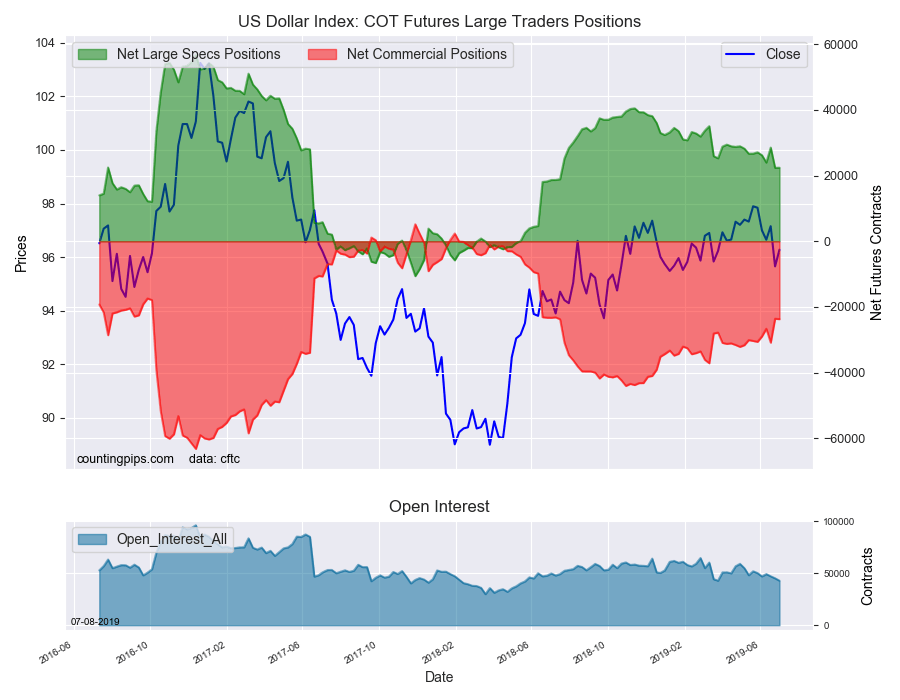

US Dollar Index Speculator Positions

Large currency speculators slightly edged their net positions higher in the US Dollar Index futures markets last week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Monday (delayed due to July 4th holiday).

The non-commercial futures contracts of US Dollar Index futures, traded by large speculators and hedge funds, totaled a net position of 22,417 contracts in the data reported through Tuesday, July 2nd. This was a weekly bump of 51 contracts from the previous week which had a total of 22,366 net contracts.

This week’s net position was the result of the gross bullish position falling by -830 contracts (to a weekly total of 33,497 contracts) while the gross bearish position dipped by -881 contracts for the week (to a total of 11,080 contracts) .

Large speculator positions were virtually unchanged this week following a drop by over -6,000 contracts in the previous week. The current US Dollar Index standing remains bullish but is near the low end of the range of its recent bullish strength.

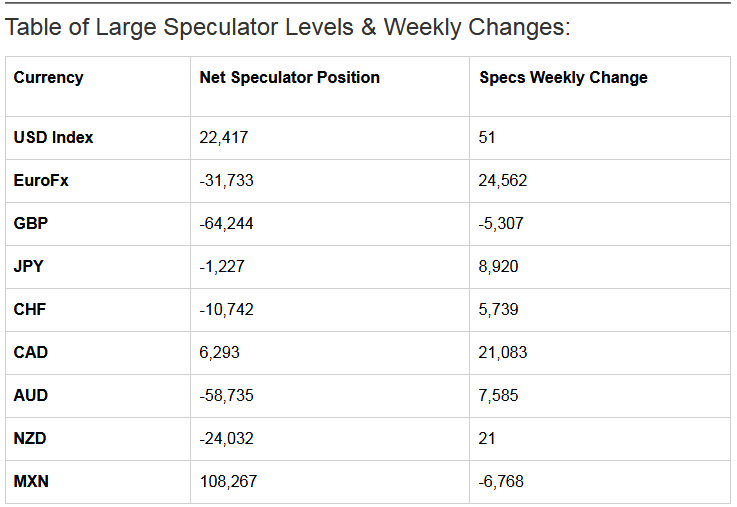

Individual Currencies Data this week:

In the other major currency contracts data, we saw two substantial changes (+ or – 10,000 contracts) in the speculators category this week.

