At the start of a another trading week which culminates in the monthly Non Farm Payroll release on Friday, it’s perhaps a good time to review the daily June futures for the four currency majors, namely the Aussie dollar, the British pound, the euro and the Canadian dollar, all of which have one characteristic in common on the daily chart – a return of US dollar strength.

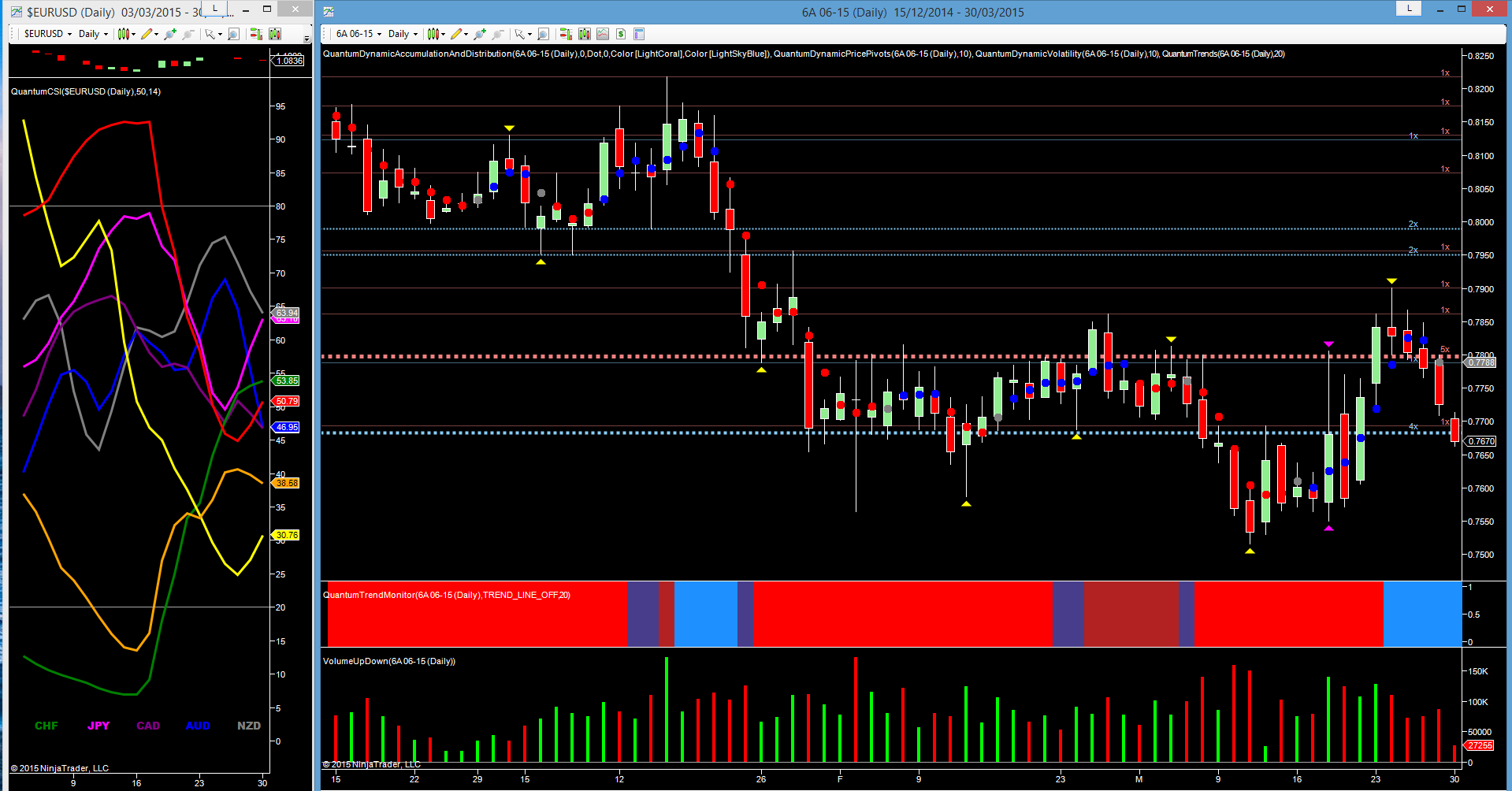

Starting with the AUD/USD, the recent rally higher ran into resistance in the 0.7900 range. With the shooting star candle of Tuesday last week duly topped off with a pivot high and a consequent move lower, the Aussie picked up the bearish tone once again. This, coupled with a recovery for the US dollar, took the pair back into the extended congestion phase of February. Friday’s price action suggested an acceleration of this sentiment with rising volumes in a falling market. This bearish sentiment has continued in early trading, with the AUD/USD moving through potential support in the 0.7680 area to currently trade at 0.7667 at time of writing, with a test of the platform of support in the 0.7500 region now looking to be the next logical target for a pause.

