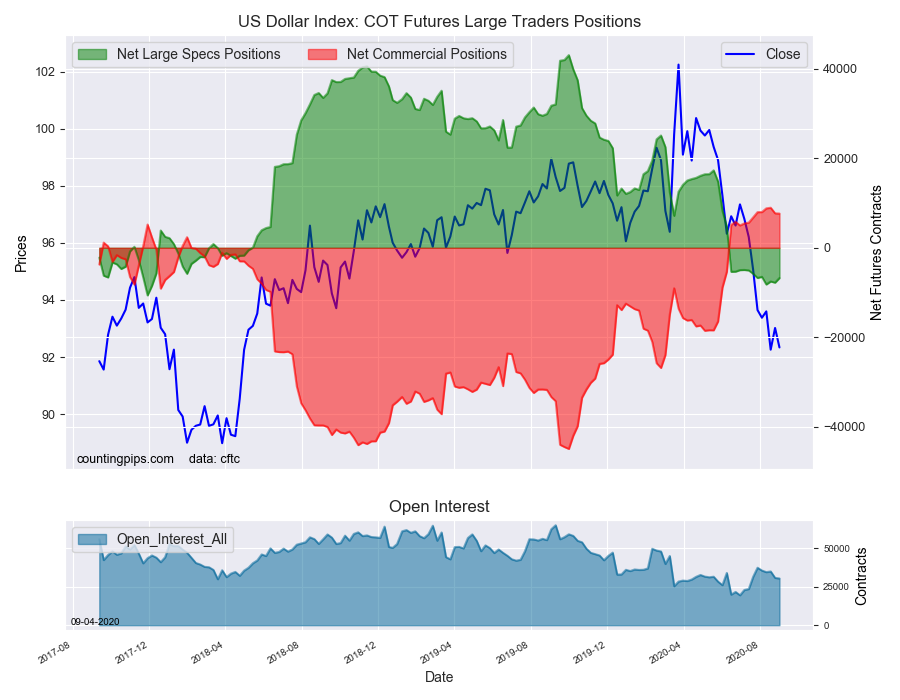

US Dollar Index Speculator Positions

Large currency speculators reduced their bearish net positions in the US Dollar Index futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of US Dollar Index futures, traded by large speculators and hedge funds, totaled a net position of -6,746 contracts in the data reported through Tuesday September 1st. This was a weekly improvement by 1,027 contracts from the previous week which had a total of -7,773 net contracts.

This week’s net position was the result of the gross bullish position (longs) gaining by 766 contracts (to a weekly total of 14,348 contracts) compared to the gross bearish position (shorts) which saw a decrease by -261 contracts on the week (to a total of 21,094 contracts).

The US Dollar Index speculators cut back on their bearish bets this week for the second time in the past three weeks. This week’s gain by over +1,000 contracts is the best week for dollar positions in the past twenty-two weeks, dating back to March 31st. Despite this week’s improvement for USD bets, the overall standing remains bearish for a twelfth consecutive week and the positions have been over the -6,000 contract level for the past six weeks..

Individual Currencies Data this week: Euro bets cool off after record highs

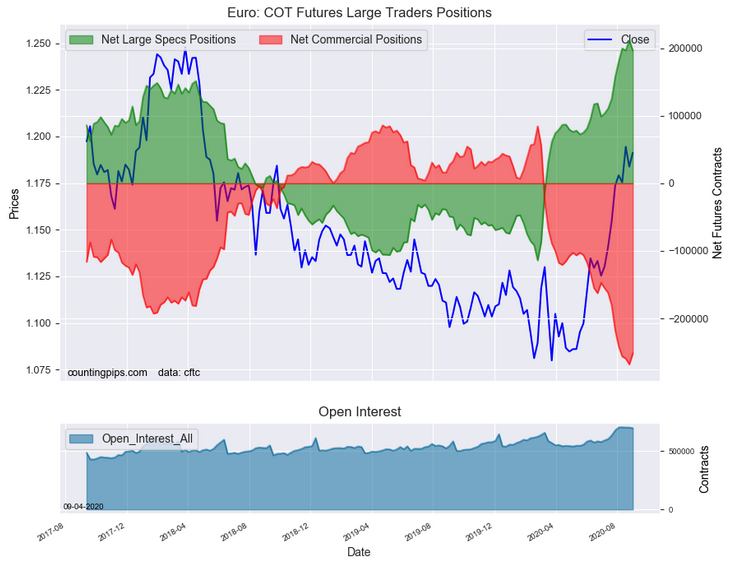

In the other major currency contracts data, we saw just one substantial change (+ or – 10,000 contracts) in the speculators category this week as the euro positions fell sharply following the record highs of the past few weeks.