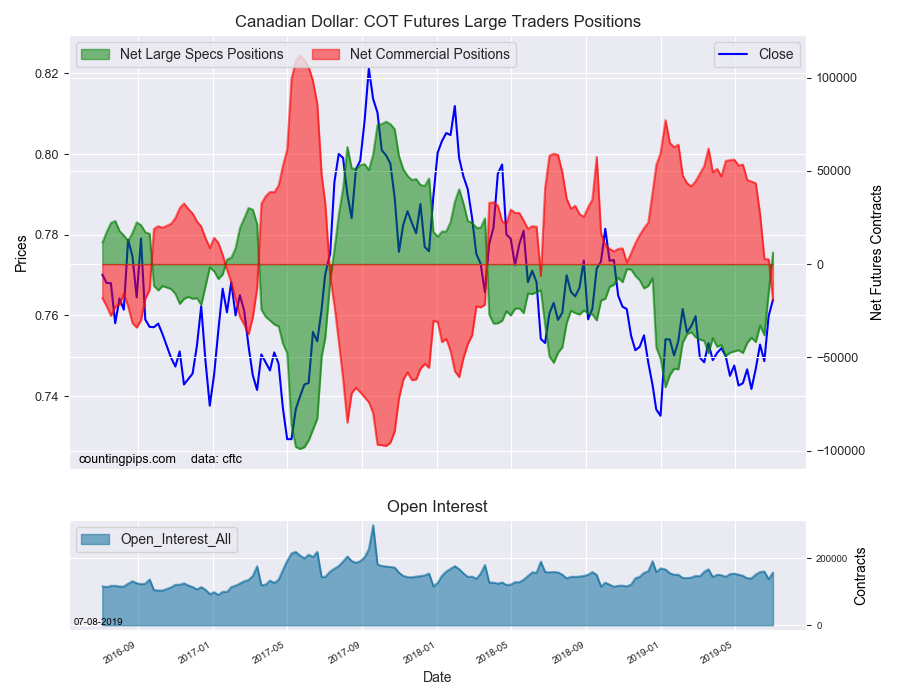

Canadian dollar positions jumped sharply for a second straight week by at least+20,000 net contracts. The CAD speculator standing has now turned into an overall net bullish position for the first time since March 20th of 2018 (a span of 67 weeks).

