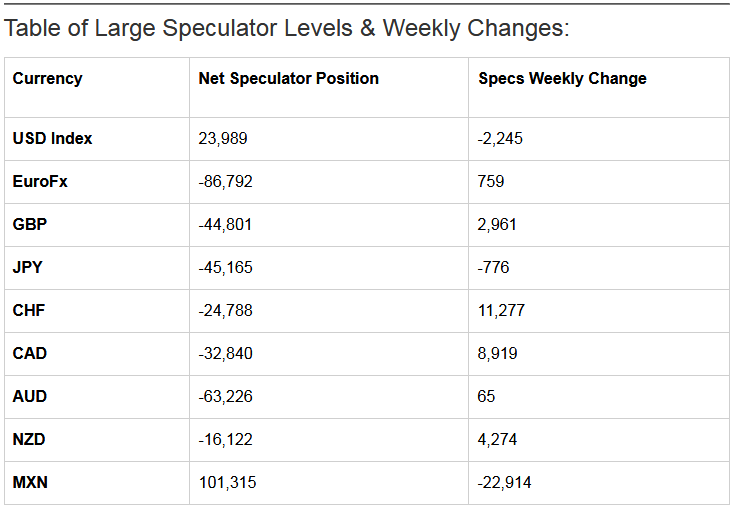

Individual Currencies Data this week:

In the other major currency contracts data, we had two substantial changes (+ or – 10,000 contracts) in the speculators category this week.

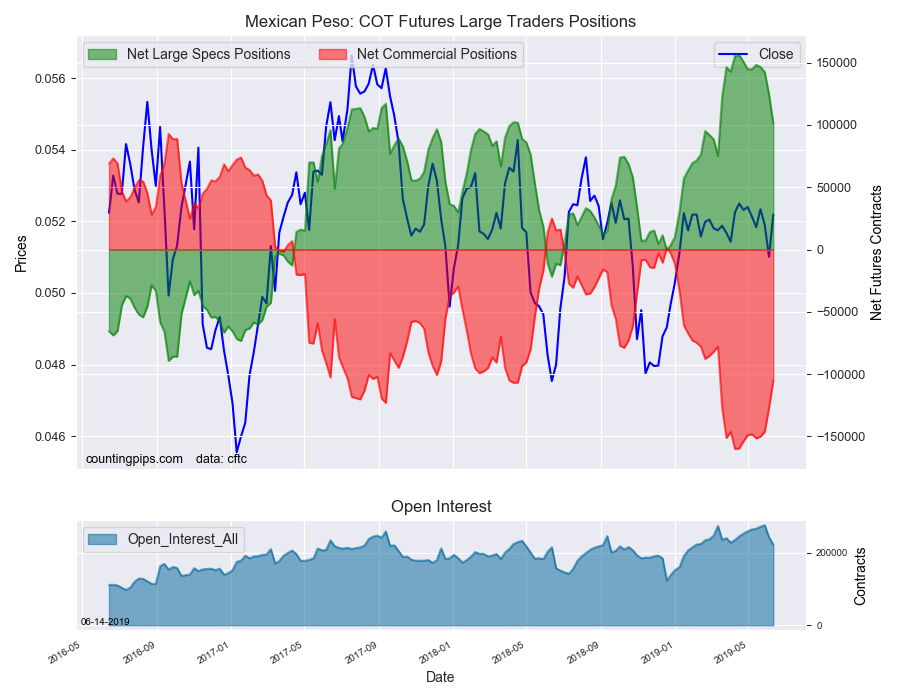

Mexican peso positions fell sharply again this week and have now decreased for four straight weeks as well as seven out of the past eight weeks. Peso bullish bets had climbed to an all-time record high position of +156,030 contracts on April 16th before starting their retreat. The net position has dropped by -46,892 contracts over the past four weeks and is now down to a net standing of +101,315 contracts. The spec position remains still very bullish but has clearly lost momentum.