Euro speculator positions cooled off this week after rising to an all-time record high bullish position last week. Euro speculative positions have been exploding higher over the past few months with new record highs several times in the past six weeks and ultimately a new all-time high of +211,752 contracts on August 25th. This week the speculative positions fell by over -15,000 contracts to bring the net position back under +200,000 contracts. The EURUSD currency pair took a breather as well as the pair closed the week just below the 1.1850 exchange rate after threatening the 1.20 level earlier in the week.

Overall, the major currencies that saw improving speculator positions this week were the US dollar index (1,027 weekly change in contracts), British pound sterling (712 contracts), Japanese yen (5,988 contracts), Canadian dollar (2,312 contracts), Australian dollar (3,734 contracts), New Zealand dollar (2,778 contracts) and the Mexican peso (2,107 contracts).

The currencies whose speculative bets declined this week were the euro (-15,005 weekly change in contracts) and the Swiss franc (-269 contracts).

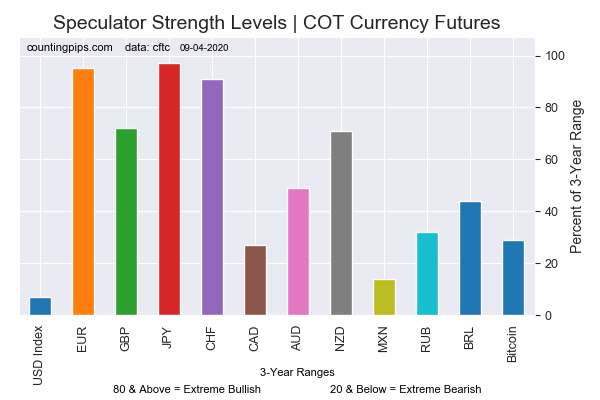

Chart: Current Strength of Each Currency compared to their 3-Year Range

The above chart depicts each currency’s current speculator strength level compared to data of the past 3 years. A score of 0 percent would mean speculator bets are currently at the lowest level of the past three years. A 100 percent score would be at the highest level while a 50 percent score would mean speculator bets are right in the middle of the data (a neutral score). We use above 80 percent (extreme bullish) and below 20 percent (extreme bearish) as extreme score measurements.

Please see the data table and individual currency charts below.

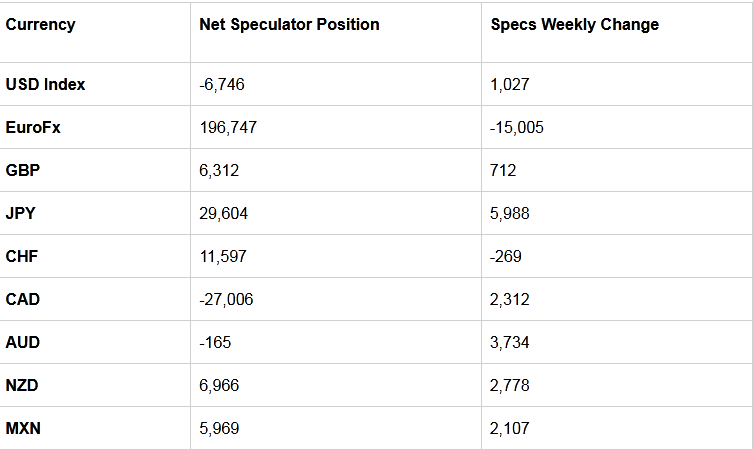

Table of Large Speculator Levels & Weekly Changes:

This latest COT data is through Tuesday and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets. All currency positions are in direct relation to the US dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar while a bet against the euro will be a bet that the dollar will gain versus the euro.

