For the last three trading sessions, the dollar index has been crossing up and down the 200-day moving average every day. All in all, the flirting with this level has been going on for more than three weeks, during which neither bulls nor bears were able to form a stable trend.

Right now, there are about equal chances of a trend forming in one direction or the other, so it is worth watching closely to see which trend crystallises.

The dollar bumped around in October and declined sharply in November, with only some stabilisation late last month. The recent settlement, from this point of view, looks like an attempt to stand still and gather strength before a new downward impulse. The first signal to switch to a bearish bias could be a sharp downward impulse under the 200-day average at 103.3 versus the current 103.6. The final confirmation will come in the form of an update of the November lows at 102.37.

But the situation is far from desperate for the bulls as well. The dollar showed a convincing close last month, managing to rebound sharply to close the month above the significant 200-day moving average. An attempt to sell the dollar last Friday failed to gain traction, and the index returned to growth on Monday.

The latest dollar momentum at least created a springboard for a broader bounce and extended profit-taking. A classic Fibonacci retracement of the November decline amplitude opens upside potential at 104.12 (+0.5% from current levels). The dollar's ability to overcome the last level and further gain will be the final confirmation of the trend change to growth.

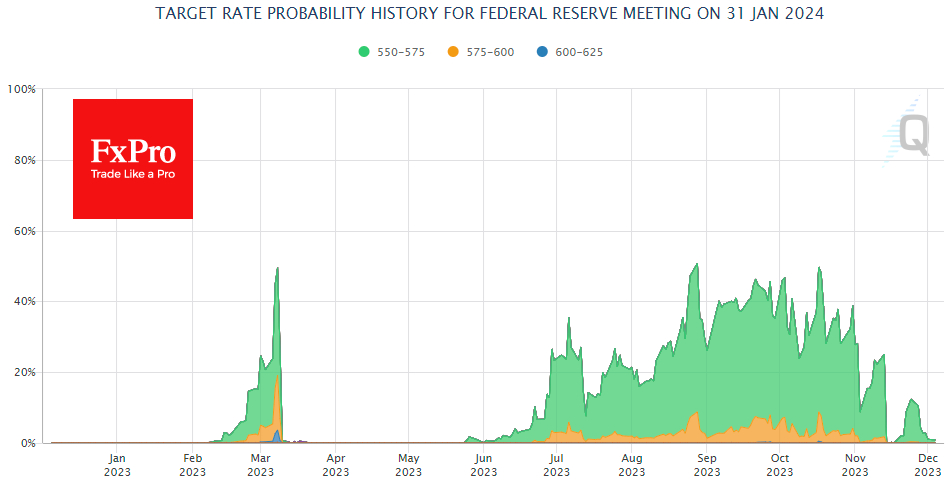

Among other factors, we note the extremely dovish expectations from the Fed: rate futures give a 14.5% chance of a cut already in January, and at the March meeting, the odds of a cut exceed 62%. Less than two months ago, the market was giving roughly equal odds between raising and keeping rates on hold.

This dramatic revision in expectations has been the fundamental fuel for the weakening dollar and the rally in equities. In contrast, the Fed is more inclined to raise the rate and is setting up for an extended period of holding it. The return of market expectations to those of the Fed looks like a strong case for a dollar recovery in the coming weeks.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

US Dollar Bulls Battle for Uptrend: Can Greenback Move Higher?

Published 12/05/2023, 06:00 AM

Updated 03/21/2024, 07:45 AM

US Dollar Bulls Battle for Uptrend: Can Greenback Move Higher?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.