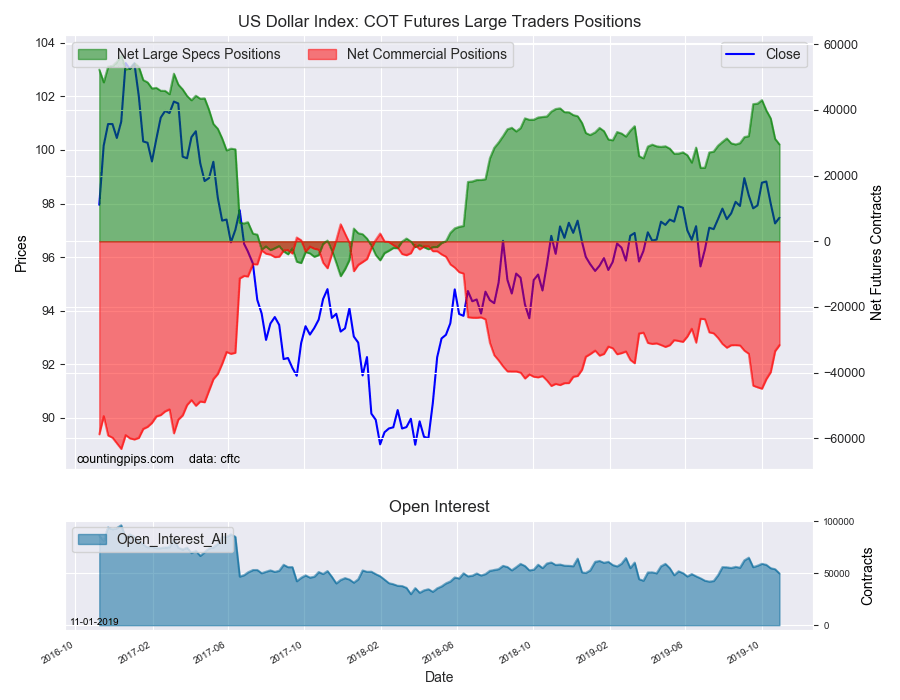

US Dollar Index Speculator Positions

Large currency speculators continued to cut back on their bullish net positions in the US Dollar Index futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of US Dollar Index futures, traded by large speculators and hedge funds, totaled a net position of 29,509 contracts in the data reported through Tuesday October 29th. This was a weekly decrease of -1,701 contracts from the previous week which had a total of 31,210 net contracts.

This week’s net position was the result of the gross bullish position (longs) tumbling by -3,650 contracts (to a weekly total of 37,183 contracts) compared to the gross bearish position (shorts) which fell by a lesser amount of -1,949 contracts on the week (to a total of 7,674 contracts).

US Dollar Index speculators dropped their bullish bets for a fourth consecutive week and pushed the overall bullish position to the lowest level in ten weeks, dating back to August 27th. Previously, the USD speculative position had risen to a 127-week high on October 1st before this recent cool off. The current level of bullish bets is just below the 2019 average position of +30,726 net contracts.

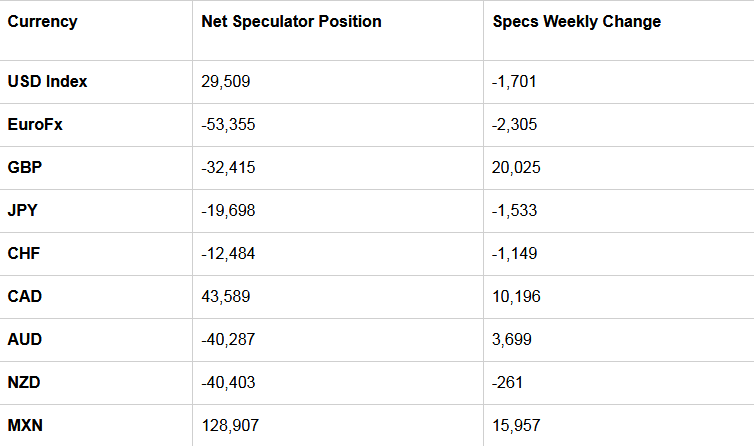

Individual Currencies Data this week:

In the other major currency contracts data, we saw three substantial changes (+ or – 10,000 contracts) in the speculators category this week.

