Talking Points:

- US Dollar Falls as Treasury Bond Yields Sink After Japan Enters Recession

- Yen Spikes Down as Tax Hike Chances Fade, Rebounds on Political Turmoil

- Euro Looking to ECB Bond Purchase Tally, Draghi Testimony for Direction

The US Dollar underperformed in overnight trade, sliding as much as 0.4 percent on average against its leading counterparts. The decline tracked a slide in benchmark 10-year Treasury bond yields, pointing to eroding rates appeal as the catalyst behind the selloff. For their part, yields moved lower as an unexpectedly soft Japanese GDP figure triggered risk aversion, fueling haven-linked demand for Treasuries and pushing bond prices upward.

The preliminary third-quarter data set showed Japan slipped into a technical recession, with output shrinking 0.4 percent compared with the three months through June. Economists were penciling in a 0.5 percent expansion ahead of the announcement. The second-quarter reading was also revised lower to reveal a 1.9 percent contract, a slightly larger drop than the 1.8 percent dip initially reported. The New Zealand Dollar led the way higher against the greenback as a robust Retail Sales report amplified Japan-linked price action. Receipts rose 1.5 percent in the third quarter, topping forecasts for a 0.8 percent advance and registering the largest gain in over two years.

As for the JPY, the currency initially spiked lower after the GDP report, presumably reflecting the ebbing probability of another sales tax increase (planned to go up to 10 percent in October 2015). That reaction was swiftly overturned however as risk aversion gripped the markets and pushed the safety-geared unit higher. The dour reaction may have reflected rising political uncertainty amid rumors that Prime Minister Shinzo Abe will dissolve the lower house of the Diet and call a snap election as soon as tomorrow, presumably to reclaim a mandate as the economy sputters.

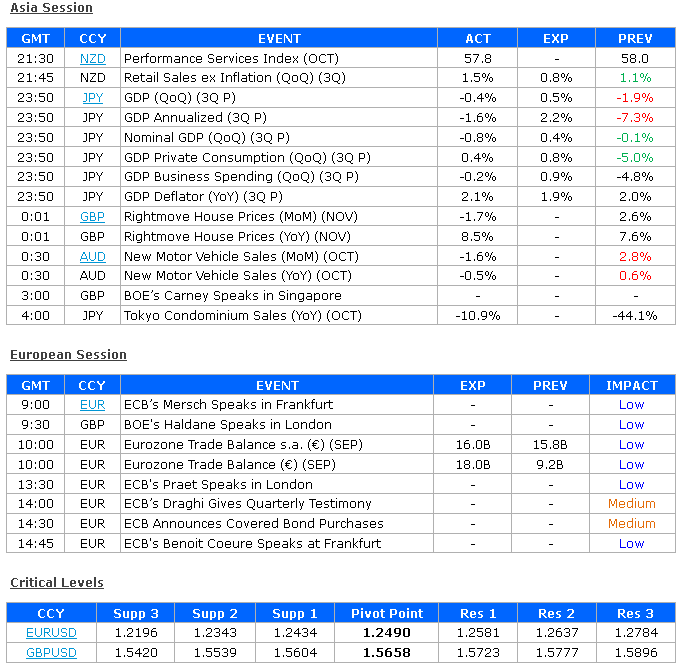

Looking ahead, the outlook for European Central Bank monetary policy dominates the spotlight. The central bank will report the size of last week’s covered bond purchases while ECB President Mario Draghiwill deliver his quarterly testimony to the European Parliament. Traders will look to the former to see if officials are stepping up the pace of balance sheet expansion, an effort heretofore judged as insufficient to jump-start lending and reverse the slide toward deflation. Meanwhile, Draghi’s comments will be closely scrutinized for clues as to the ECB’s willingness to introduce “sovereign QE” should the medley of easing measures introduced this year fall short. A pickup in bond uptake and/or a strongly-worded commitment to overturn sinking inflation by whatever means are necessary may weigh on the Euro.