Weekly Charts: Large Trader Weekly Positions vs Price

EuroFX:

The euro large speculator standing this week equaled a net position of 196,747 contracts in the data reported through Tuesday. This was a weekly decline of -15,005 contracts from the previous week which had a total of 211,752 net contracts.

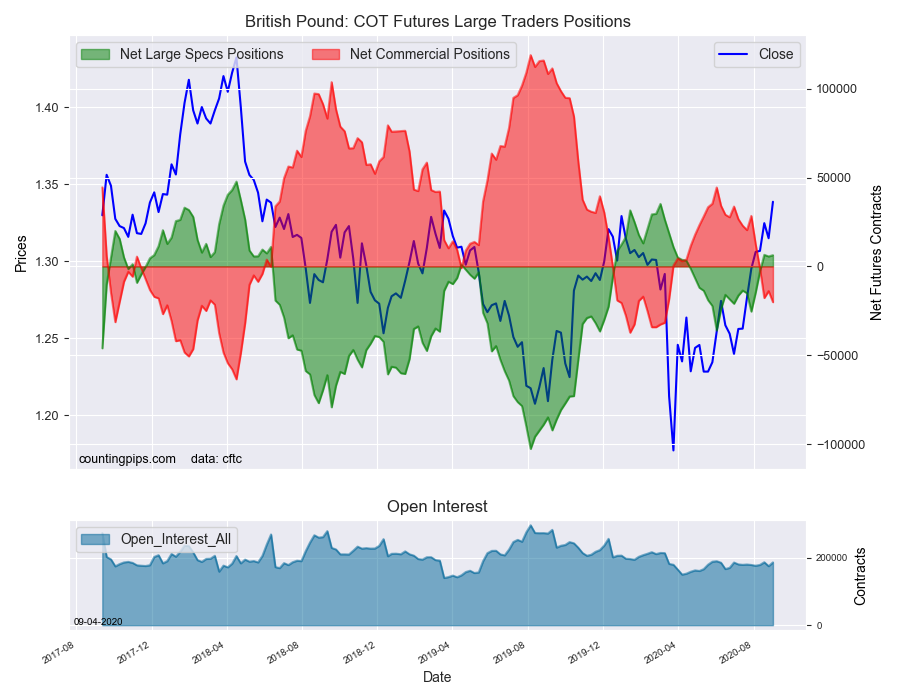

British Pound Sterling:

The large British pound sterling speculator level reached a net position of 6,312 contracts in the data reported this week. This was a weekly advance of 712 contracts from the previous week which had a total of 5,600 net contracts.

