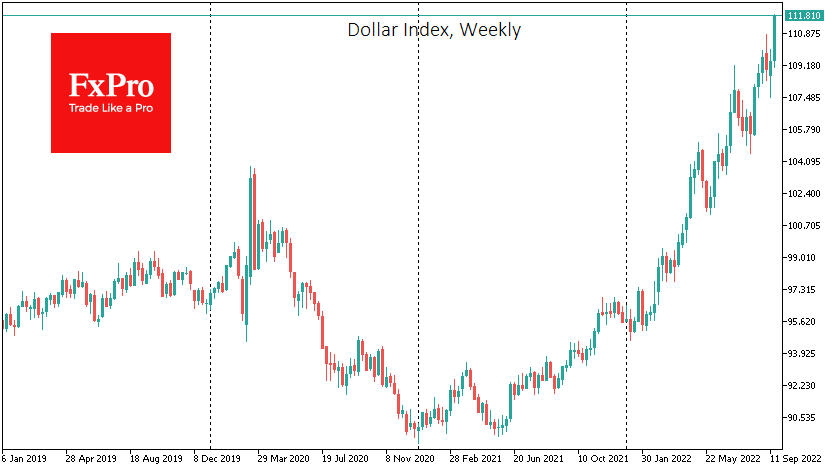

The US dollar is developing its FX offensive, leaving it at highs against a basket of the six major currencies. The main driver of this rise remains the monetary policy differential, where the US has had the most hawkish stance amongst the major central banks for over a year.

The Fed has raised the rate three times in three months by 75 points. Fed members’ expected rate path suggests one more 75-point hike in November, another 50 in December, and 25 next February.

A couple of months ago, short-term investors were speculating about the point at which the Fed would slow the hike and when it would move to lower it. The sentiment is now shifting towards when other central banks will catch up with the flagship central bank. However, not everyone can do that.

On Thursday, the Bank of England and the Swiss National Bank raised their rates by 50 points. Several other smaller European central banks took earlier similar steps. Japan is not in a position to tighten its policy.

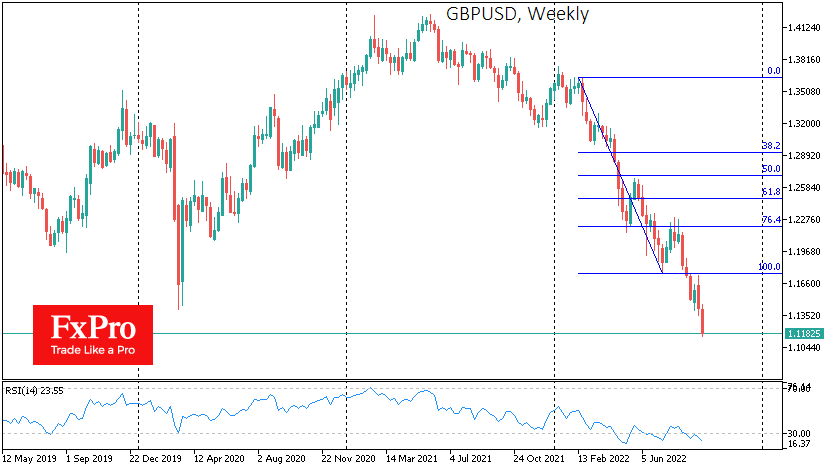

The reaction on the markets is eloquently showing that this is not enough. The Swiss franc and Japanese yen were sharply lower on Thursday after their central bank meetings. GBP/USD held up most of the day on Thursday but returned to rewrite lows from 1985 on Friday, hitting 1.1160. The BoJ’s first currency intervention in 24 years halted the yen’s gaining momentum yesterday.

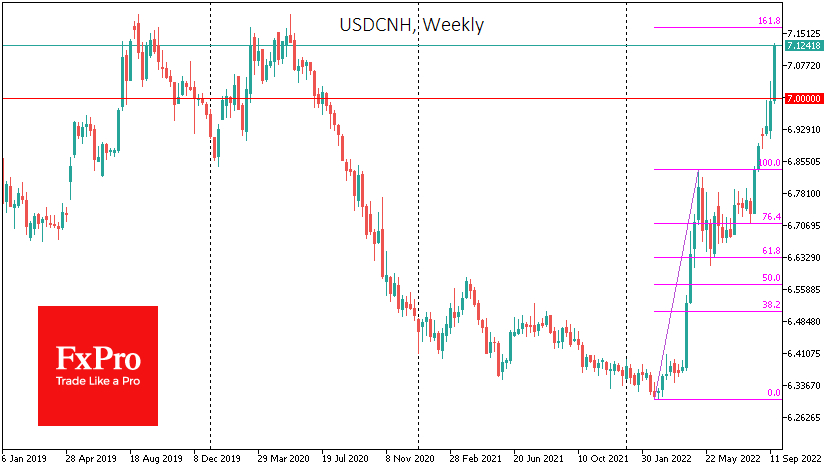

The Chinese renminbi is also involved in massive selling against the American currency. The USD/CNH offshore rate surpassed 7.11 on Friday morning, surviving an unprecedented 6% rally in just over a month. The pair had reversed down from 7.20 in 2019 and 2020, with the People’s Bank of China’s help, but the renminbi risks losing this final 1.2% from now without much resistance.

Despite more than 20-year highs for the US dollar, it is hardly prudent to bet on a trend reversal as there are fundamental reasons behind this rally, which are unlikely to change today or tomorrow. It now seems more reasonable to expect the dollar rally to lose strength when the Fed slows the pace of rate hikes and stops announcing increasingly hawkish rate forecasts.

The technical view of market dynamics also does not give any hope of a reversal. We are seeing very orderly selloffs of the major currencies, whereas abnormally sharp moves and capitulations often characterize the end of the cycle. Perhaps the major currency pairs have not yet reached an inflection point.