- The US Dollar Index (DXY) continues to advance due to a lack of impactful US data and expectations of robust retail sales.

- Donald Trump’s comments on tariffs and the Federal Reserve’s independence.

- The DXY faces technical challenges, with the RSI in overbought territory, but the overall outlook remains bullish.

The US Dollar Index (DXY) continues its advance with the lack of high-impact US data keeping the greenback on the front foot. A move lower in the DXY may need a batch of softer US data which thus far has not been forthcoming. US retail sales this week is expected to remain robust which will keep the Dollar supported.

Yesterday, Donald Trump addressed an event where he highlighted two key market issues: tariffs and the Federal Reserve’s independence. He took a notably hawkish stance on protectionism, specifically focusing on U.S. car imports from Europe and Mexico. Regarding the Fed, he stated he wouldn’t interfere with its independence, yet asserted that the president should have a voice in rate decisions.

As elections draw closer in the US we may see demand for the US Dollar increase. The uncertainty around the election could help the US Dollars safe haven appeal and thus keep the greenback advancing until after the election.

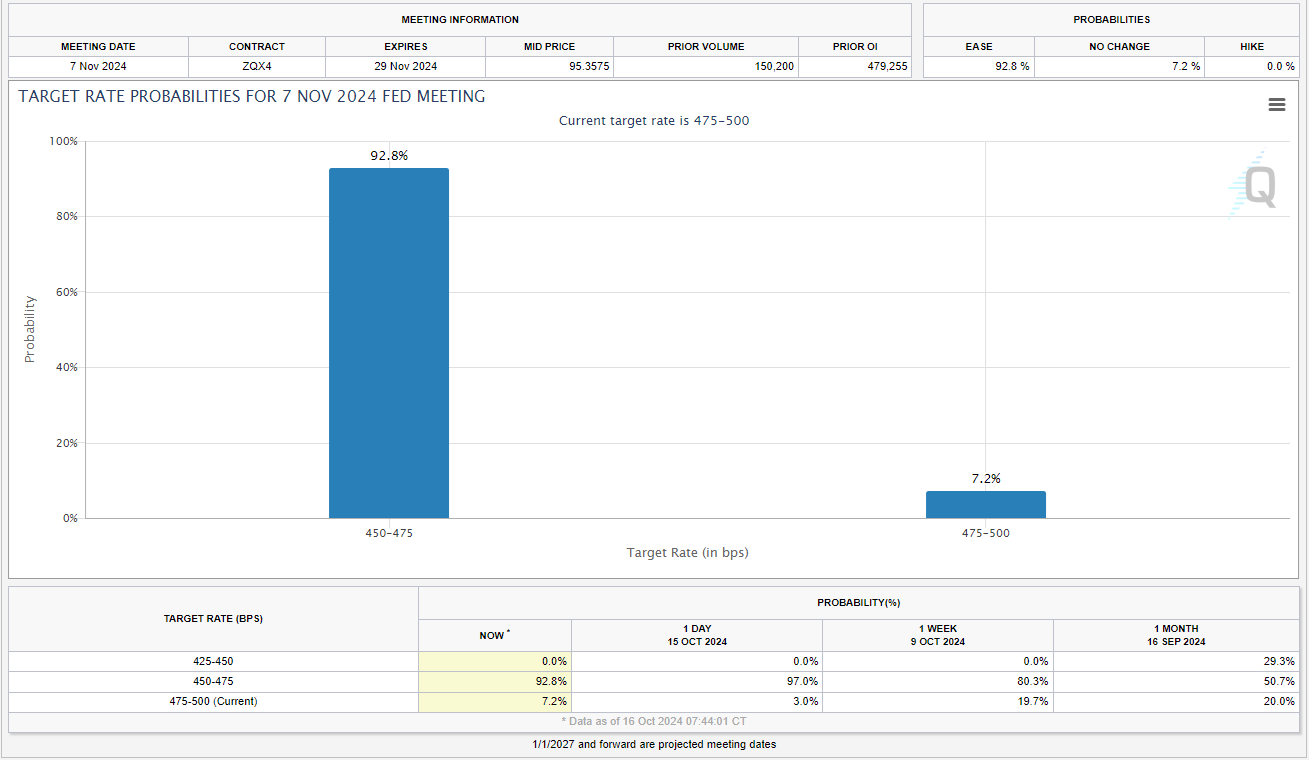

Markets are now expecting less aggressive Fed rate cuts in November and December which does bode well for the USD. Policymakers from the Federal Reserve continue to caution around the rate cut cycle, Governor Waller elaborated on this in a speech delivered at Stanford University.

Governor Waller elaborated further stating that the baseline expectation remains to gradually lower the policy rate over the coming year, regardless of short-term developments. When questioned about the job market’s current state, Waller noted, “The labor market is still robust, even though labor demand is easing.”

US Federal Reserve Rate Cut Probabilities, November Meeting

Source: CME FedWatch Tool

The outlook for the Dollar remains bullish despite some technical concerns. How much further can the rally go?

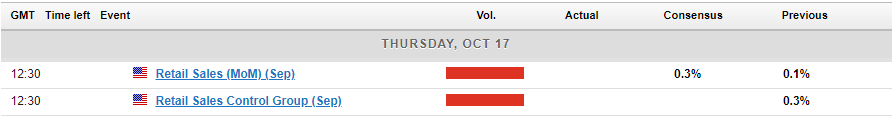

Economic Data Ahead

The week ahead is a relatively quiet one when it comes to high-impact US data. The only notable event on the calendar this week is retail sales which market participants believe will come in better than expected.

Technical Analysis – US Dollar Index

The US dollar’s rally has been an impressive one, but there are a host of challenges that lie in wait from a technical perspective.

Firstly the RSI on the daily has finally crossed into overbought territory. Now, the issue with this is markets can oftentimes be in overbought on the RSI but continue to rise. Having broken above the 100-day MA for the first time since July with a daily candle close above this MA setting the tone for further gains.

Immediate resistance is at the confluence area which houses the 200-day MA around the 103.70 handle with further resistance areas resting at 104.00 and the psychological 105.00 handle.

Conversely, a retracement here may find support at 103.00, 102.16 and 101.00

US Dollar Index Chart, October 16, 2024

Source: TradingView

Support

- 103.00

- 102.16

- 101.00

Resistance

- 103.70

- 104.00

- 105.00