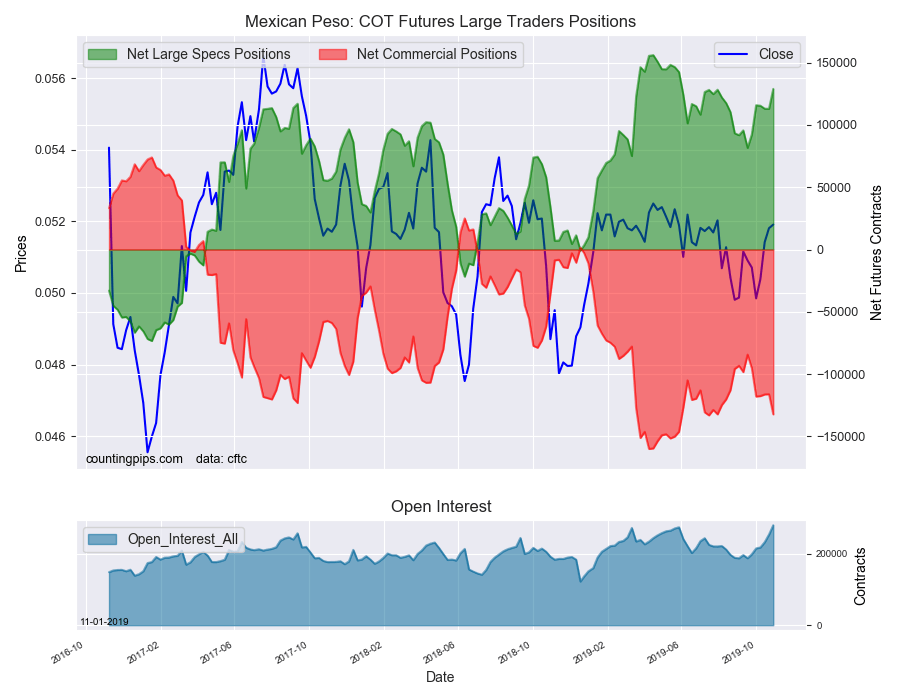

Mexican peso speculators sharply boosted their bullish bets this week by over +15,000 contracts (over a 14 percent gain) following three straight weeks of lower positions. This rise pushed the current bullish standing (+128,907 contracts) for the peso to the most bullish level in 22 weeks, dating back to late May. Peso positions marked a bullish record high earlier this year with a total of +156,030 contracts on April 16th.

