- The US Dollar Index (DXY) starts the week lower as market participants reposition ahead of a data-heavy week.

- EUR/USD recovers but will German inflation derail the rally?

- The DXY is at a key confluence; a break of the trendline could lead to a downside correction, while a bounce could open up the possibility of fresh highs.

The US Dollar Index (DXY) has started the week on the back foot as the Index flirts with a key level. It would appear market participants are repositioning ahead of a data heavy week that ends with the NFP jobs report on Friday.

Another reason that has been cited is that the US Dollar could reconnect with the slight deterioration in its rate advantage over the holiday period. The holidays saw US Yields remain steady while rates in Germany, the Eurozone benchmark ticked higher.

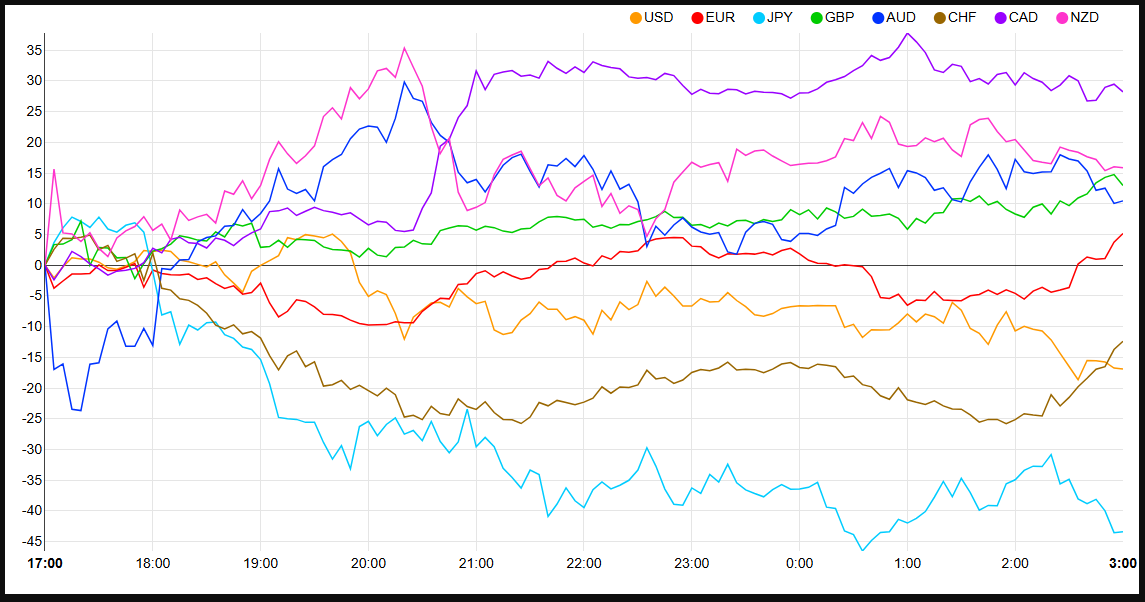

Currency Strength Chart: Strongest – CAD, NZD, GBP, AUD, EUR, CHF, USD, JPY – Weakest

Source: FinancialJuice

EUR/USD Rises To Mid 1.03’s, German Inflation Data Ahead

EUR/USD has continued its recovery following the holiday period selloff which saw the pair fall to 1.02225. Parity for EUR/USD in 2025 cannot be ruled out yet as policy divergence remains a real possibility.

The only upside for market participants is that such a drop may present an enticing opportunity. Historically any move toward parity or dips below have proved short-lived with significant buying pressure emerging. Will history repeat itself once more?

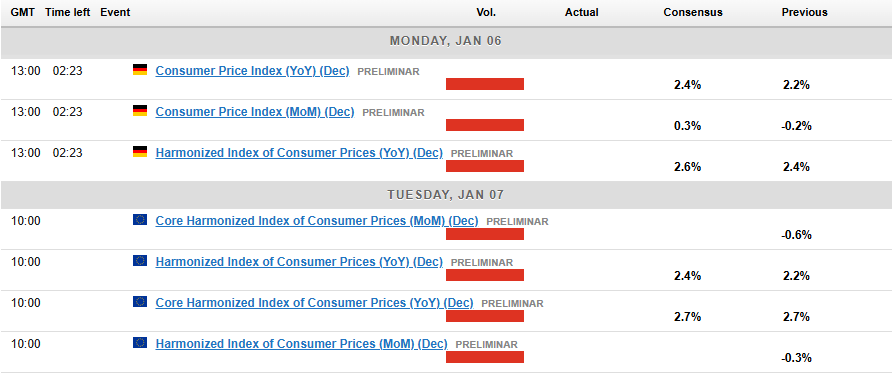

Looking at the immediate risks for EUR/USD, and German inflation data is due later in the day. German inflation is forecast to rise to 2.4% on a yearly basis in December from 2.2% in November.

A stronger print could help push EUR/USD toward the 1.0400 handle but I do not expect such a move to last.

EUR/USD still faces significant bearish pressure and with a slew of data ahead this week, an early week correction followed by a selloff later in the week cannot be ruled out.

Technical Analysis

EUR/USD

EUR/USD has found some momentum following Friday’s bullish inside bar candle close.

On the daily timeframe, the trend remains bearish without a daily candle close above the 1.04300 handle.

Until such a break occurs, the possibility of fresh lows remains high. There is however the possibility of a break above the 1.0430 which could push EUR/USD toward the long term descending trendline and key resistance around the 1.0500 handle.

This could in theory provide a better risk to reward opportunity for potential shorts, however at this point the daily chart would have noted a change in character with the swing high at 1.04300 having been broken. This would make such a play counter-trend in nature and increase the risk of EUR/USD rising even further.

Interesting week ahead for EUR/USD with the DXY likely to be central to any development for the pair.

EUR/USD Daily Chart, January 6, 2025

Source:TradingView.com

Support

- 1.0293

- 1.0222

- 1.0000

Resistance

- 1.0430

- 1.0500

- 1.0535

US Dollar Index (DXY)

The US Dollar index daily chart is intriguing to say the least. The selloff this morning has brought the index into a key confluence that could help determine price action in the coming days.

The index has come within a whisker of the ascending trendline on the daily timeframe as it bounced off support at 108.64 this morning.

The next move will be key as a break of the trendline could lead to a short-term downside correction for the index toward 108.00 or potentially 107.00.

A bounce off the support level and a move higher could open up the possibility of fresh highs above the 110.00 handle.

The narrative around the US Dollar is one of strength. Recent comments by Fed policymakers touting rising inflation as a concern may lead to a pivot toward price pressures once more. Such a move could keep the US Dollar supported in the medium term.

The Expectations around the Trump Presidency may also factor in as the January 21 inauguration nears.

The inauguration however does present two potential paths for the USD index. First one would be continued USD weakness before buying pressure returns just ahead of the Trump inauguration as market participants attempt to get the dollar on the ‘cheap’.

The second possibility is that we see a strong US Dollar right up until the inauguration. Thai move does however leave the USD vulnerable to selling pressure post election should President Trump not deliver on key campaign promises.

US Dollar Index (DXY) Daily Chart, January 6, 2025

Source:TradingView.com

Support

- 108.64

- 108.00

- 107.60

Resistance

- 109.00

- 109.52

- 110.00