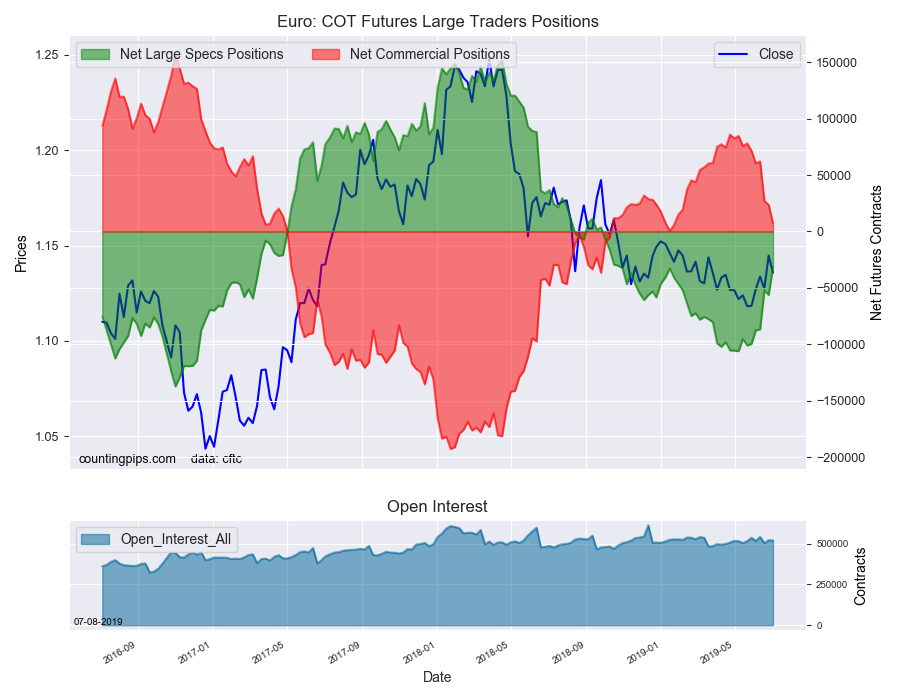

Euro speculator bets improved (went less bearish) by over +24,000 contracts last week. Euro positions have now gained by at least +10,000 contracts in three out of the past five weeks of as bearish sentiment has cooled. The Euro position is now at the least bearish level since October 2018.

Overall, the major currencies that saw improving speculator positions this week were the US dollar index (51 weekly change in contracts), euro (24,562 contracts), Japanese yen (8,920 contracts), Swiss franc (5,739 contracts), Canadian dollar (21,083 contracts), Australian dollar (7,585 contracts) and the New Zealand dollar (21 contracts).

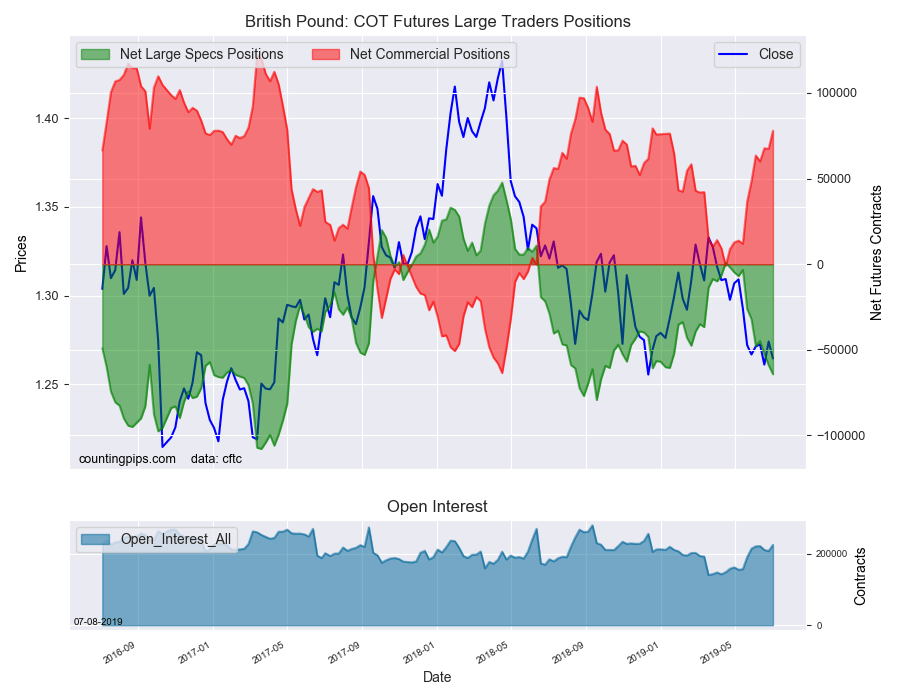

The currencies whose speculative bets declined this week were the British pound sterling (-5,307 weekly change in contracts) and the Mexican peso (-6,768 contracts).

See the table and individual currency charts below.

This latest COT data is through Tuesday and shows a quick view of how large speculators or non-commercial (for-profit traders) were positioned in the futures markets. All currency positions are in direct relation to the US dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar while a bet against the euro will be a bet that the dollar will gain versus the euro.

Weekly Charts: Large Trader Weekly Positions vs Price

EuroFX:

The euro large speculator standing this week totaled a net position of -31,733 contracts in the data reported through Tuesday. This was a weekly boost of 24,562 contracts from the previous week which had a total of -56,295 net contracts.