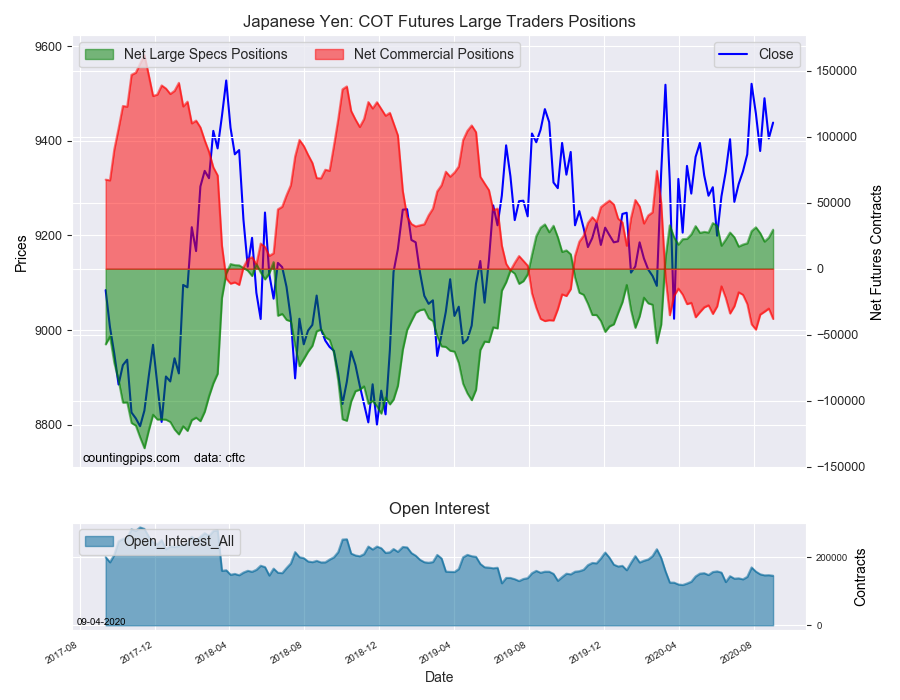

Japanese Yen:

Large Japanese yen speculators came in at a net position of 29,604 contracts in this week’s data. This was a weekly rise of 5,988 contracts from the previous week which had a total of 23,616 net contracts.

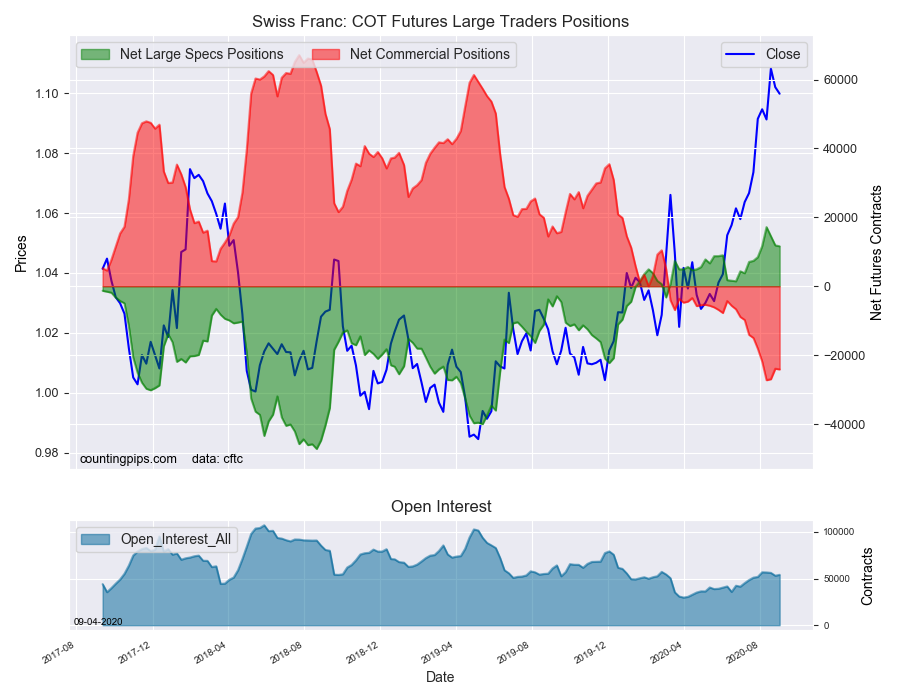

Swiss Franc:

The Swiss franc speculator standing this week recorded a net position of 11,597 contracts in the data through Tuesday. This was a weekly decrease of -269 contracts from the previous week which had a total of 11,866 net contracts.

