Investing.com’s stocks of the week

UPDATED (23-July-2020): Only a month has gone by since my last update to this post, but again a few things have changed, and I thought it worth flagging a couple of the key moving parts and some interesting recent insights.

Firstly, as flagged on Twitter, the US dollar index has broken down against its first key line of support. This is a key bearish development and could open the door for further and more sustained dollar weakness.

(and here it comes...) *BUT* anyone who has been paying attention will by now know intimately that the US dollar has had a penchant for delivering maximum pain and confusion to the maximum number of participants... in other words, we've seen a procession of fakeouts on both the bullish and bearish side, so while I am admittedly pleased to see price evolving in line with my core thesis, I am a tad reluctant to go full-happy on it just yet.

Anyway, enough talk, let's look at a couple of charts...

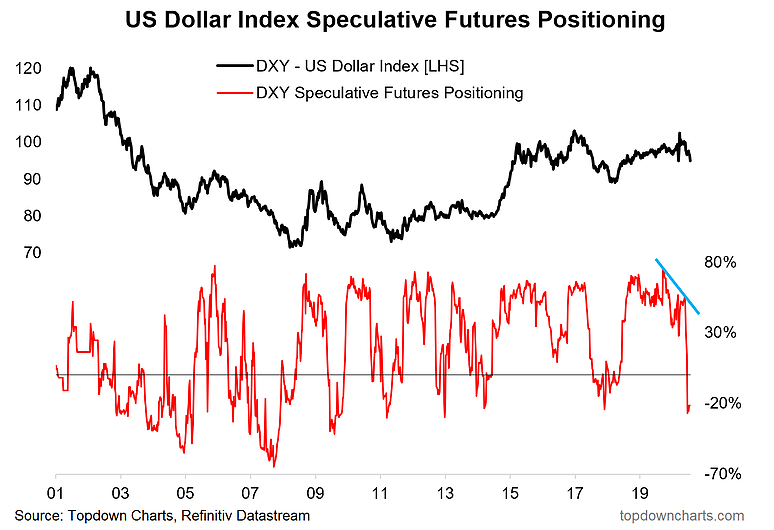

First one comes from my latest weekly report. It shows a clear and decisive turn in opinion on the US dollar index judging by the actual futures positioning of speculators (for reference, this also aligns with some of the other measures of sentiment I track).

The other thing to note is the bearish divergence between the index (higher highs) and the indicator (lower highs), which coalesced with the nascent turning point that seems to be developing in the DXY. So with the change in mood I would say that brings a certain element of bearish momentum.

Naturally the bullish take would be that sentiment has now undergone a healthy reset, and we can expect a rally. (but...)

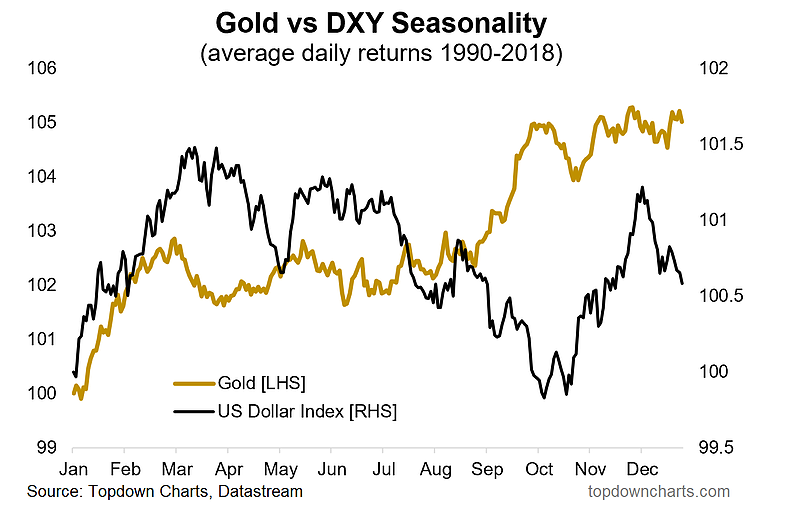

Looking at the seasonality pattern for the US dollar index, there is an interesting tendency for the US dollar to generally trend down from around July through Oct./Nov., as the chart below shows (as a side note, gold—as you might guess—tends to do the opposite, which is certainly interesting with respect to what's going on over there).

Normally I wouldn't focus too much on seasonality as the averages can deceive and seasonality has a habit of breaking when you try to rely on it... having said that, I also say that when seasonality aligns with a broader thesis it can help boost conviction levels and the seasonal headwinds that seem to be swirling for the US dollar, certainly at the margin, dog-pile on with the rest of the building bearish evidence.

So what do you say? A "healthy reset"? Or the start of a more sustain and substantial bearish run for the DXY?

Medium-longer term I think the bearish case is compelling, and see promise in the shorter term price action and shifts in sentiment and seasonality, but again I do feel a little apprehension and sense it won't be a clear cut straight line...