- The US Dollar rose this morning as President-Elect Trump took aim at BRICS over de-dollarization efforts.

- The Euro weakens further due to concerns over a potential French government collapse.

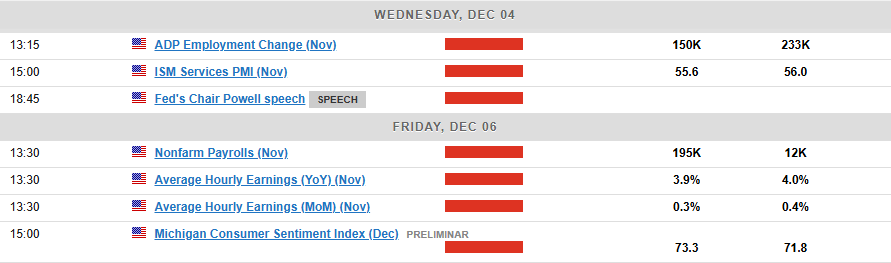

- The Dollar Index shows potential for both upside and downside moves, with key resistance at 107.00 and support at 105.00.

The US Dollar kicked December off on the front foot as market participants digested comments from US President-Elect Donald Trump. This is the second week that markets have taken their cue from Trump comments to start the week, with the President-Elect threatening tariffs of 100% to BRICS countries.

BRICS group of developing nations spearheaded by Russia, China, India, Brazil and South Africa have been discussing a rival to the US Dollar as well as a potential alternative to the swift system. Trump has warned the bloc which has had a surge of interest for membership this year that includes the likes of Turkey, Saudi Arabia, Iran and a host of other developing nations.

The US Dollar for its part shook off the malaise from the Thanksgiving holiday week to trade back above the key 1.0600 handle once more.

France Uncertainty Hits the Euro

Another major reason that the US Dollar Index (DXY) has roared to life this morning could be down to developments in Europe. The Euro (EUR/USD), which is the main currency in the US Dollar Index basket of currencies, has been under pressure as concerns around France continue to mount.

The failure of budget talks have led to concerns that the French Government may collapse given its current composition. France’s far-right National Rally is likely to support a no-confidence vote against the government unless there’s a last-minute change. Marine Le Pen has given Prime Minister Michel Barnier until Monday to meet their demands during ongoing budget negotiations.

At present though market sentiment appears to be largely driven by ongoing trade war concerns and how they may impact markets moving forward.

Trump’s Threat to BRICS, a Concern or Not?

President-Elect Donald Trump continues to shake up global markets with his comments. His most recent tweet targeted at BRICS countries has however generated a lot of interest. As calls have grown in recent times for an alternate money system to swift as well as de-dollarization, many did not expect Trump’s comments.

However, I would urge caution as despite the optimism around the US Dollar the implications of Trump’s proposed measures are fraught with danger. Firstly, the US is no longer a manufacturing but a service and consumer-driven economy, meaning it has a strong reliance on imports. Thus any tariffs imposed may be met with tariffs in return which could push up prices which US consumers will bear the brunt off. This could affect the strong support Trump enjoys with the working class Americans.

If anything, consumers are opting and prioritizing affordability in recent years which means that sudden spikes in prices could have a negative impact on US and global growth. Markets will be hoping that last week’s appointment of Scott Bessent as Treasury Secretary will reign in some policies that could in theory create more problems than they would solve.

There has been no comment from the BRICS group as yet toward President Trump’s comments and it will be interesting to see if we get any form of unified statement.

US Jobs Report Key This Week

The US Dollar may continue to trade choppy this week and may take cues from any further geopolitical development ahead of Friday’s key.

Markets are leaning more toward a rate cut from the Fed in December following last weeks data and the hope is that the jobs report on Friday will confirm this.

