Market movers today

- Financial markets will be looking to the developments in Hong Kong amid the stand-off with China, while also, any response from China to the delay in the US imposing tariffs until December will be in focus. Finally, the prospects of a wider contagion effects from the crisis in Argentina is a possible market mover in emerging markets.

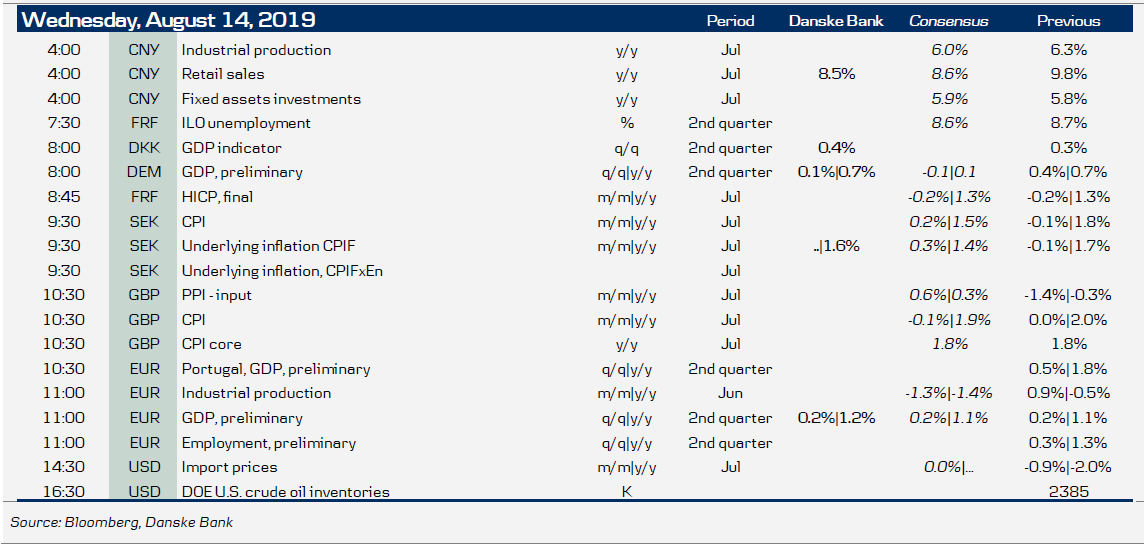

- In terms of data releases, a key focus point in the euro area is the GDP release for Q2. We expect an unchanged euro area GDP growth figure from the advance estimate (0.2% q/q), but with the first release of the drivers we will assess if investments are still holding up amid the global uncertainty. Furthermore, the ailing German economy will publish its first Q2 GDP estimate. We expect 0.1%, but we acknowledge a downside risk to our forecast.

- In the UK, CPI inflation in July is due out, where consensus is for unchanged core inflation compared to June at 1.8%.

- In the Nordic region, the Swedish CPI data is one of the more anticipated releases.

Selected market news

The Trump administration took the markets by surprise once again yesterday as the Office of the US Trade Representative announced that tariffs will be delayed to 15 December on a range of goods such as mobile phones, computers and video game consoles (see here ). The announcement led to a jump in equities and bond yields along with a surge in the oil price and yen. As such, it is positive for companies like Apple (NASDAQ:AAPL) and electronics companies that they do not have to pay tariffs on Christmas sales. But apart from that we do not believe it is a sign that the US side is softening in the trade talks. The decision seems to be solely for domestic reasons and not to ease the pressure on China. Some goods will also be removed from the list due to health and security reasons according to the statement. News also broke that US and Chinese negotiators had talked on the phone on Tuesday. It was likely a call to confirm that the two sides will meet physically in Washington in early September. One effect of the tariff delay may be that China reads it in a way that Trump is not willing to take much pain in the trade war and as such it could make China less willing to make concessions, as they may think they have time on their side as we move closer to the US elections next year.

Meanwhile, data releases overnight showed a substantial weakening in economic activity in China in July. Industrial production growth dropped to 4.8% y/y from 6.3% y/y and retail sales growth slipped to 7.6% y/y from 9.8% y/y.

The Italian Senate has called for Prime Minister Conte to appear before the Senate on Tuesday next week, which could mean that a no confidence vote will take place on this day.

The German government published its 2020 budget proposal yesterday, which includes no net debt increase, i.e. does not propose fiscal stimulus (see details in FI section below).

Scandi markets

We expect July CPIF and CPIF excl. Energy to print 0.3% mom/1.5% y/y and 0.2% mom/1.7% y/y, respectively. The y/y rates is, hence, 0.1pp above and spot on the Riksbank’s forecasts, respectively. Besides the balance of counteracting prices this month, such as lower clothing prices and higher prices on food, international airline tickets and charter packages, there is an extra uncertainty this time: the new method of measuring dental care will pull down inflation by 0.1-0.2 percentage points (an effect that will be taken back in the coming 11 months). Given the extremely uncertain economic prospects, both domestically and internationally, we believe the outcome may be less relevant for the Riksbank and markets than usual.

In Norway, today brings Q2 wage figures. After picking up gradually since 2016, wage growth has shown some signs of accelerating over the past two or three quarters. This ties in well with reports of firms having increasing problems sourcing skilled labour and is normally a sign of a labour market that is getting seriously tight. We therefore expect wage growth to climb further from 3.2% y/y in Q1. A bit surprising, market attention is almost absent.

Fixed income markets

The US economy surprised positively as the US core-CPI rose modestly more than expected and with the delay of the trade tariffs, risky assets rallied and the US Treasury curve bear flattened yesterday. The positive surprise from the delay of trade tariffs also supported Italian government bonds, where the curve bull steepened. We expect to see more of the same today with spreads between core-EU and periphery tightening, although very soft German GDP data could change this.

If the German GDP numbers are weak, then the call for a softer fiscal policy in Germany will be strengthened. This is likely to add to the volatility in the market given the speculation regarding the Bund supply next year, as the gross funding need will increase from EUR185bn to EUR234bn. However, the bulk of the rise in the funding for 2020 is due to higher redemptions in 2020 relative to 2019. Hence, it is only EUR9bn that is not “accounted” for in the budget. The increase in the funding need is covered by issuing more T-bills and less long-dated government bonds contrary to recent speculation of an increase in the issuance of 30Y government bonds.

FX markets

The announcement of a delay of the upcoming tariffs on Chinese imports (see details on the front page) took FX and commodity markets by complete surprise yesterday. Oil prices jumped more than 4% on the news, while USD/JPY moved as high as 106.97. Notably, EUR/USD did not really move. In fact, despite the surge in risky assets, EUR/USD fell back. We think there is potential for the market to eventually fade the sharp moves yesterday as the news is not a game changer in our view. Furthermore, the global economy is still on a weakening trend, as highlighted by the weak Chinese data out overnight. Finally, inflation expectations remain at depressed levels and central banks seem reluctant to come up with a forceful response.

The good news on the trade front supported Scandies and sent EUR/NOK as low as 9.9080 and EUR/SEK close to 10.65. Note this does not change our call on Norges Bank tomorrow (see preview). If the Swedish inflation numbers do surprise on the upside (see Scandi section for details), the cross could drop further. Hardened as we are regarding the trade dispute, we expect risk-off will surely re-emerge at some point. As for inflation, it’s heading lower and will soon challenge the Riksbank and the SEK. To us, EUR/SEK is a buy on dips.

Key figures and events