- The US Treasury reached the debt ceiling in January

- Biden administration needs to find a resolution before August 18th to avoid a potential crisis

- As this unfolds, US debt ceiling resolution will be the short-term market driver as inflation takes backstage

Short-term investors must always be aware that events of all kinds can cause stress on a daily basis, and human nature tends to be biased toward negative events, as mentioned many times in the field of behavioral finance.

Last year's sentiment was driven by inflation and interest rate hikes, which led to the 2022 downturn.

Since mid-October, the markets started to rally, but pessimism still lingered amid recession fears, and now, in my opinion, the next hot topic to dictate markets will be the US debt ceiling.

On January 19, the US Treasury reached the debt ceiling, taking extraordinary measures to meet various government expenses. Let's be clear: this has happened before, but a lot also depends on the general sentiment, which continues to be negative.

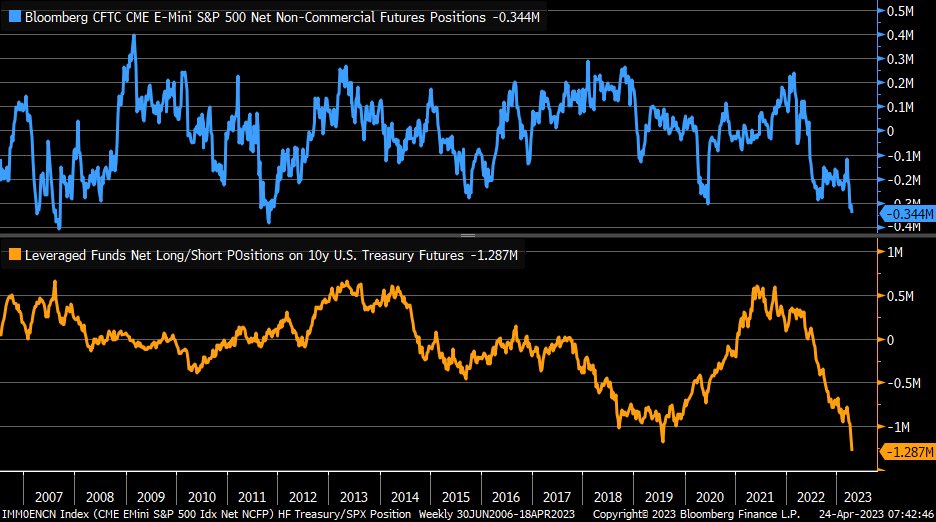

In fact, as we can see, short bets not only on equity but also on U.S. debt are at an all-time high, and this has caused (along with yesterday's First Republic Bank (NYSE:FRC) quarterly report) some jitters.

The cost of insuring against an (unlikely) U.S. default has also risen a lot, a sign that markets are following developments very closely (see below).

Now, theoretically, August 18 is the key date when the funds are supposed to run out. So, it will be crucial for the Biden administration to find an agreement before this date.

Possible options would be:

- Political solution (a deal is struck with the Republicans, who in return demand a reduction in federal spending)

- New debt is issued in completely abnormal situations (perhaps above nominal, but I don't know how the markets would react to that and especially who would buy it)

- Further extraordinary measures (President Biden could invoke the 14th Amendment to follow up on federal payments)

And then there are other more 'creative' solutions that I don't think are worth giving any weight to.

So the theme is that while everyone is still focused on inflation (which, in my view, will continue to fall, especially in June and July, where the base effects will be greater than 1 percent), the real and next short-term market mover will be the US debt ceiling and its resolution.

As always, these are just distractions for the medium- to the long-term investor, but human nature never changes.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky, and therefore, any investment decision and the associated risk remains with the investor.