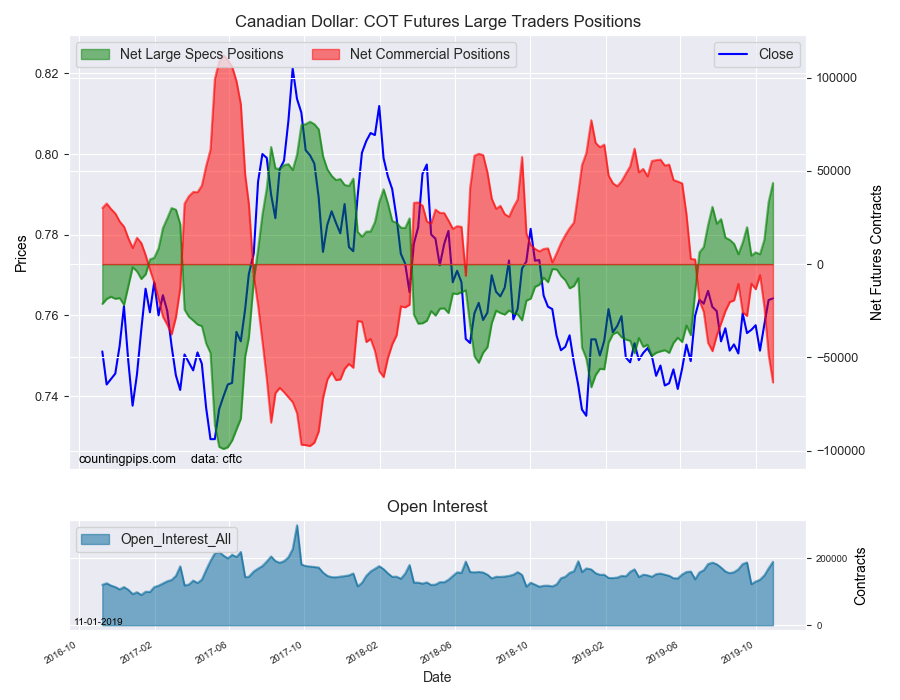

Canadian dollar speculators raised their bullish bets for a third consecutive week and by a total of +38,276 contracts over this three-week period. The gains puts the current bullish standing at the highest level in ninety-seven weeks, dating back to December of 2017. The CAD position has now been in bullish territory for eighteen straight weeks after flipping from bearish to bullish on July 2nd.

British pound sterling speculators sharply pared their bearish bets by over 20,000 contracts in each of the past two weeks. Overall, the GBP position has now improved for seven straight weeks dating back to September 17th and by a total of 59,818 contracts in those past seven weeks. The pound sterling, now with a hard Brexit not currently on the schedule, has improved to the least bearish level in 22 weeks, dating back to May 28th.

Overall, the major currencies that saw improving speculator positions this week were the British pound sterling (20,025 weekly change in contracts), Canadian dollar (10,196 contracts), Australian dollar (3,699 contracts) and the Mexican peso (15,957 contracts).

The currencies whose speculative bets declined this week were the US dollar index (-1,701 weekly change in contracts), euro (-2,305 contracts), Japanese yen (-1,533 contracts), Swiss franc (-1,149 contracts) and the New Zealand dollar (-261 contracts).

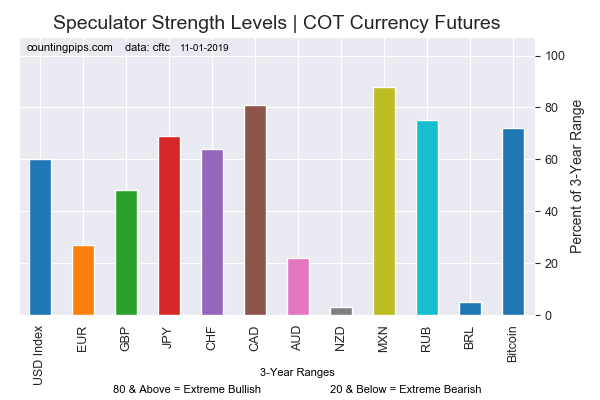

Chart: Current Strength of Each Currency compared to their 3-Year Range

See the table and individual currency charts below.

Table of Large Speculator Levels & Weekly Changes:

This latest COT data is through Tuesday and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets. All currency positions are in direct relation to the US dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar while a bet against the euro will be a bet that the dollar will gain versus the euro.

Weekly Charts: Large Trader Weekly Positions vs Price

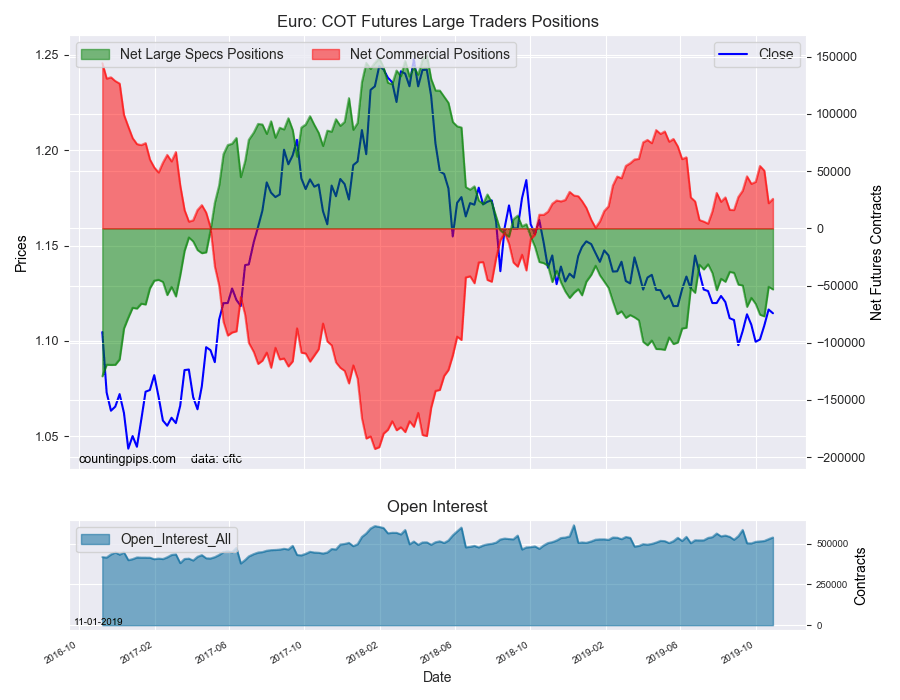

EuroFX:

The euro large speculator standing this week resulted in a net position of -53,355 contracts in the data reported through Tuesday. This was a weekly lowering of -2,305 contracts from the previous week which had a total of -51,050 net contracts.

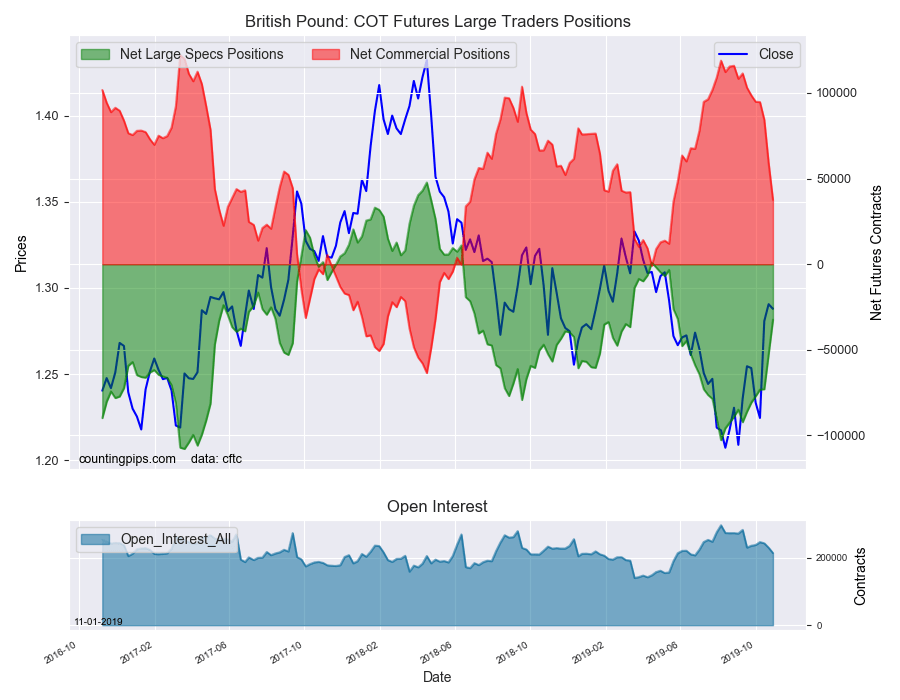

British Pound Sterling:

The large British pound sterling speculator level recorded a net position of -32,415 contracts in the data reported this week. This was a weekly rise of 20,025 contracts from the previous week which had a total of -52,440 net contracts.