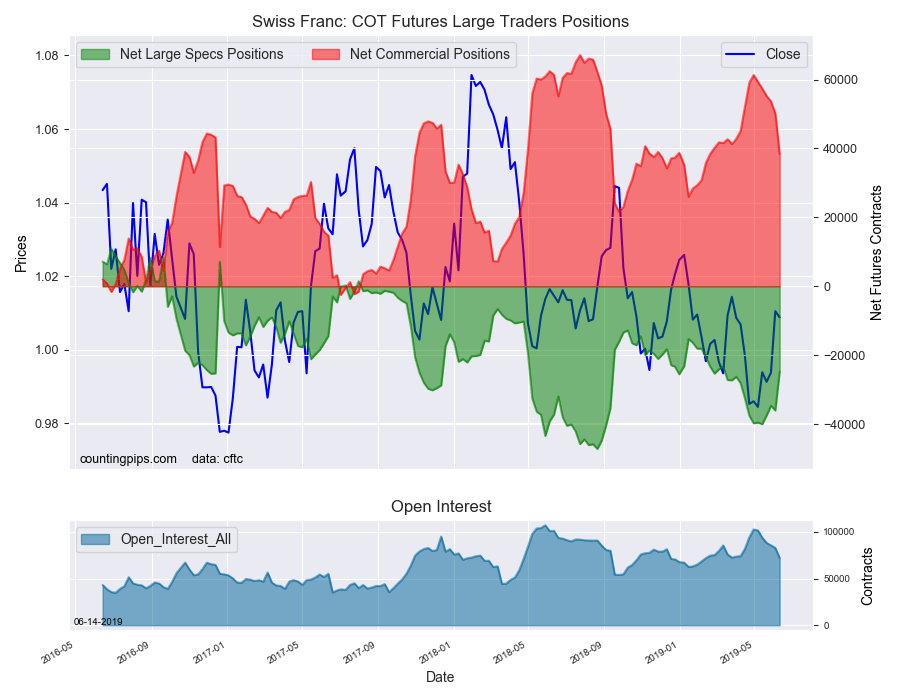

Swiss franc speculators strongly pared back on their bearish bets this week by +11,277 contracts. This was the third time in the past four weeks that CHF bets have improved. The franc speculator position has been consistently in bearish territory and has remained there since August 1st of 2017 which is a span of 97 straight weeks.

Overall, the major currencies that saw improving speculator positions this week were the euro (759 weekly change in contracts), British pound sterling (2,961 contracts), Swiss franc (11,277 contracts), Canadian dollar (8,919 contracts), Australian dollar (65 contracts) and the New Zealand dollar (4,274 contracts).

The currencies whose speculative bets declined this week were the U.S. dollar index (-2,245 weekly change in contracts), Japanese yen (-776 contracts) and the Mexican peso (-22,914 contracts).

Other Notables for the week:

See the table and individual currency charts below.

This latest COT data is through Tuesday and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets. All currency positions are in direct relation to the US dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar while a bet against the euro will be a bet that the dollar will gain versus the euro.