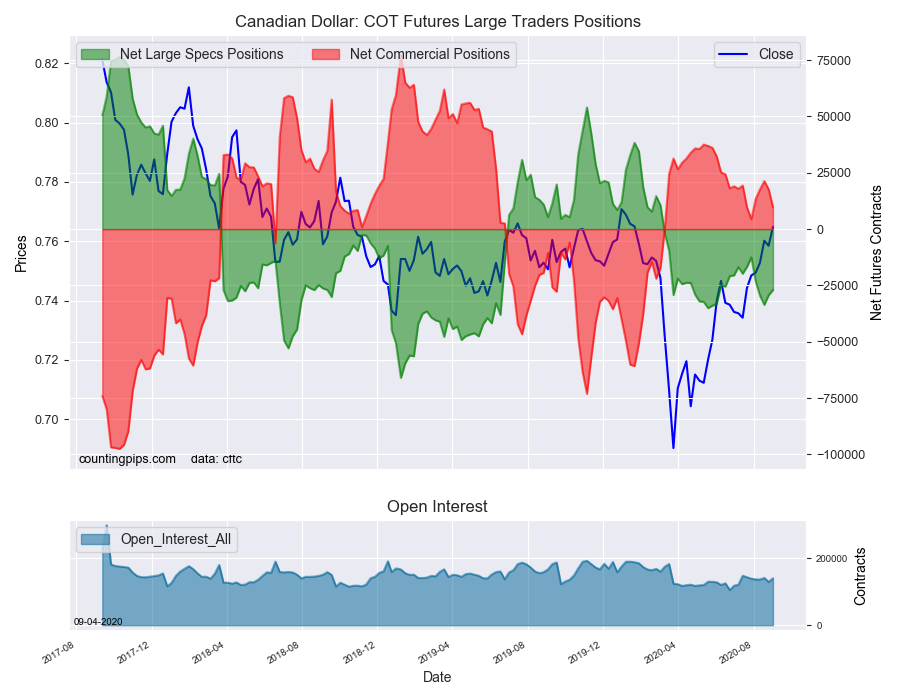

Canadian Dollar:

Canadian dollar speculators recorded a net position of -27,006 contracts this week. This was a boost of 2,312 contracts from the previous week which had a total of -29,318 net contracts.

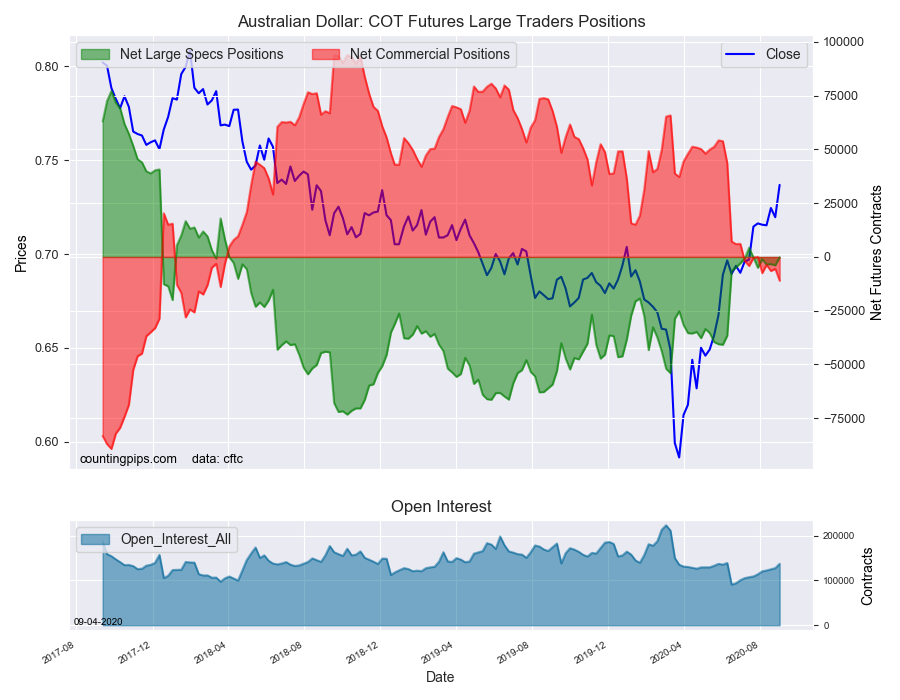

Australian Dollar:

The large speculator positions in Australian dollar Futures was a net position of -165 contracts this week in the data ending Tuesday. This was a weekly gain of 3,734 contracts from the previous week which had a total of -3,899 net contracts.