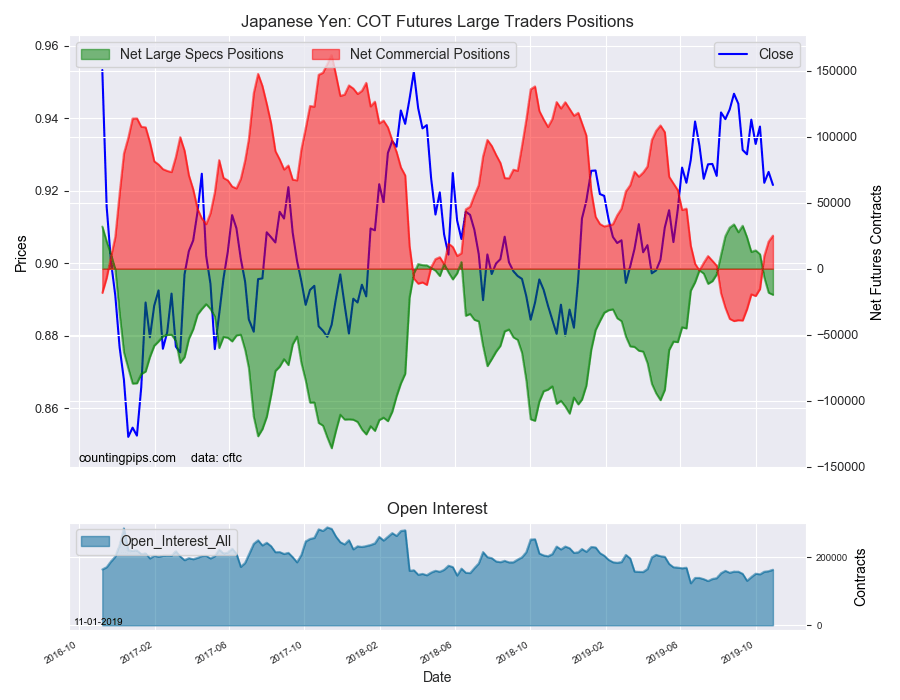

Japanese Yen:

Large Japanese yen speculators totaled a net position of -19,698 contracts in this week’s data. This was a weekly decrease of -1,533 contracts from the previous week which had a total of -18,165 net contracts.

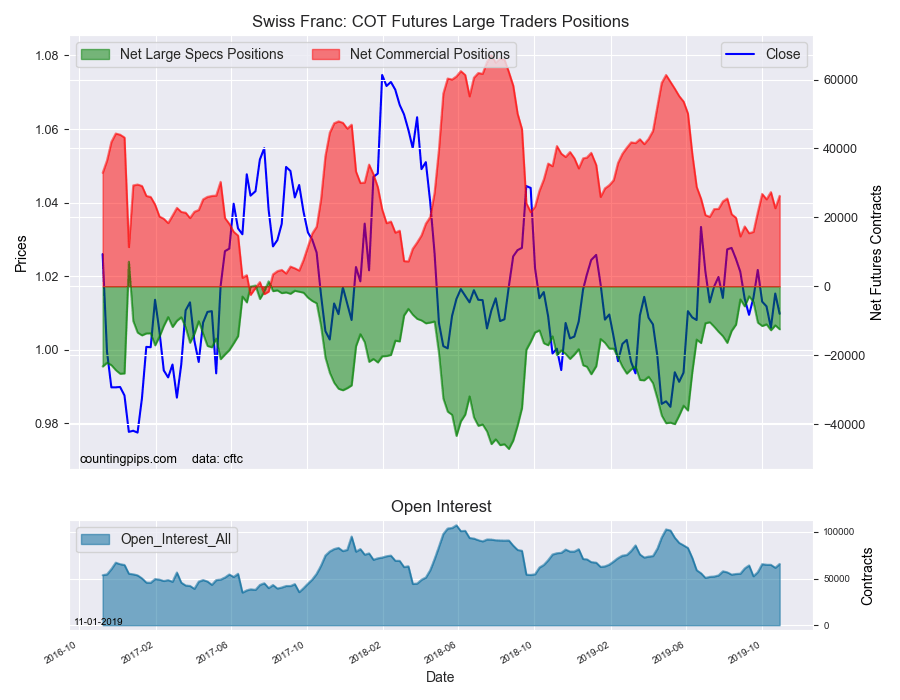

Swiss Franc:

The Swiss franc speculator standing this week was a net position of -12,484 contracts in the data through Tuesday. This was a weekly decline of -1,149 contracts from the previous week which had a total of -11,335 net contracts.

Canadian Dollar:

Canadian dollar speculators reached a net position of 43,589 contracts this week. This was an advance of 10,196 contracts from the previous week which had a total of 33,393 net contracts.