Weekly Charts: Large Trader Weekly Positions vs Price

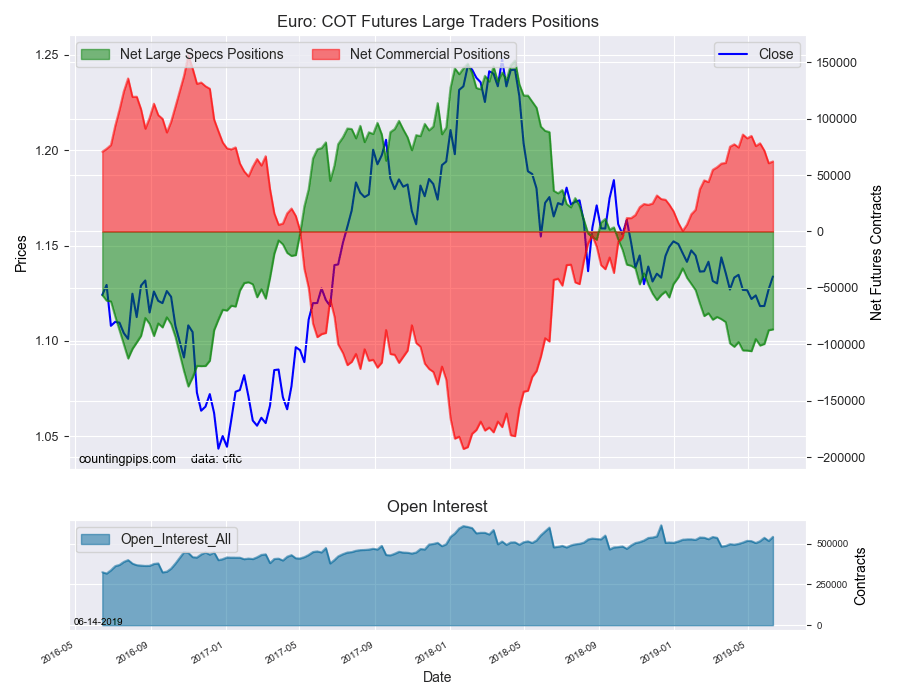

EuroFX:

The Euro large speculator standing this week totaled a net position of -86,792 contracts in the data reported through Tuesday. This was a weekly gain of 759 contracts from the previous week which had a total of -87,551 net contracts.

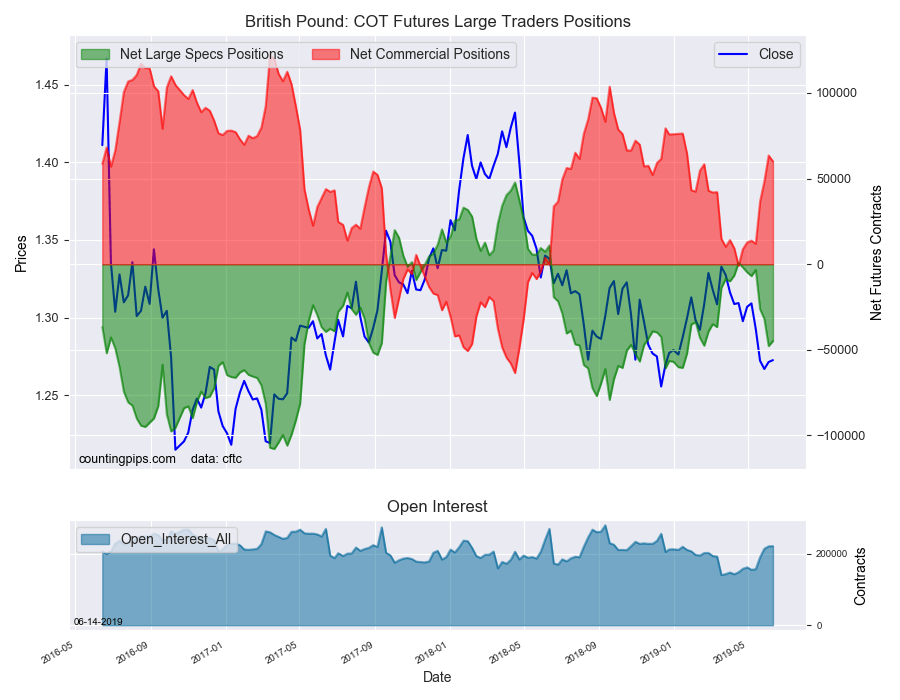

British Pound Sterling:

The large British pound sterling speculator level recorded a net position of -44,801 contracts in the data reported this week. This was a weekly increase of 2,961 contracts from the previous week which had a total of -47,762 net contracts.