For a full breakdown of the week ahead, read: Markets Weekly Outlook – US Dollar’s Fate Hinges on NFP as Fed Rate Cut Looms

Technical Analysis

US Dollar Index (DXY)

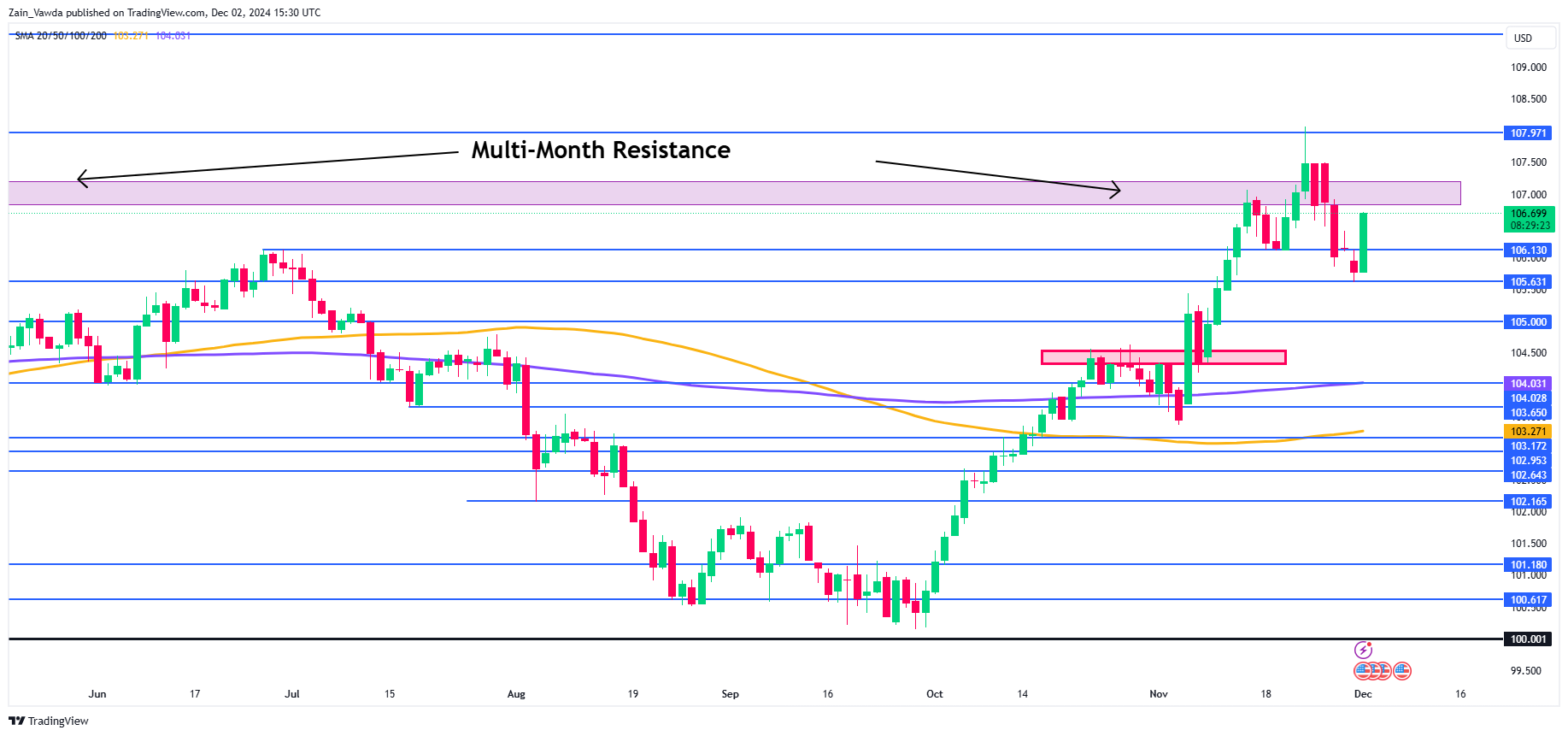

The Dollar Index has been interesting to monitor of late and has been a driving force for dollar-denominated pairs.

The DXY is trading below the multi-month key level at 107.00 following last week’s selloff. However, a strong bounce this morning off support at the 105.63 handle does offer bulls some hope that further upside may be on the cards this week.

The daily chart did print a change of structure last week with the previous higher low at 106.13 being broken hinting that a downtrend may be in play.

This brings the key multi-month resistance level at 107.00 back in the spotlight. A rejection here could send the DXY tumbling back to last week’s lows or a potential retest of the psychological 105.00 handle.

Data releases ahead of Friday may stoke volatility but barring a really surprising print I expect any moves to prove short-lived.

US Dollar Index (DXY) Daily Chart, December 2, 2024

Source: TradingView.com

Key Levels to Consider:

Support

- 106.13

- 105.63

- 105.00

Resistance

- 107.00

- 107.50

- 108.00