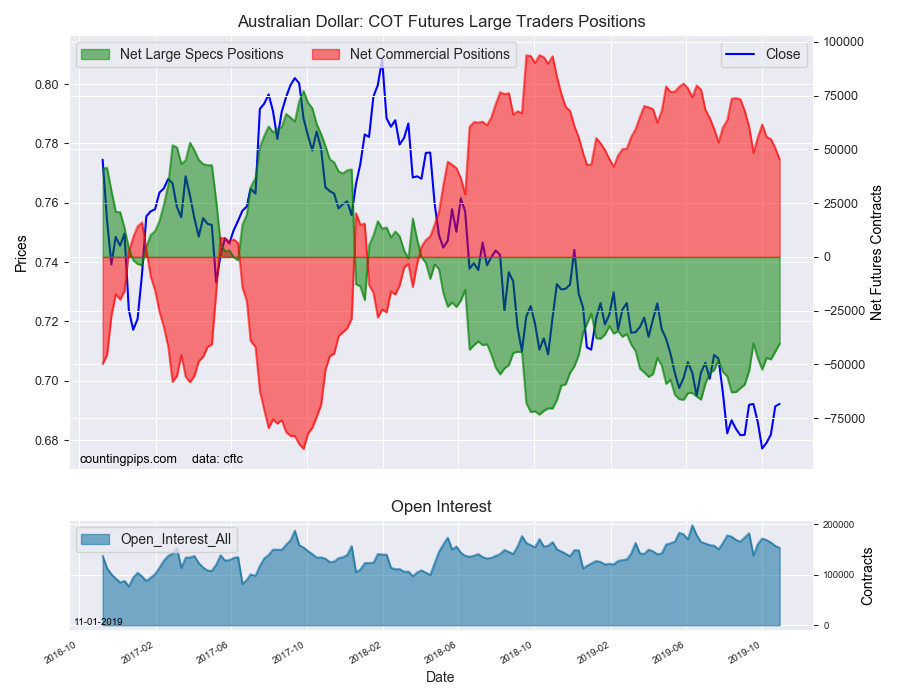

Australian Dollar:

The large speculator positions in Australian dollar futures recorded a net position of -40,287 contracts this week in the data ending Tuesday. This was a weekly lift of 3,699 contracts from the previous week which had a total of -43,986 net contracts.

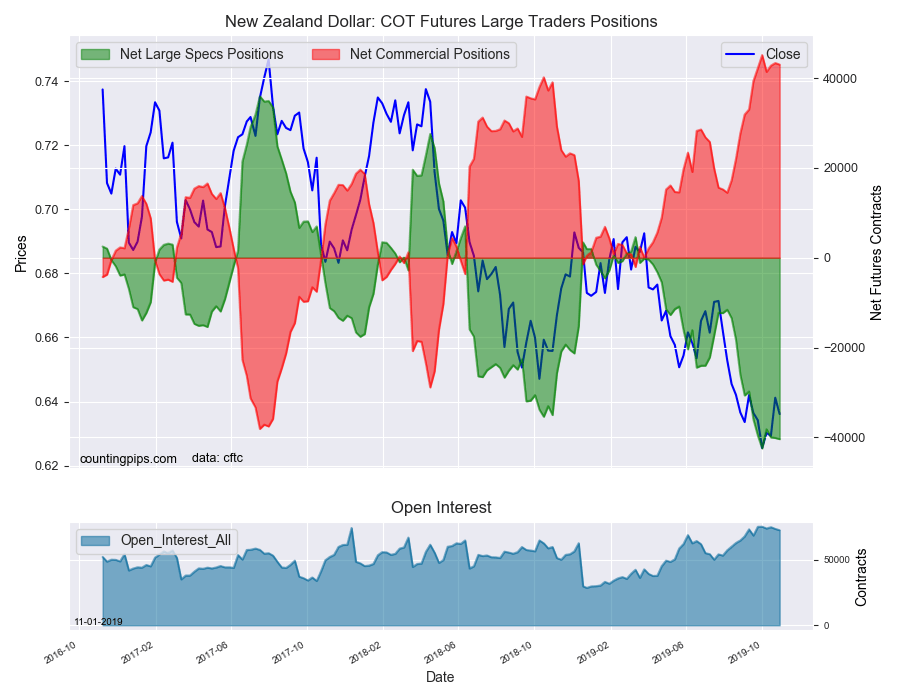

New Zealand Dollar:

The New Zealand dollar speculative standing equaled a net position of -40,403 contracts this week in the latest COT data. This was a weekly reduction of -261 contracts from the previous week which had a total of -40,142 net contracts.

Mexican Peso:

Mexican peso speculators resulted in a net position of 128,907 contracts this week. This was a weekly gain of 15,957 contracts from the previous week which had a total of 112,950 net contracts.