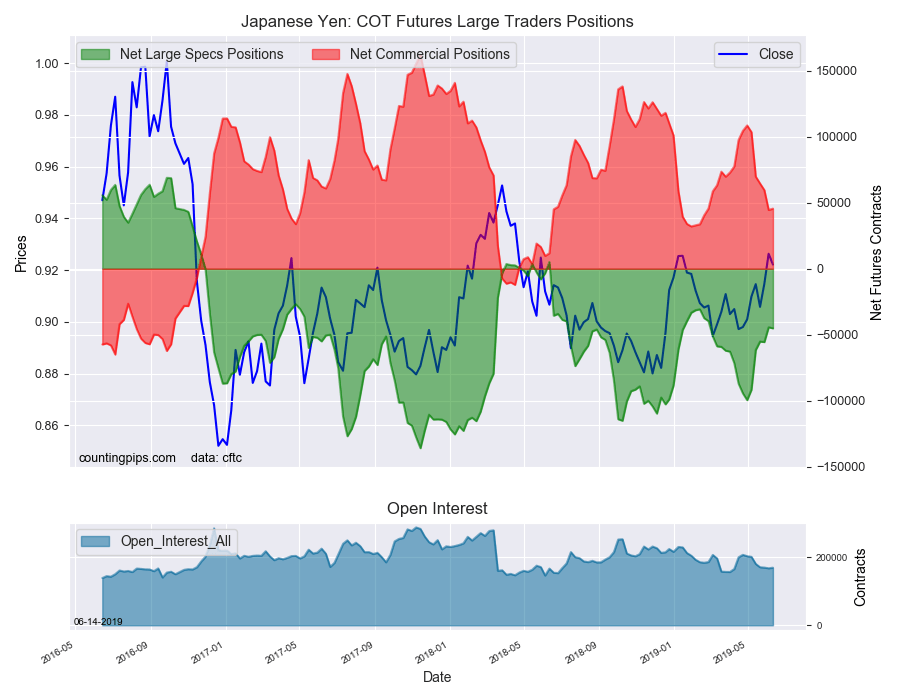

Japanese Yen:

Large Japanese yen speculators totaled a net position of -45,165 contracts in this week’s data. This was a weekly reduction of -776 contracts from the previous week which had a total of -44,389 net contracts.

Swiss Franc:

The Swiss franc speculator standing this week was a net position of -24,788 contracts in the data through Tuesday. This was a weekly boost of 11,277 contracts from the previous week which had a total of -36,065 net contracts.

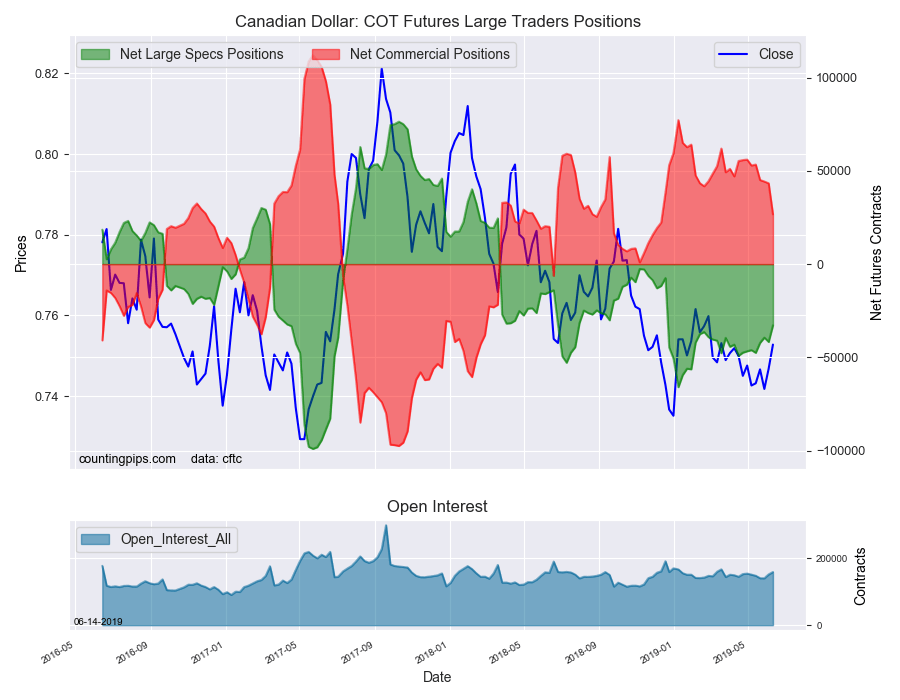

Canadian Dollar:

Canadian dollar speculators reached a net position of -32,840 contracts this week. This was an increase of 8,919 contracts from the previous week which had a total of -41,759 net contracts.