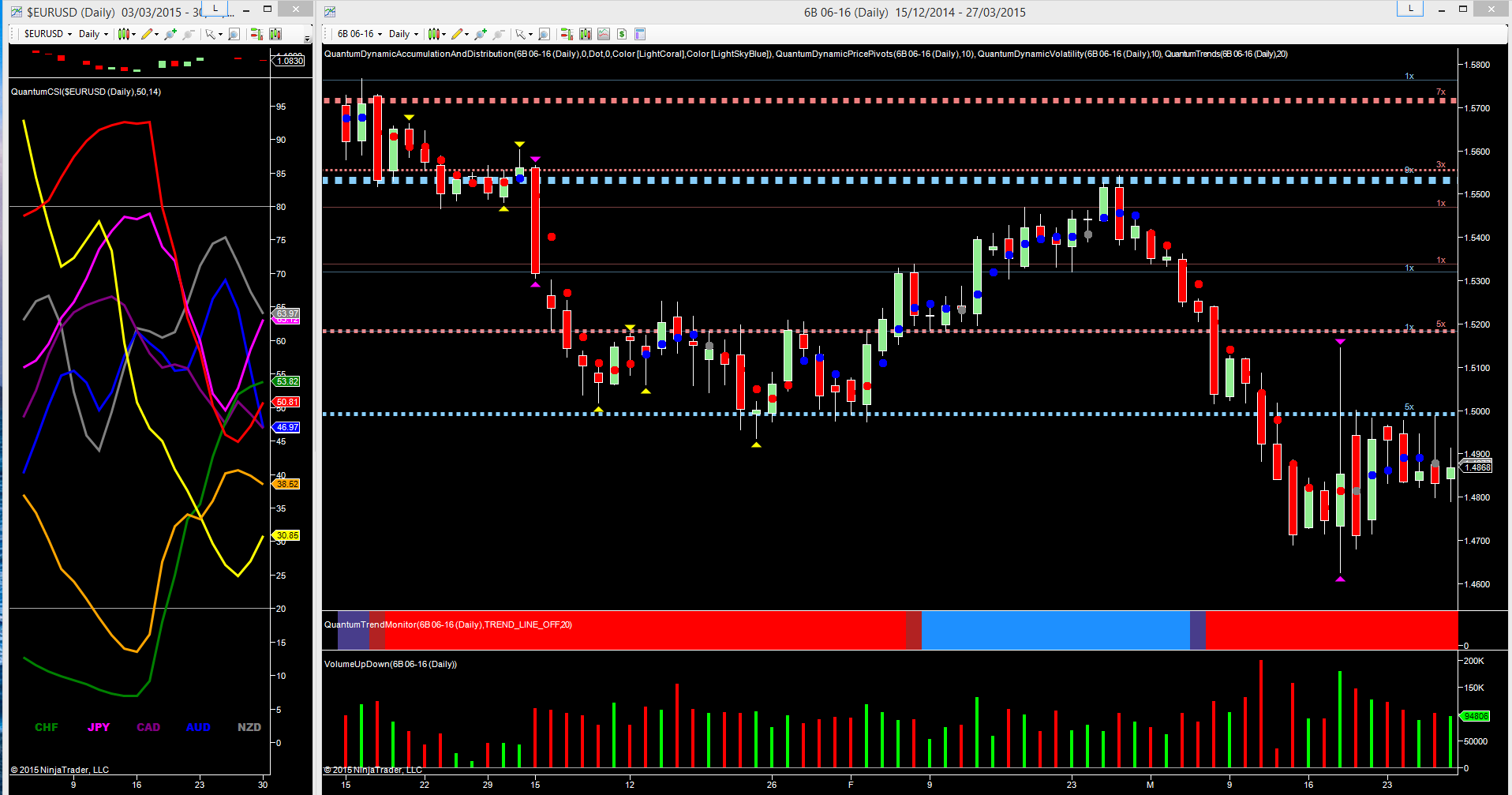

For the British pound, it was the psychological 1.5000 level which provided the solid barrier of resistance, although the reaction in Cable was less muted last week, with the pair trading in a relatively narrow range, and continuing to trade within the spread of the volatility candle of the 18th March. Overnight, Cable has moved lower, once again confirming this weak technical picture. Should the potential support platform now in place at 1.4790 be breached, then we can expect to see the pair move lower to test the 1.4700 area in due course.

Moving to the single currency, the technical picture here is very similar to Cable, with the price action contained within the volatility candle. Here too, and having tested this level on three occasions last week, it is now turning increasingly bearish once again to currently trade at 1.0845 at time of writing with a test of the platform of support in the 1.080 level now on the horizon. A close below here will then open the way for a move towards the 1.0650 area once more.

