- The US Dollar Index (DXY) is in an intriguing position after mixed price action and ahead of PPI data.

- The future of the dollar may be influenced by external factors like oil prices and Middle East tensions.

- Technically, the DXY is facing resistance and a potential pullback, but underlying fundamentals remain supportive.

The US Dollar Index (DXY) continued its ascent yesterday to tap a fresh high before finishing the day flat. Some mixed price action thus far this morning leaves and PPI data ahead leaves the Dollar in an intriguing position.

The FED minutes and US CPI releases have kept the greenback largely supported this week as safe-haven demand waned. The data itself was a mixed bag but has raised questions about Fed rate cuts moving forward, which has been a positive for the greenback.

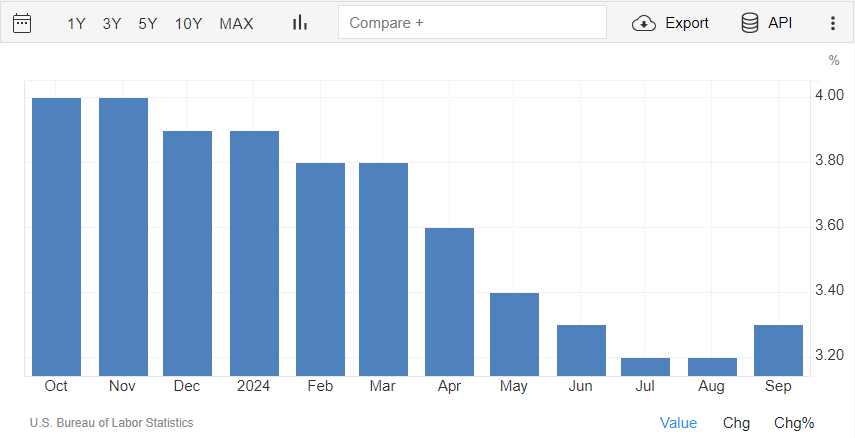

CPI inflation came in higher than expected, with the core rate increasing from 3.2% to 3.3% year-on-year, thanks to a second straight 0.3% monthly rise. In ideal trading conditions, this would boost the dollar, but this did not materialize.

US Core Inflation Rate YoY

Source: TradingEconomics

The explanation could be down to the shifting focus to the jobs market. This seems to be the narrative since the downward revisions in jobs data a few months back. In such an instance CPI figures matter less. The unexpected rise in jobless claims could possibly due to the extreme weather, had a negative effect on the dollar.

It appears the US Dollar could be entering a new phase of ‘wait and see’ which would leave the DXY caught in a range. At present outside influences and developments could impact the longer-term trajectory of the US Dollar and Fed rate path.

A continued rise in Oil prices or an attack on Iranian energy facilities could lead to a surge in inflationary pressure and remains a key concern in the near term. An escalation in Middle East tensions is a double-edged sword, as it could help stir up inflation, while at the same time potentially seeing the US Dollar benefit from safe-haven demand.

Developments around the US Dollar and Dollar Index (DXY) have a wide impact on markets. Interesting times ahead for market participants with the US elections drawing near as well.

Technical Analysis – US Dollar Index

The US dollar’s rally has been an impressive one, rising from the ashes to wipe out around six weeks of losses in around a week and a half (9 days). The DXY has however run into a key confluence area and is facing the growing threat of a pullback.

Yesterday saw the daily candle close as a doji, which does hint that a potential reversal may be on the way. As mentioned the overarching fundamentals do continue to keep the US Dollar supported and could limit any potential downside.

Immediate resistance rests at 102.95 before the key confluence area around 103.200 comes into focus. A break above the 100-day MA could be a big deal given that we traded below it since the middle of July. Would a break above be the start of a similar two-and-a-half-month trend to the upside?

Conversely, support is provided by 102.64 and 102.165, while particular attention should be given to the breakout area around 101.80.

US Dollar Index Chart, October 11, 2024

Source: TradingView

Support

- 102.64

- 102.16

- 101.80

Resistance

- 102.95

- 103.20

- 103.70