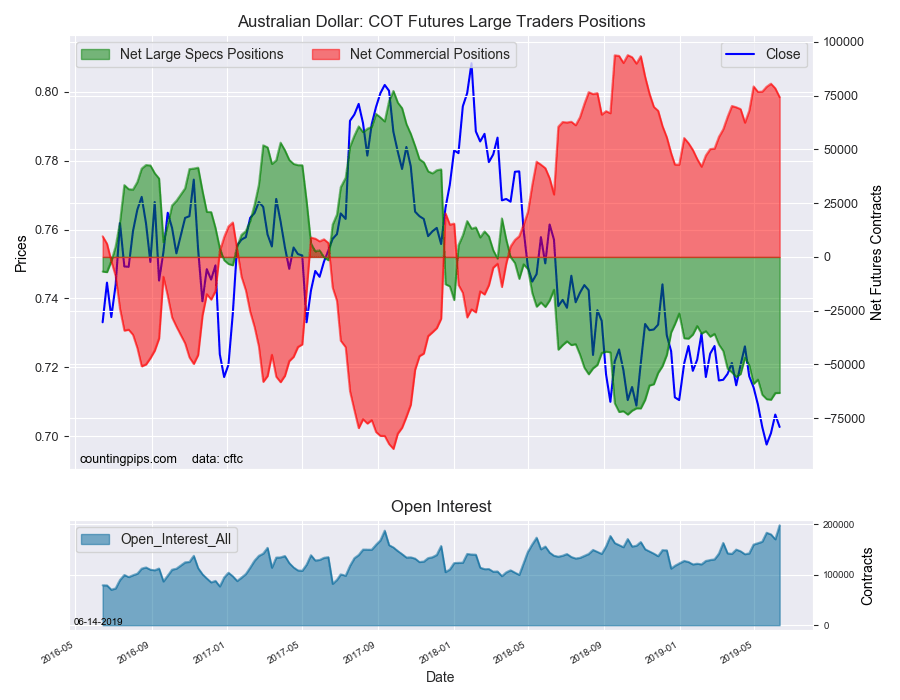

Australian Dollar:

The large speculator positions in Australian dollar futures recorded a net position of -63,226 contracts this week in the data ending Tuesday. This was a weekly increase of 65 contracts from the previous week which had a total of -63,291 net contracts.

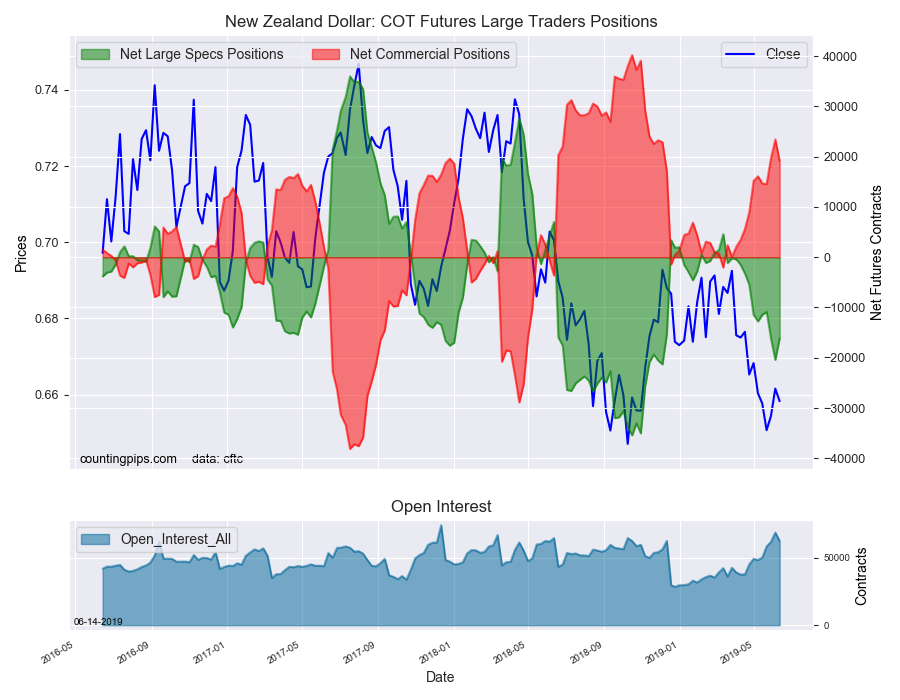

New Zealand Dollar:

The New Zealand dollar speculative standing was a net position of -16,122 contracts this week in the latest COT data. This was a weekly rise of 4,274 contracts from the previous week which had a total of -20,396 net contracts.

Mexican Peso:

Mexican peso speculators totaled a net position of 101,315 contracts this week. This was a weekly decrease of -22,914 contracts from the previous week which had a total of 124,229 net contracts.