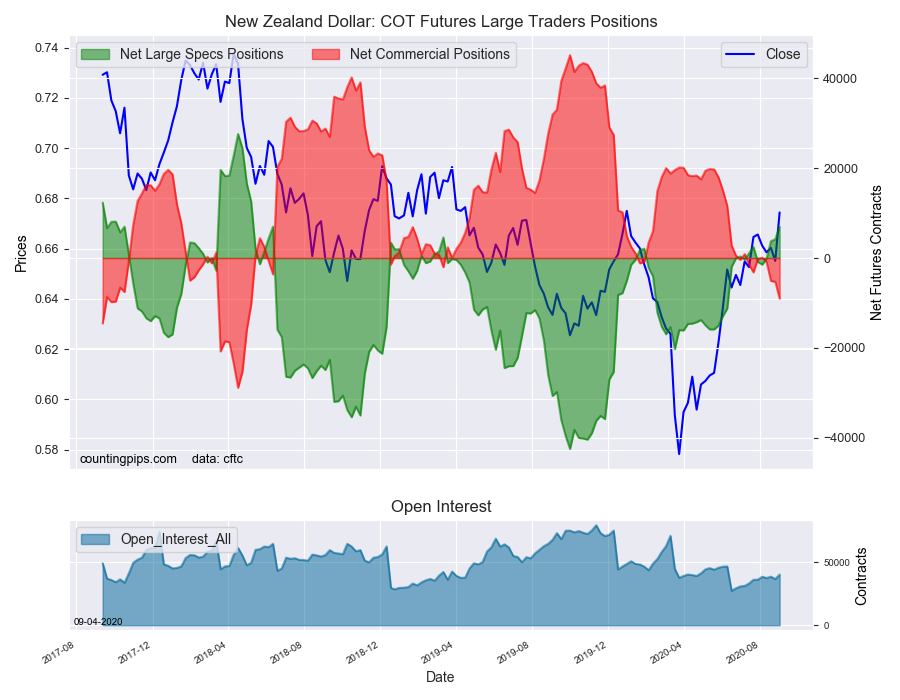

New Zealand Dollar:

The New Zealand dollar speculative standing was a net position of 6,966 contracts this week in the latest COT data. This was a weekly boost of 2,778 contracts from the previous week which had a total of 4,188 net contracts.

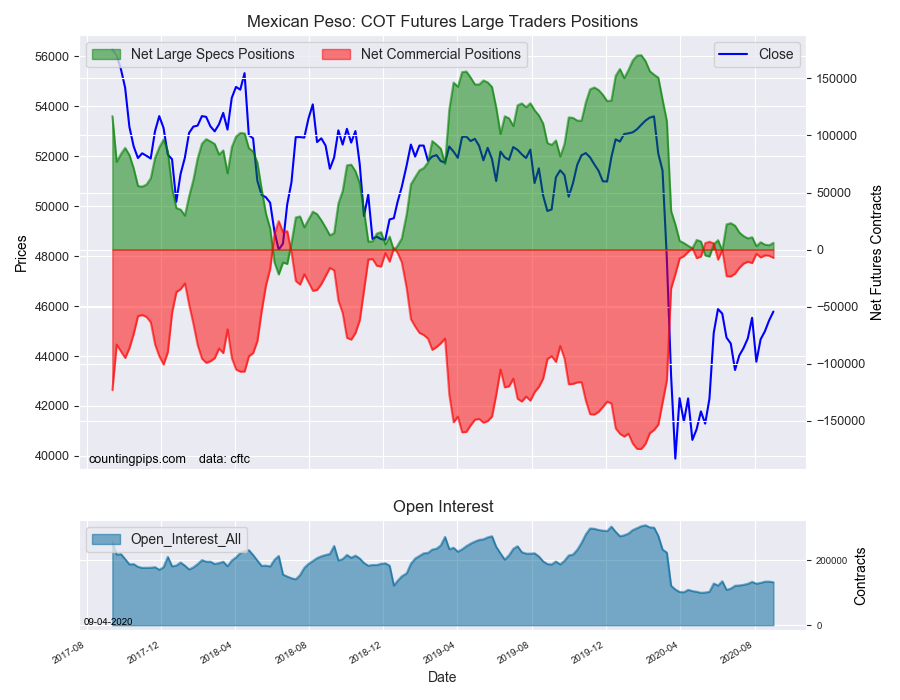

Mexican Peso:

Mexican peso speculators equaled a net position of 5,969 contracts this week. This was a weekly lift of 2,107 contracts from the previous week which had a total of 3,862 net contracts.