British Pound Sterling:

The large British pound sterling speculator level was a net position of -64,244 contracts in the data reported this week. This was a weekly decline of -5,307 contracts from the previous week which had a total of -58,937 net contracts.

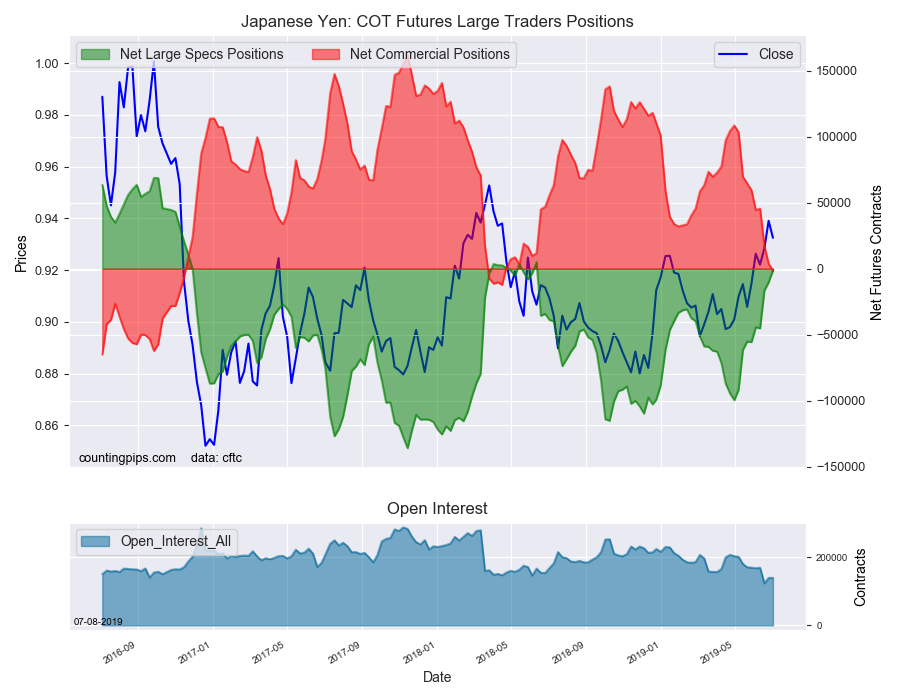

Japanese Yen:

Large Japanese yen speculators totaled a net position of -1,227 contracts in this week’s data. This was a weekly rise of 8,920 contracts from the previous week which had a total of -10,147 net contracts.