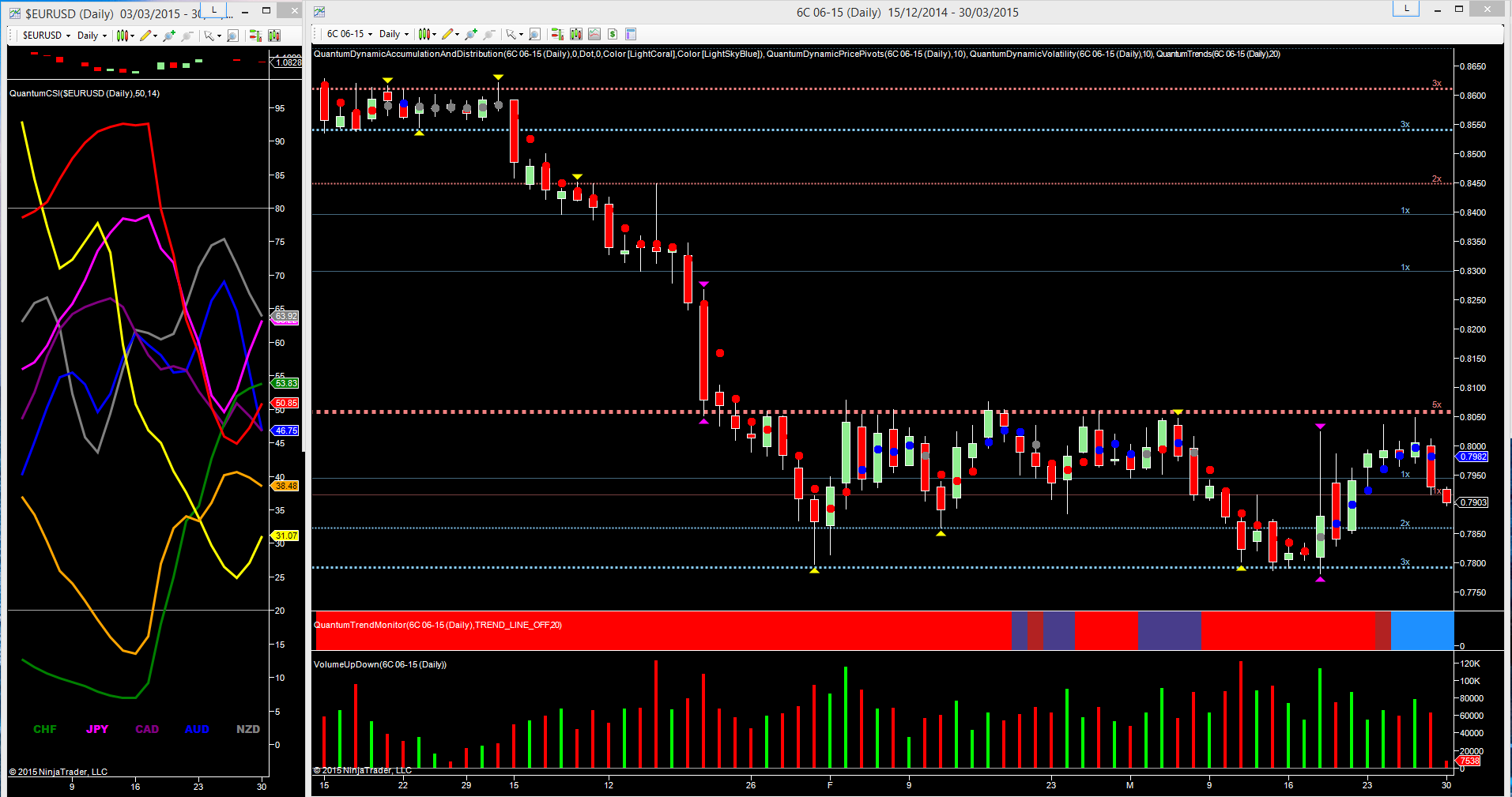

Finally to the CAD/USD, where once again the recent rally driven by US dollar weakness now appears to be over, with the strong and well developed resistance region at 0.8050 bringing the move higher to an abrupt halt. Last week’s two shooting star candles on good volume sent a strong signal of potential weakness ahead, with Friday’s price action duly delivering with a wide spread down candle, with the bearish tone continuing in early trading this morning. With the pair currently trading at 0.7898, the next logical target is the platform of support in the 0.7800 region, now waiting below.

All the price action is also defined on the currency strength indicator to the left of the chart, with the US dollar, the red line, now reversing and looking to move higher on the daily timeframe, and with the AUD, the CAD and the euro turning lower.