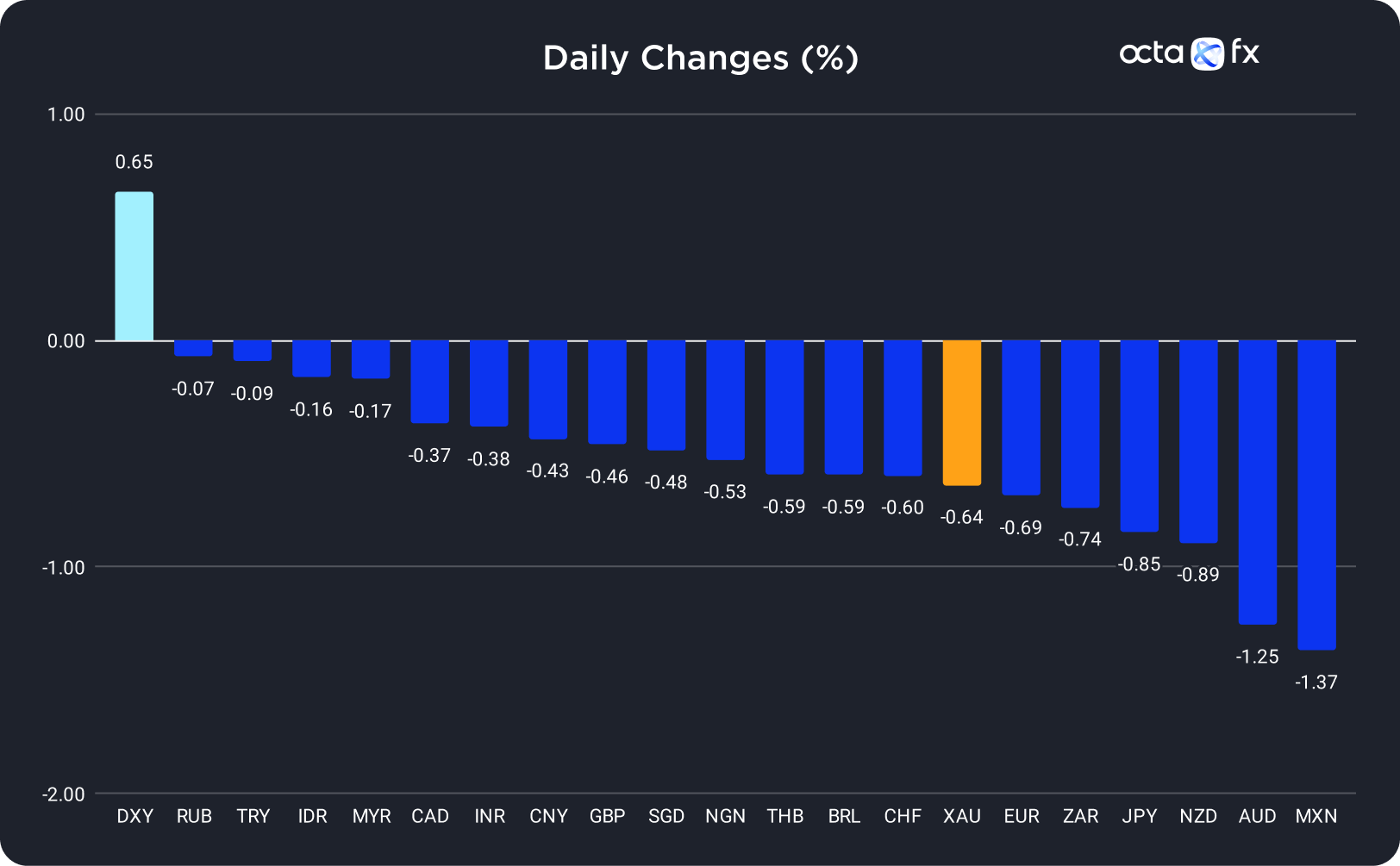

On Tuesday, the US Dollar was the best-performing currency among the 20 global currencies we track, while the Mexican peso (MXN) showed the weakest results. The Russian rouble (RUB) was the leader among emerging markets, while the Australian dollar underperformed among majors.

Gold Drops as Safe-Haven Flows Go Into the US Dollar

On Tuesday, the gold price plunged by 0.64% on the safe-haven buying of the US dollar after worse-than-expected Chinese macroeconomic data raised concerns about the global economy's health.

Chinese Caixin Services Purchasing Managers Index (PMI) was much lower than anticipated, making investors more skeptical about global economic growth. As a result, U.S. equity indices dropped, while Treasury yields rose as investors sought a hedge against the recession risks. Therefore, safe-haven flows into the US dollar increased, exerting downward pressure on precious metals. However, the decline in XAU/USD was limited by very dovish interest rate expectations. According to the CME FedWatch Tool, the market is currently pricing in a 93% chance that the Federal Reserve (Fed) will leave the base rate unchanged in September and a 38% chance of a 25-basis-point (bps) rate hike in November.

XAU/USD was essentially flat in the Asian session. Today, the interest rate decision by the Bank of Canada (BOC) at 2:00 p.m. UTC might trigger some volatility in gold. Also, traders should pay attention to the upcoming speeches by the Fed officials. Susan Collins, the President of the Boston Fed, and Lorie Logan, the President of the Dallas Fed, will give speeches at 12:30 p.m. and 7:00 p.m. UTC. Moreover, the U.S. will release the latest ISM Services PMI at 2:00 p.m. UTC, which might help to define the Fed's monetary policy in the future. 'Spot gold may fall into a range of 1,916–1,918 USD per ounce as an uptrend from 1,884 has reversed,' said Reuters analyst Wang Tao.

The Canadian Dollar Declined as Investors Worried About the Global Economic Slowdown

The Canadian Dollar lost 0.37% on Tuesday as worries over global economic growth, particularly in China, made investors flee to the safe-haven greenback.

CAD is a high-beta commodity currency sensitive to global risk trends. Thus, USD/CAD was among the first pairs to react to downbeat macroeconomic data from China. The pair is now trading near a five-month high even though investors firmly believe the Federal Reserve's (Fed) rate hiking cycle is over. 'Worries are on the rise about a China and Europe-led slowdown in global growth. As a result, the dollar is catching a solid safe haven bid,' said Joe Manimbo, the senior market analyst at Convera.

USD/CAD rose during the Asian session and managed to consolidate above the important 1.36400 level. Today, the Bank of Canada (BOC) will announce its interest rate decision at 2:00 p.m. UTC. The market expects the regulator to leave the interest rate unchanged at 5%. Still, it may add hawkish comments to the Monetary Policy Statement, which might trigger a sell-off in USD/CAD. However, if the BOC says inflation is tackled or downside risks to the economy are rising, the rally in USD/CAD will continue, possibly towards 1.37000.