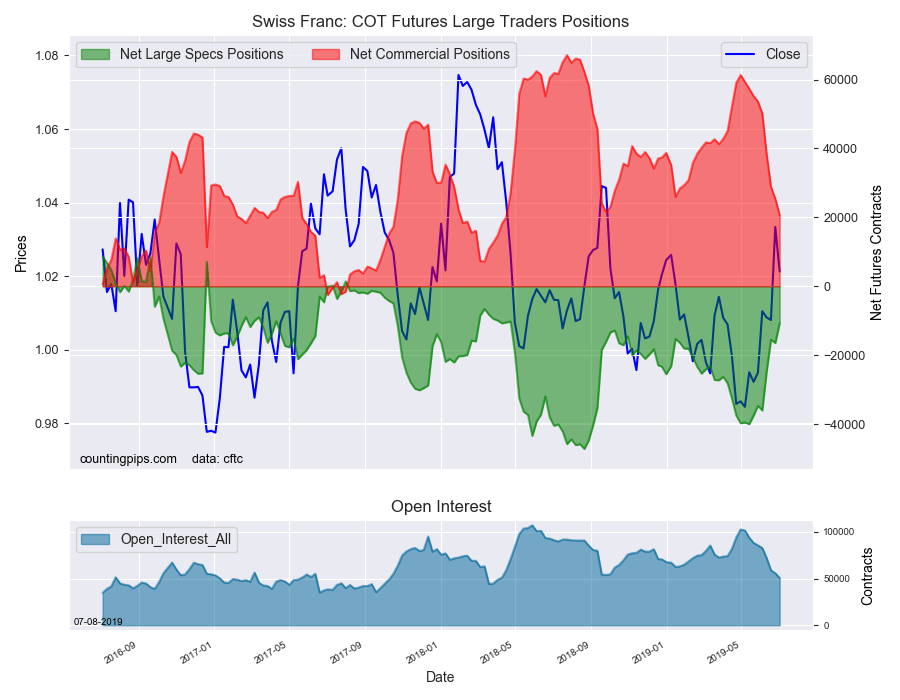

Swiss Franc:

The Swiss franc speculator standing this week reached a net position of -10,742 contracts in the data through Tuesday. This was a weekly lift of 5,739 contracts from the previous week which had a total of -16,481 net contracts.

Canadian Dollar:

Canadian dollar speculators came in at a net position of 6,293 contracts this week. This was a lift of 21,083 contracts from the previous week which had a total of -14,790 net contracts.

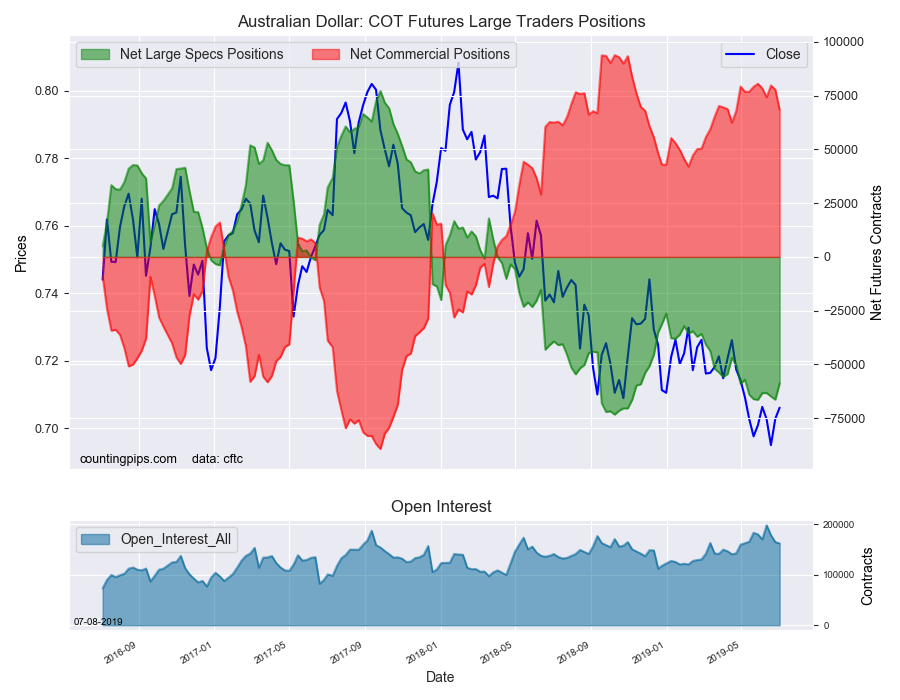

Australian Dollar:

The large speculator positions in Australian dollar futures equaled a net position of -58,735 contracts this week in the data ending Tuesday. This was a weekly boost of 7,585 contracts from the previous week which had a total of -66,320 net contracts.

