Key Points:

- DXY fails to breach daily cycle high.

- Parabolic SAR declining.

- DXY outlook remains bearish.

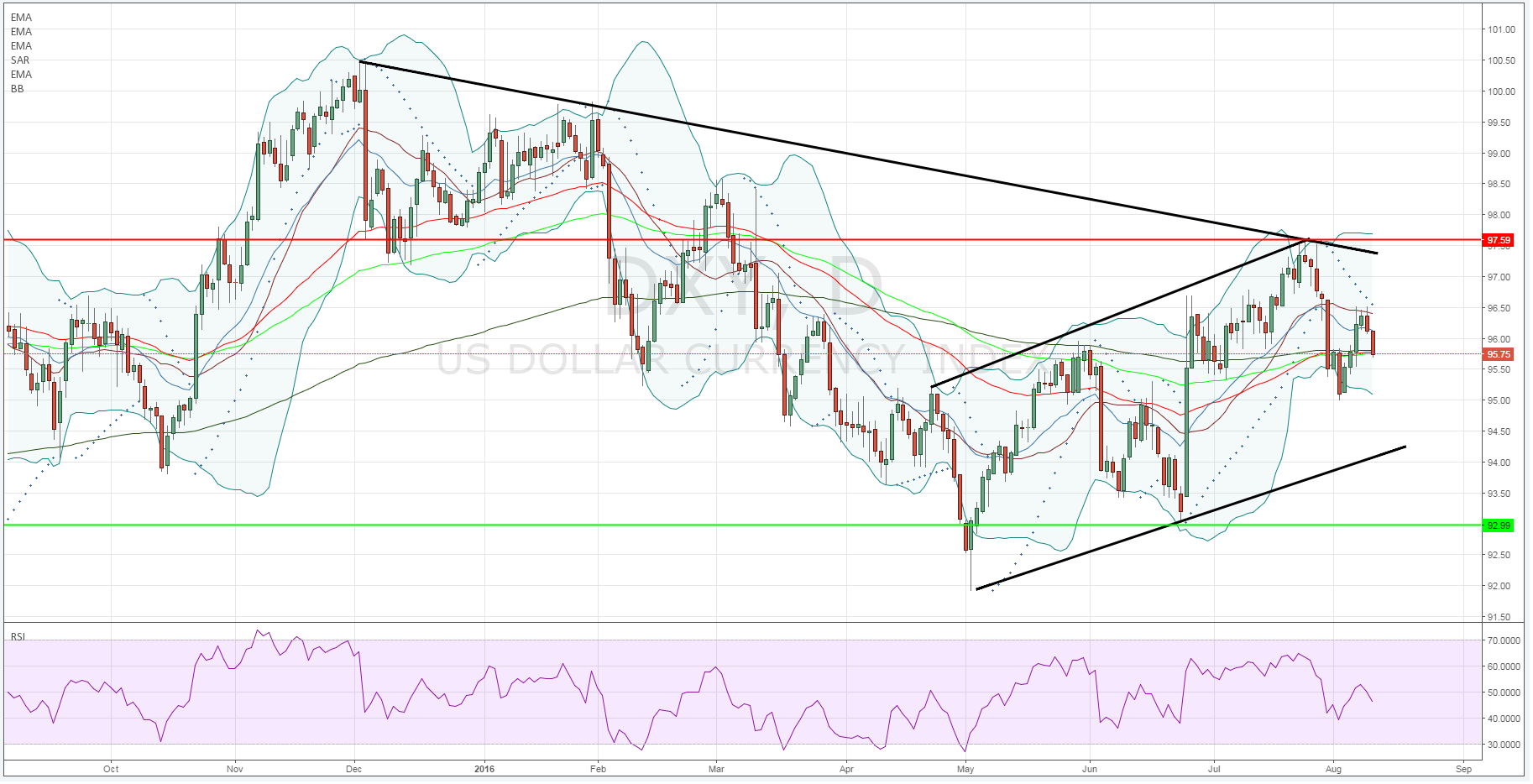

The highly watched US Dollar Index took another hit over night as a broadly weaker USD sentiment was pervasive within markets. Primarily, the index was unable to break above the 98.47 daily cycle high (DCH) which may suggest further falls in the week ahead.

From a technical perspective, the index has seen a sharp rally towards to the medium term descending trend line before failing and pulling back to its current level at 95.77. Price action’s recent decline has largely been mirrored within the RSI Oscillator which has also fallen sharply and currently remains within neutral territory. In addition, the parabolic SAR is signalling bearish activity ahead as it continues to trend lower. Subsequently, given both the failure to breach the DCH and RSI’s declining neutral status, it would appear that the index isn’t yet finished its decline.

It is therefore relatively intuitive that, at least from a technical standpoint, that the index is predisposed to test new lows in the coming week. The failure to breach both the descending medium term trend line and DCH largely sets up the play for the remainder of the week. Subsequently, a likely target over the weekly timeframe would appear to be the daily cycle low around the 93.14 mark. This is a fairly realistic target point with the next possible reversal zone being support at 92.54

However, from a fundamental perspective there is some important economic news due out in the latter part of this week. In particular, the US JOLTS Job Openings and Unemployment Claims figures are likely to be closely watched and cause plenty of volatility within the DXY. Subsequently, any deviation from the forecasts of 5.58m, and 265k respectively, will cause the index to move and may invalidate the technical aspects of the trade.

Ultimately, the index is largely heading one direction and that is invariably to follow the broadly negative sentiment tone that is pervading the US Dollar currently. Subsequently, keep a close watch on the index overnight as it may move relatively quickly once both the bearish direction and JOLTS Job Openings data is confirmed.