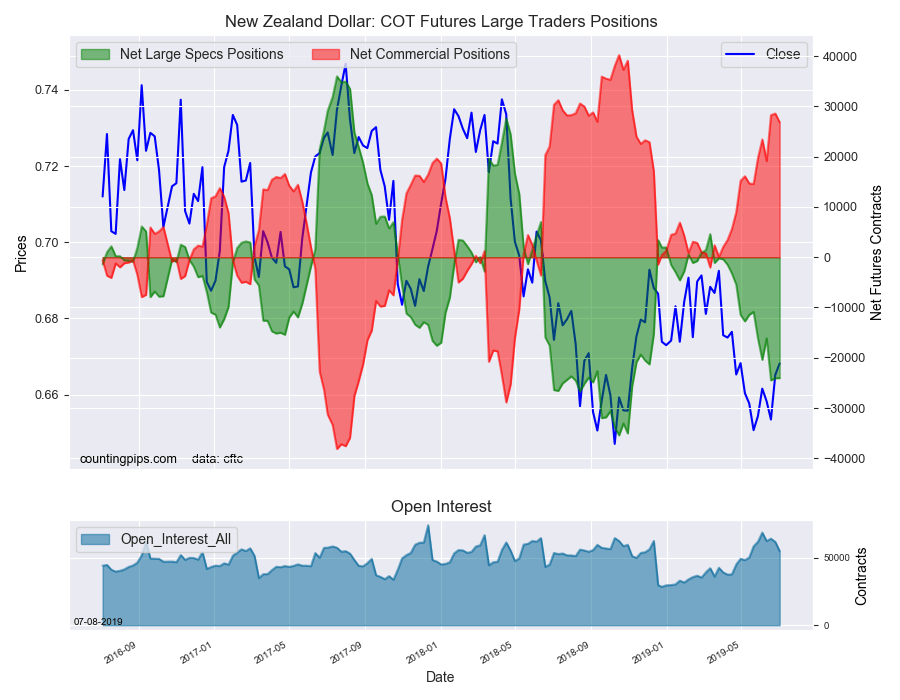

New Zealand Dollar:

The New Zealand dollar speculative standing reached a net position of -24,032 contracts this week in the latest COT data. This was a weekly advance of 21 contracts from the previous week which had a total of -24,053 net contracts.

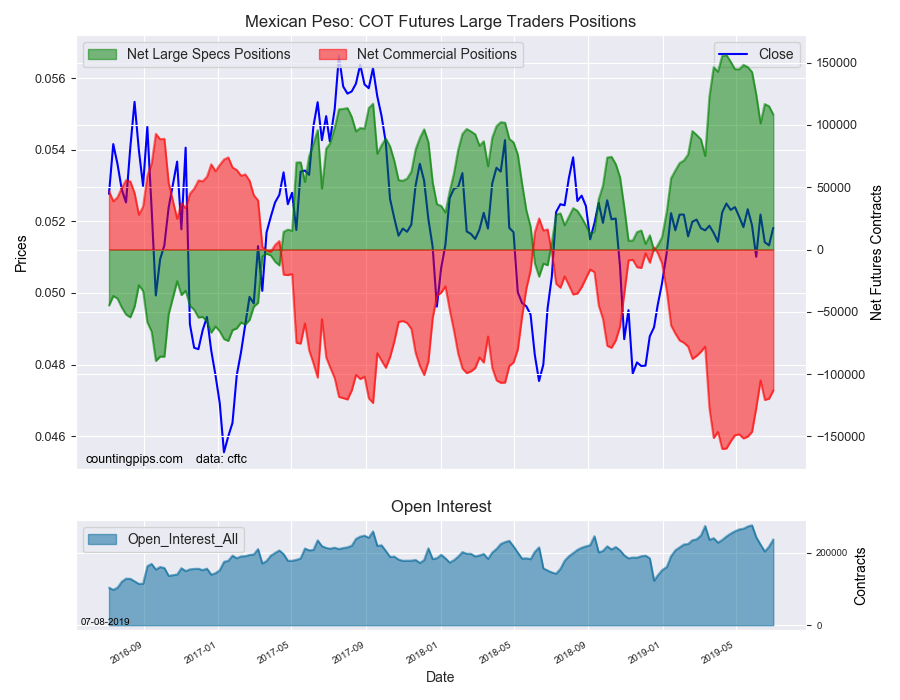

Mexican Peso:

Mexican peso speculators totaled a net position of 108,267 contracts this week. This was a weekly lowering of -6,768 contracts from the previous week which had a total of 115,035 net contracts.